| Recently, September 18, 2015, the Dow Jones dropped 290 points (1.74%). The volatility of the stock market has been very high, having over one percent moves several times a week. Our monetary policy has injured this economy. The fiscal situation and long-term federal debt is a big player in warping the monetary system that hampers the economy. This Quantitative Easing (QE) and long-term low-interest rates hide the actual value of the dollar until it is so distorted that it has to be revealed and often crashes the stock market and the economy as everyone tries to adjust. |

| The first major mistake is that we have the federal government through the Federal Reserve setting prices of interest, which is price controls. Price controls always end with higher prices, lower quality and quantity of products. The false ways these factors are measured belie this last statement; however, true measures and recognition of where the excess cost emerge prove the damage. |

| The second major mistake is that the FED set the price of interest so low (roughly 0% for seven years) that it reduces the incentive for people saving for retirement. Lack of saving causes significant problems for the person not saving for retirement and also depriving the economy of much-needed capital. Capitalism requires capital. |

| People’s inflation adjusted salaries are often significantly down, and they become underwater in their home. Values of long-term contracts such as loans, mortgages, and business contracts rely on a stable value of the currency. QE and price controls on interest rates unconstitutionally change the value of the dollar and distort significant business planning. |

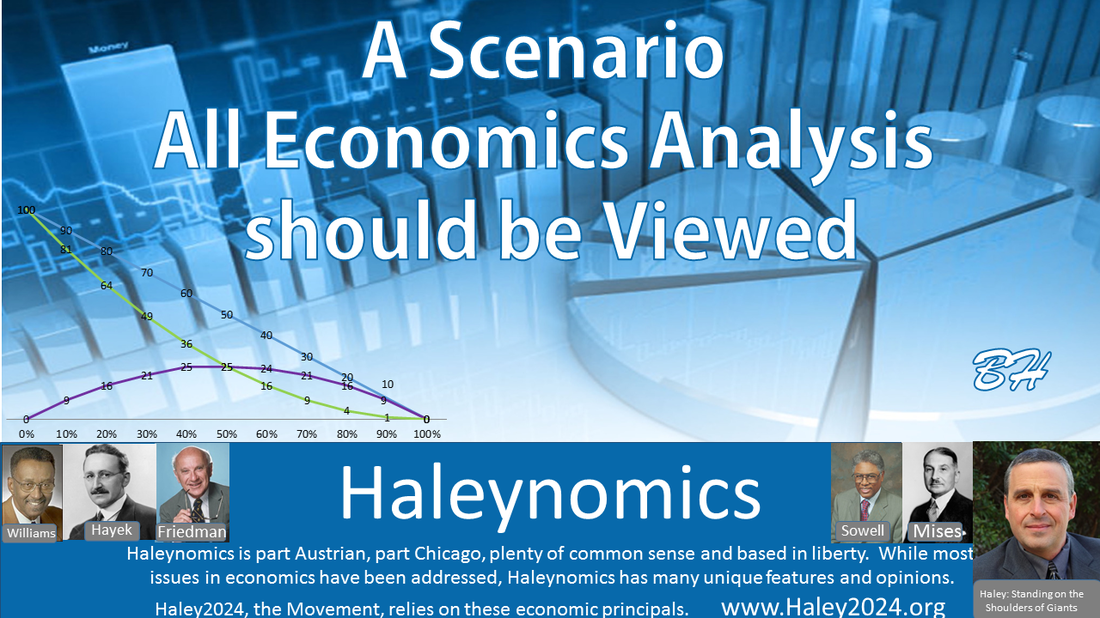

| Let's look at our small closed island of 100 people and test what happens if we inject massive amounts of extra money in the system. If there is a $100x economy a week, meaning the average person brings $1x of goods and services to market, some a little higher and some lower. Now let's say the bank starts to issue $1x extra dollar into the system every month for years. These new dollars are not backed up like the original. These were introduced as loans which pushed down interest rates. |

| These extra dollars do several adverse things. First, with lower interest rates, the people are not as willing to save some money for their future. Lower interest rates incentivize long-term investment not advisable at higher rates, which fails when the reality of higher rates occurs. Without gradual inflation to match the currency inflation, the people become vulnerable to a sudden massive move in the value of the dollar. Now merge this small closed economy with America to see the possible symptoms, results, and solutions. |

| So many people are holding savings in a currency that has no underlying worth. QE and low-interest rates are increasing this monetary base. When an undeniable downturn happens, like it always does about once a decade, many people will try to turn their currency into real goods and services, creating a mass realization that the value is not there. Prices have the real possibility of a massive popping of the money bubble that was pumped up by the FED with the destructive hot air of QE and low-interest rates. |

| This bubble popping could suddenly shoot prices up and push down the buying power of everyone’s paycheck. This inflation would wreck long-term contracts and sink banks that are on the losing side of being paid back with currency a fraction of the original value of the loans. Retirement plans, including Social Security, would also be on the losing side. Government statistics will under-measure the cost of living. Retirees will be worse off. |

| A government that messed up our banking system will 'FIX' the problem with far greater control. They did not learn the correct lessons from 2008 and just increased the 'Fix' that just took this economy to a more treacherous cliff with thinner trails along the edge. All the rocks we are stepping on seem to be unstable, and our way back has already collapsed. The FED needs to continually use every tool in the climbing bag to hang on, and the only path is up to more perilous places. |

| Capitalism and the free enterprise system are strong enough to rescue this economy if Congress allows the American people to grasp capitalism's hand for a rescue. In 2016, America has a choice of Bernie Sander’s massive government control that leads to more dangerous cliffs and massive problems or a Ted Cruz free-enterprise approach that puts the U.S. on the firm ground of solid economic growth, personal liberty and self-government. |

| | |