Haleynomics

|

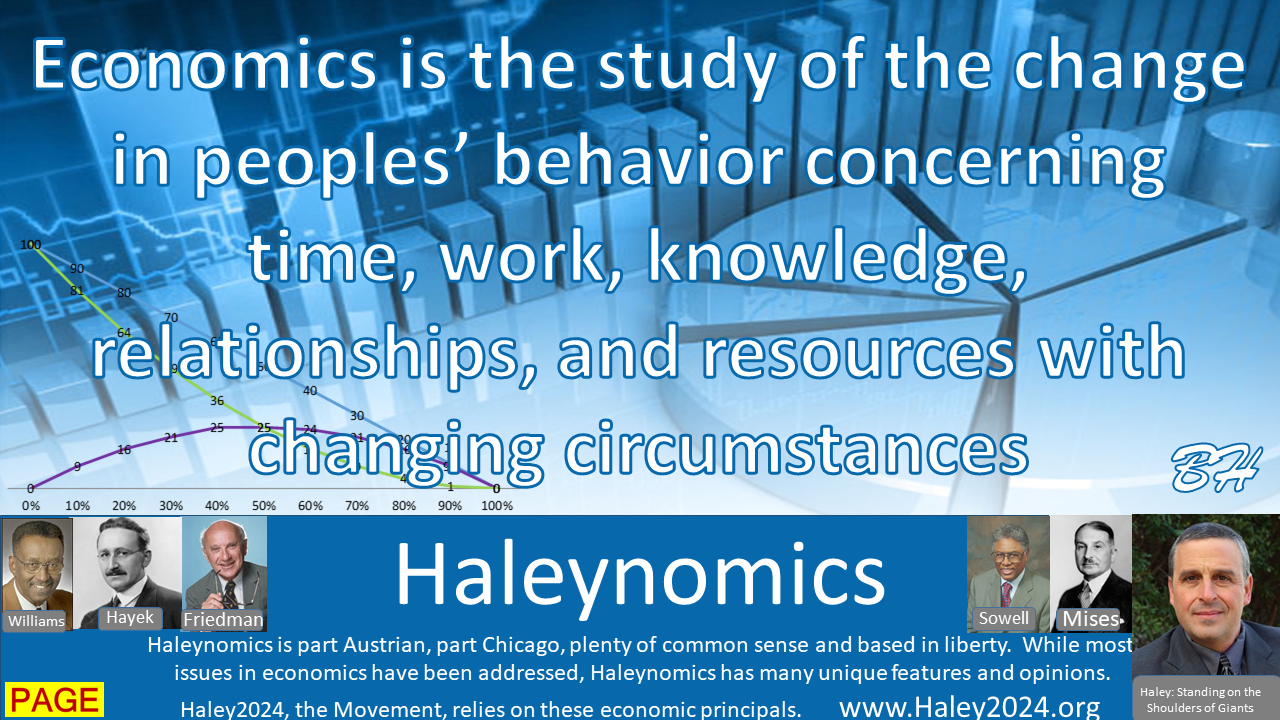

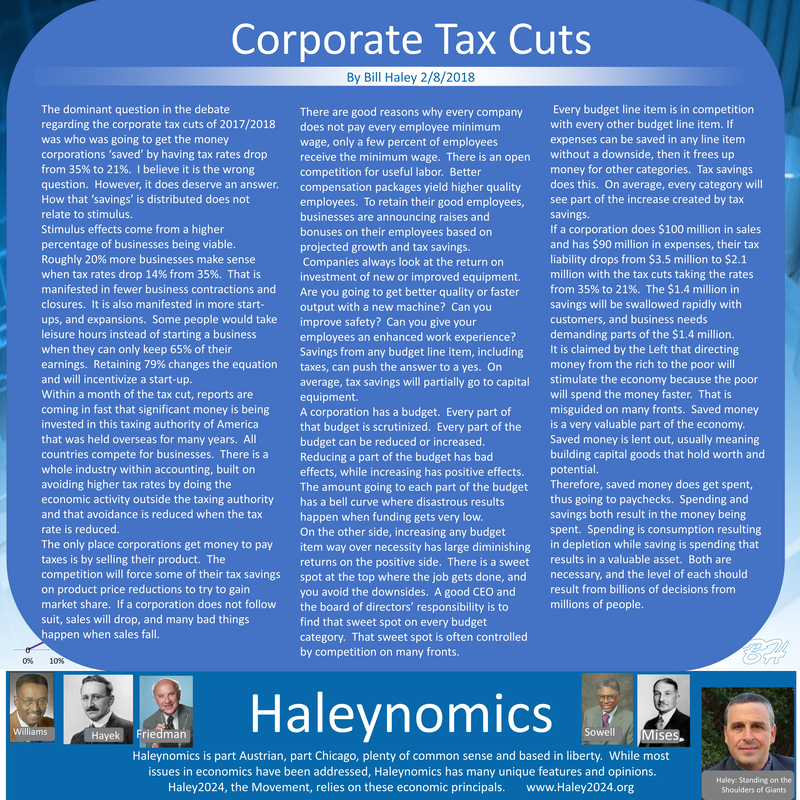

I love economics. "Haleynomics" is a phrase I created, not out of conceit, but because I have well-thought-out unique economic views. I studied economics extensively and developed unique ideas and my own point of view. I studied a wide variety of economic thinkers with many thoughts and perspectives, learning from all and developing my own views.

|

|

Most everyone knows economics in practice. When someone buys something on sale that they would not have otherwise purchased, or when someone decides to work overtime to pay for a "want," that is changing behavior. That is economics. Economics is the study of what you and millions of others decide to do or not do. Many people have not put their thoughts in order with their actions in order to truly know good economics and the public policies that develop from those natural actions. While deriving many of my underlying understandings from great thinkers before me, I strive to be unique in creating my own policies and statements.

|

|

|

The first lesson of economics:

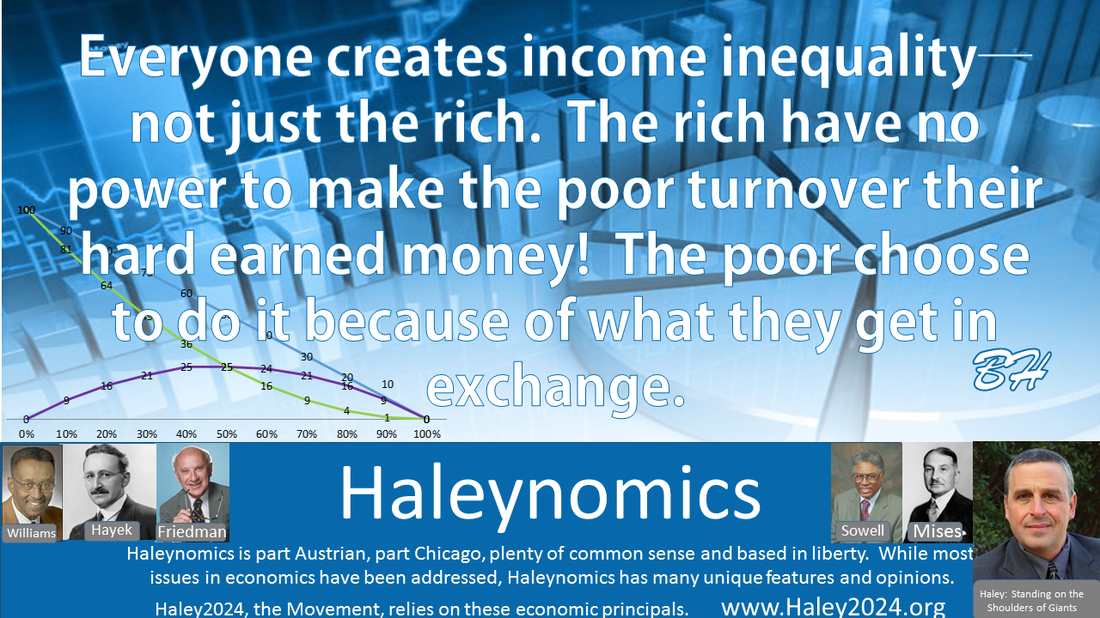

Prices fluctuate regularly because people continuously change what they are willing to pay for one item compared to other items. Supply and demand are substantial causes of price and price is a significant factor in supply. The role of prices is a vitally essential factor in ensuring the best efficiency and advancements. The government unduly influencing price does great harm.

|

|

The Tenth Commandment is one of the most important economic lessons. The message is not that you should not desire more and work hard for those things; you clearly should. The moral here is that you should not resent your neighbor having more property than you. If they have a car, you can clearly want a vehicle also; however, this is about you thinking that you deserve their car more than your neighbor does.

|

|

Since the establishment of the Federal Reserve, the value of our currency has lost roughly 96% of its value, thus failing in the mission of a stable currency. In the past, our currency has been backed by gold or silver, and many wish to return to this policy. While this is far better than not having it backed at all, the value of gold has experienced extreme swings over time. The Haley2024 plan is to repeal the federal law that bans banks from creating money that is fully backed by items of real value and allowing individuals to use that money for exchange. This plan has a structure in the private sector through Financial Sectors using CRA’s.

|

Inflation

There are a lot of opinions and speculations on why there is inflation, but most miss the root of the issue. There is only inflation when the currency is not back by things of real value (fiat money). If we develop a currency entirely backed up by an extensive variety of assets and resources, inflation will vanish. Backed money cannot have inflation. Inflation would shift to certain goods having price increases and decreases compared to the average of all assets.

|

|

|

The President is responsible for roughly 23% of spending in the USA. While he has assistance, the knowledge, time, and dedication he and his administration have are not close to the 330 million peoples' brains, intelligence, time, experience, or level of caring. People looking after their own lives and businesses are much more dedicated than a distant bureaucrat will ever be.

|

Educational Media and BooksThere is a wealth of free to very low-cost economic lessons on the internet. I have compiled a few videos and books that have introduced me to the knowledge of people's lifetime of learning. My basic conclusion from all of my studying is that free enterprise is the best and most fair economic system that brings the most wealth to the most significant number of people. Free enterprise communities are also characterized as the most freely giving societies to those experiencing hard times.

|

|

Currently, taxes are collected in a general fund, and programs or agencies are funded from the general fund. Haley2024 proposes, many things to return to the free enterprise system. When that happens, the cost of the service of regulations is tied directly to the benefits. A designated tax should fund any programs funded by the government so people can match the taxes with the services.

|

The Wealth of Nations (1776) Adam Smith

|

Government Spending

|

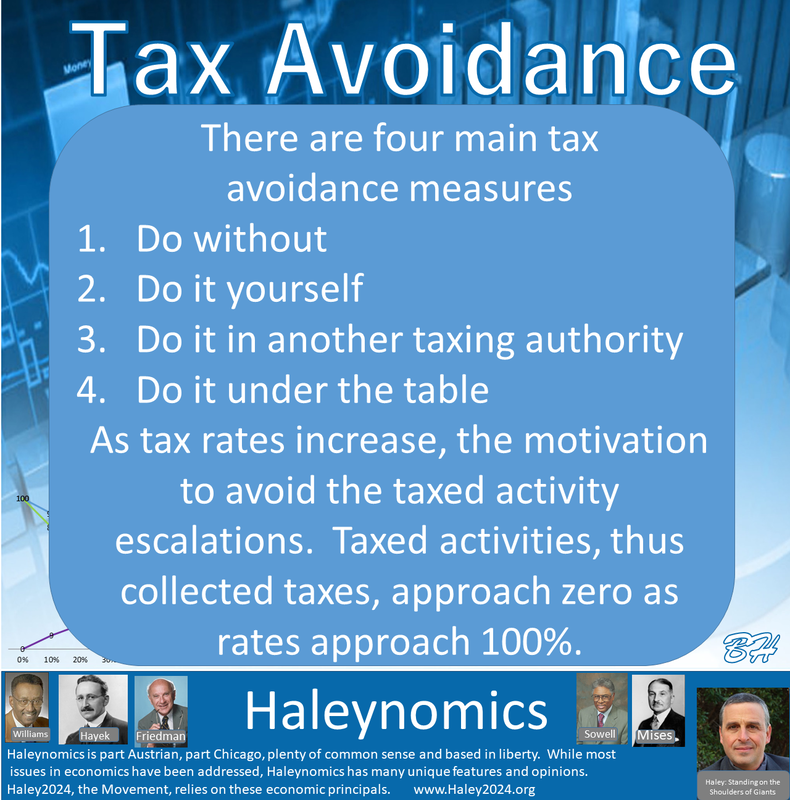

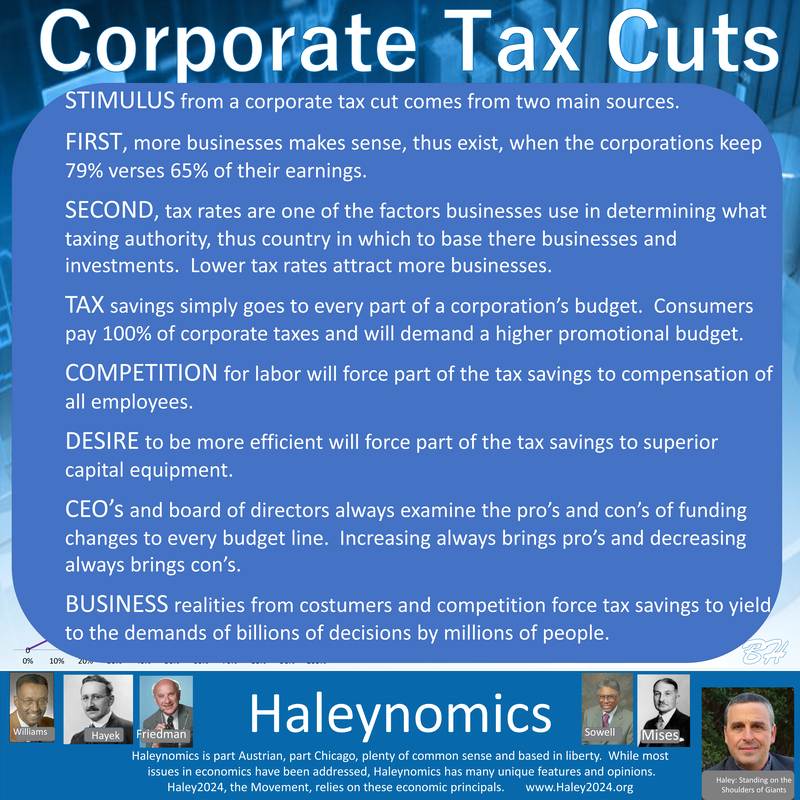

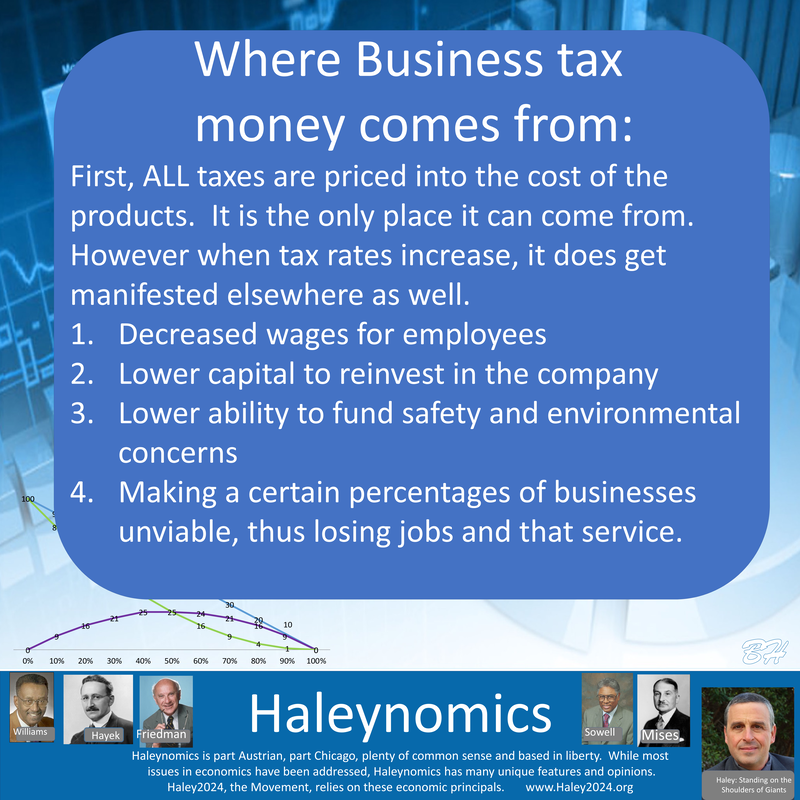

All Taxes Harm the Poor the MostThe higher the tax rate (the price of doing business), the less business will be done. The larger the opportunity in business, the higher the opportunity for the poor. When jobs are relatively scarce and hard to find, people will start to bid down their labor rates (pay) to, 'at least have a job.'

|

|

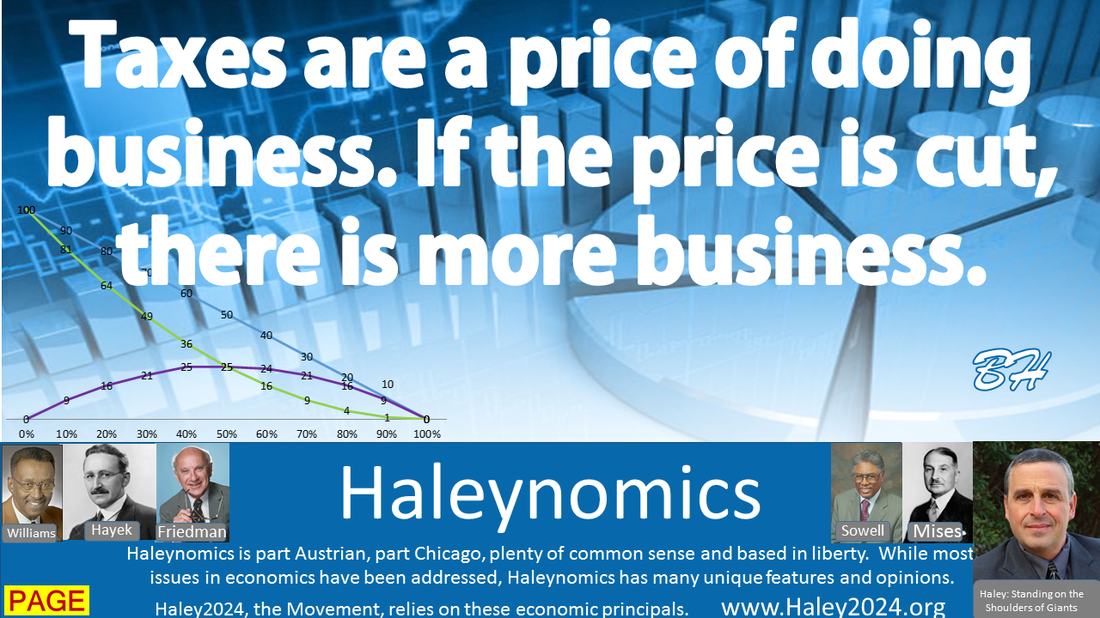

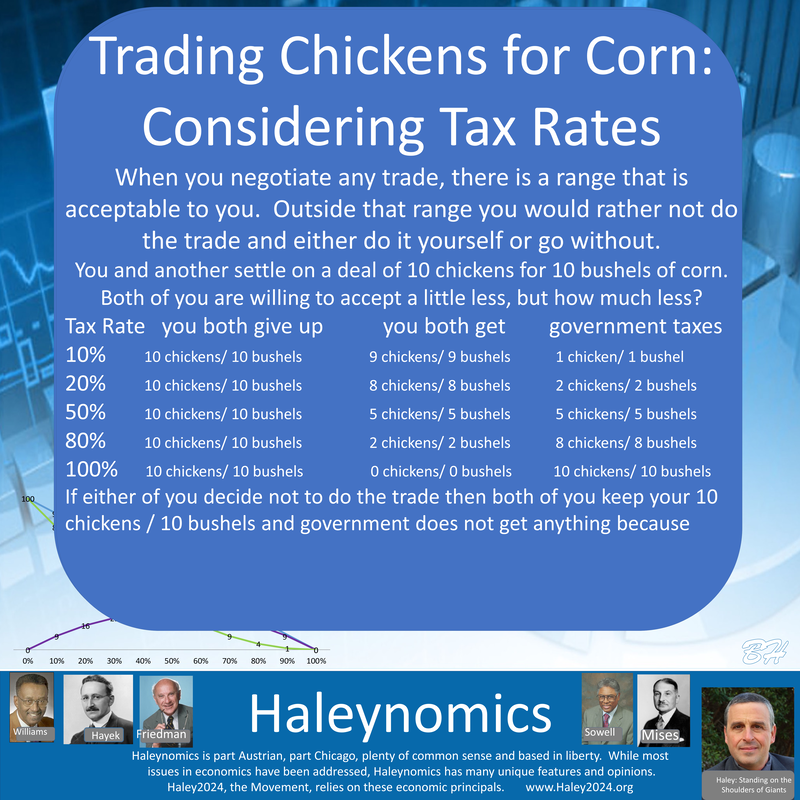

Most people who teach ‘the Laffer Curve’ concentrate on tax income to the government. While this is vitally important, I believe the larger lesson is the loss of economic activity and the overall wealth created as the tax rates rise. The price of doing business is the tax rate. The higher the price of anything the less willing people will do that thing, even making money. Ask yourself a simple question, if your boss told you that after twenty hours of work a week, your pay would drop x%. At what point would 'X' be too large, causing you to stop working over twenty hours a week?

|