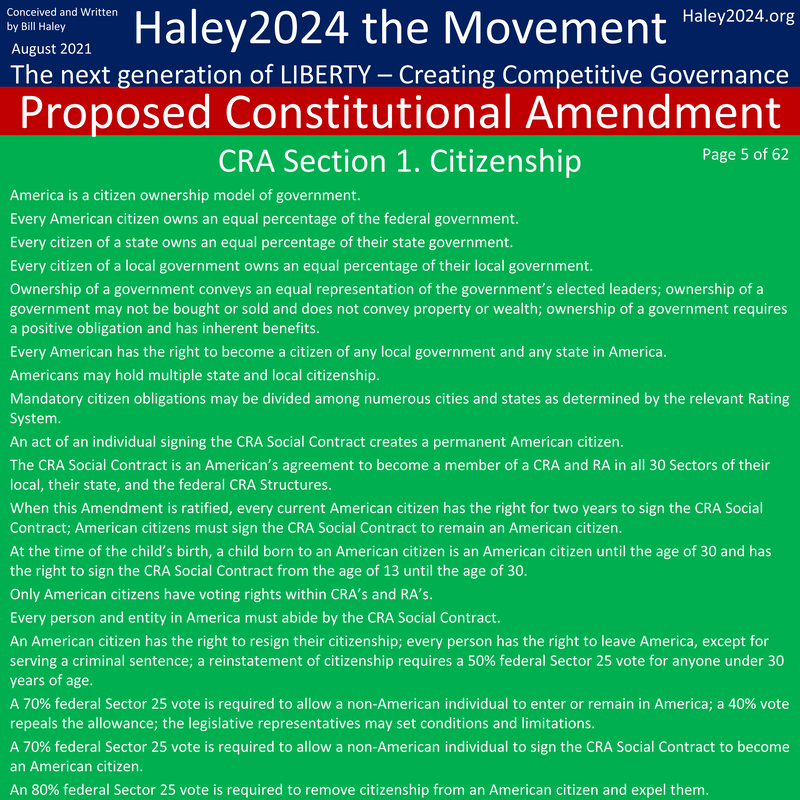

A Citizen’s Responsibility

|

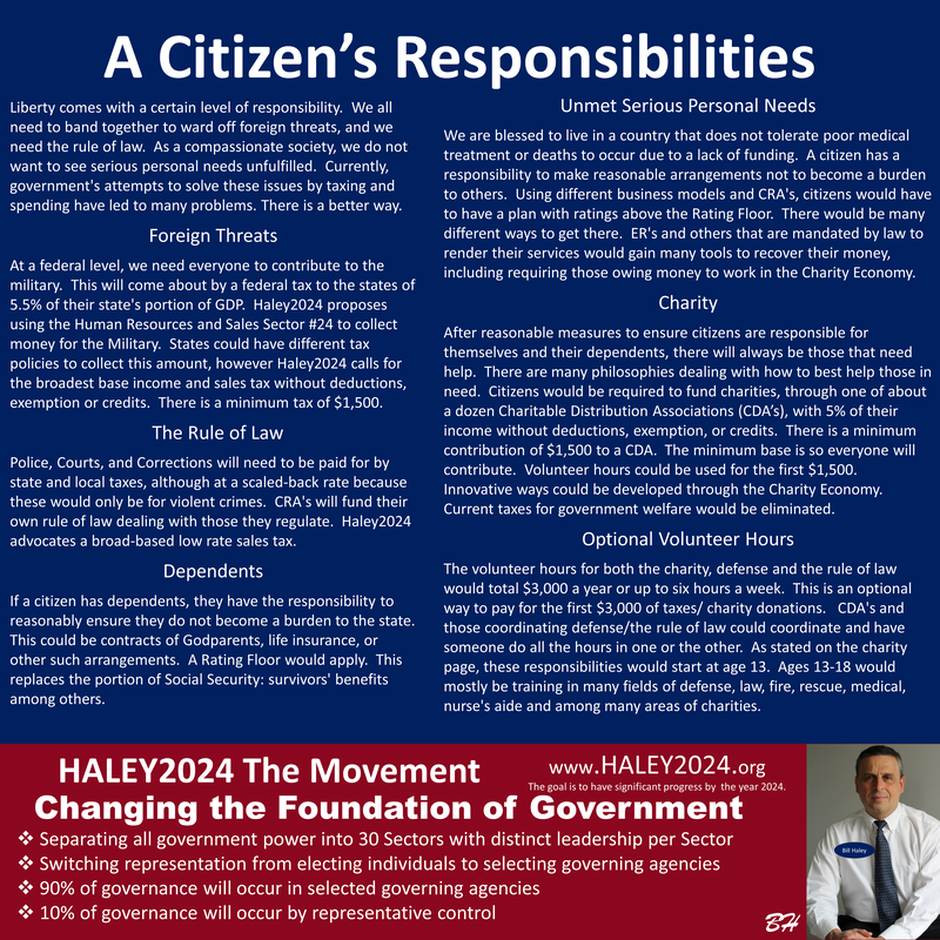

Liberty comes with a certain level of responsibility. We all need to band together to ward off foreign threats, and we need the rule of law. As a compassionate society, we do not want to see serious personal needs unfulfilled. Currently, government's attempts to solve these issues by taxing and spending have led to many problems. There is a better way.

|

Foreign ThreatsAt a federal level, we need everyone to contribute to the military. This will come about by a federal tax to the states of 5.5% of their state's portion of GDP. Haley2024 proposes using the Human Resources and Sales Sector #24 to collect money for the Military. States could have different tax policies to collect this amount, however Haley2024 calls for the broadest base income and sales tax without deductions, exemption or credits. There is a minimum tax of $1,500.

|

|

Police, Courts, and Corrections will need to be paid for by state and local taxes, although at a scaled-back rate because these would only be for violent crimes. CRA's will fund their own rule of law dealing with those they regulate. Haley2024 advocates a broad-based low rate sales tax.

|

|

Dependent

If a citizen has dependents, they have the responsibility to reasonably ensure they do not become a burden to the state. This could be contracts of Godparents, life insurance, or other such arrangements. A Rating Floor would apply. This replaces the portion of Social Security: survivors' benefits among others.

|

|

Unmet Serious Personal Need

We are blessed to live in a country that does not tolerate poor medical treatment or deaths to occur due to a lack of funding. A citizen has a responsibility to make reasonable arrangements not to become a burden to others. Using different business models and CRA's, citizens would have to have a plan with ratings above the Rating Floor. There would be many different ways to get there. ER's and others that are mandated by law to render their services would gain many tools to recover their money, including requiring those owing money to work in the Charity Economy.

|

|

After reasonable measures to ensure citizens are responsible for themselves and their dependents, there will always be those that need help. There are many philosophies dealing with how to best help those in need. Citizens would be required to fund charities, through one of about a dozen Charitable Distribution Associations (CDA’s), with 5% of their income without deductions, exemption, or credits. There is a minimum contribution of $1,500 to a CDA. The minimum base is so everyone will contribute. Volunteer hours could be used for the first $1,500. Innovative ways could be developed through the Charity Economy. Current taxes for government welfare would be eliminated.

|

|

Optional Volunteer Hours

The volunteer hours for both the charity, defense and the rule of law would total $3,000 a year or up to six hours a week. This is an optional way to pay for the first $3,000 of taxes/ charity donations. CDA's and those coordinating defense/the rule of law could coordinate and have someone do all the hours in one or the other. As stated on the Charity Page, these responsibilities would start at age 13. Ages 13-18 would mostly be training in many fields of defense, law, fire, rescue, medical, nurse's aide and among many areas of charities.

|