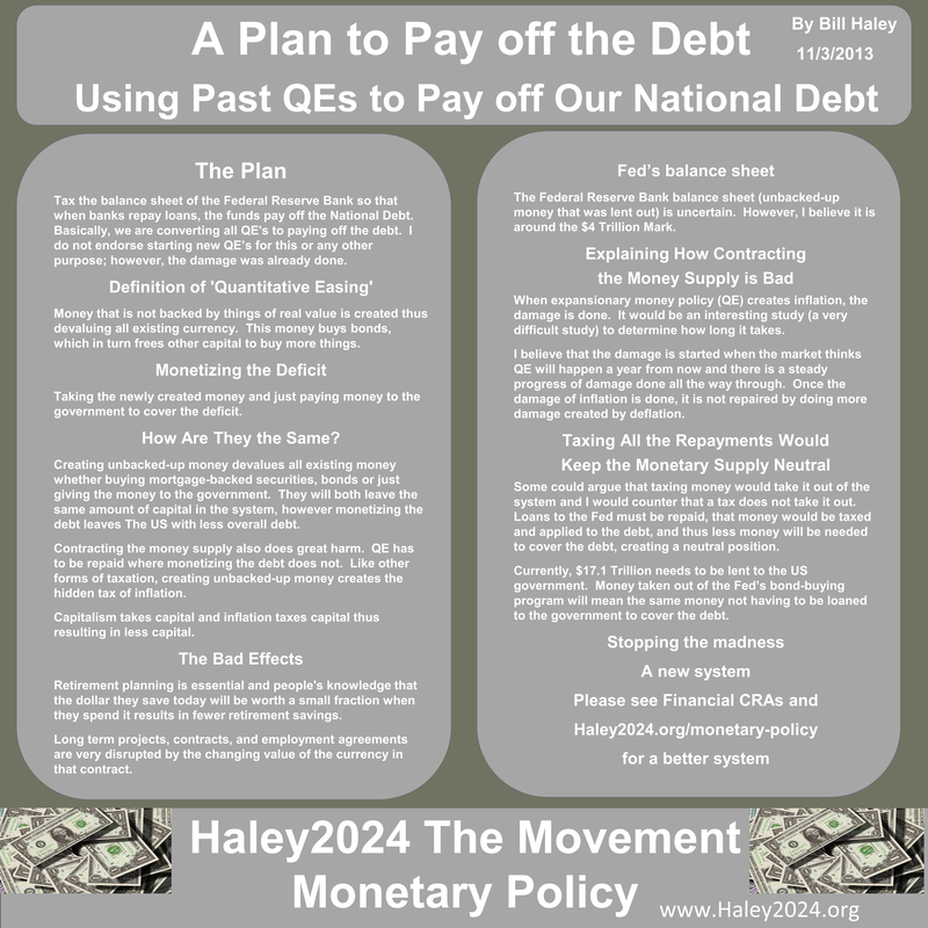

Using Past QEs to Pay off Our National Debt

How Are They the Same? Creating unbacked-up money devalues all existing money whether buying mortgage-backed securities, bonds or just giving the money to the government. They will both leave the same amount of capital in the system, however monetizing the debt leaves The US with less overall debt. |

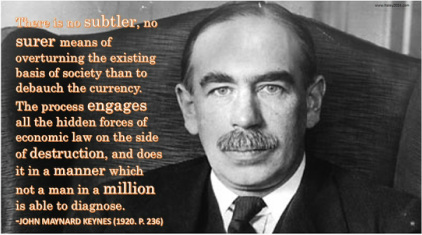

The Bad Effects Retirement planning is essential and people's knowledge that the dollar they save today will be worth a small fraction when they spend it results in fewer retirement savings. Long term projects, contracts, and employment agreements are very disrupted by the changing value of the currency in that contract. |

Taxing All the Repayments Would Keep the Monetary Supply Neutral Some could argue that taxing money would take it out of the system and I would counter that a tax does not take it out. Loans to the Fed must be repaid, that money would be taxed and applied to the debt, and thus less money will be needed to cover the debt, creating a neutral position. |

Stopping the Madness |