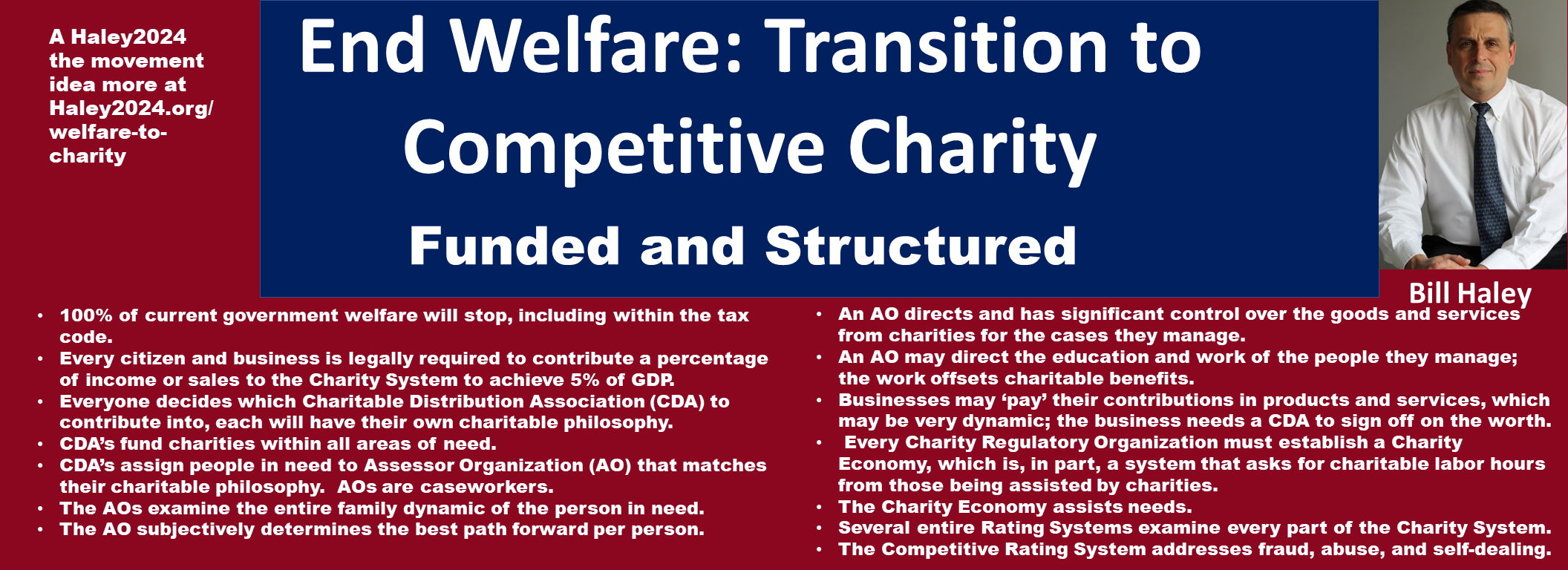

End Welfare: Transition to Competitive Charity

This page attempts to mirror the End Welfare: Transition to Competitive Charity Facebook page.

Please follow, subscribe, and comment on Facebook.

Email Bill at Bill@Haley2024.org

Donate at the non-profit 501C3 tax exempt and fully tax deductible Haley2024 the Movement

This page takes this one reform separate from all the other Haley2024 reforms. This reform fully integrated with other reforms can be easily found using the drop down menu on Haley2024.org

Please follow, subscribe, and comment on Facebook.

Email Bill at Bill@Haley2024.org

Donate at the non-profit 501C3 tax exempt and fully tax deductible Haley2024 the Movement

This page takes this one reform separate from all the other Haley2024 reforms. This reform fully integrated with other reforms can be easily found using the drop down menu on Haley2024.org

Funded and Structured

|

|

|

|

A 4-minute overview

|

|

|

|

A 2-minute overview

|

|

A 3-minute overview

|

|

|

|

A 21-minute overview

|

|

A 11-minute overview

|

|

|

|

Everyone decides which Charitable Distribution Association (CDA) to contribute into, each will have their own charitable philosophy.

|

|

Every citizen and business is legally required to contribute a percentage of income or sales to the Charity System to achieve 5% of GDP.

|

|

|

|

100% of current government welfare will stop, including within the tax code.

|

|

CDA’s assign people in need to Assessor Organization (AO) that matches their charitable philosophy. AOs are caseworkers.

|

|

|

|

CDA’s fund charities within all areas of need.

|

|

The Competitive Rating System addresses fraud, abuse, and self-dealing.

|

|

|

|

Businesses may ‘pay’ their contributions in products and services, which may be very dynamic; the business needs a CDA to sign off on the worth.

|