Click Here to go to the Haley2024 Tax Page

|

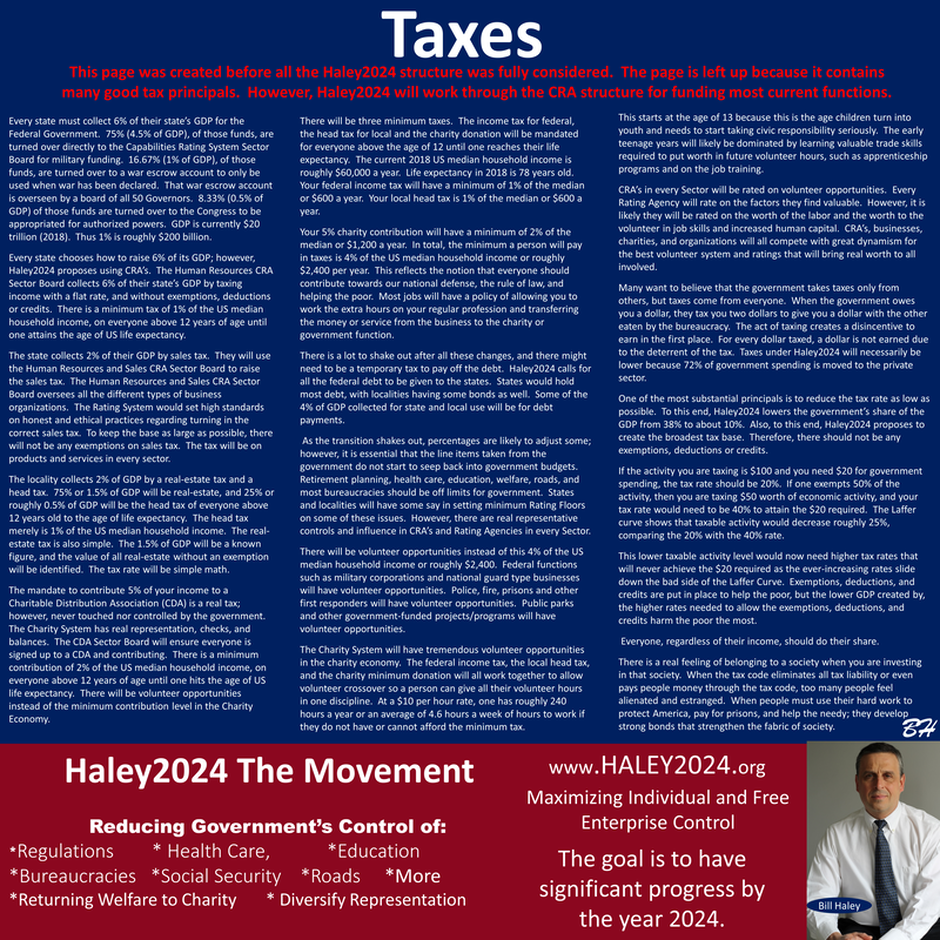

Every state must collect 6% of their state’s GDP for the Federal Government. 75% (4.5% of GDP), of those funds, are turned over directly to the Capabilities Rating System Sector Board for military funding. 16.67% (1% of GDP), of those funds, are turned over to a war escrow account to only be used when war has been declared. That war escrow account is overseen by a board of all 50 Governors. 8.33% (0.5% of GDP) of those funds are turned over to the Congress to be appropriated for authorized powers. GDP is currently $20 trillion (2018). Thus 1% is roughly $200 billion.

|

|

Every state chooses how to raise 6% of its GDP; however, Haley2024 proposes using CRA’s. The Human Resources CRA Sector Board collects 6% of their state’s GDP by taxing income with a flat rate, and without exemptions, deductions or credits. There is a minimum tax of 1% of the US median household income, on everyone above 12 years of age until one attains the age of US life expectancy.

|

|

The state collects 2% of their GDP by sales tax. They will use the Human Resources and Sales CRA Sector Board to raise the sales tax. The Human Resources and Sales CRA Sector Board oversees all the different types of business organizations. The Rating System would set high standards on honest and ethical practices regarding turning in the correct sales tax. To keep the base as large as possible, there will not be any exemptions on sales tax. The tax will be on products and services in every sector.

|

|

The locality collects 2% of GDP by a real-estate tax and a head tax. 75% or 1.5% of GDP will be real-estate, and 25% or roughly 0.5% of GDP will be the head tax of everyone above 12 years old to the age of life expectancy. The head tax merely is 1% of the US median household income. The real-estate tax is also simple. The 1.5% of GDP will be a known figure, and the value of all real-estate without an exemption will be identified. The tax rate will be simple math.

|

|

The mandate to contribute 5% of your income to a Charitable Distribution Association (CDA) is a real tax; however, never touched nor controlled by the government. The Charity System has real representation, checks, and balances. The CDA Sector Board will ensure everyone is signed up to a CDA and contributing. There is a minimum contribution of 2% of the US median household income, on everyone above 12 years of age until one hits the age of US life expectancy. There will be volunteer opportunities instead of the minimum contribution level in the Charity Economy.

|

|

There will be three minimum taxes. The income tax for federal, the head tax for local and the charity donation will be mandated for everyone above the age of 12 until one reaches their life expectancy. The current 2018 US median household income is roughly $60,000 a year. Life expectancy in 2018 is 78 years old. Your federal income tax will have a minimum of 1% of the median or $600 a year. Your local head tax is 1% of the median or $600 a year.

|

|

Your 5% charity contribution will have a minimum of 2% of the median or $1,200 a year. In total, the minimum a person will pay in taxes is 4% of the US median household income or roughly $2,400 per year. This reflects the notion that everyone should contribute towards our national defense, the rule of law, and helping the poor. Most jobs will have a policy of allowing you to work the extra hours on your regular profession and transferring the money or service from the business to the charity or government function.

|

|

There is a lot to shake out after all these changes, and there might need to be a temporary tax to pay off the debt. Haley2024 calls for all the federal debt to be given to the states. States would hold most debt, with localities having some bonds as well. Some of the 4% of GDP collected for state and local use will be for debt payments.

|

|

As the transition shakes out, percentages are likely to adjust some; however, it is essential that the line items taken from the government do not start to seep back into government budgets. Retirement planning, health care, education, welfare, roads, and most bureaucracies should be off limits for government. States and localities will have some say in setting minimum Rating Floors on some of these issues. However, there are real representative controls and influence in CRA’s and Rating Agencies in every Sector.

|

|

There will be volunteer opportunities instead of this 4% of the US median household income or roughly $2,400. Federal functions such as military corporations and national guard type businesses will have volunteer opportunities. Police, fire, prisons and other first responders will have volunteer opportunities. Public parks and other government-funded projects/programs will have volunteer opportunities.

|

|

The Charity System will have tremendous volunteer opportunities in the charity economy. The federal income tax, the local head tax, and the charity minimum donation will all work together to allow volunteer crossover so a person can give all their volunteer hours in one discipline. At a $10 per hour rate, one has roughly 240 hours a year or an average of 4.6 hours a week of hours to work if they do not have or cannot afford the minimum tax.

|

|

This starts at the age of 13 because this is the age children turn into youth and needs to start taking civic responsibility seriously. The early teenage years will likely be dominated by learning valuable trade skills required to put worth in future volunteer hours, such as apprenticeship programs and on the job training.

|

|

CRA’s in every Sector will be rated on volunteer opportunities. Every Rating Agency will rate on the factors they find valuable. However, it is likely they will be rated on the worth of the labor and the worth to the volunteer in job skills and increased human capital. CRA’s, businesses, charities, and organizations will all compete with great dynamism for the best volunteer system and ratings that will bring real worth to all involved.

|

|

|

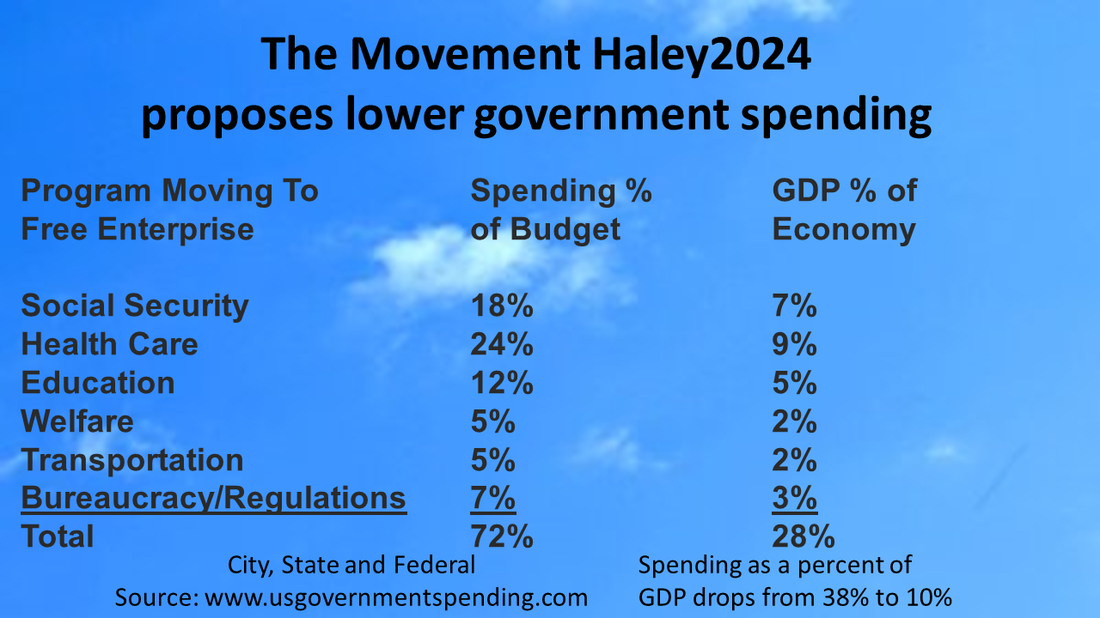

Many want to believe that the government takes taxes only from others, but taxes come from everyone. When the government owes you a dollar, they tax you two dollars to give you a dollar with the other eaten by the bureaucracy. The act of taxing creates a disincentive to earn in the first place. For every dollar taxed, a dollar is not earned due to the deterrent of the tax. Taxes under Haley2024 will necessarily be lower because 72% of government spending is moved to the private sector.

|

|

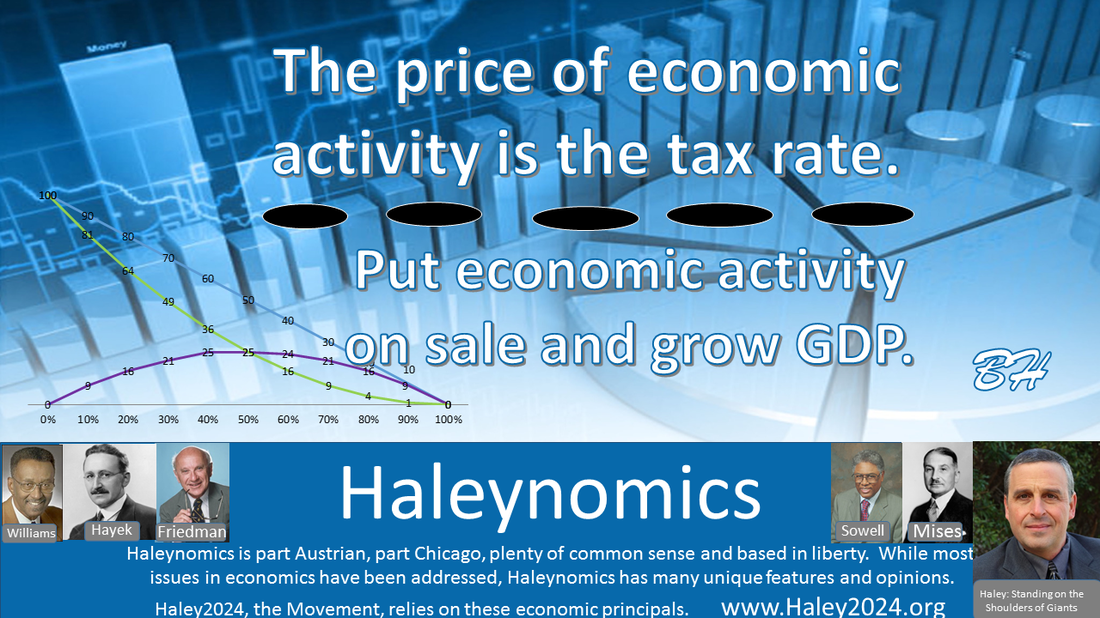

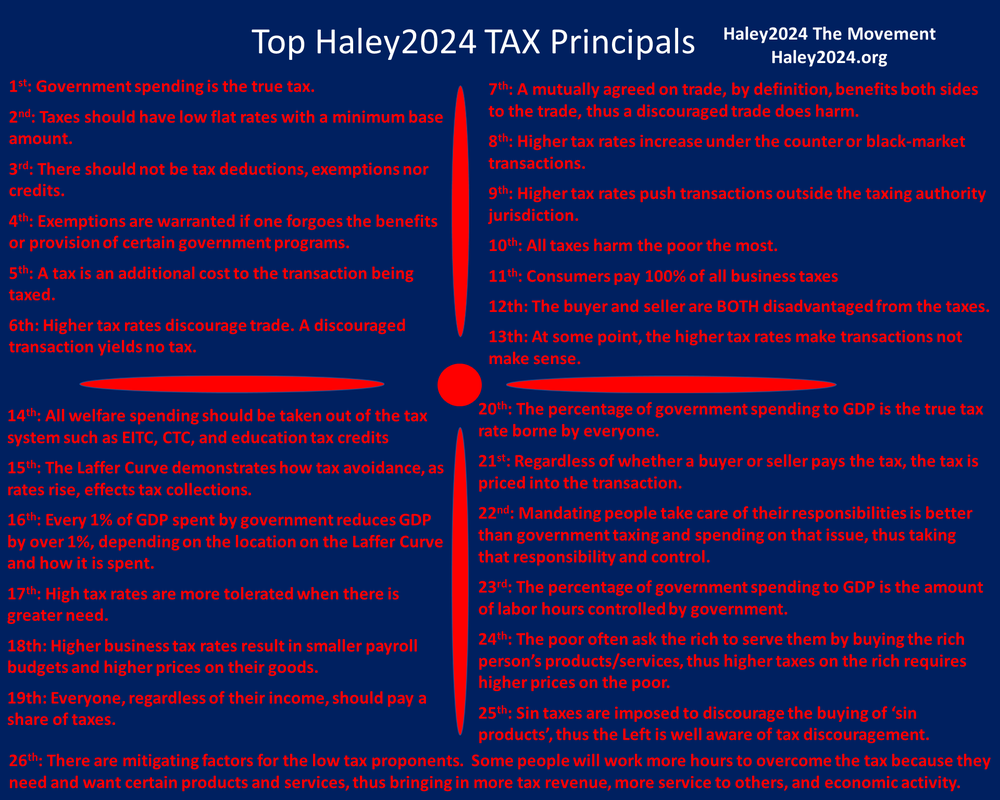

One of the most substantial principals is to reduce the tax rate as low as possible. To this end, Haley2024 lowers the government’s share of the GDP from 38% to about 10%. Also, to this end, Haley2024 proposes to create the broadest tax base. Therefore, there should not be any exemptions, deductions or credits.

|

|

|

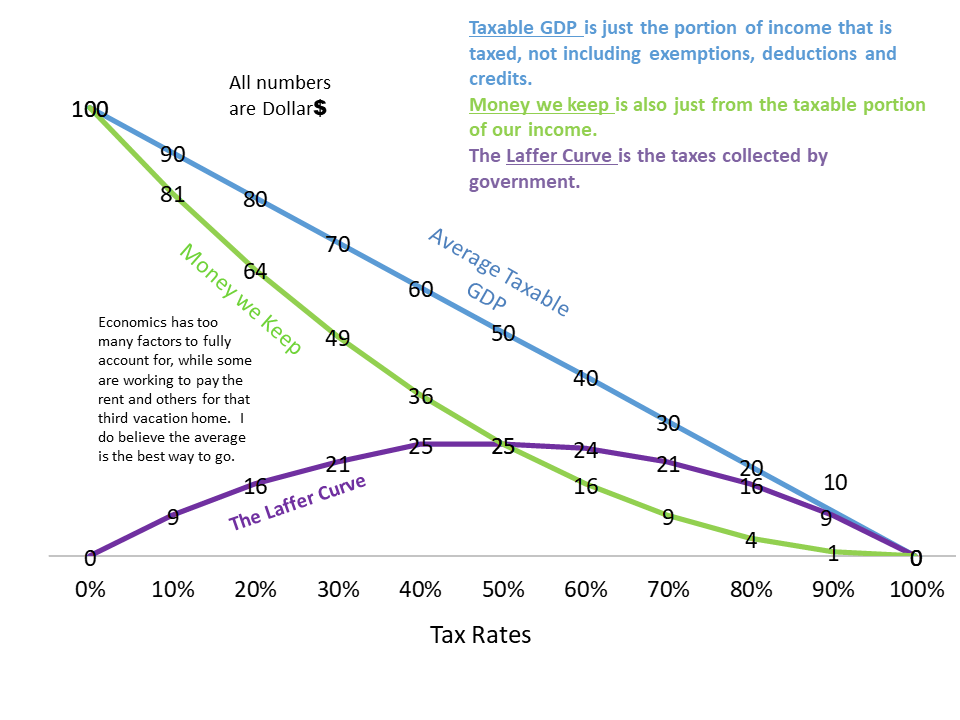

If the activity you are taxing is $100 and you need $20 for government spending, the tax rate should be 20%. If one exempts 50% of the activity, then you are taxing $50 worth of economic activity, and your tax rate would need to be 40% to attain the $20 required. The Laffer curve shows that taxable activity would decrease roughly 25%, comparing the 20% with the 40% rate.

|

|

This lower taxable activity level would now need higher tax rates that will never achieve the $20 required as the ever-increasing rates slide down the bad side of the Laffer Curve. Exemptions, deductions, and credits are put in place to help the poor, but the lower GDP created by, the higher rates needed to allow the exemptions, deductions, and credits harm the poor the most.

|

Everyone, regardless of their income, should do their share.There is a real feeling of belonging to a society when you are investing in that society. When the tax code eliminates all tax liability or even pays people money through the tax code, too many people feel alienated and estranged. When people must use their hard work to protect America, pay for prisons, and help the needy; they develop strong bonds that strengthen the fabric of society.

|