Competitive Currencies

|

This page attempts to mirror the Competitive Currencies Facebook page.

Please follow, subscribe, and comment on Facebook. Email Bill at Bill@Haley2024.org Donate at the non-profit 501C3 tax exempt and fully tax deductible Haley2024 the Movement This page takes this one reform separate from all the other Haley2024 reforms. This reform fully integrated with other reforms can be easily found using the drop down menu on Haley2024.org |

|

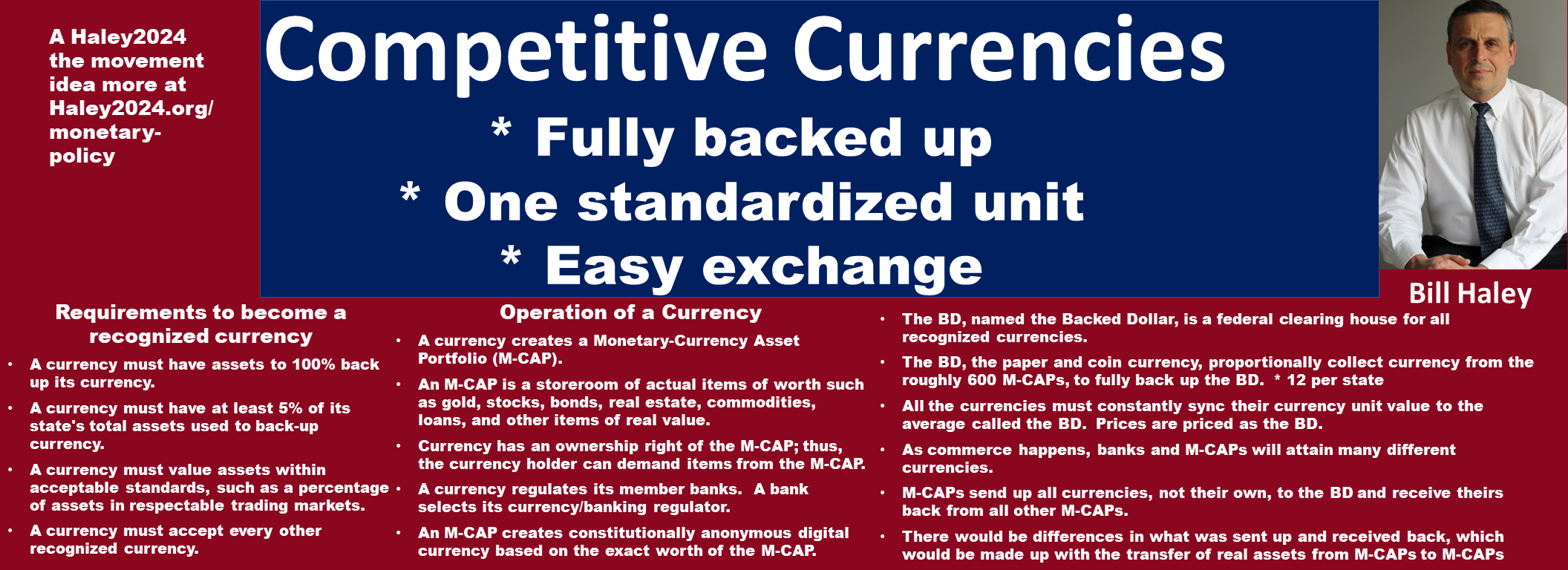

* Fully backed up

* One standardized unit

* Easy exchange

Requirements to become a recognized currency

• A currency must have assets to 100% back up its currency.

• A currency must have at least 5% of its state's total assets used to back-up currency.

• A currency must value assets within acceptable standards, such as a percentage of assets in respectable trading markets.

• A currency must accept every other recognized currency.

• A currency must have at least 5% of its state's total assets used to back-up currency.

• A currency must value assets within acceptable standards, such as a percentage of assets in respectable trading markets.

• A currency must accept every other recognized currency.

Operation of a Currency

|

• A currency creates a Monetary-Currency Asset Portfolio (M-CAP).

• An M-CAP is a storeroom of actual items of worth such as gold, stocks, bonds, real estate, commodities, loans, and other items of real value. • Currency has an ownership right of the M-CAP; thus, the currency holder can demand items from the M-CAP. • A currency regulates its member banks. A bank selects its currency/banking regulator. • An M-CAP creates constitutionally anonymous digital currency based on the exact worth of the M-CAP. • The BD, named the Backed Dollar, is a federal clearing house for all recognized currencies. |

• The BD, the paper and coin currency, proportionally collect currency from the roughly 600 M-CAPs, to fully back up the BD. * 12 per state

• All the currencies must constantly sync their currency unit value to the average called the BD. Prices are priced as the BD. • As commerce happens, banks and M-CAPs will attain many different currencies. • M-CAPs send up all currencies, not their own, to the BD and receive theirs back from all other M-CAPs. • There would be differences in what was sent up and received back, which would be made up with the transfer of real assets from M-CAPs to M-CAPs |

|

The hour-long overview

|

|

|

|

M-CAPCreating the Monetary Currency Asset Portfolio

|

|

The operation of the M-CAP and currency

|

|

|

|

Explaining the Backed Dollar and syncing values

|

|

Explaining assets gaining or losing value compared to the average.

|

|

|

|

M-CAP settling up

|

|

Assets of an M-CAP

|

|

|

|

Keeping the value of the assets honest

|

|

The Federal Reserve and the transition

|

|

|

|

The practical use of competitive currencies

|

|

|

|

|

|

|