| What is the right interest rate? Most people think of that question regarding the Federal Reserve (FED). This Blog addresses how the free enterprise system would answer this question. This blog will expound on why the government should not be involved surrounding the adverse effects of government price controls of the interest rate. This blog will also explain how the FED can; however, should not maintain an interest rate that is not the natural balance. |

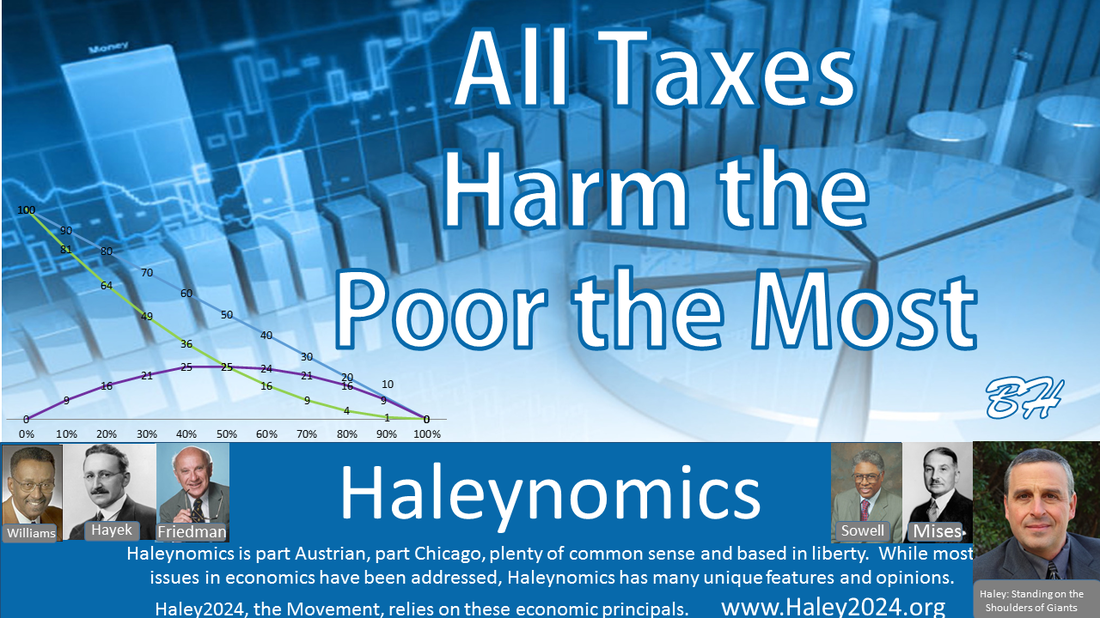

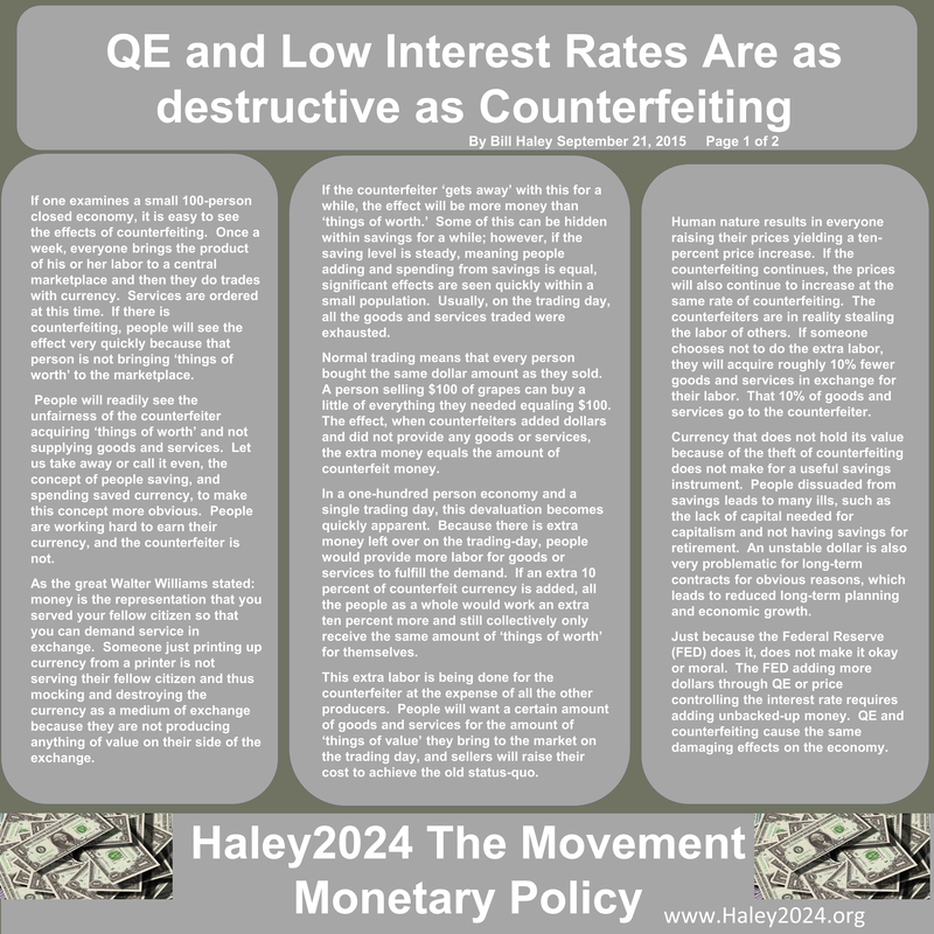

| Some people state that the Federal Reserve bank is part of the free enterprise system. That is very wrong! It was government legislation that set up the FED. No other person, bank or organization is allowed to do what the FED does, thus very far from free enterprise. The government allowing them to impose an inflation tax, regulate, among others is also far from free enterprise. These are government powers and even beyond powers government should have. |

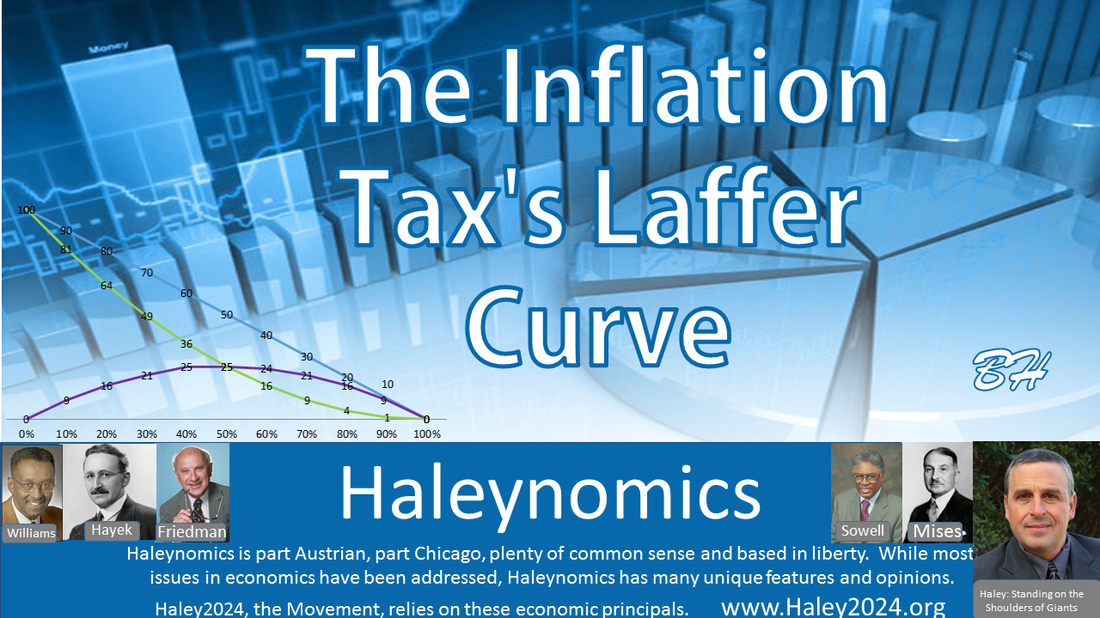

| The policies coming out of the FED are highly damaging. The FED’s dual mandate is the stable value of money and full employment. They are failing badly on both mandates; in fact, the FED’s policies are the reason they are failing. The dollar has lost well over 90% of its value since starting about 100 years ago. Their efforts for full employment has done considerable damage by trying to control (limit) free enterprise. The FED needs to end, and Congress needs to allow banks to be regulated by Financial Competitive Regulatory Agencies. |

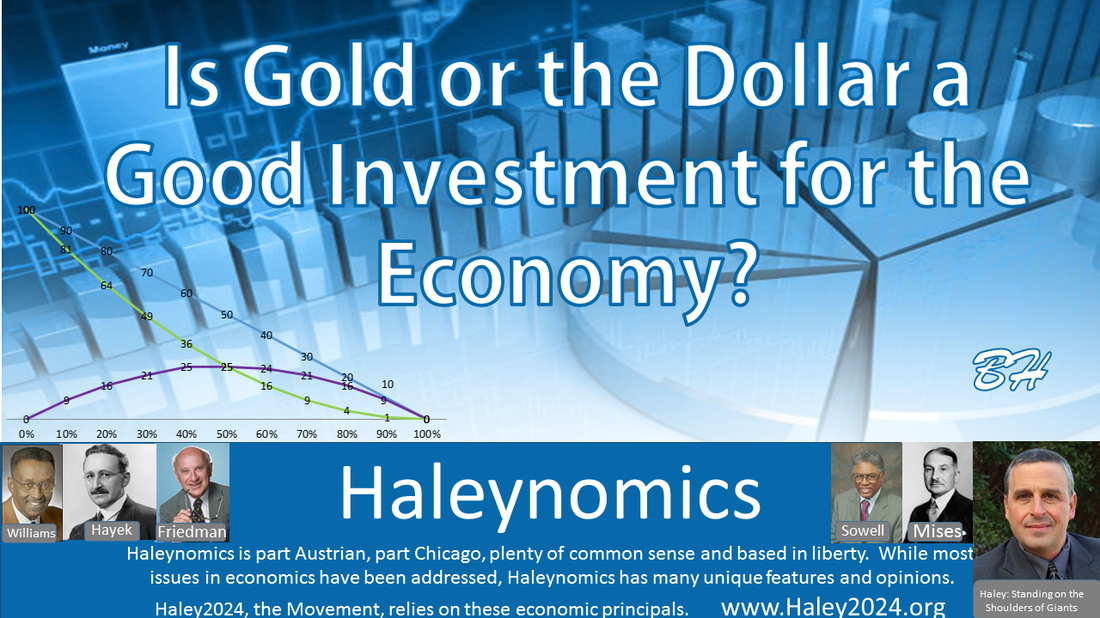

| So how would interest rates be set in the free enterprise system without a central planner? Quite simply, there is a desire, thus a market for saving money and a desire, thus a market for borrowing money. The bank is a business that matches both needs and takes a cut for the very valuable service of matching and servicing the two. There are many, but the primary way a bank makes money is by paying interest to people saving money, then charges a higher interest rate from the people borrowing. |

| The higher the interest rate a bank pays to savers, the more money they receive and vice versa. The higher the rate of interest the bank charges for borrowing, the less money is lent. Simply, if there is more money being saved than the demand for borrowing, the rates of interest for saving and/or borrowing is lowered. If the demand for borrowing is higher than the money available from savings, the rate of interest of saving and/or borrowing is increased. Competitive forces from other banks put constraints around all rates. |

| Every bank needs to attract customers that are savers and/or borrowers. Providing services surrounding banking are essential to acquire and retain customers. The competitive nature of banks is the best and most important constraint of banks behaving badly or acting strictly on greed. Regulations of banks are highly relevant, thus giving politicians and bureaucrats a monopoly on regulations is highly damaging. |

| Having different private Financial Competitive Regulatory Agencies trying out different regulations creates the most improvements. Without real counterfactuals, it is just an argument about whether the monopoly regulations are working. Even when there are bad results we get, ‘it would have been worse.’ People freely making choices of where they will bank will clearly show which regulations are better. We do not need ‘experts’ claiming that all people are restricted to only using their, the experts, wisdom of regulations. The more government regulators fail, the greater control the regulators seek. |

So going back to the title of the blog: What is the right interest rate?

| Every bank will set their saving rate and borrowing rate. People will save or borrow at whatever bank they choose. Competitive forces will not allow rates to differ much. Quality of borrowers would have major effects. Services of banks would also be critical. So just like the answer to the correct price of anything, it is the price that people are willing to pay. |

| Banks with better services could charge higher interest rates for loans. Banks that loan to people with lower credit ratings would have to charge higher rates to compensate for higher default rates, while people with good credit would be able to demand lower borrowing rates. The examples of why interest rates would differ are just as numerous as any other product. Service, quality, proximity, soundness, reliability, and regulations would all be factors that would be very important to the cost of the use of money over time. |

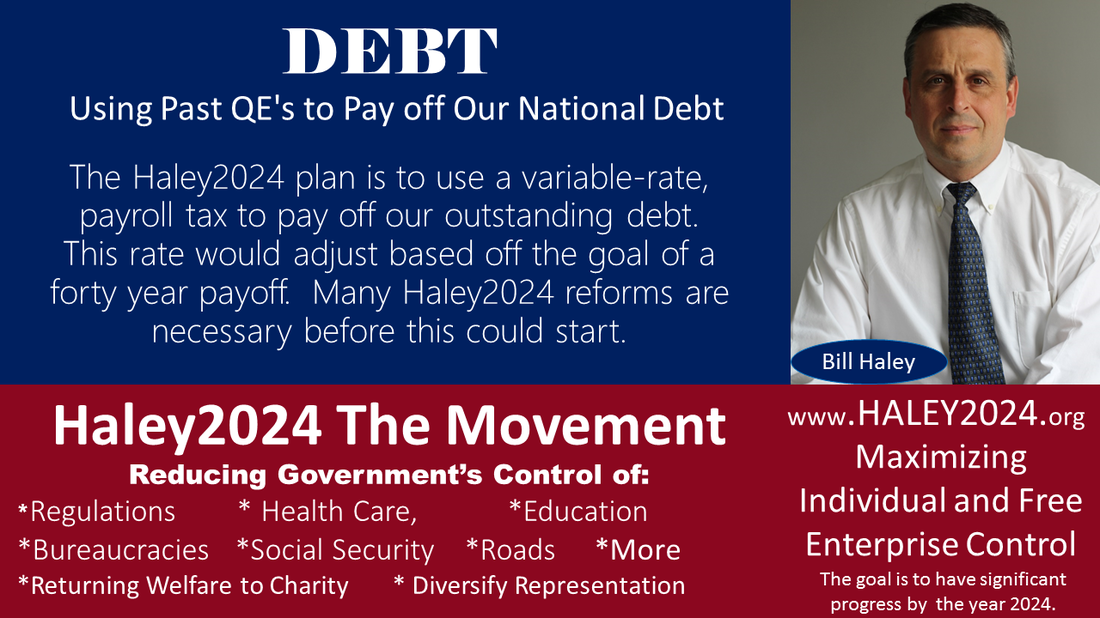

| So how does the FED set rates? The natural rate of the average interest rates is when the rate of saving and borrowing with a ‘service charge’ percentage for the bank, brings in enough in saving to have most of it lent out, while always keeping a percentage to operate. For example, let’s say that $1 billion comes in at a saving rate of 4%. The bank would have to keep about 20% in reserves to operate, and then they give loans for $0.8 billion with 7% rate for borrowing. |

| If a bank can borrow at 1% from the FED, they would be foolish to offer saving rates above that rate to the general population. Much less money would be saved at 1% compared to 4%, thus doing great harm to capitalism because capitalism needs capital. Therefore, the rest of the money would be borrowed from the FED. |

| With the bank’s ability to get money at 1%, they would offer (competitive forces) loans for roughly 4%, which is much lower than the natural 7%. (7% is just a stand-in example of the natural rate) This lower rate would drive up the demand for loans, thus requiring borrowing more money from the FED. Now, where does the FED get the money to loan to the banks at such a low (compared to the natural) interest rates. |

| Just like in Quantitative Easing, the money is just created from thin air. The value of the money can only come from one place, the existing money. If one percent of the current money supply is added to the money supply, by just creating more money, whether printing paper or digitally, then ALL existing dollars give up 1% of their worth. It is the only place the value/ worth of the new dollars can be acquired. This devaluation does great damage. |