Haley2024 Taxes

|

Citizenship comes with responsibilities. The three primary responsibilities are providing for the national defense, providing for the rule of law, and providing for serious unmet needs. Every citizen must contribute to all three. Currently, the government's attempts to solve these issues by taxing and spending have led to many problems. There is a better way.

|

|

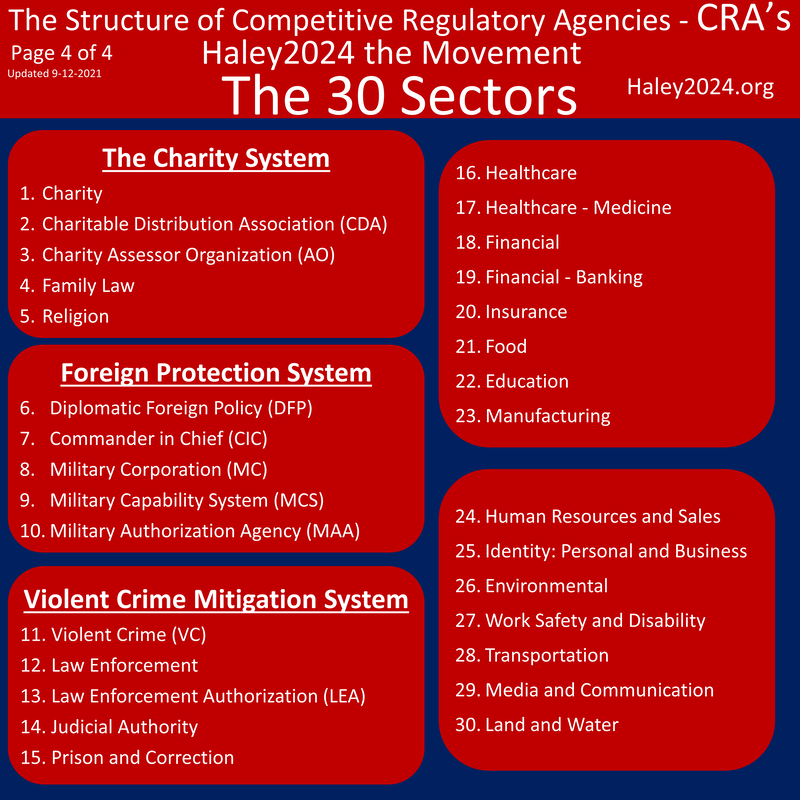

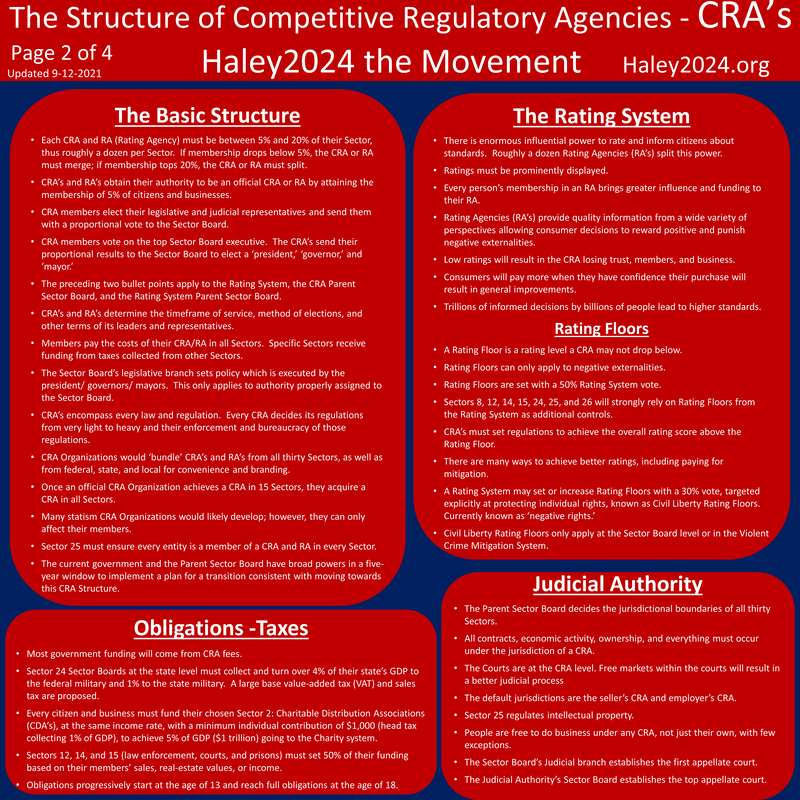

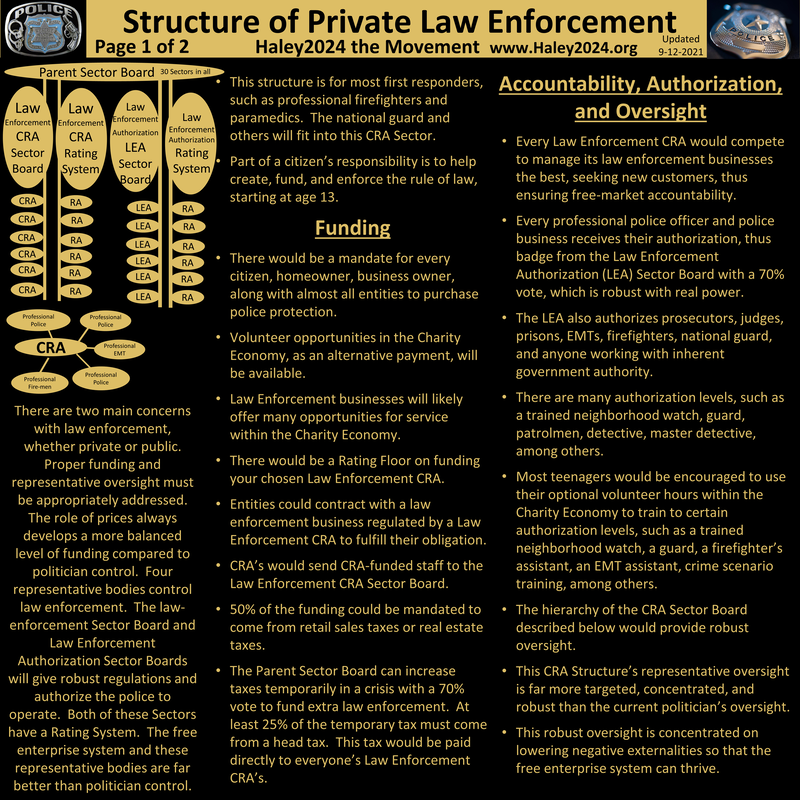

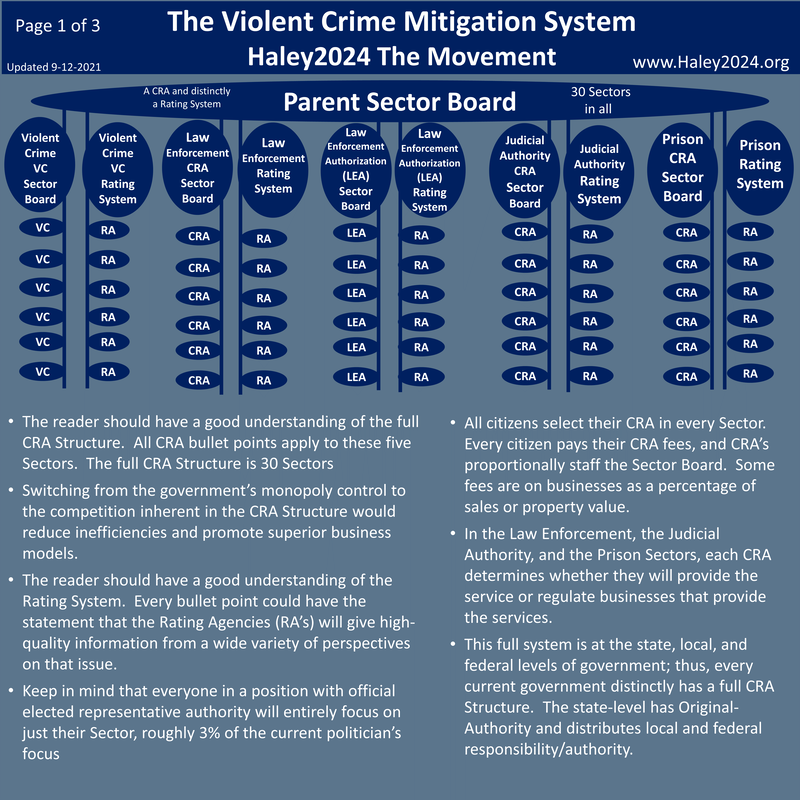

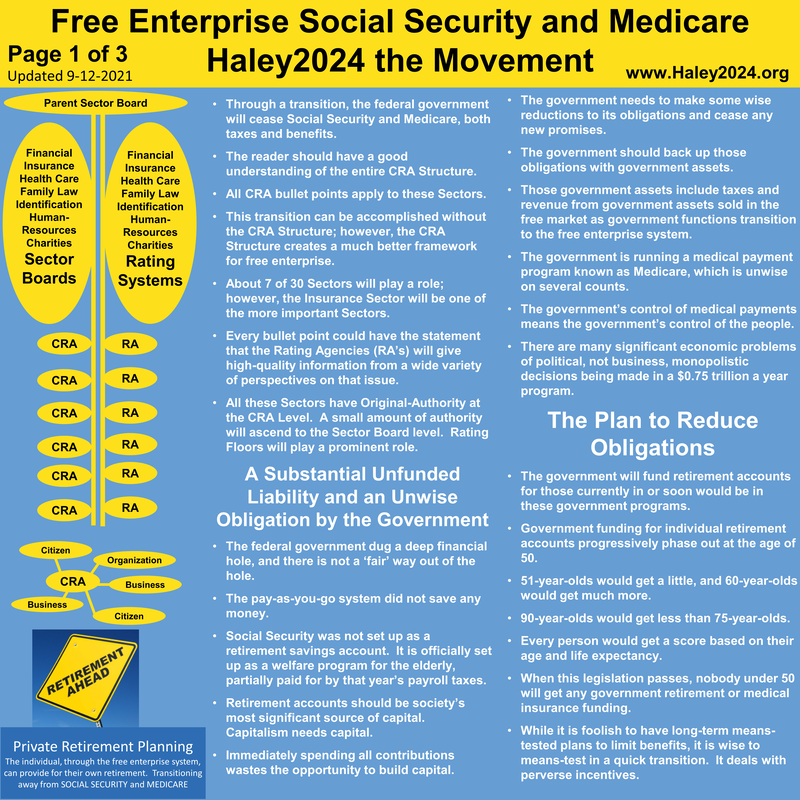

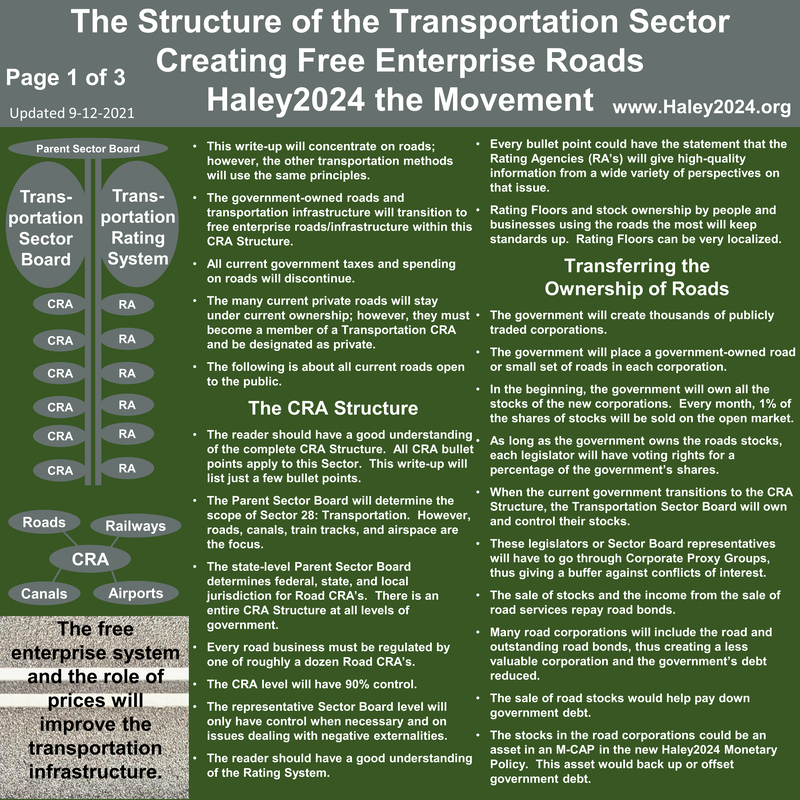

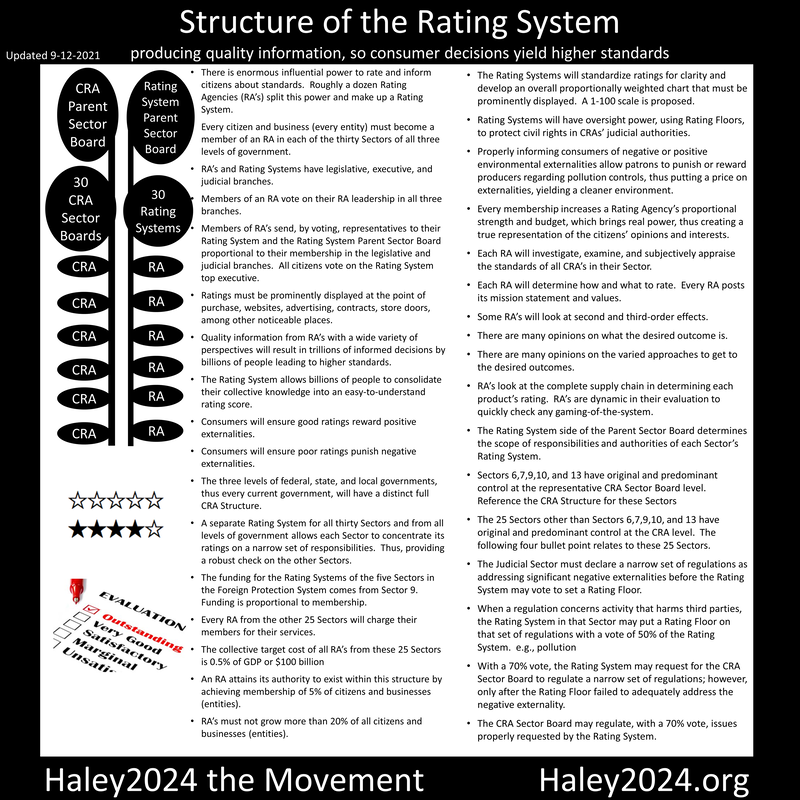

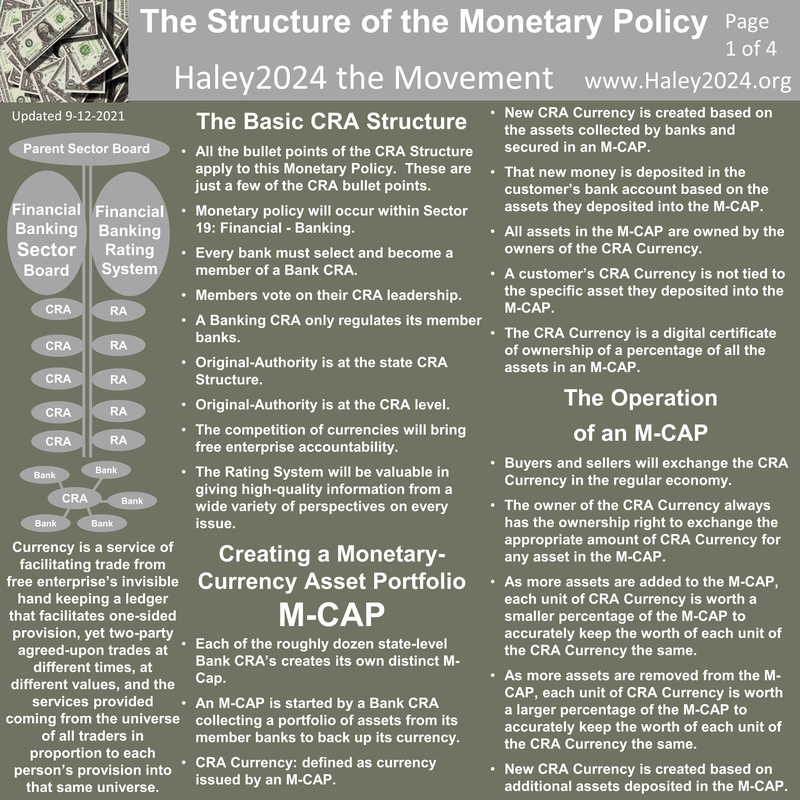

Haley2024 reforms divide all government responsibilities into thirty sectors. Each of the thirty sectors has distinct leadership. Each of the thirty sectors has roughly a dozen Competitive Regulatory Agencies (CRA’s). Every citizen must belong to one CRA per sector. Every CRA charges a fee for their service. Most CRA’s would utilize the charity economy for volunteer hours as in option, instead of the fee.

Businesses and organizations must also belong to one CRA per sector. Many of the CRA’s in particular sectors would attain most of their funding from businesses. Some of the sectors would charge fees based on a percentage of income, sales, or value. Some of the sectors would be straight fees for everyone. |

|

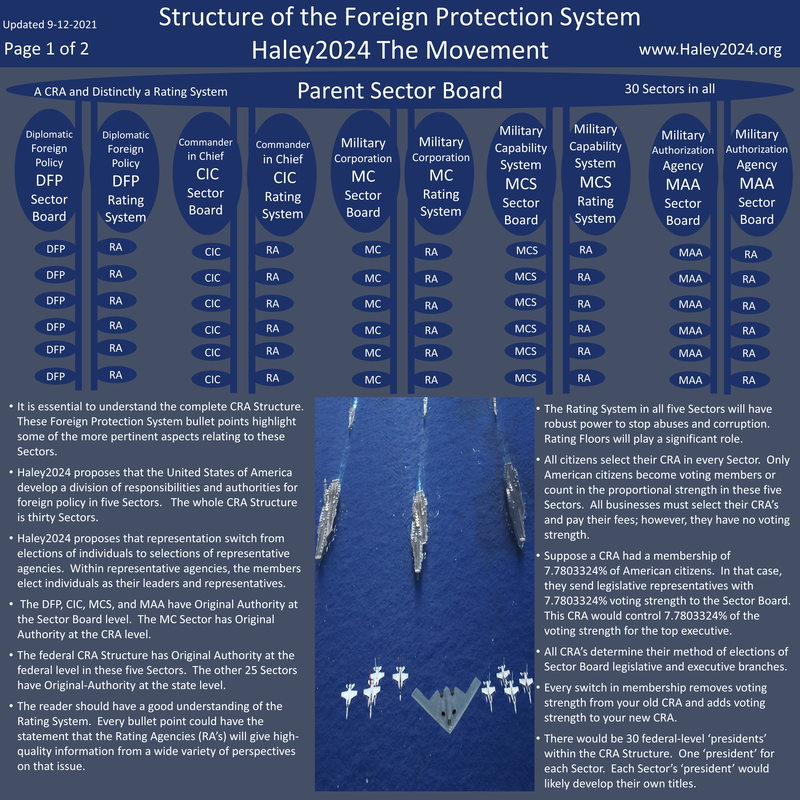

Everyone must contribute to national defense. Haley2024 proposes that every state fund the Foreign Policy and private military system to the tune of 5% of their state’s portion of GDP. Every state’s Parent Sector Board can choose their method of taxation. However, Haley2024 proposes splitting the tax between income, sales, real estate, and a per-head tax.

5% of GDP is roughly $1.1 trillion or about $10,000 per household. Income tax, sales tax, and real estate should take 30% each, and the head tax should take on the last 10%. The head tax is on everyone from age 13 to life expectancy. The head tax would be roughly $500 a year. Citizens can fulfill the head-tax in the charity economy. There are about 110 million households and about 200 million heads within the age range. |

|

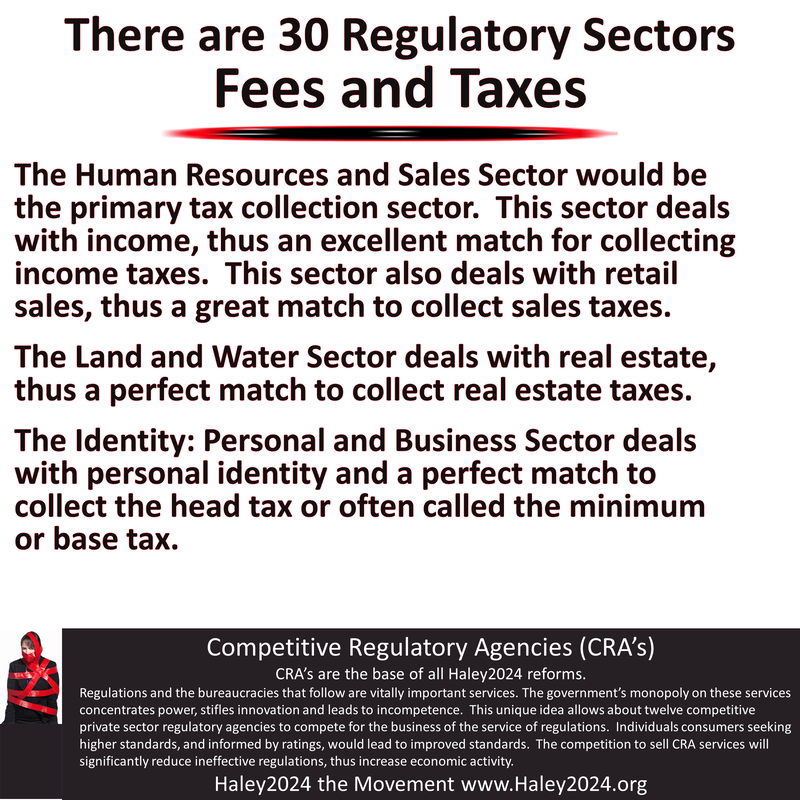

The Human Resources and Sales Sector would collect the income tax and the sales tax. The Land and Water Sector would collect the real estate tax. The Identity: Personal and Business Sector would collect the head tax. Each CRA within these sectors collects the tax from their members.

The rating system would ensure high standards on reporting with some strong standardization from the representatives on the sector boards. The funds would be turned over to the Military Capabilities System and distributed within that system. |

|

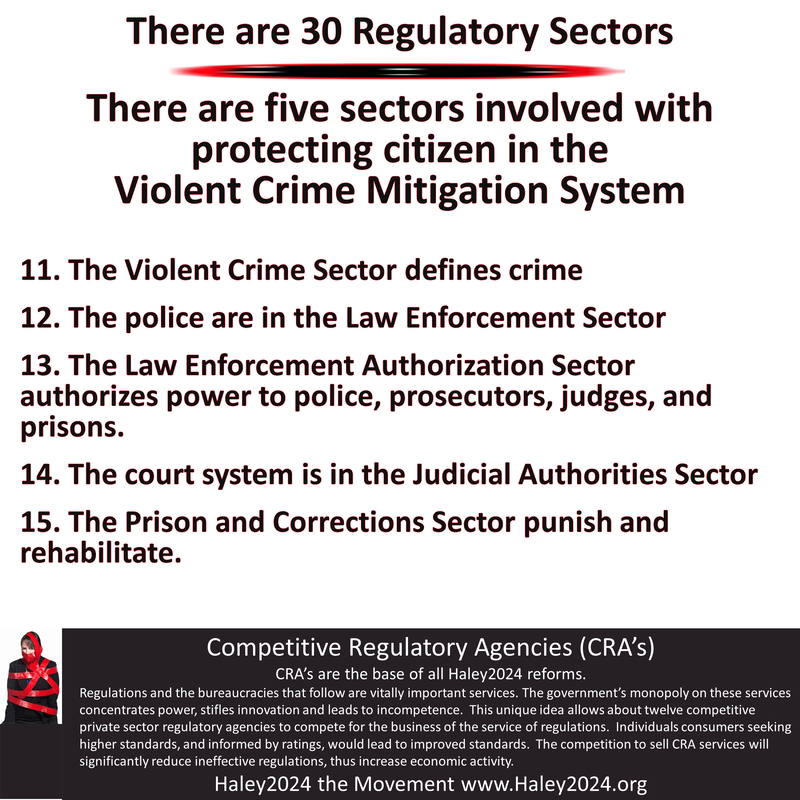

The Violent Crime Sector and the Law Enforcement Authorization Sector are relatively inexpensive. Every person and every business would just pay their CRA fee.

Haley2024 proposes that every person, every homeowner, and every business must buy law-enforcement services up to the rating level. The local fire department and EMT’s are included in this mandate. The Law-Enforcement Rating System must set a floor on how much law-enforcement citizens, homeowners, and businesses must attain. These contracts would increase on more expensive homes and factor in the size of a business. |

|

The funding for the courts goes through the Judicial Authority Sector. This sector will also use the sales tax, income tax, real-estate tax, and the head tax. Businesses also use the court system, and would likely pay a majority of the court administrative fees. While some fees would be individual court case fees, it is likely the majority of the funding would come from every member, both individual and business, paying their CRA fees.

The size of the business would likely determine fee levels. Many CRA memberships would come with a yearly retainer and other ongoing fees. Both the CRA representatives and the rating system representatives would set certain standards and rating floors. |

|

The funding for the Prison and Corrections Sector would also be mostly proportional and partially a head tax. Income taxes and real estate taxes would account for 75% of every individual’s prison tax. The other 25% comes from a head tax. Every citizen becomes a member of a prison CRA and must fund their CRA with those taxes. The Haley2024 prison system reform has a full system in place to achieve the best results.

|

|

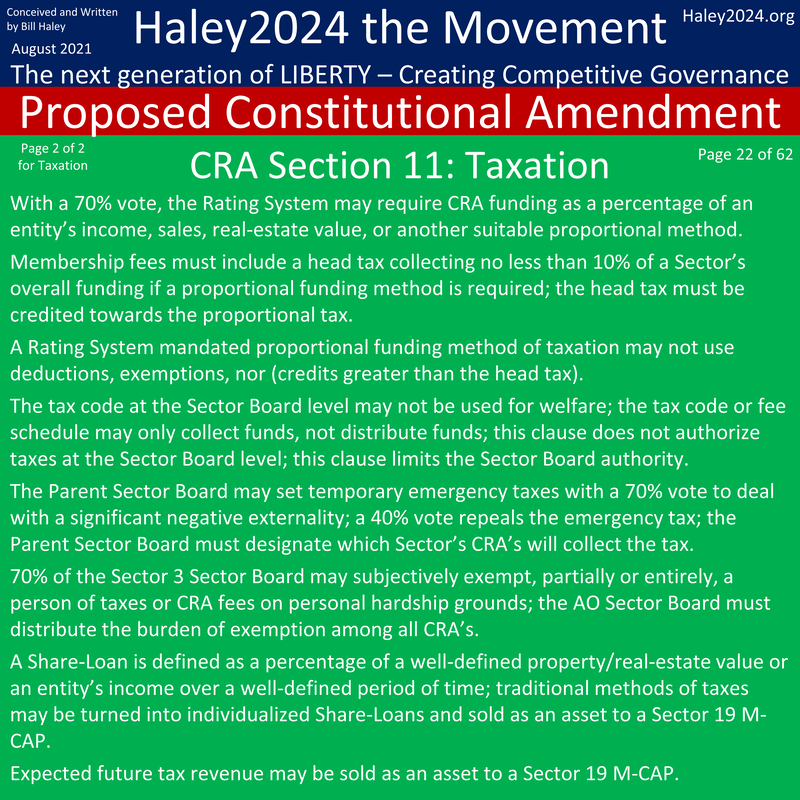

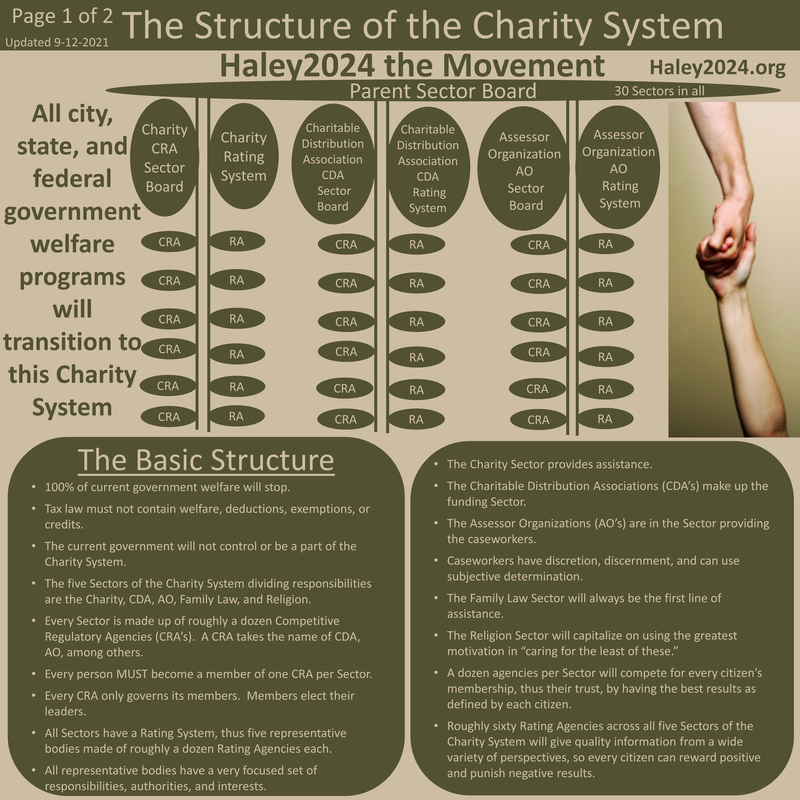

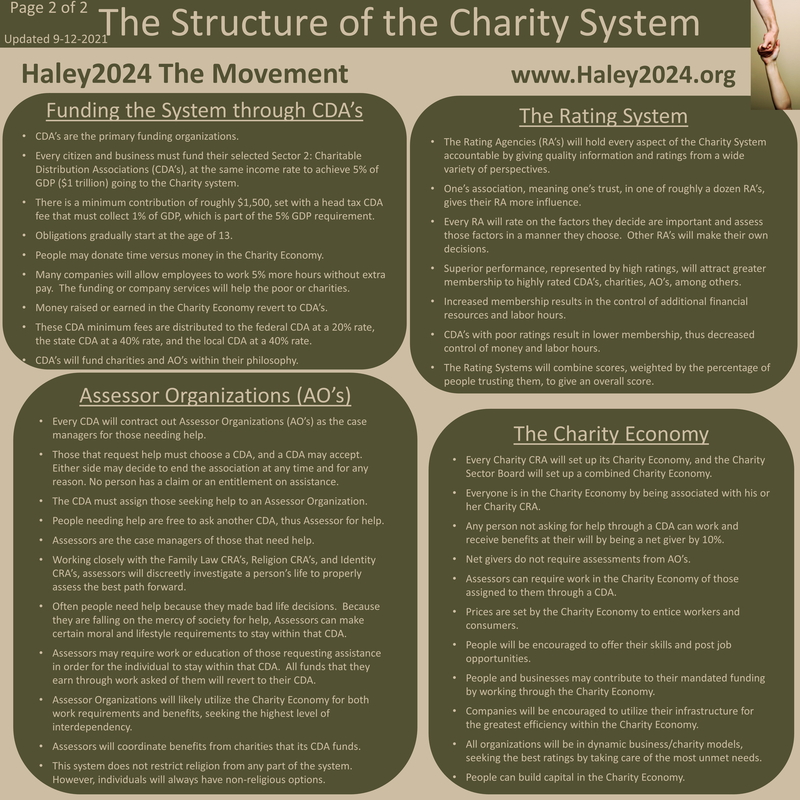

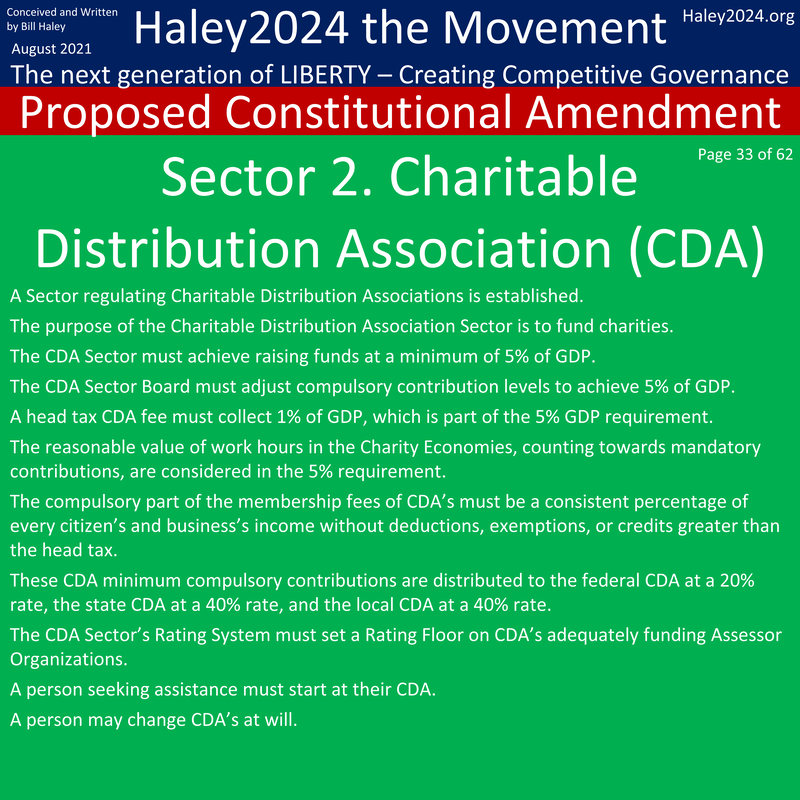

Every citizen starting at the age of 13 must contribute to helping the poor. Everyone must contribute 5% of his or her income to his or her chosen Charitable Distribution Association with a minimum of $1,500 per year.

People can work in the charity economy for some or all of their contributions. Individuals can work extra hours for their employer in exchange for approved services that business does to help the poor. Many dynamic business and charity models are likely. |

|

Most CRA’s would have a system where their members can pay some or all of their membership fees in the charity economy. The charity economy allows the regular economy to intermix with helping the poor. The Charity Economy is more controlled by Assessor Organizations, charities, and Charitable Distribution Associations.

The charity economy can put people to work faster and hold people accountable. For many people, the charity economy will replace unemployment insurance. The charity economy is a very dynamic system that will solve or mitigate many negative externalities and problems. |

|

Most of the funding for education will be in the free enterprise system. However, some families will struggle with funding. The financial system will have many long-term financing options, and the free enterprise system will decrease costs.

The Charity System will step in with many education solutions for the needy. No child should be without an education because of funding issues. However, parents should always maintain the control of their children’s education and often that might mean a struggle. That struggle brings new solutions and business models in a free market system. |

|

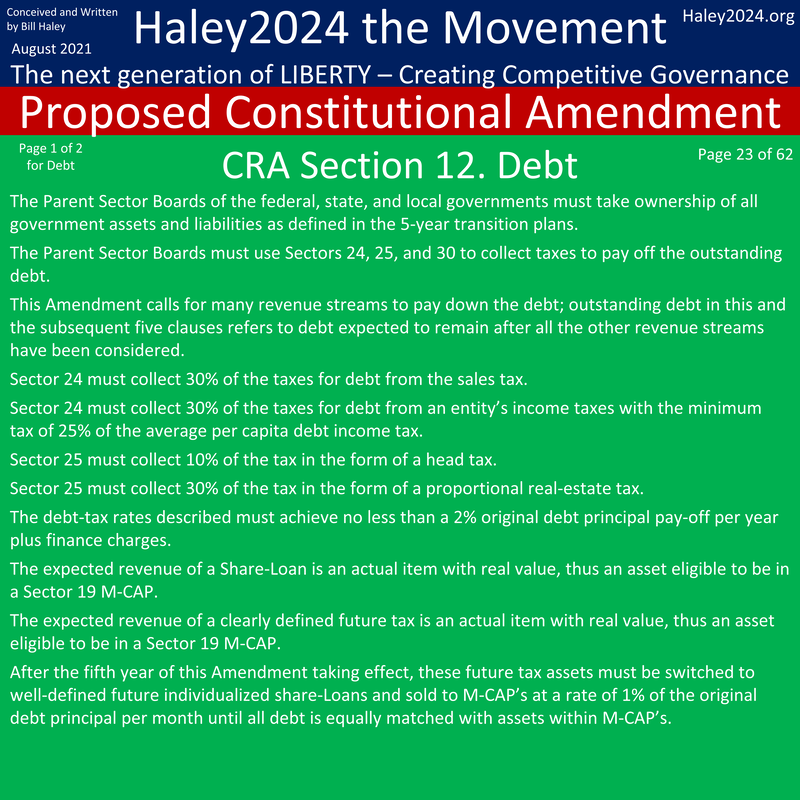

Social Security and Medicare taxes will continue for several decades as a way to pay off the debt within the system. During the transition, people only pay the tax until the age of fifty, so they can start concentrating on building their own retirement accounts. Haley2024 proposes a simple mandate that people have a retirement plan above the minimum rating. After the transition and the debt is paid off, the tax will cease to exist.

|

|

RA’s would likely develop several revenue streams. The first revenue stream is a direct fee to their members. The second revenue stream is advertising. The third revenue stream is direct member involvement as inspectors or analysts. These funding models could be truly dynamic.

The rating system does not need to be that expensive. Businesses would likely fund the majority of the Rating system. |

|

The Human Resources and Sales Sector would be the primary tax collection sector. This sector deals with income, thus an excellent match for collecting income taxes. This sector also deals with retail sales, thus a great match to collect sales taxes.

The Land and Water Sector deals with real estate, thus a perfect match to collect real estate taxes. The Identity: Personal and Business Sector deals with personal identity and a perfect match to collect the head tax or often called the minimum or base tax. |

|

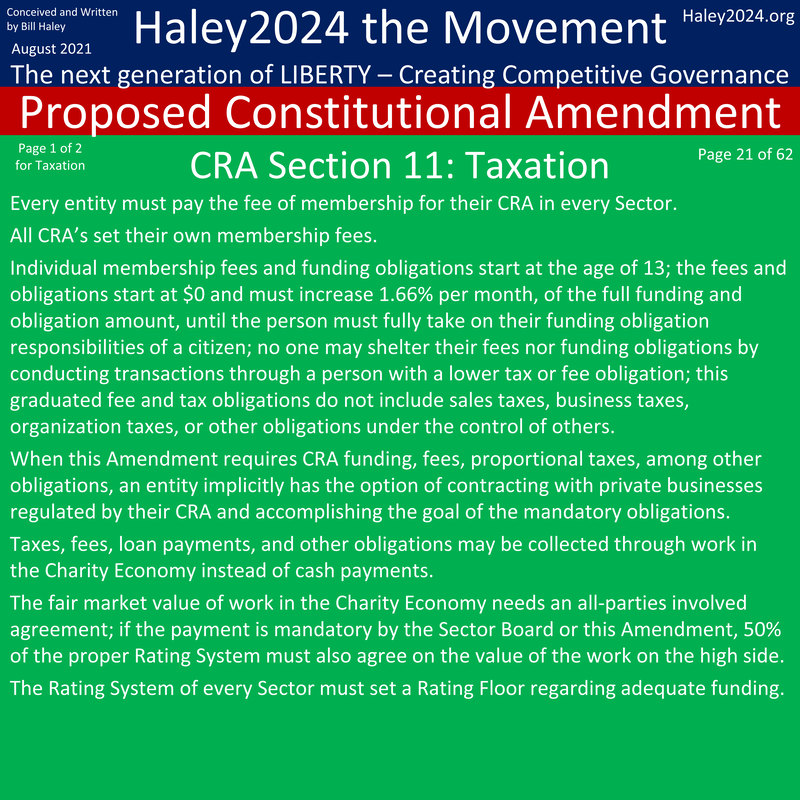

Every citizen must belong to a CRA in every sector. Every CRA and RA charges their members fees for their regulatory and rating services.

The funding for the Charity System is based on a percent of one’s income with a minimum base contribution of $1,500 a year. The funding for the Foreign Protection System comes from income taxes, sales taxes, real estate taxes, and a head tax of $500 a year. The Family Law Sector and Religious Sector would be individual or family based fees. |

|

The funding of the Law Enforcement Sector will mostly come from law-enforcement contracts of individuals, homeowners, and businesses. Many of the police contracts are based on the size and worth of the home or business.

The rest of the funding for the Violent Crime Mitigation System comes from income taxes, sales taxes, real estate taxes, and a head tax of $500 a year. Businesses would dominate the funding of sectors 16 through 30. However sectors 25 and 30 would have large individual components. Larger businesses naturally pay more substantial fees. |

|

There is a 70% Rating System representative vote threshold to increase a Rating Floor and a 40% threshold to lower the rating floor.

Part of the Rating Floor deals with fees and taxes. The rating system of every sector will address the issues of everyone paying a base amount versus how much of the fees should be based on sales volume, the worth, or the necessity or use of regulations. |

|

If all the taxes are too much for an individual or family, those individuals or family can seek relief from their Assessor Organization (AO). An AO will evaluate the individual and family situation, and if the AO agrees that a hardship tax exemption is warranted, they can exempt that individual from part or all of their citizen’s tax responsibility. The Assessor Organization Rating System will have a rating floor on hardship tax exemptions, meaning 70% of AO-RA representatives must approve the exemption. People with severe disabilities would qualify.

|