Monetary Policy

The page Haley2024’s Monetary Structure has more reasoning and explanations behind this reform.

|

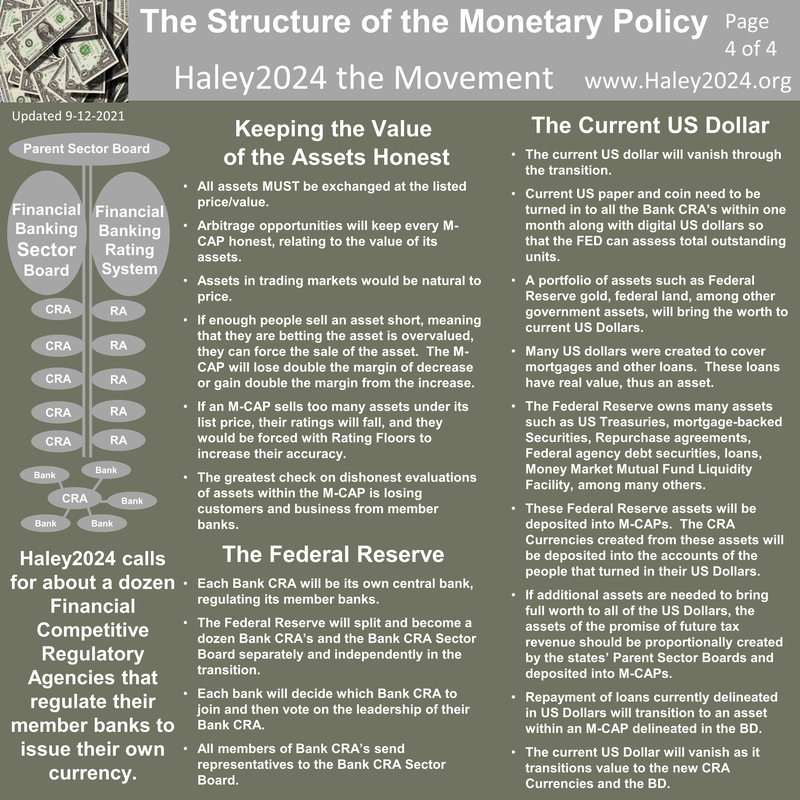

Too many people just assume that government must control the currency. Too many people cannot wrap their thoughts around the idea of free enterprise money. The government has had control for a long time, and since they already took over education, they teach the government must control the money. Too often, they teach that all free market attempts at currency were failures. They promote only the good of the Federal Reserve without explaining the harms. Even the top business, finance, and monetary schools teach with flawed fundamentals.

|

|

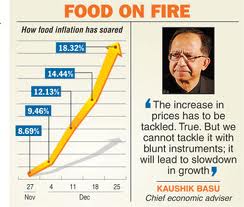

Governments monopoly control of money has done considerable damage.

Government changes the value of currency thus also contracts. The government taxes the people by shaving value from our money with QE, accordingly, violating the US Constitution. The Federal Reserve creates price controls on the use of money over time and government price controls ALWAYS does harm. The role of prices of the use of money over time is valuable yet infringed under the current laws and policies. The US dollar has lost over 96% of its value over the last 100 years, hampering the critical role of saving in the economy. Capitalism requires capital. Thus unbacked-up or fiat money is destabilizing to capitalism. The policies implemented to fulfill the Federal Reserve’s dual mandates for full employment and stable values are counterproductive and does tangible harm. |

|

Using money allows you to do half trades. You trade your labor for money and then use that money to get services. It allows you to sell your services to different people than you get services from. The money should hold value so the time of the services you give can be different from the time you receive the services.

There are many factors in money. What will hold its value the best? What is universally desired? What is easily divisible? What is easily transferred? What is easily verifiable? What has uniform quality? What can stand up to the test of time? Does the rule of law give proper protection? What is universally accepted? |

|

Having a dozen different providers will allow many monetary models to emerge to address every one of these questions. Trillions of decisions by billions of people will enable constant improvements.

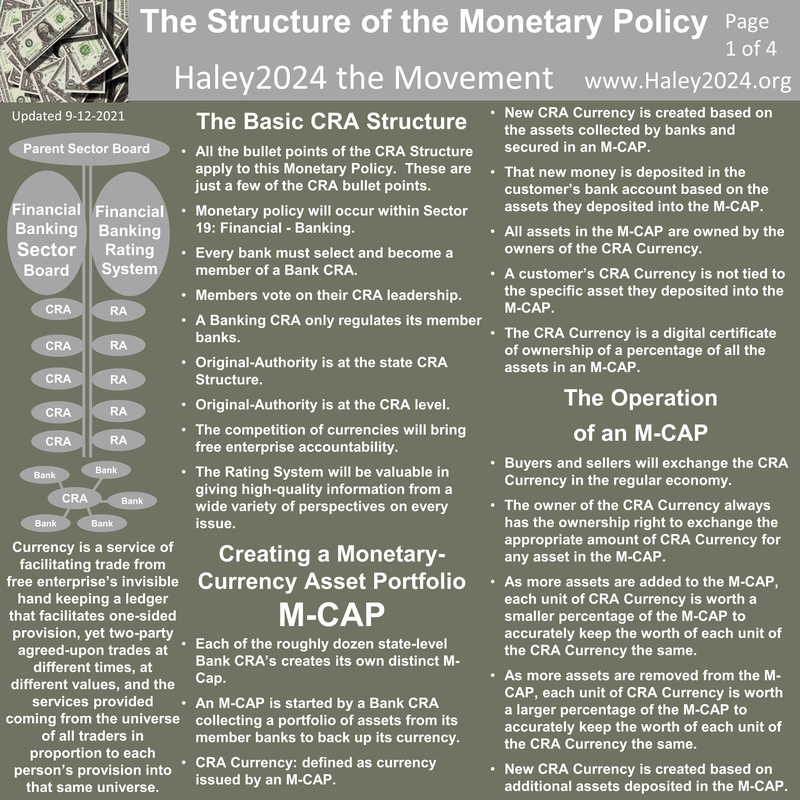

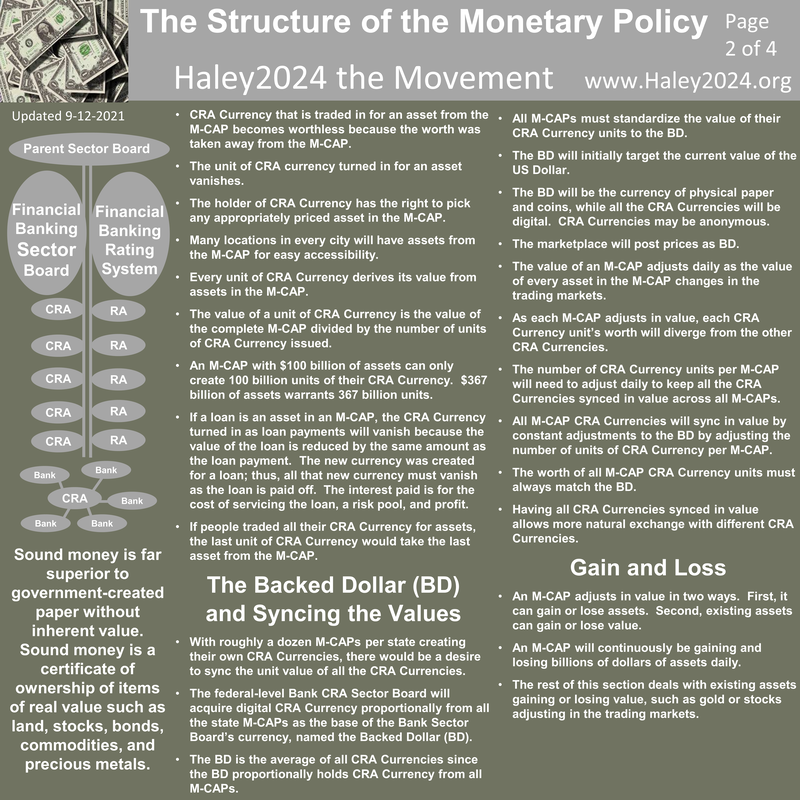

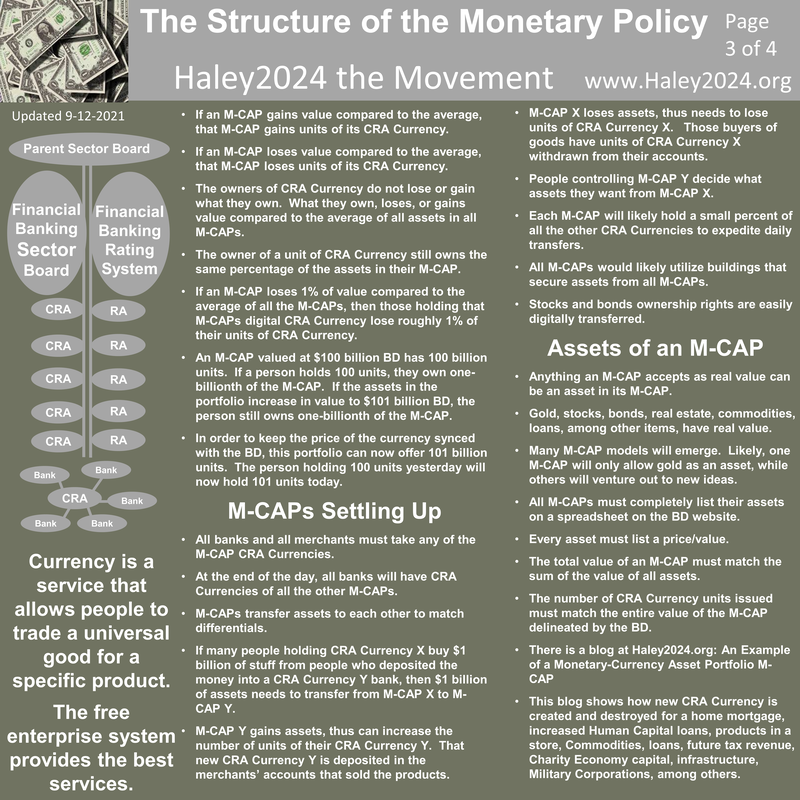

Every bank will have their choice of which Financial CRA will regulate them. All banks and CRA’s will be rated, and consumers of banking services will ultimately force standards to increase by choosing higher rated banks. Banking regulations are vitally important; thus, competition of different models is imperative. |

|

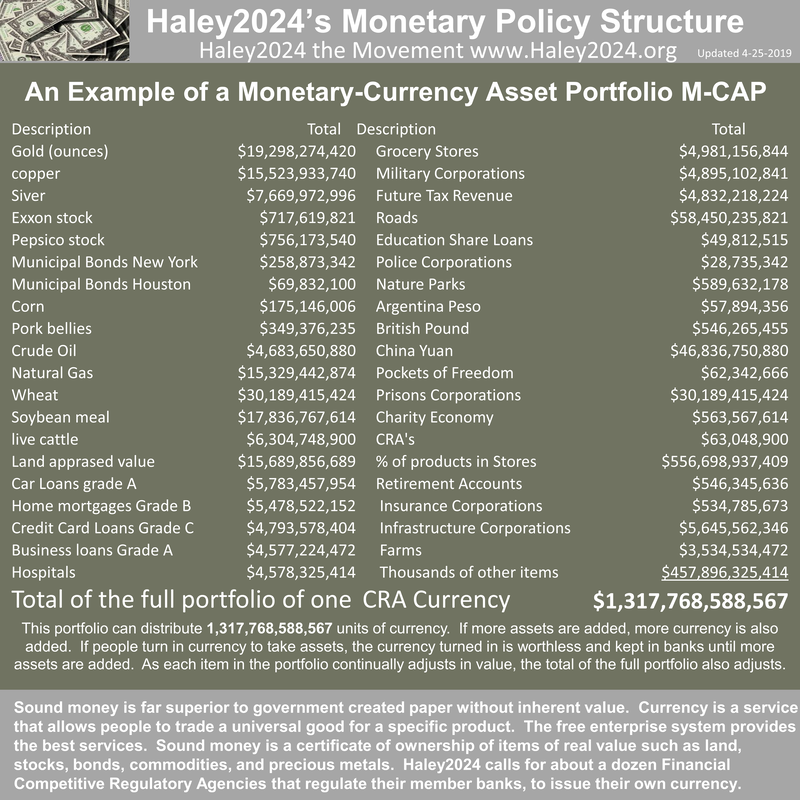

A CRA creates a currency by collecting assets and issuing certificates of ownership to a percentage of the portfolio of assets. As more assets enter, the portfolio percentages per unit are reduced to maintain a constant value. If there are 10 grams of gold in the portfolio and 100 units of currency issued than each unit is worth 1% of the portfolio or 0.1 grams of gold. If 90 more grams are deposited than 900 more units of currency are issued. Each unit of currency is now worth 0.1% of the entire portfolio or still the 0.1 gram of gold. At any time, units of currencies should be able to be turned in and assets diminished with the last unit of currency collecting the last of the assets.

|

|

Many different assets will be tried with many portfolios consisting of hundreds of different types of assets. Each asset will come in with a price and added to the value of the portfolio. As prices of assets within a portfolio adjust to market forces, the value of the portfolio adjusts. The owner of a note will own, for example, 0.000000000231% of the portfolio. His percentage does not change. However, the value does.

The Financial Sector Board will collect currency from the roughly dozen CRA’s to create the average of all currencies called the backed dollar or BD. The BD will be the currency of paper and coins. CRA currencies would be mostly digital. |

|

There are considerable benefits in having all currencies synchronized in value per unit. No one wants to have to look at exchange rates when buying products. If your CRA portfolio outperforms the average, the BD, then your value per unit does not change, you just get additional units. On the other side, if your CRA portfolio underperforms the BD, then you lose units of currency. This is similar to current stock on the stock market in that you still own the same percentage of the company; however, when the company value adjusts, so does the worth of each stock in terms of dollars. Those that want stable amounts of units could hold accounts that mirror the BD.

|

|

Every person will have a desire to trade with every other person, and that desire will cause every bank and Financial CRA to cooperate with all other banks and CRA’s. Every CRA will accept the other CRA’s currencies. At the end of the day, Financial CRA’s will request the transfer of certain assets in exchange for the currency. For example, if 1,000,000 units of Currency A was transferred to a bank that uses Currency B, then Currency B request assets from currency A’s portfolio equal to 1,000,000 units. Most currencies would likely have enough liquid assets that are very easily transferred for this purpose.

|

|

Every currency needs to list their assets of their portfolio and the price of every asset giving the total value of the portfolio. The list must be fully accessible online and in real time. Anybody holding that currency can demand any asset for the listed price. Ultimately, the last outstanding unit of currency should buy the last asset, and the currencies that successfully put that to the test will be rated high.

Anything of value can backup currency. Prices of all assets will stabilize as many people will be searching for arbitrage opportunities. |

|

There needs to be a transition from the current system. The US dollar used to be backed up by gold and was decoupled in the early 1970s; however, the gold should still be at the Federal Reserve. There is much debate about how many US dollars are out there. Many paper dollars were lost in fires, in sinking ships, buried in tin cans, among other losses. The best transition is to give one month for all US dollars to be turned in to banks. Anonymous accounts would be available. All the paper and coin would be added to digital money. The Federal Reserve would put up enough gold to cover the accounts. At the end of the month, all outstanding US dollars would be worthless.

|

|

If the gold does not cover the amount, then a certain amount of US-owned land would be offered up. Much of the US dollars are in the form of loans. Loans repayments would be transitioned to be repaid in BD’s or that bank’s CRA currency. Loans are a claim on future labor consequently has real value. Accordingly, the switch to repayment in BD’s could cover a large percentage of the value of un-backed fiat US dollars.

|

|

New loans will likely be a staple asset in many portfolios because they have real value. Stocks have a known value on the stock market. Most bonds are considered secure investments. Commodities have known prices. Future contracts are valuable assets. Real estate has appraised value based on actual trades. All precious metals have intrinsic value. All these items have long histories of having real worth and traded for other things of real worth. All these items will likely be a substantial majority of the base of portfolios. However, every CRA will decide their own set of assets and compete with other CRA’s.

|

|

Since the Federal Reserve was established, our currency has lost roughly 96% of its value, thus failing in the mission of a stable currency. With the expectation that currency will continue to lose its value, people have less incentive to save for long-term purposes and long-term saving (retirement) is crucially important. Saved money represents capital and capitalism requires capital.

|

|

All the factors that make a sound currency will be addressed by all the CRA’s in different ways. That is how the free enterprise system excels. Monopolies do not have counterfactuals to compare. Is gold, corn, Exxon stock, or municipal bonds the best asset or is it a combination of them all? Are Soybeans future markets more divisible than silver? Can cattle be transferred easier than a building? Can the value or the existence of a bond be verified better than a car loan? Do pigs have uniform quality? Did gold or Google stock stand the test of time? What asset is most conducive to the protection of the law? How convenient is the service? Finally, what CRA can provide this service at the best price?

|

|

New wisdom could emerge that if a long-term asset is created, that asset could be created with new money and bought back by the ‘owner’ of the asset. A car for 5 years, a house for 30 years or a road for 50 years. The people holding the currency have ownership rights to the item. However, the terms of the contract of the loan give the ‘owner’ the right to buy back all the currency on a monthly basis. As the ‘owner’ buys back the shares of his house, the currency is reduced to match the lower outstanding balance of the home owned within the portfolio. This is not very liquid; however, it could be the base of many annuities that pay out in a similar fashion.

|

|

|

There is much debate over whether those quoting Keynes are truly using his policies. Economics is complicated with many variables; however, it is clear he wanted the government to spend more money when ‘experts’ concluded that people or assets were idle, to boost demand. First, this moved more things from free enterprise to government control and second, businessmen desiring to make a profit, WANTS to do business and people always desire or demand more products and services.

|

|

The main problems are government policies, regulations, and taxes that put hurdles in front of free enterprise. Government spending is often the foundations of the obstacles.

As long as there is monopoly control of monetary and fiscal policy, we will always have a debate about whether it ‘worked.’ Counterfactuals are rarely seen, and dozens of factors could be blamed or credited. |

|

|

|

Many people argue that increased government spending is ‘new money’ and thus adding to the economy. They conveniently forget that the money was TAKEN from people in the form of taxes, loans or shaving value off existing dollars. All these forms of taking means that the same amount of money is not available in the free market. In addition, the act of taking is a disincentive to do the activity being taxed. It can be credibly argued that government spending reduces economic activity. However, dozens of factors make economic arguments very difficult.

|

|

Many new models will emerge, and the best will continuously be surpassed. One option: a CRA could consider that when a person makes a deposit in a bank, they really buy a share of the bank and their assets (others just a set of assets and not the bank itself). When a person withdrawals money from the bank, in reality, they are selling their shares of the bank or the set of assets. One's share is adjusted continuously based on the size of other deposits.

|

|

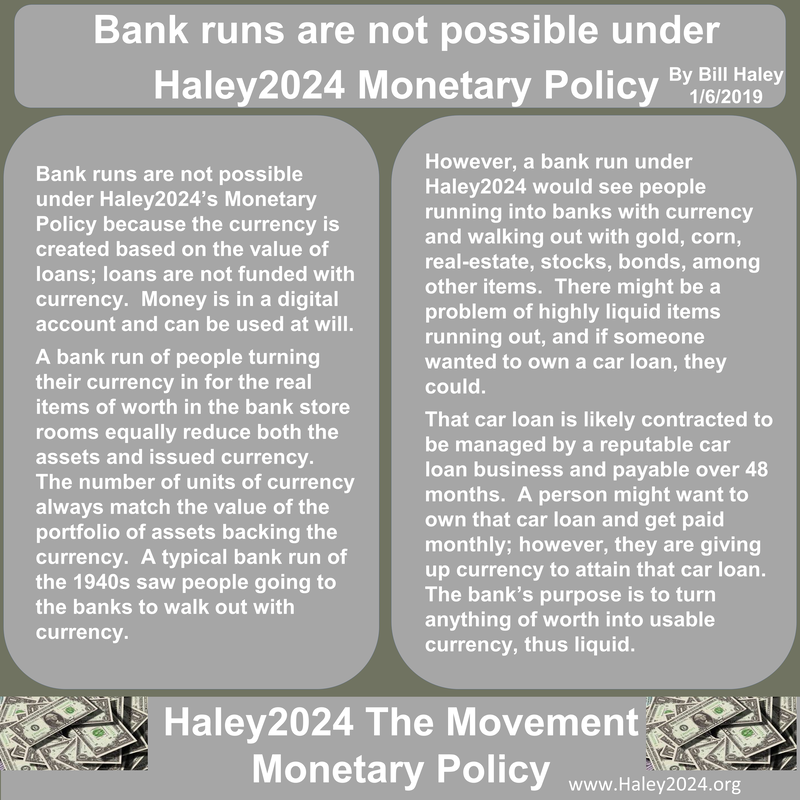

Bank runs are not possible under Haley2024 Monetary Policy. Money is in a digital account and can be used at will. A bank run of people turning their currency in for the real items of worth in the bank store rooms equally reduce both the assets and issued currency. The number of units of currency always match the value of the portfolio of assets backing the currency. A typical bank run of the 1940s saw people going to the banks to walk out with currency. However, a bank run under Haley2024 would see people running into banks with currency and walking out with gold, corn, real-estate, stocks, bonds among other items.

|

|

There might be a problem of highly liquid items running out, and if someone wanted to own a car loan, they could. That car loan is likely contracted to be managed by a reputable car loan business and payable over 48 months. A person might want to own that car loan and get paid monthly; however, they are giving up currency to attain that car loan. The bank’s purpose is to turn anything of worth into usable currency, thus liquid.

|

|

Anonymous Money

Ideally, we will see the rise of anonymous electronic transfers between accounts. Paper currency is used mainly because of the anonymous nature of cash. Ease of transfer encourages economic transactions and thus economic activity. I would encourage anonymous accounts that are attained by just depositing money into an empty account vessel, and the owner would be the person with a username and password. Money from these accounts would be highly convenient; for example, you are at the beach and don’t want to lose a wallet or cash, so you use your username and password to transfer money to a vendor on the spot. You could transfer money to your child in college instantly or call someone when you lost your wallet and have them transfer money directly to the gas station or store. Many steps would be taken to protect the security of these accounts.

|

Going Global

|

This currency could go global by allowing different nations' currency to adjust to the BD. If that nation has stable assets, the Financial Sector Board could purchase some of their assets as the base of the BD. The other nations would have a voice; however, will not be a voting member of the leadership of the Financial Sector Board. Other nations could come together to set up their own Financial Sector Board like we do and adjust theirs to the BD or just have an exchange rate, thus having only a few exchange rates. As long as transparency and arbitrage opportunities are available, we should not fear other nations currency.

|

The Central Banks Balance Sheet

|

The central bank is highly secretive, and it is not known the level of loans made out of thin air. However, the level of quantitative easing indicates very large negative balances, which is to say that the central bank is owed a lot of money. This is called an expansive monetary policy, and it has done much harm in many ways, primarily inflation. The fix is not to have a contraction of the money supply as that will also cause significant damage, primarily deflation.

|

|

While this might be out of my knowledge base because of the secret nature of the Fed, I would like to throw this into the arena of ideas: Money owed to the Fed should be taxed to pay off federal debt as a way to keep the currency stable. This assumes that the QE already changed the value of our money and this plan recognizes that we already paid the inflation tax. This plan just applies the inflation tax to the debt. Read more about this on the Debt Page.

|

A New House as Capital for New Currency

Is There really Inflation?

Money on the Closed Island

The Problem with Bit Coins

The Value of Fiat Currency

QE Equals a Pay Cut from your Job

QE=$772 Tax per Month per Family

QE is Not Printing Cash from Thin Air

A Plan to Pay off the Debt

Quantitative Easing (QE) = Devalued Money

Hollowing out our economy

The 2008 Financial Crisis

The Economy, On A Rocky Cliff

QE and low interest rates are as destructive as counterfeiting

New currency for increased human capital

The Stock Market Crashes Because of A Sudden Mass Realizations of the Decreased Value of Money

Is There really Inflation?

Money on the Closed Island

The Problem with Bit Coins

The Value of Fiat Currency

QE Equals a Pay Cut from your Job

QE=$772 Tax per Month per Family

QE is Not Printing Cash from Thin Air

A Plan to Pay off the Debt

Quantitative Easing (QE) = Devalued Money

Hollowing out our economy

The 2008 Financial Crisis

The Economy, On A Rocky Cliff

QE and low interest rates are as destructive as counterfeiting

New currency for increased human capital

The Stock Market Crashes Because of A Sudden Mass Realizations of the Decreased Value of Money