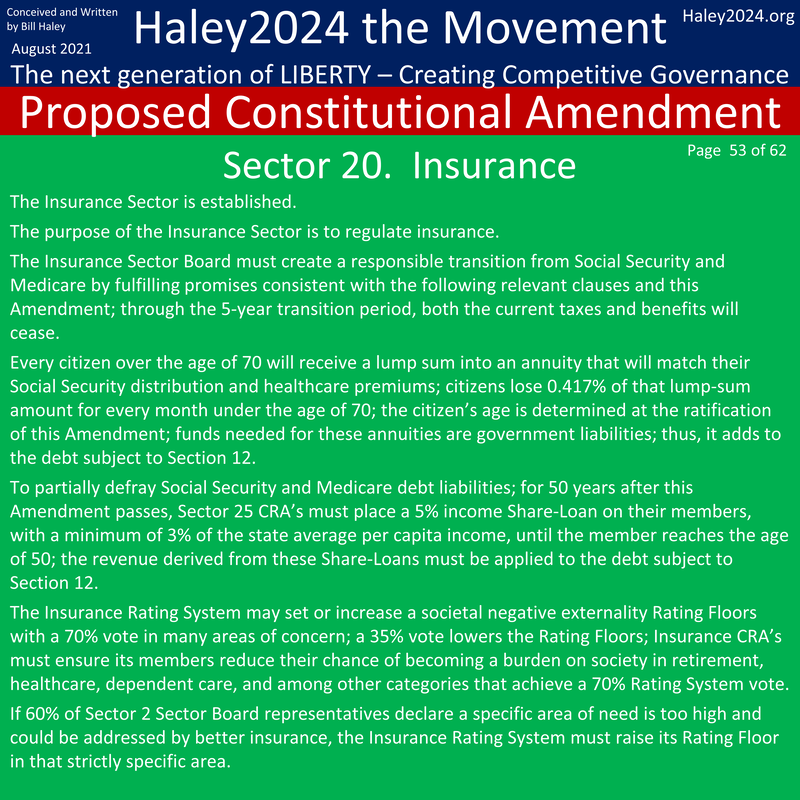

The Insurance Sector

Competitive Governance within every geographic jurisdiction

|

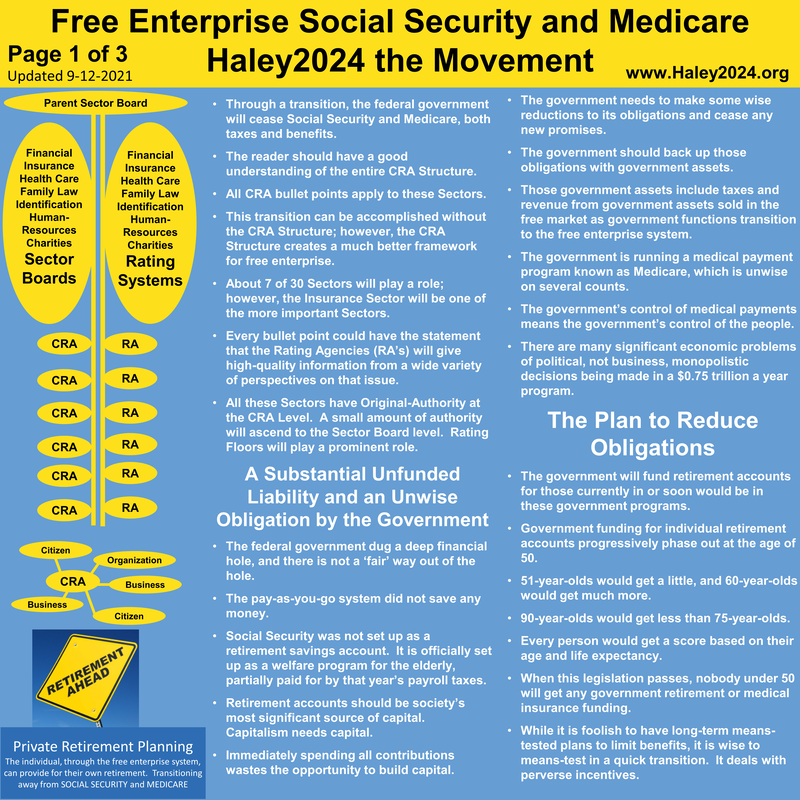

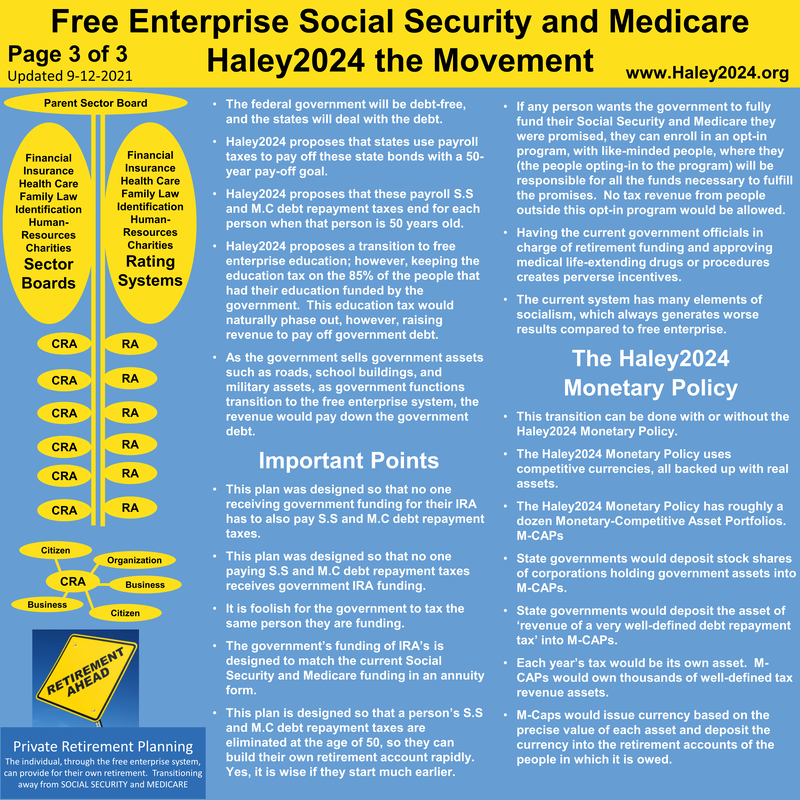

All insurance regulations will be taken away from the government and given to the Competitive Regulatory Agencies. Insurance is currently regulated by the state. Thus, every insurer in that state currently has one regulatory option. Having many options to choose from creates many new regulatory systems. The best will emerge and the ineffective will wither on the vine. Ratings and the high desire to protect the brand will increase standards and create the best insurance companies.

|

|

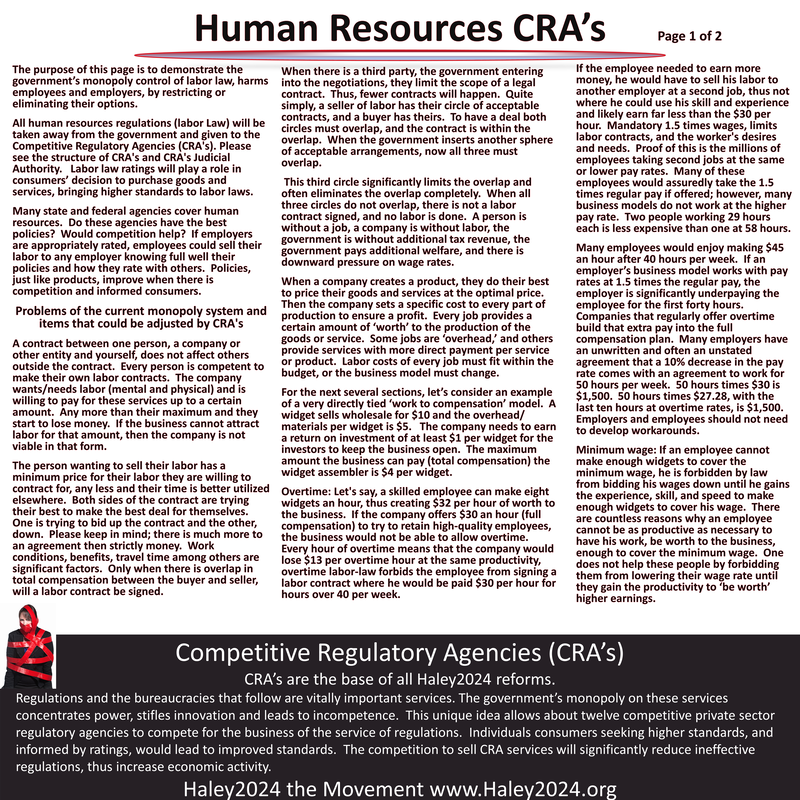

Unemployment compensation will move to private companies and will be regulated by the CRA's dealing with human resources or by insurance CRA's. An idea for CRA's: anyone collecting unemployment compensation should be in a temp agency and their labor sold to the highest bidder. They would get their regular unemployment compensation payment, and the CRA would collect the temp money whether higher or lower. If people had to work full time and only get half pay, they would be more motivated to find a job. This keeps the security there, cost less and motivates people back to work. They could also bundle a set of workers together in small start-up companies to get them up and running that might end up with full-time jobs for those people.

Unemployment Insurance Should be Privatized 12-29-2013 |

|

Health care insurance would have their own CRA's and would work closely with Charity CRA's and Health Care CRA's. Most of the dysfunctions of health care can be blamed on unwise and counterproductive regulations. Having a competitive regulatory system that can showcase proper regulations and cast-off destructive ones would increase the level of health care for all of America. Guarantee renewal health insurance policies are the free enterprise system of dealing with pre-existing condition clauses; however, politicians forbid by law, consumers freely contracting guarantee renewal health insurance policies.

|

|

Life insurance is an incredible way for people to minimize the number of people that need to fall on the mercy of society for assistance. Because only a few percent of the people collect on life insurance policies, as is the proper nature of insurance, not many people have first-hand knowledge of how benefits are ultimately paid out. While the free market has ways to inform consumers of the quality of different plans, the Insurance Rating System will likely give far better quality information with ratings coming from roughly a dozen different sources with different perspectives.

|

|

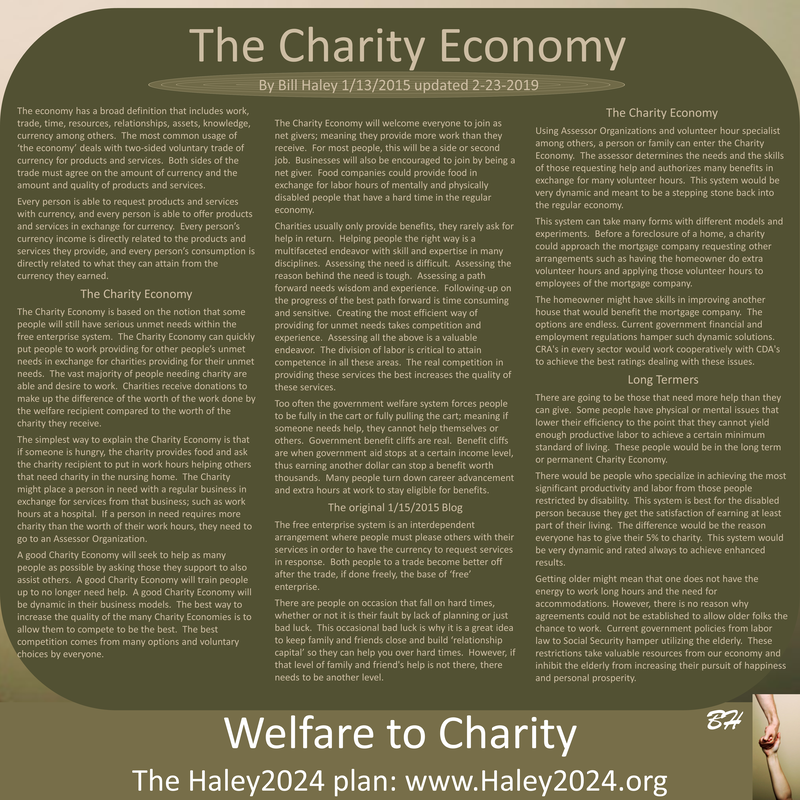

All other insurance products need to have wide latitude to experiment so the best methods can develop. Often regulations steer all business plans in one direction and stop different business plans and insurance models from evolving. The Haley2024 Charity Economy could play a profound role in risk pools.

|