|

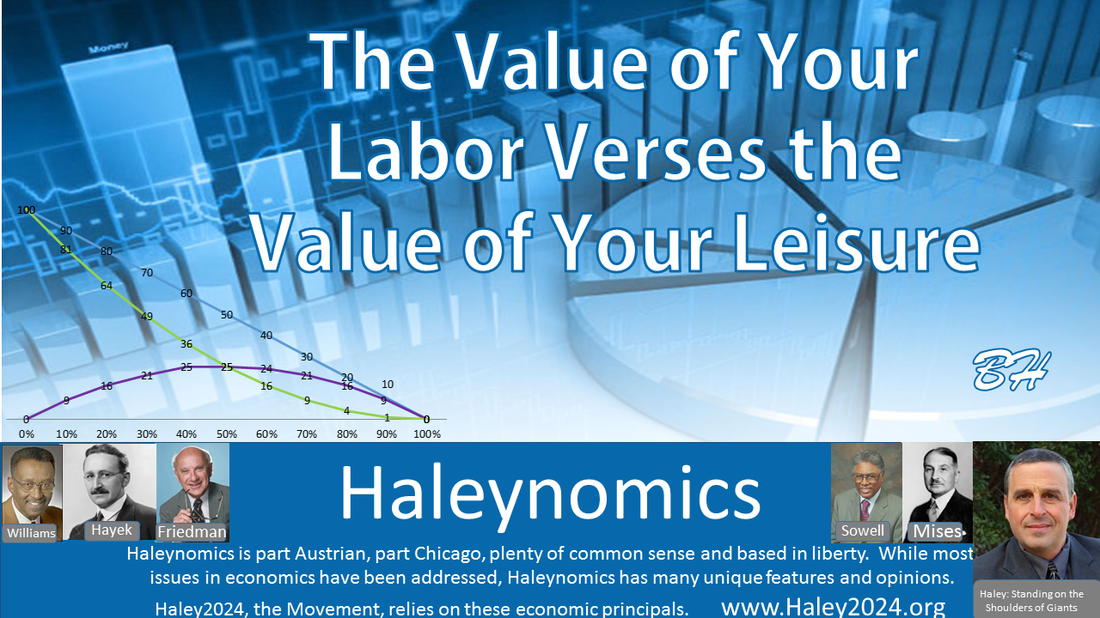

Good economics is common sense, and the role of prices is just your reaction to offers of trade. First, your money represents work that you do to earn that money. When you buy something, you instinctively know you are trading a certain amount of your time at your work for the goods or services you purchase. The more work you have to do to buy an item, the less willing you are to make that purchase. The higher the price, the less attractive the trade.

|

|

On the consumer side, everyone is different and affected by various circumstances; therefore, all people value an item to purchase differently. To some, an item is not desired at all, and they will not buy it at $0. Others could value it just a little and so on, all way to a few people who will pay vast amounts to buy that item. Therefore, a low price will attract many buyers and the higher the price becomes, the fewer people are willing to buy. This is just common sense, the lower the cost, the more people buy. Stores know this very well and are proven every time a ‘sale’ moves more product.

|

|

When prices markedly rise for a business on a specific expense, the company quickly seeks out new suppliers. The higher price sends a signal that more supply is needed to bring the price back down. A company can deliver that service ‘in house’ or encourage people with that expertise to start supplying that service again. These higher prices also cause a more significant interest in innovation and capital. Often that expense can be substituted for a different but acceptable alternative which leaves less demand on the original product so the price can drop. Free enterprise is very dynamic leading to many responses to changing prices.

|

|

Let say there are 1,000 identical widgets produced every day by ten producers at 100 widgets each. At $x price, only 900 are sold a day. No producer wants to be the one not to sell their product so the producer with leftover product will lower their price to sell out. All the producers will eventually drop their price, so THEY sell all their merchandise. As the price decreases, more people decide to buy, thus bringing demand up to 1,000 widgets a day. Let’s say that the price settles at $.90x to achieve the demand of 1,000 widgets.

|

|

All the producers will determine for themselves if that price is profitable enough for their employees and themselves, the employers. If one producer closes down, the supply is at 900. If the demand is 1,000 widgets, customers will be deprived of 100 widgets. Many customers will bid the price back up to $x so that they are not deprived of their desired widget. The factors and scenarios are so numerous that no article can address them all, but the principal on the production side is that if prices are high, more producers looking for that high profit will produce more product. The producers that value their labor and time more than the going price will seek different more profitable products to make.

|

|

If a business is selling $x and their expenses are $1.1x, then they are losing $0.10x. The business owner might be the one making the final call to lay everyone off, but in reality, the customers of that business did not value their product or service enough to pay the needed expenses. In the end, a business owner cannot just choose to pay out more then what is coming in just to be nice. The customers are the final deciders of whether a business fails or succeeds. Thousands of factors go into decisions surrounding attempts to save a failing company that are too numerous for this article.

|

|

On the production side, the businessman looks at the going price and tries to determine their cost per product. The businessman decides whether the profit achievable at the ‘going price’ is worth his labor of starting that business. That businessman will often evaluate many products in search of the most profitable enterprise to start. That search and evaluation is a key component ensuring the ‘correct’ amount of product is produced.

|

|

If a particular sector of the economy, even a tiny subsection is requiring x% of the overall labor to fulfill the demand, it is vital to allow prices to entice enough labor hours in that sector. If new capital meets with ingenious ideas that lead to substantial productivity gains, less labor is needed to achieve the same output. This leads to two great things happening, the price drops making that item available to a larger group of consumers and labor is freed up to serve people in new ways. The Left just looks at the lost jobs and those that understand economics look at increased living standards for everyone.

|

|

The proper price cannot be imposed by government officials, in fact, when they try, things go badly. If the government prices an item to high, supply would increase and the demand decrease, leaving excess product. The minimum wage is a good example. If the government prices a product too low, quantity and quality are decreased and demand increases. Shortages will occur, and the government would step in and determine rationing. The government has a long history of distorting the price and then trying to regulate more to ‘fix’ the problem they created, often making the problems worse. The price mechanism solves issues if the government gets out of the way.

|

|

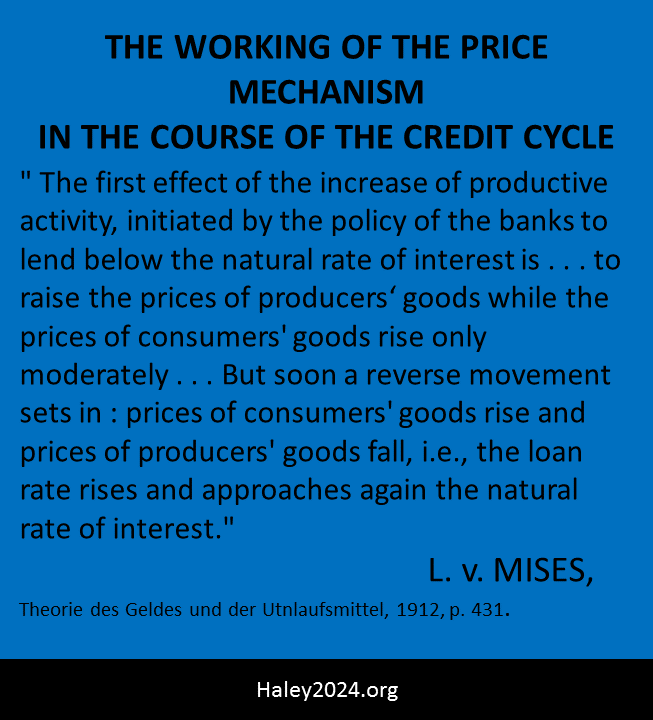

In the banking sector, the price of people borrowing capital for a certain amount of time is called the interest rate. In the free enterprise system, the higher the price (interest rate), the fewer people are willing to buy (take a loan) and alternatively, the lower the price, the more significant the amount people will be willing to borrow. Ten percent interest is likely to be paid to keep a business open; however, is likely not going to attract many home buyers. On the supply side, the more a bank is willing to offer to pay someone to deposit their money, the more money (capital) will be saved; thus, more will be available to be lent out. The government through the Federal Reserve profoundly distorts this market wreaking havoc with the economy.

|

|

|

|