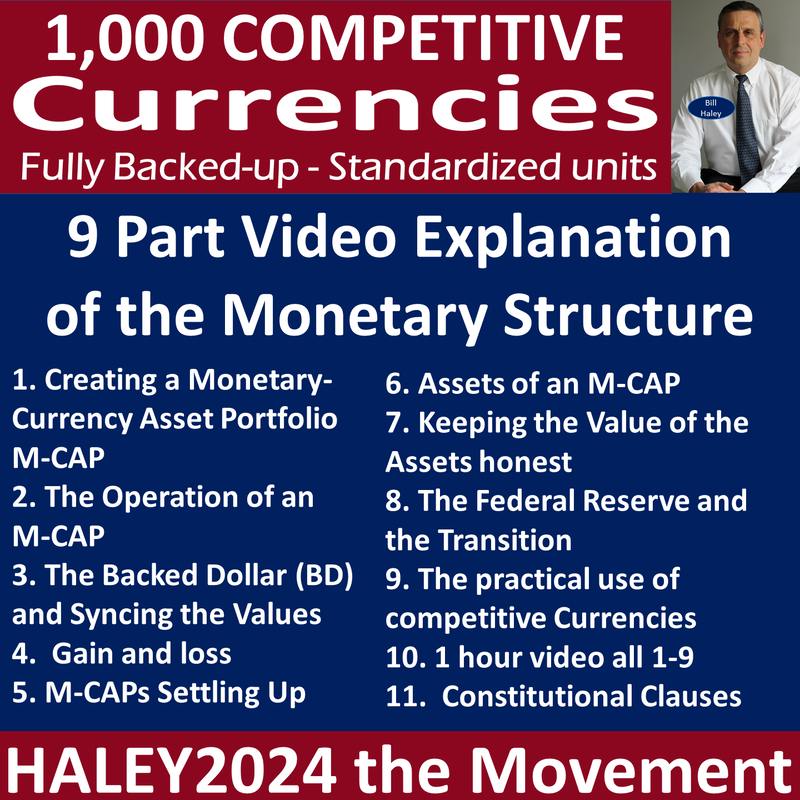

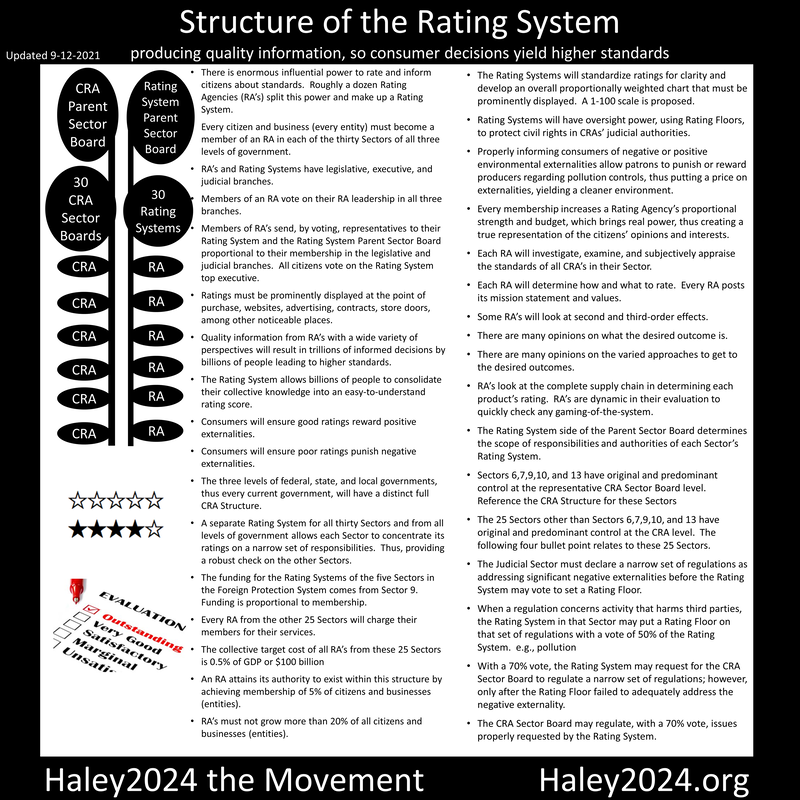

Haley2024’s Monetary Structure

Competitive Governance within every geographic jurisdiction

|

This page explains all the bullet points regarding the structure of Haley2024’s Monetary Policy. Many explanations of bullet points rely on other bullet points and their explanations to explain each bullet point fully. By the end, most points are covered several times in different ways. A new system warrants a little over-explaining.

|

The bullet points below were created 10-5-2019. It remains consistent. However, I talked about a dozen currencies because I wanted people to focus on one state and not 1,000 currencies from all the states.

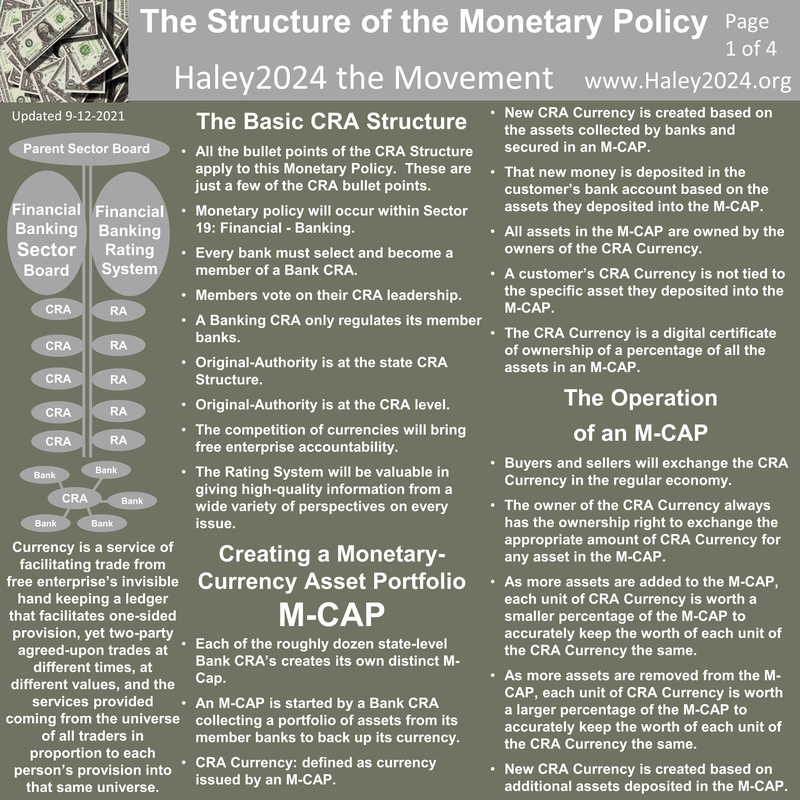

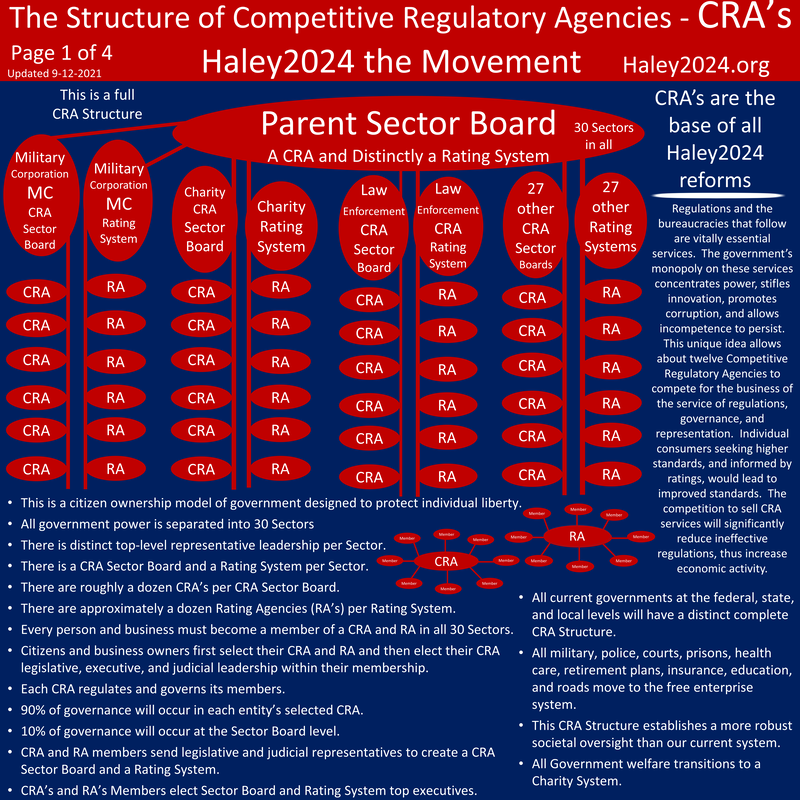

Sound money is far superior to government-created paper without inherent value. Currency is a service that allows people to trade a universal good for a specific product. The free enterprise system provides the best services. Sound money is a certificate of ownership of items of real value such as land, stocks, bonds, commodities, and precious metals. Haley2024 calls for about a dozen Financial Competitive Regulatory Agencies that regulate their member banks, to issue their own currency. |

Every bank must become a member of one of roughly a dozen Financial CRA’s. Members vote on CRA leadership.As a condition and requirement of being a citizen, organization, or a business in America, Haley2024 proposes that every entity must associate with a CRA from every Sector. As a bank, the membership in the Financial Sector is the most important. Roughly a dozen Financial CRA’s will compete for a bank’s business of regulations. Each CRA will have its own regulations.

If a bank picks a CRA with low ratings on issues customers care about, the bank will repel customers. If a bank picks a highly rated CRA, it will attract customers. Having the members of each CRA vote on their CRA’s leadership helps develop each CRA’s philosophy and is an essential check within the checks and balances of the system. |

A Financial CRA only regulates its members.A significant part of the CRA Structure is that CRA’s only regulate its members. This is a key feature for phasing out hostile or inefficient regulations. If all the CRA’s develop new regulations, the good and bad of each are revealed. Some CRA’s will implement Dodd-Frank type regulations, while others would regulate closer to the Heritage Foundation preferences.

Libertarians would likely control a Banking CRA. Socialists have their own preferences on financial regulations and would have their own CRA. Every citizen desiring financial services would pick a bank based on its regulations. The Financial Sector’s Rating System would provide quality information. |

Every Financial CRA creates its own currency by collecting a portfolio of assets from its member banks to back up its currency.Every CRA will set up its own system; however, the base of the system is collecting a portfolio of assets to back up their CRA’s currency. Some CRA’s might make a portfolio of strictly gold. Other CRA’s might have a blend of gold and other precious metals. Different CRA’s will introduce stocks and bonds into their portfolios. Loans are of real value, and specific CRA’s will incorporate loans into their portfolio. Land, buildings, percentages of private companies, and commodities are all options.

The best options are likely those traded on markets and have long-term stability. High liquidity would probably be valued over items with low liquidity. Share loans, home loans, car loans, business loans, among others, could all be tried as assets. Loans with equity will likely be valued over personal loans. There are many factors related to valuing assets. |

The value of a Financial CRA’s currency is the value of the portfolio divided by the number of the units of currency issued.If a CRA collects $100 of assets, they can issue 100 $1 units of currency. Each unit of currency is a certificate of ownership worth 1% of the portfolio. The owner of the one unit of currency can go to the portfolio and trade their one unit of currency in for one percent of the portfolio. After someone trades their one unit for 1% of the portfolio, there are only $99 worth of assets left in the portfolio and only 99 $1 units outstanding. The one $1 unit of currency, traded in, is held by the bank, now, worthless, because there is no asset to back it up.

|

A Financial CRA with $100 billion of assets can only create 100 billion units of their currency. $367 billion of assets warrants 367 billion units.The number of units of currency must match the worth of all the assets in the portfolio. If a bank wants to expand or inflate its monetary base, they must add assets to the portfolio. If a CRA desires to offer 1,200,000 more units of currency, they must add about 1,000 ounces of gold to the portfolio. The owners of the currency are now the owners of the gold. If someone wanted to turn their gold to currency, they give that gold to a CRA portfolio, and the banks create brand new currency. If someone wants to turn their currency to gold, they give their currency to the CRA portfolio to be destroyed and receive the gold.

|

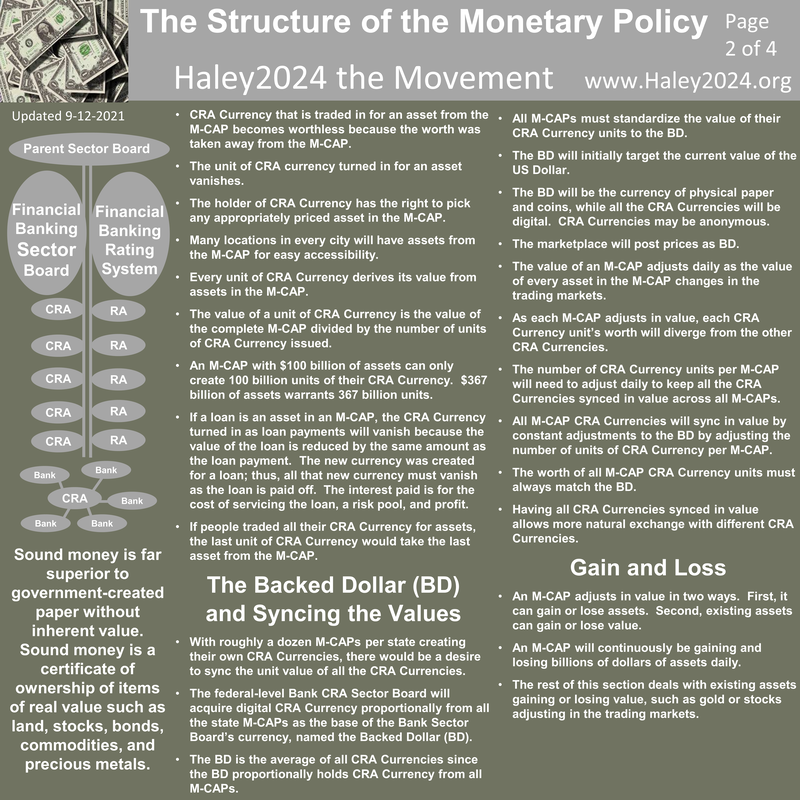

The Financial CRA Sector Board will acquire currency from all the Financial CRA’s as the base of the Financial Sector Board’s currency, the Backed Dollar (BD).The roughly dozen Financial CRA’s will all have their own currency; however, there is significant value in having one standard value, so there are no exchange rate issues. If one CRA gave 10 units of currency for an ounce of gold, and another CRA gave out 400 units, and still another gave out 3,479,083,735 units for the same one ounce of gold, the different currencies would have different values.

Different currencies with varying values would make commerce very difficult. All the currencies should sync in value. To that end, the Financial Sector Board acquires currency from all Financial CRA’s and issues a combined currency called the Backed Dollar or nicknamed the BD. |

The BD will be the currency of paper and coin, while all the CRA currencies will be digital.The BD will be a physical currency, and all CRA currencies are digital. The BD will have the most stable price, thus conducive for paper and coins. As described below, the digital currency must adjust to the standard BD value; therefore, the CRA currencies are digital. While CRA’s can have physical currency units, it will be more difficult because it will quickly need an exchange rate.

|

The marketplace post prices as BD.The marketplace will post prices in units valued as BD. Every CRA’s currency is synced with the BD. All stores will accept all currencies. Currency is a service that facilitates a trade of something of worth for something of worth. This system ensures every currency is something of real and identifiable worth; therefore, there would be little reason for a store to question or refuse to take a currency. A store turns in all the currencies into their bank, and the banks worry about settling up with the other CRA Currencies.

|

The BD is the average of all currencies since the BD proportionally holds currency from all Financial CRA’s.The BD will represent the broadest average of all prices. The BD is required to hold currencies from all CRA’s proportional to their currency’s market share. There is a particular demand for paper and coins. Representatives from all CRA’s will determine the amount; however, in reality, the people will decide how much they desire. The BD holds an amount of CRA currency to match the value of the BD in circulation.

|

The value of all portfolios change in value daily as the value of each asset in the portfolio adjusts in the trading markets.All items of worth continually change in value in our economy. The base of economics is that something is worth what someone is willing to pay for it. Everything has a going price. A certain percentage of the portfolio will be items in the trading markets. Exxon, Microsoft, GM, gold, Amazon, and other stocks have prices in the trading markets, so they are easy to value. Other items are not as liquid, but the system will develop ways to value everything. Specific methods of assessing value are described below. The value of each portfolio is determined daily.

|

Having a dozen currencies with different values creates a burden; therefore, the number of units will adjust to keep all the currencies synced in value.As the value of each of the CRA portfolios adjusts, all the currencies will change in value. Having a dozen currencies at different values creates a burden in the marketplace. As described above, the prices in the marketplace are listed as the BD. The Haley2024 solution is to adjust the number of units, not the value of each currency unit. If a CRA’s portfolio increases in value compared to the average of all other CRA portfolios, they gain units, so the value of each unit stays synced to the average of all currencies represented by the BD.

|

All CRA currencies will sync in value by constant adjustments to the BD, meaning adjusting the number of units of currency, so the value of all currency units match.If the price of Apple stock dropped 5% on the day, holders of Apple stocks still own the same number of units or the same percentage of the company. However, if someone tried to buy a car with Apple stocks, the car dealership would ask for more units of Apple stocks compared to a day ago. If the value of Apple increased by 5%, the buyer could offer 5% fewer units to buy the car.

The Haley2024 reform is to keep the value of each unit steady by changing the number of units. The essential factor is that a unit of currency continues to represent the ownership of a percentage of the portfolio. The number of units of currency times the percentage of every unit to the whole portfolio should always equal one. |

Having all currencies synced in value allows easier exchange with different currencies.People having an account with currency ‘A’ wants to buy something from someone banking with currency ‘B.’ That transaction would not be a problem. As described below, at the end of every day, all CRA portfolios will have a system to even the books.

There would be a demand for digital BD accounts because those accounts would not have fluctuations of units. However, most portfolios would seldom have fluctuations above 0.1% daily. Broad portfolios under proper management would remain steady. Portfolios with just one or just a few items have the highest risks of instability. |

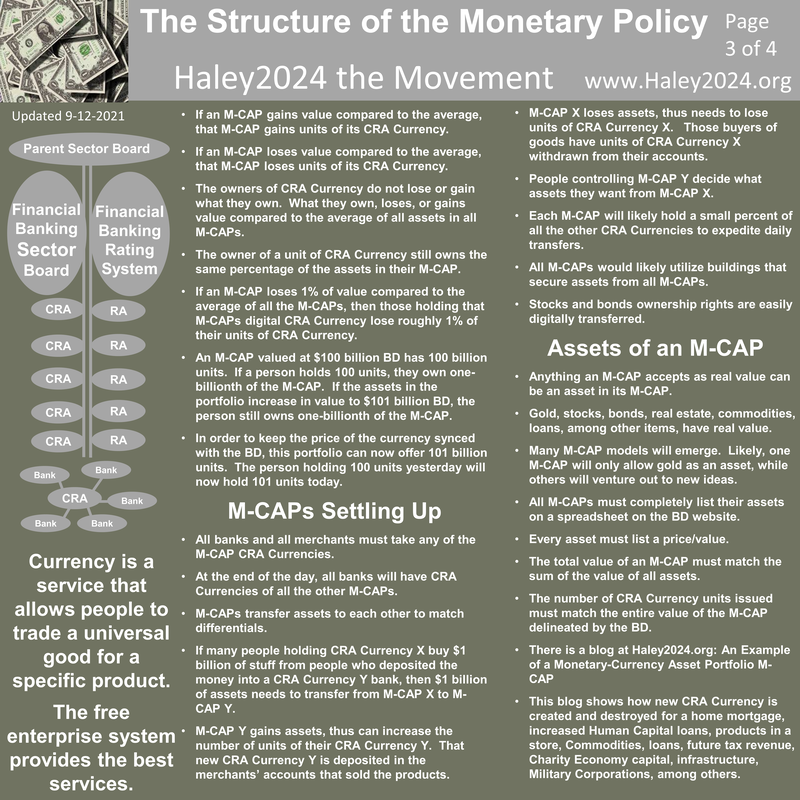

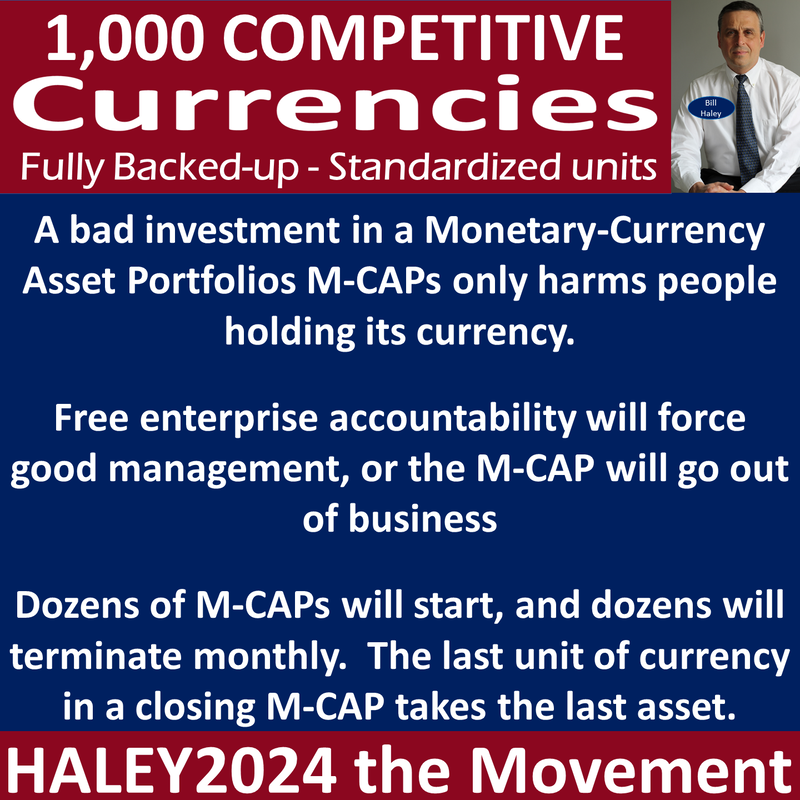

All banks and all merchants take any of the CRA currencies.All banks would readily accept all other currencies because the values are the same. All CRA portfolios must settle their books at the end of every day. If a portfolio does not, they shut down, and the Financial Sector Board takes over. In order to run a currency portfolio, mandates are required. These mandates are mainly anti-fraud measures. The owner of currency (the holder of currency) has the right to acquire the correct percentage of the assets in the portfolio that issued the currency.

|

If a portfolio loses 1% of value compared to the average, then those holding that digital currency, lose roughly 1% of their units of currency.If a CRA’s portfolio decreases in value compared to the average of all portfolios, their units of currency do not lose value; they lose units of currency to match the loss and stay synced to the BD. When the portfolio is reduced by 1%, all holders of that currency lose 1% of their units. When the portfolio is increased by 1%, all holders of that currency, increase their units of currency, not the value of each unit.

|

A portfolio valued at $100 billion BD has 100 billion units. If a person holds 100 units, they own one-billionth of the portfolio. If the assets in the portfolio increase in value to $101 billion BD, the person still owns one-billionth of the portfolio.This new currency system is ownership of real items of value. The values of all items always fluctuate. Most portfolios will have a broad array of items to smooth over spikes or falls in specific items. Instead of owning particular items in the portfolio, the holder of the currency owns a percentage of the entire portfolio. The holder of currency has a demand on any item in the portfolio equal to the listed price of the items.

|

In order to keep the price of the currency synced with the BD, this portfolio can now offer 101 billion units. The person holding 100 units yesterday, now holds 101 units.This method of keeping units synced in value to the average represented by the BD, by adjusting the number of units, could catch-on with stocks in publicly traded companies. The value of each stock would always be one BD. However, the change in value would be represented by increasing or decreasing unit amounts. A holder of 100 stocks of Exxon would always value each stock as $1 BD; however, if the company value goes up by 3% over a month, they would now own 103 units of stocks.

|

At the end of the day, all banks will have currencies of all the other CRA’s.At the end of every day, after billions of transactions occur, every bank will hold billions of units of currency of all of the dozen CRA’s. Since the values are synced per unit, a simple trade will occur to get the currencies back to their own portfolios. Smart bankers will have incentives to reduce these transaction costs.

It might be helpful for representatives from the Financial CRA’s to the Financial Sector Board to set a standard. They will all have motivations to keep the cost down and the quality and reliability of transfers high. There would still be some differences as each CRA portfolio will have either a net inflow or net outflow. |

Financial CRA’s transfer assets to each other to match differentials.If CRA ‘A” receives a net outflow, meaning more of their currency was given out compared to how much of other CRA’s currencies were given to CRA “A” member banks; other CRA portfolios request assets from CRA “A’s”’ portfolio. Those other CRA portfolios are the rightful owners of a percentage of portfolio ‘A’s’ assets because they are the rightful owners of some of portfolio ‘A’s’ currency. Any holder of currency picks whatever assets they wish out of the portfolio based on percentage and price.

|

If many people holding currency X, buy $1 billion of stuff from people that deposited the money into a Currency Y bank; then $1 billion of assets needs to transfer from portfolio X to portfolio Y. People controlling Portfolio Y decide what assets they want from portfolio X.People holding currency X received real goods and services in exchange for currency X. That currency now belongs to the seller of the products and services. Those sellers turn that currency X into their bank that uses currency Y. Currency Y now owns units of currency X; therefore, may go into the currency X portfolio and collect real assets matching the correct units and price. Currency Y has its pick from the portfolio. In this example, Currency Y may transfer $1 billion worth of assets of its choosing out of currency X portfolio, into its (currency Y’s) portfolio. A big check in the checks and balance of the system is that holders of currency get to decide what assets to pull out of the portfolio. It is likely that each portfolio holds a certain percentage of each other’s currency, so daily settling-up is easy.

|

Anything CRA’s accept as real value can be an asset in their portfolios. Gold, stocks, bonds, real estate, commodities, loans, among other items, have real value. Many asset portfolio models will emerge.Most currencies will put items with the most stable prices in their portfolio. There are many factors of items that will make good portfolio assets. Items with widely accepted and established value are better than items with wide fluctuations. Liquid items are better than items that take a while to sell. Durable items are better than quickly consumable items. Publicly traded items are better than privately owned items. Products with a wide variety of quality are more problematic than items with more uniform quality. Large blocks of items are favored over single items.

|

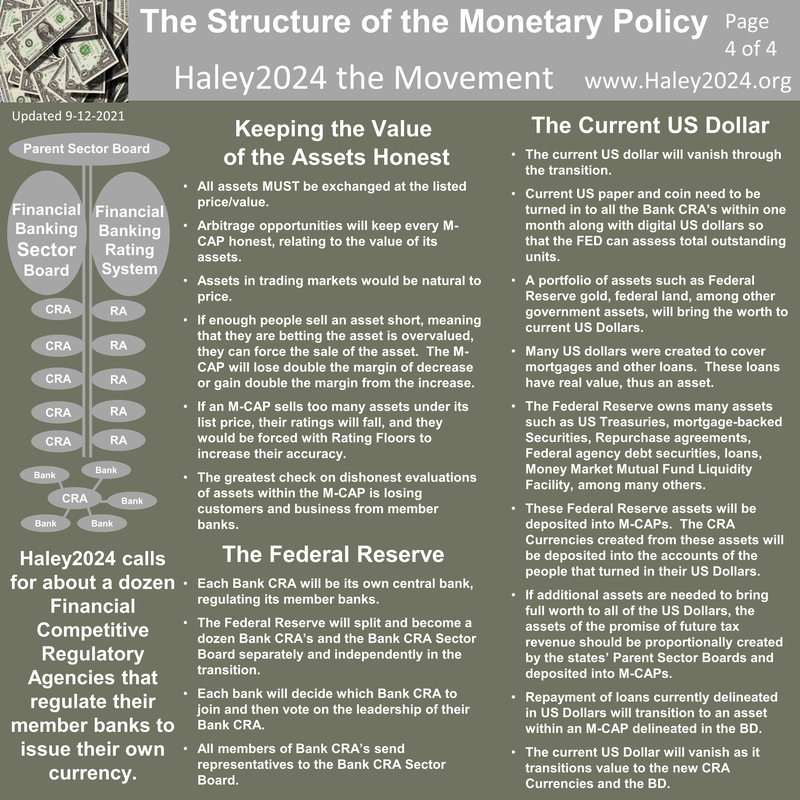

In the transition, the Federal Reserve will split and become one CRA and separately and independently, the Financial CRA Sector Board.The Federal Reserve is established and trusted. All the harm they are doing is long-term harm that individual CRA’s will be able to fix when they take control over the banks that become their members. However, the institutional knowledge and relationships are within the Federal Reserve. Many banks will stay with the Federal Reserve CRA.

Given that they will likely acquire over 20% of the banks. They will have to divide into multiple CRA’s. Each CRA will acquire banks, and the knowledge and experience will spread over many CRA’s. Member banks will vote on their leadership of their own CRA. Banks will be able to switch CRA’s to seek a better regulatory system and better ratings. |

Current US paper and coin need to be turned in to the CRA-FED within one month along with digital US dollars so that the FED can assess total outstanding units.Over the centuries, physical dollars were accidentally destroyed, lost at sea, in fires, in floods, in mattresses, or in coffee cans buried in the backyard of the now-deceased. The only way to determine the amount of outstanding physical currency is to state it will be worthless in a short time-frame, to force people’s hand to turn it all in. All digital currency must be assessed, as well. The government must live up to its commitment and honor the value of every dollar.

|

A portfolio of assets such as Federal Reserve gold, federal land, among other government assets, will bring the worth to current US Dollars.A lot of the dollars the Federal Reserve created is backed up with real assets from big banks. The FED gave digital dollars in exchange for mortgage-backed securities and other tangible assets from big banks; therefore, those assets will be part of the portfolio bringing worth to all the current US Dollars. Federal Reserve Gold and Federal land will be in the mix.

The free enterprise reforms of the military, education, and roads will bring considerable worth that will pay down government debt. Giving worth to all the US Dollars can be looked at as government debt similar to Social Security debt. Haley2024 reforms reveal assets and liabilities and have a system to deal with both. |

Repayment of loans will transition to BD’s or the bank’s currency.The BD will target its value to the current value of the US Dollar. Current loans will need to be converted from the US dollar to the BD. Loans are valuable because people promise to use future labor to repay the loan. Future labor backs up much of our current currency. Substantially, future labor in the form of loan repayments will bring value to the current US Dollar.

|

All portfolios MUST completely list their assets on a spreadsheet on their website. Every item MUST list a price/value. The total value MUST match the sum of all assets, and the number of units issued MUST match the entire value measured by the BD.Portfolios must be open and transparent. A portfolio must list every item they claim is in their portfolio. The holders of the currency own all those items, and they have a right to know what they own. This transparency is a significant check within the checks and balances of this system. When one adds up all the assets in the portfolio, there is a total. That total is the amount of currency allowed to be issued.

|

All assets MUST be for sale at the listed price/value. Arbitrage opportunities will keep every portfolio honest, relating to the value of their assets.As an extensive check on abuse, every item must be for sale at the price listed. There would be several financial mechanisms to call out an item as being over-priced. People could sell certain items short, similar to selling a stock short. If enough people are willing to put their money on the line, they could force the sale to reveal the real price. The Rating System could play a role in this, as well. The free market has many ways to reveal the true price.

|

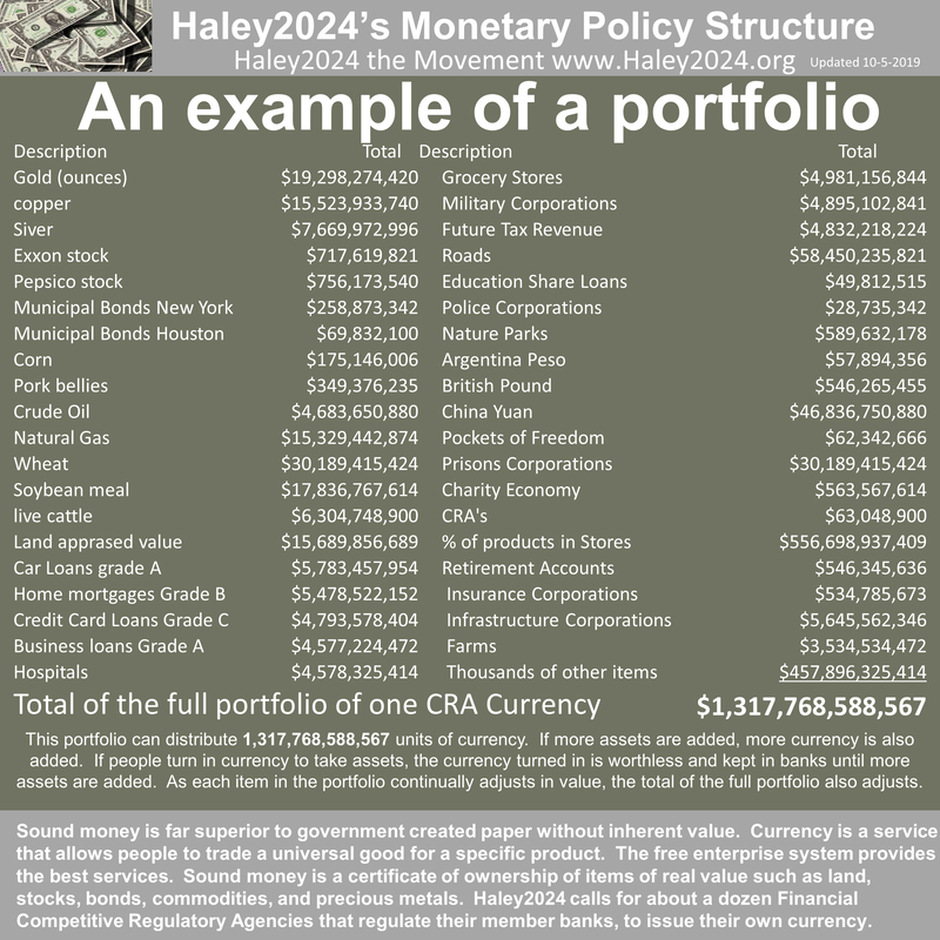

An example of a portfolio

This example of a portfolio shows about $1,317 billion in assets. The owners of the currency can demand the trade of their currency in for assets of their choosing within the portfolio. If someone has 1200 units of currency, they can take one ounce of gold. If someone had 270 units of currency, he or she could demand two PepsiCo stocks. For 313 units of currency, the bank will tell them where they could pick up their soybean meal. If someone really wanted to demand to trade 30,000 units of currency for a car loan, he or she could; however, the loan is likely to have terms that can not change, such as a reputable loan servicing business.

|