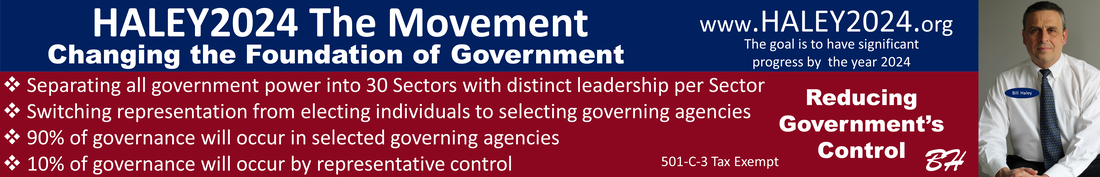

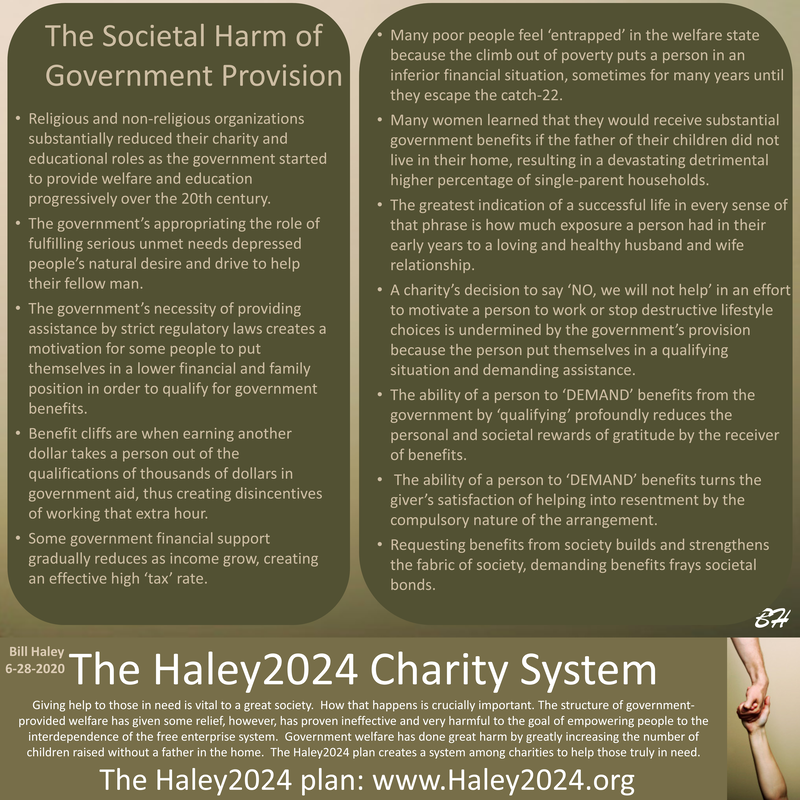

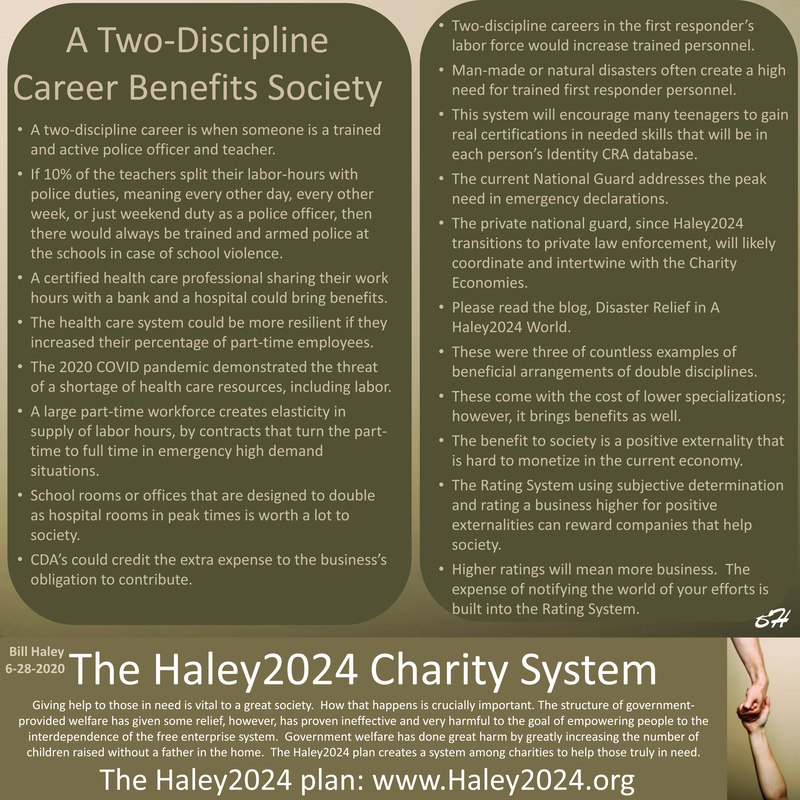

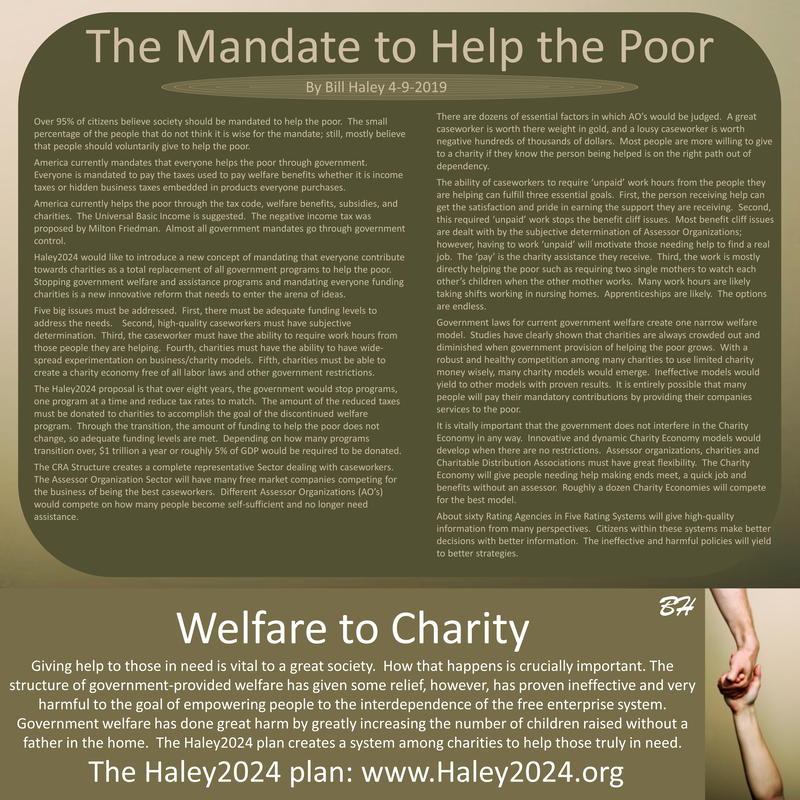

In-Depth Look at the Charity System

Competitive Governance within every geographic jurisdiction

This page is to take a more in-depth look at the Haley2024 Charity System. Please look at the blog pages as well.

The bullet points above were updated 9-12-2021. This plan remains 98% consistent.

|

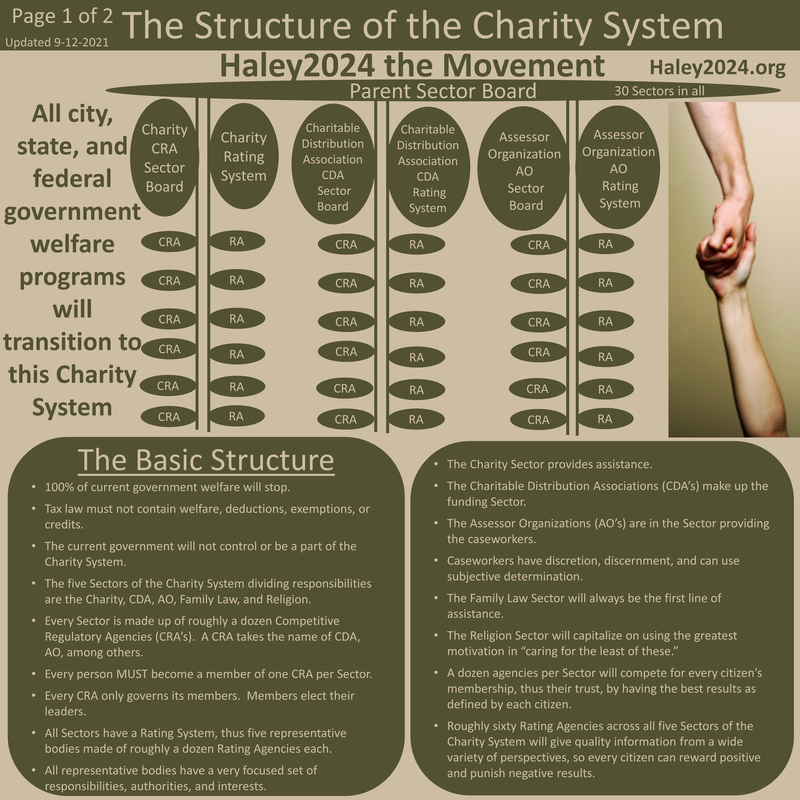

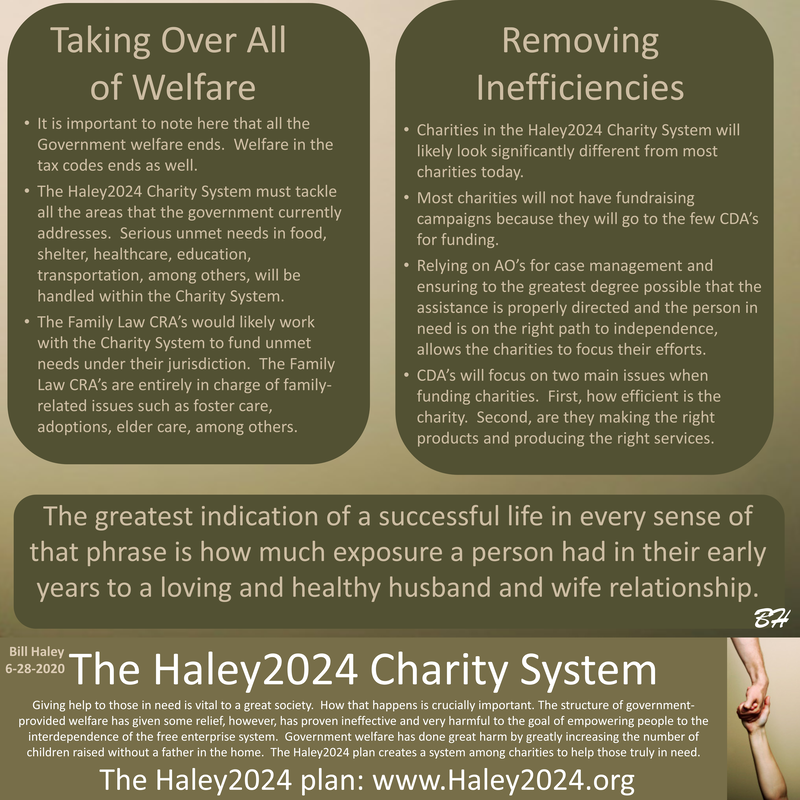

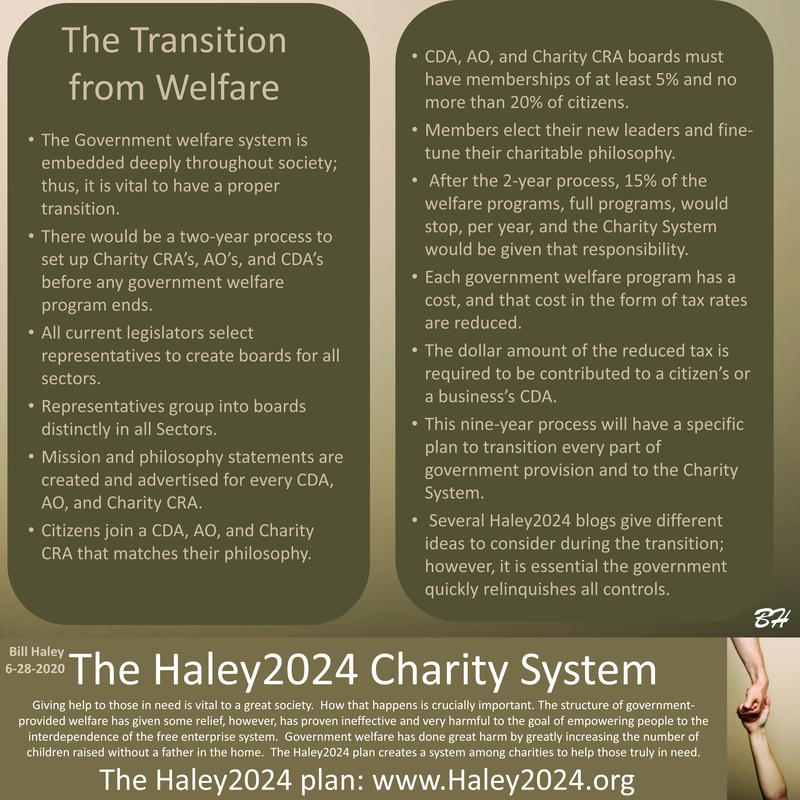

•100% of the current government welfare will stop.

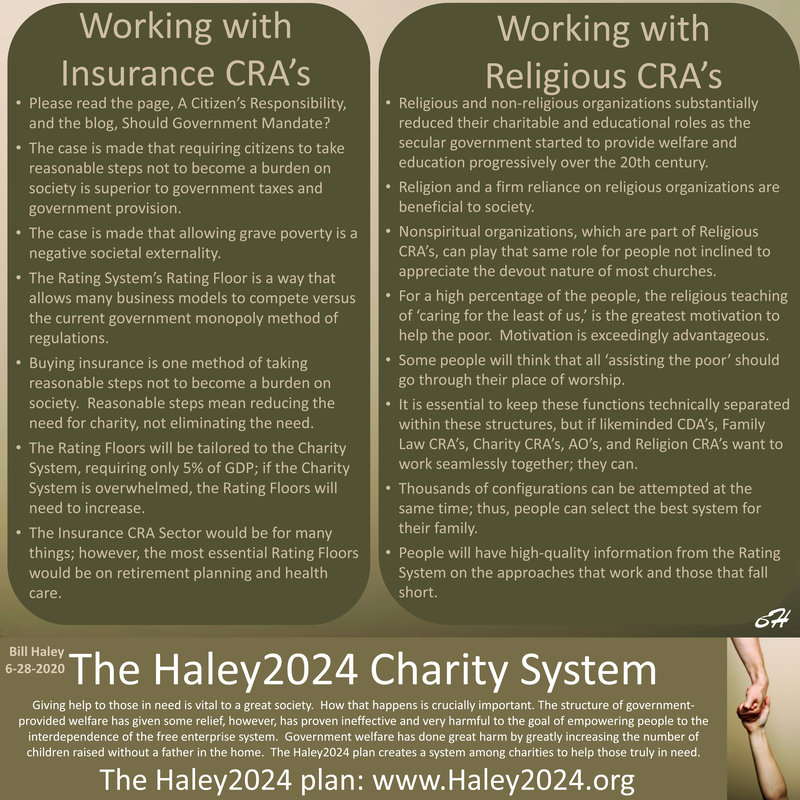

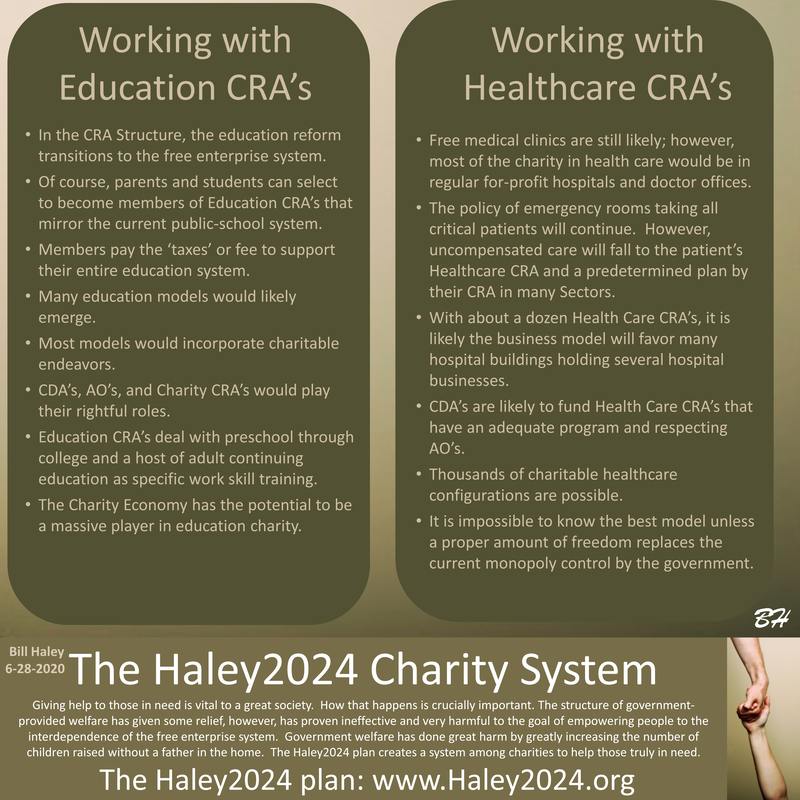

•Tax law must not contain welfare, deductions, exemptions, nor credits. •The current government will not control or be a part of the Charity System. •The five Sectors of the Charity System dividing responsibilities are the Charity, CDA, AO, Family Law, and Religion. •Every Sector is made up of roughly a dozen Competitive Regulatory Agencies (CRA’s). A CRA takes the name of CDA, AO, among others. •Every person MUST become a member of one CRA per Sector. |

|

•Every CRA only governs its members. Members elect their leaders.

All Sectors have a Rating System, thus five representative bodies made of roughly a dozen Rating Agencies each. •All ten representative bodies have a very focused set of responsibilities, authorities, and interests. •The Charity Sector provides assistance. •The Charitable Distribution Associations (CDA’s) make-up the funding Sector. •The Assessor Organizations (AO’s) are in the Sector providing the caseworkers. |

|

•Caseworkers have discretion, discernment, and can use subjective determination.

•The Family Law Sector will always be the first line of assistance. •The Religion Sector will capitalize on using the greatest motivation in “caring for the least of these.” •A dozen agencies per representative body will compete for every citizen’s membership, thus their trust, by having the best results as defined by each citizen. •Roughly sixty Rating Agencies across all five Sectors will give quality information, from a wide variety of perspectives, so every citizen can reward or punish positive and negative results. |

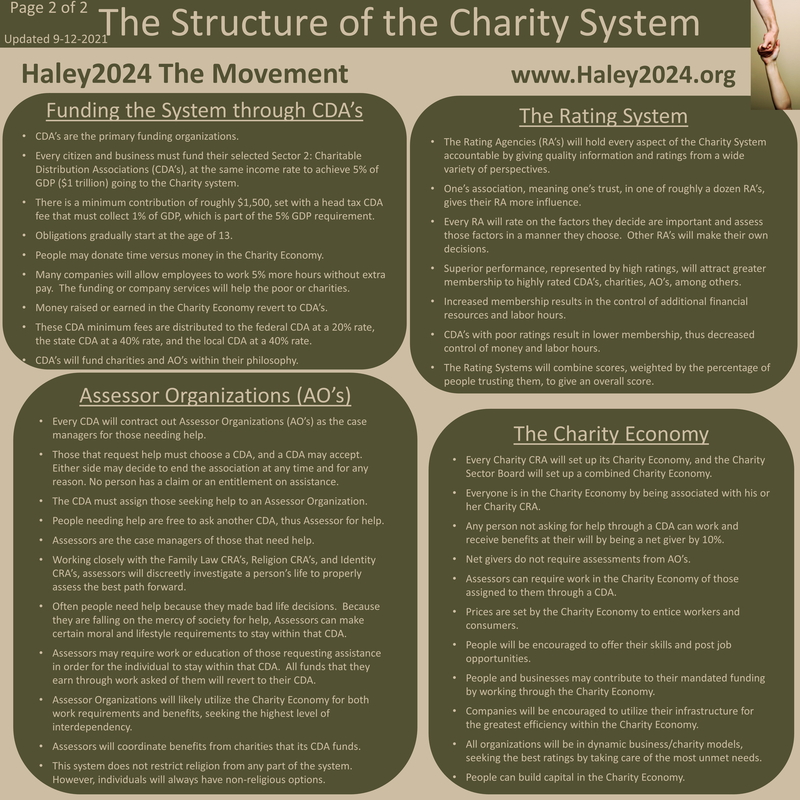

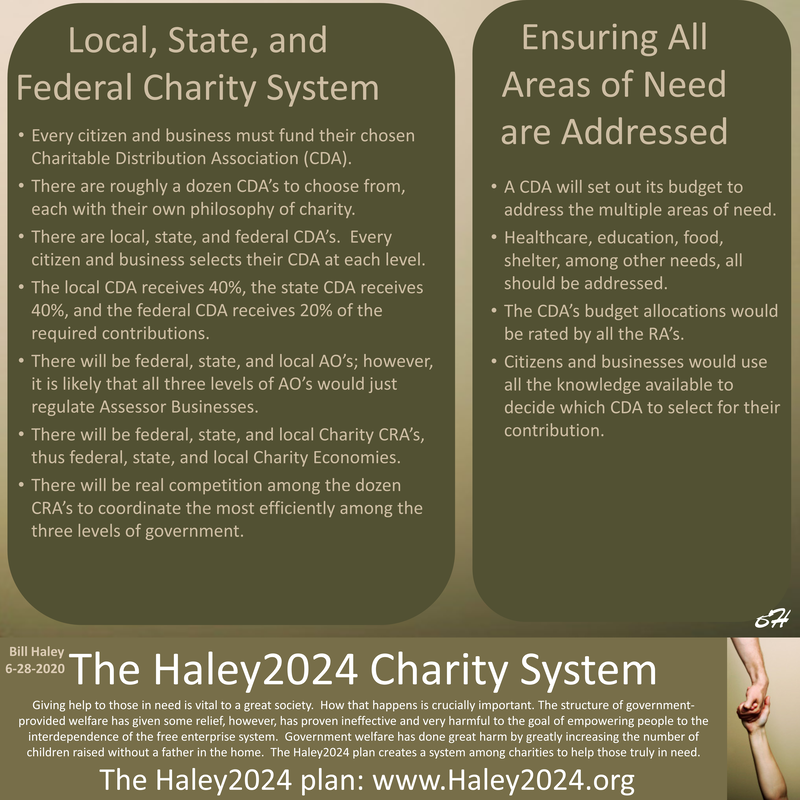

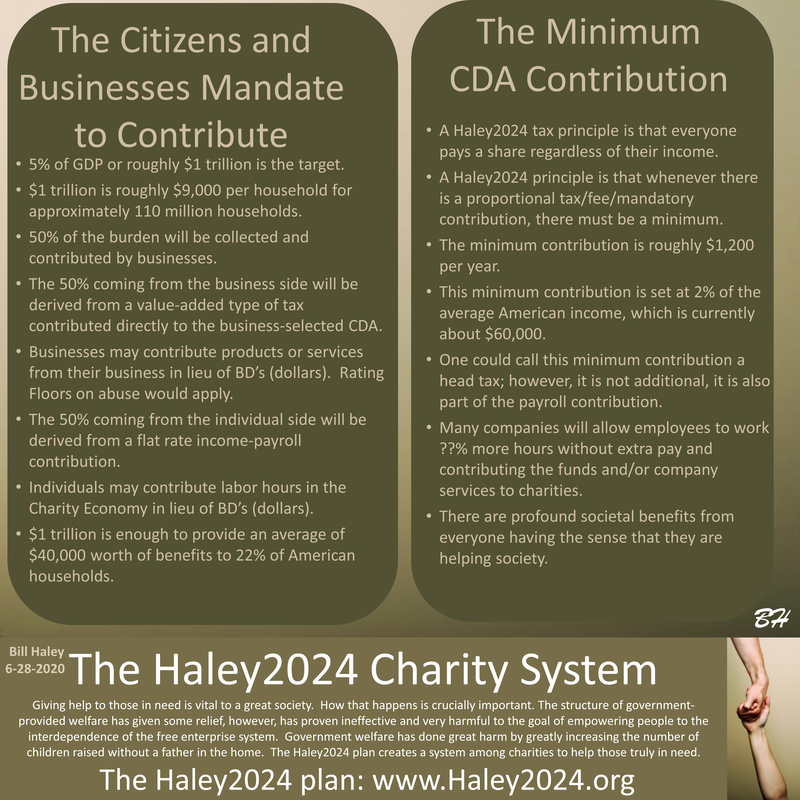

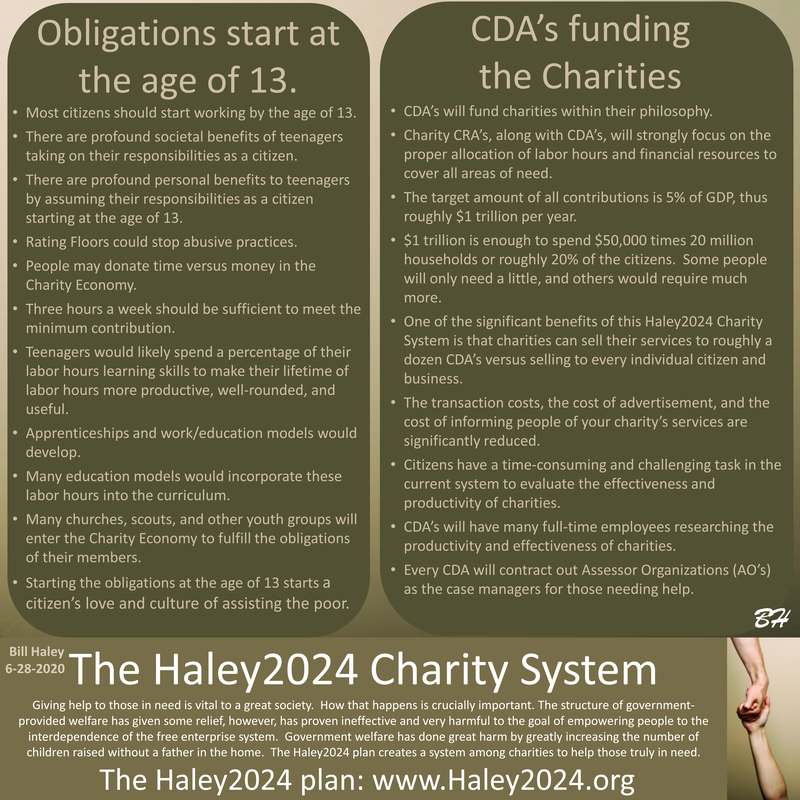

Funding the System through CDA’s

•CDA’s are the primary funding organizations.

•Every citizen and business must fund their chosen Sector 2: Charitable Distribution Associations (CDA’s), at the same income rate, with a minimum contribution of $1,200 (set at 2% of the average American income), to achieve 5% of GDP ($1 trillion) going to the Charity system. Obligations start at the age of 13. |

|

•People may donate time versus money in the Charity Economy.

•Many companies will allow employees to work 5% more hours without extra pay. The funding or company services will help the poor or charities. •Money raised in the Charity Economy revert to CDA’s. •Every CDA will contract out Assessor Organizations (AO’s) as the case managers for those needing help. CDA’s will fund charities within their philosophy. |

Assessor Organizations (AO’s)•Those that request help must choose a CDA, and a CDA may accept. Either side may decide to end the association at any time and for any reason.

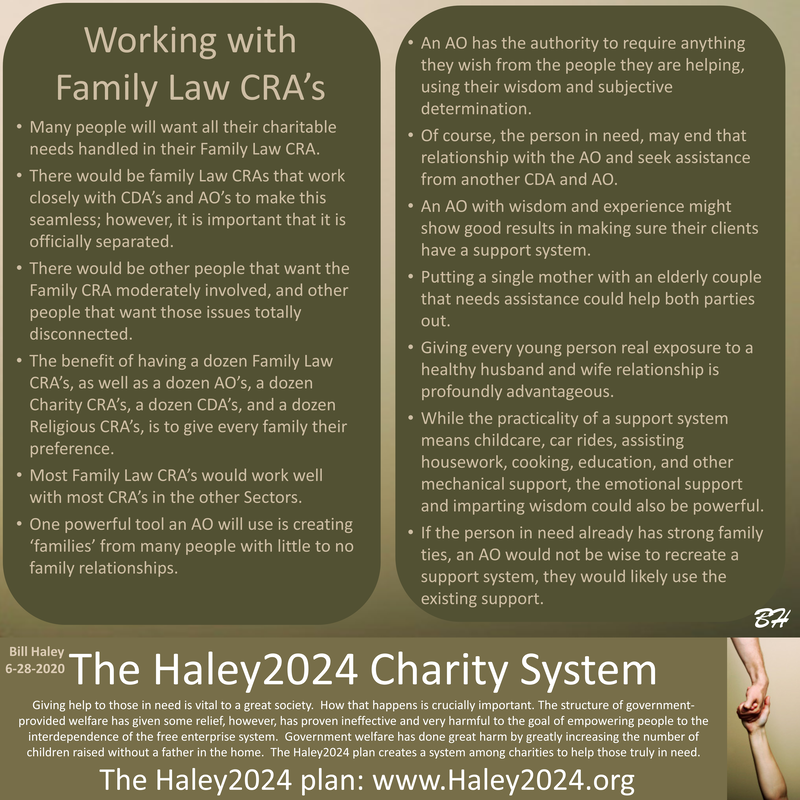

•The CDA must assign those seeking help to an Assessor Organization. •People needing help are free to ask another CDA, thus Assessor for help. •Assessors are the case managers of those that need help. •Working closely with the Family Law CRA’s, Religion CRA’s, and Identity CRA’s, assessors will look into a person’s life to properly assess the best path forward. |

|

•Often people need help because they made bad life decisions. Because they are falling on the mercy of society for help, Assessors can make certain moral and lifestyle requirements to stay within that CDA.

•Assessors can also require work and education to stay within that CDA, as determined by the Assessor. All funds earned will revert to their CDA. •Assessor Organizations will likely utilize the Charity Economy for both work requirements and benefits, seeking the highest level of interdependency. •Assessors will coordinate benefits from charities that its CDA funds. •This system does not restrict religion from any part of the system. However, individuals will always have non-religious options. |

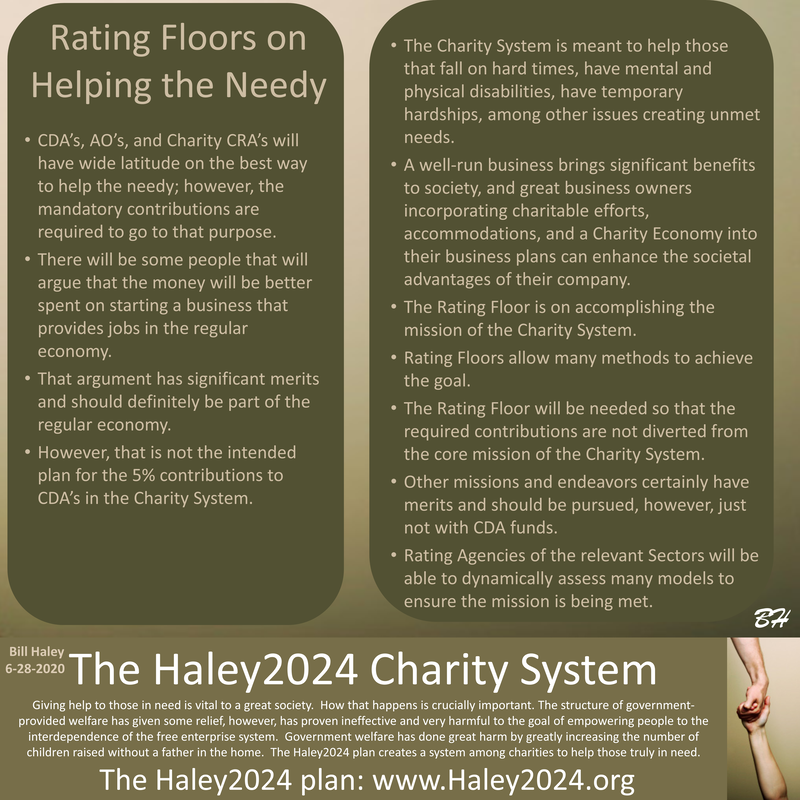

The Rating System

•The Rating Agencies (RA’s) will hold every aspect of the Charity System accountable by giving quality information and ratings from a wide variety of perspectives.

•One’s association, meaning one’s trust, in one of roughly a dozen RA’s, give their RA more influence. •Every RA will rate on the factors they decide are important and assess those factors in a manner they choose. Other RA’s will make their own decisions. |

|

•Superior performance, represented by high ratings, will attract greater membership to highly rated CDA’s, charities, AO’s, among others.

•Increased membership results in the control of additional financial resources and labor hours. •CDA’s with poor ratings result in lower membership, thus decreased control of money and labor hours. •The Rating Systems will combine scores, weighted by the percentage of people trusting them, to give an overall score. |

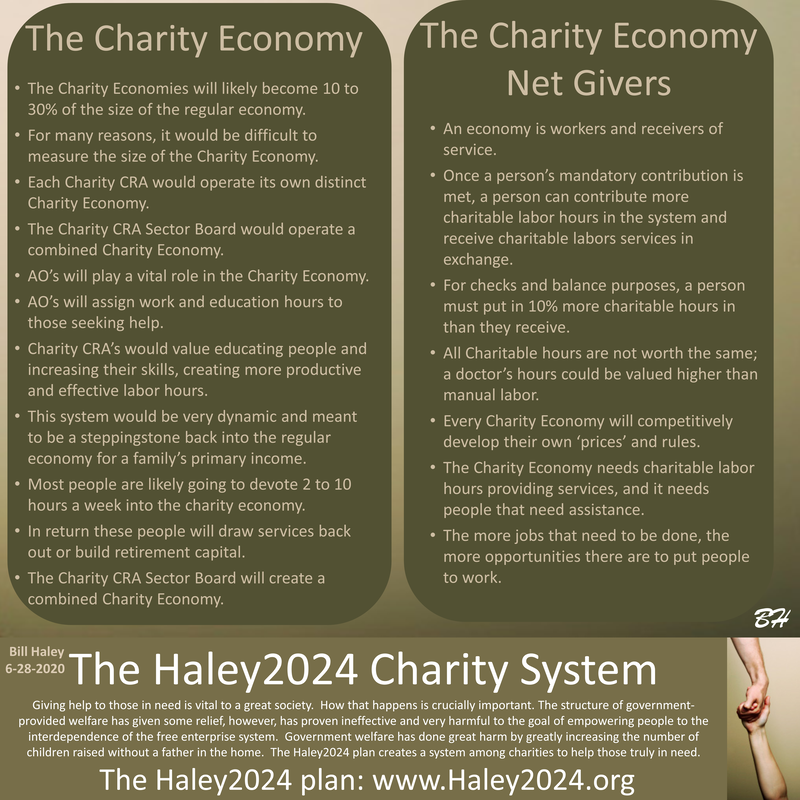

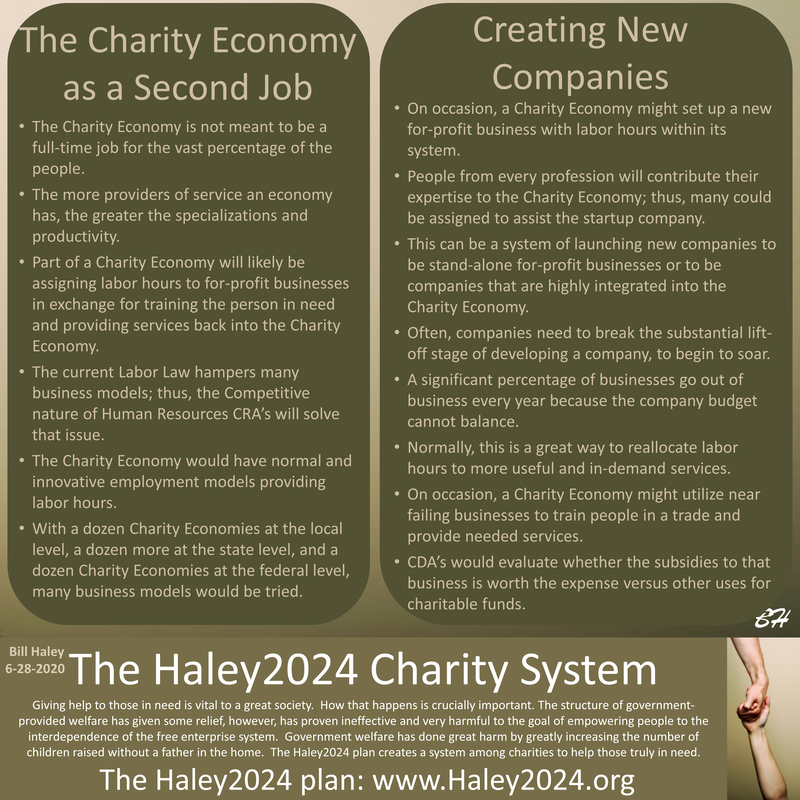

The Charity Economy

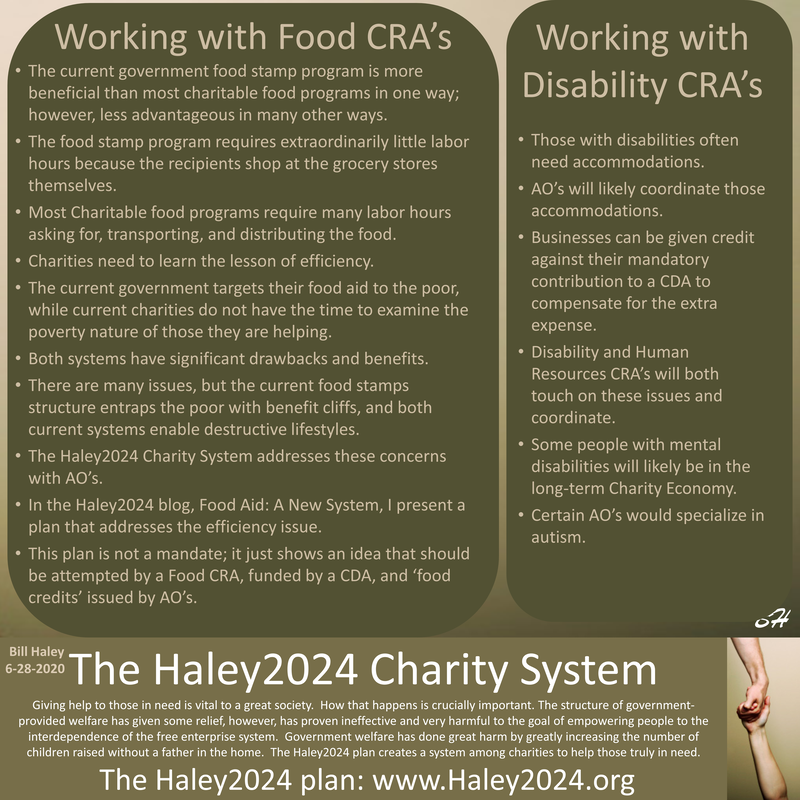

•Every Charity CRA will set up its Charity Economy, and the Charity Sector Board will set up a combined Charity Economy.

•Everyone is in the Charity Economy by being associated with his or her Charity CRA. •Any person not asking for help through a CDA can work and receive benefits at their will by being a net giver by 10%. •Net givers do not require assessments from AO’s. |

|

•Assessors can require work in the Charity Economy of those assigned to them through a CDA.

•Prices are set by the Charity Economy to entice workers and consumers. •People will be encouraged to offer their skills and post job opportunities. •People and businesses may contribute to their mandated funding by working through the Charity Economy. •Companies will be encouraged to utilize their infrastructure for the greatest efficiency within the Charity Economy. •All organizations will be in dynamic business/charity models, seeking the best ratings by taking care of the most unmet needs. •People can build capital in the Charity Economy. |

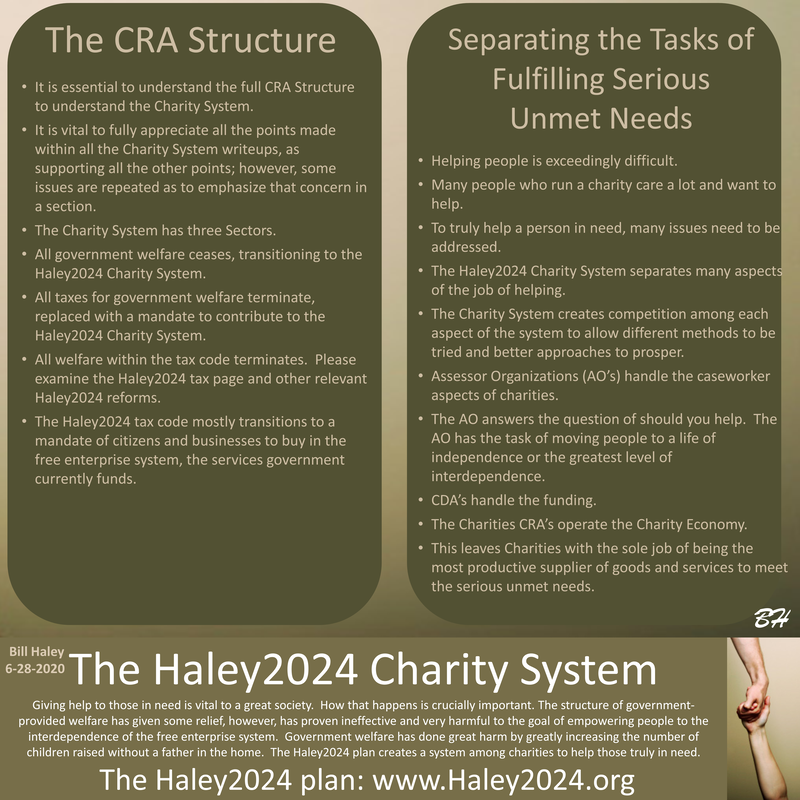

Subjective Determination

•The current government monopoly control of welfare cannot use subjective determination. That is deleterious.

•It is vital that every part of the Charity System, along with most Sectors, who have people with jobs formerly in the purview of government, have subjective determination. •The very nature of subjective determination requires competition for those services formerly in the purview of government. •The full CRA Structure was built on this notion of removing the government’s monopoly power. •Taking away the government’s monopoly control of regulations in most areas of law will lower ineffective and harmful regulations. •Using individual subjective determination is essential to stop the game playing or abuse in the system. |

The Tools of an AO

•Every AO would decide how deeply and discretely they will dig into a person’s life to determine the best path forward.

•A person’s identity business regulated by an Identity CRA would have ownership records, criminal records, medical records, credit reports, education records, licenses, and other documents, thus an excellent resource for AO’s. •Only a few people at AO’s will need to dig into a family situation and determine whether they are on the right path out and not being entrapped in the system. •The Charity Economy run by the Charity CRA’s would be a practical tool for the Assessors to utilize. •The assessor business could set a person in need up in the Charity Economy, where they would get benefits and also work to the greatest extent possible. |

|

•Unemployment and disability insurance, as well as the failure to pay loans, would likely have mandatory labor hours in the Charity Economy built into the contract; thus, AO’s will have many skilled people to utilize.

•AOs have the authority to require anyone they are assessing to work and achieve an education. • The AO could partner with a person’s Family Law CRA to bring two or more families or people together for mutual assistance. •The AO could utilize the services of religious organizations. •The Education CRA’s would likely offer many free to low-cost options. |

|

•Many businesses would pay their mandatory contributions with services from their business; thus, AO’s would have thousands of tools.

•Prisoners in the Haley2024 Prison Reform would be mandated to work many hours, bringing many labor hours into the system. •Charity Assessor Organization App’s will likely develop to match services and charitable hours quickly and efficiently. •There is so much that needs to be done to help the poor, and AO’s would specialize in gaining work hours from those in need. |

The Goals of an AO

•There would be different opinions about what outcomes are the most desired.

•Every AO would publish their mission statement and goals as part of the philosophy of how they will help the poor. I believe most Americans would be astonished to learn the substantial differences. •Some Americans would be horrified that people want to address a person-in-need’s lifestyle choices in order to offer charity. Some people are shocked by the idea that we should not address those concerns. •Some Americans would be appalled that people do not want their charity dollars funding a smoker’s lung cancer treatment. Some people are dismayed by the notion that we should. |

|

•Some Americans would be aghast that AO’s would ask those in need to put labor hours into the Charity Economy. Some Americans are angry that they are working 60 hours a week, making as much money as someone’s welfare check derived from zero labor hours.

•There are some people with the goal of getting as many people in the cart as possible. In contrast, others concentrate on increasing the people pulling the wagon. • The goal is an independent, moral, and healthy lifestyle. However, that looks different for many people. |

The Benefits to Those in Need

•The AO’s will coordinate with charities that will meet the serious unmet needs.

•The AO’s will give those seeking help the pride of ‘earning’ what they receive, at least to the greatest degree possible. •The contributed funds can reach further. •AO’s would hire life coaches. •The person in need, gains work experiences and skills, which is beneficial in acquiring or advancing in a job in the regular economy. •Total independence is not achievable for everyone. However, Assessor Organizations would specialize in maximizing pride, worth, work, and interdependence. |

Assessing AO’s

•Knowing an assessor from an AO they trust has done a complete evaluation and that those needing help are on the right path, will create trust with people contributing money.

•Many charities would help families over a certain rating level and only from Assessor Organizations that, within reason, match their philosophy. •These Assessment Organizations would be rated on how their recommendations result in as much independence as possible. •There would be different models of charities and how to assess families dynamically. •The many AO’s will have their own method of assessing those in need and informing charities of the best path forward. |