|

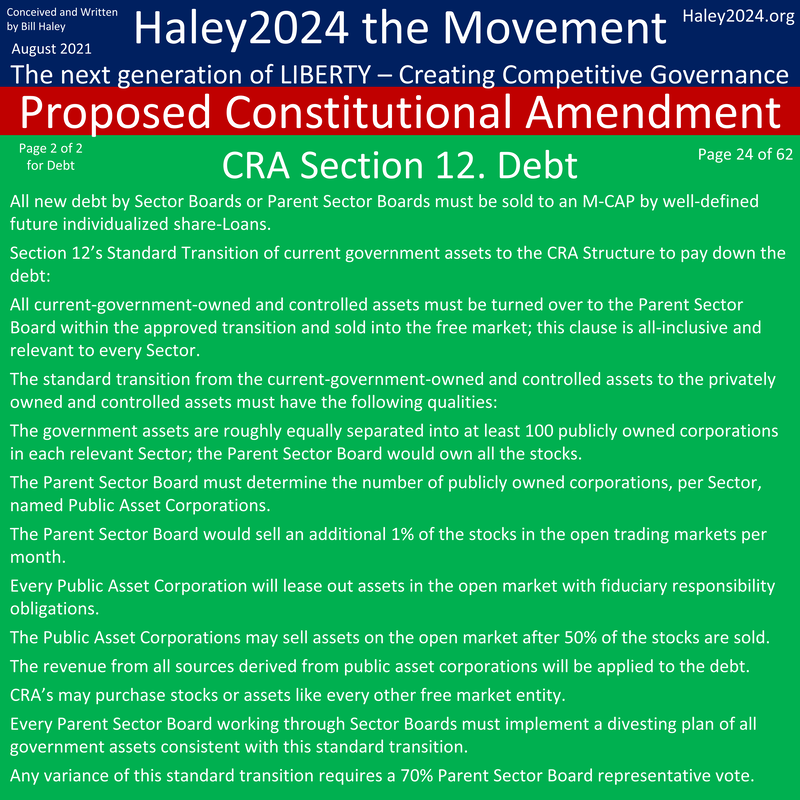

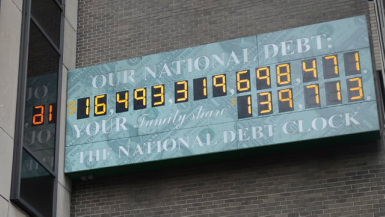

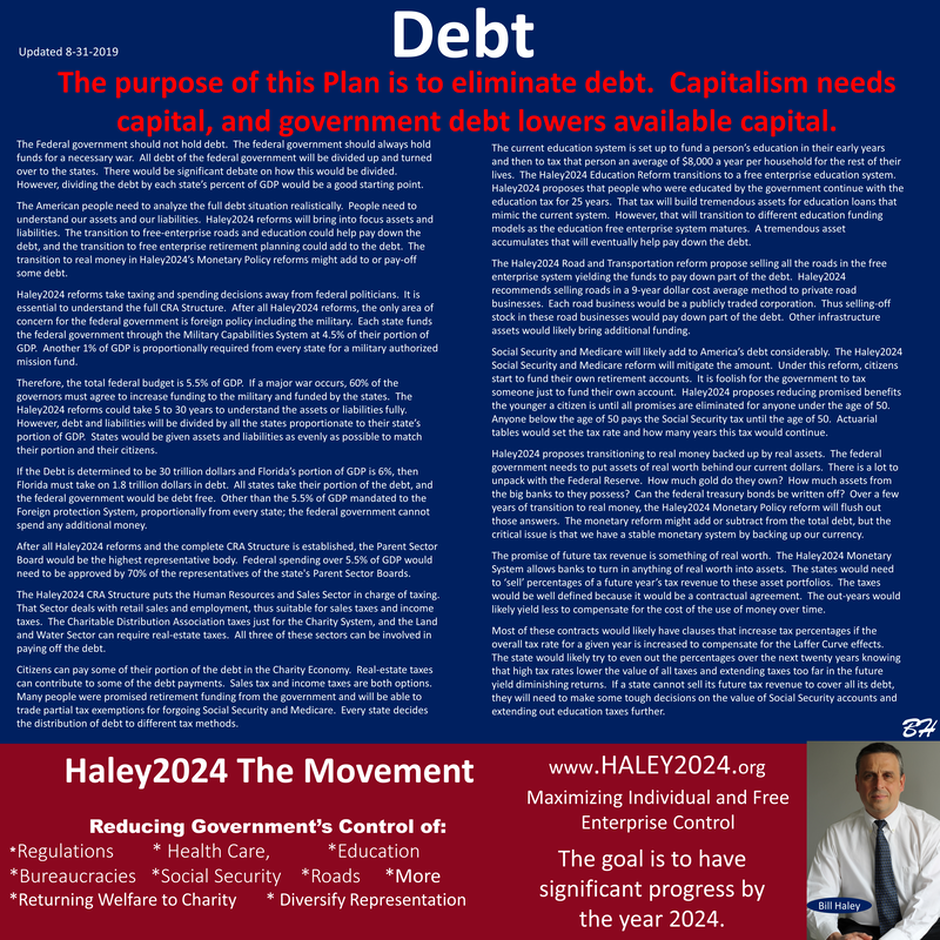

The Federal government should not hold debt. The federal government should always hold funds for a necessary war. All debt of the federal government will be divided up and turned over to the states. There would be significant debate on how this would be divided. However, dividing the debt by each state’s percent of GDP would be a good starting point.

|

|

The American people need to analyze the full debt situation realistically. People need to understand our assets and our liabilities. Haley2024 reforms will bring into focus assets and liabilities. The transition to free-enterprise roads and education could help pay down the debt, and the transition to free enterprise retirement planning could add to the debt. The transition to real money in Haley2024’s Monetary Policy reforms might add to or pay-off some debt.

|

|

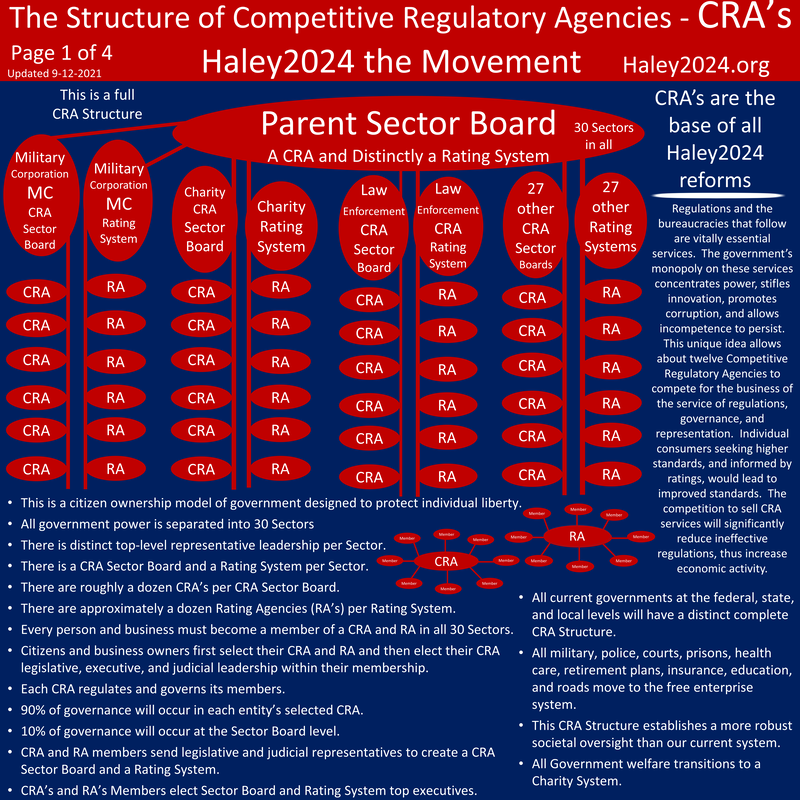

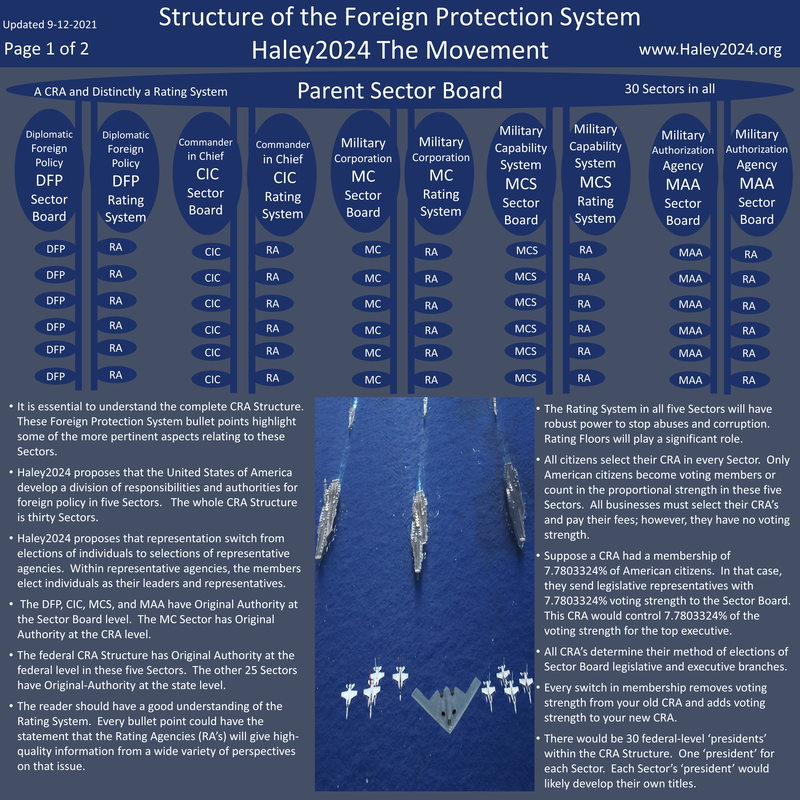

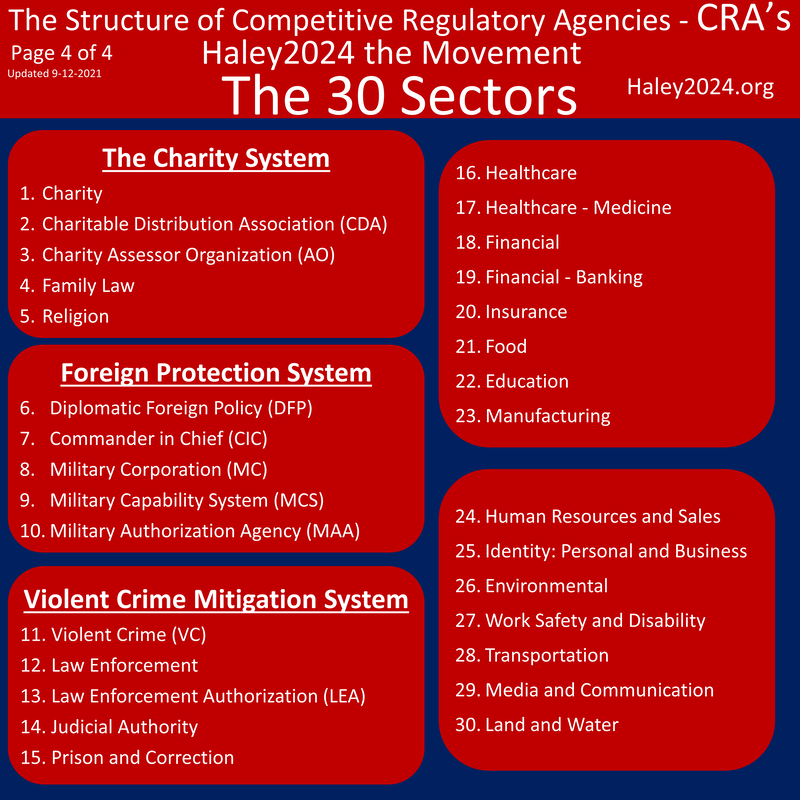

Haley2024 reforms take taxing and spending decisions away from federal politicians. It is essential to understand the full CRA Structure. After all Haley2024 reforms, the only area of concern for the federal government is foreign policy including the military. Each state funds the federal government through the Military Capabilities System at 5% of their portion of GDP. Another 1% of GDP is proportionally required from every state for a military authorized mission fund.

|

|

Therefore, the total federal budget is 5% of GDP. If a major war occurs, 60% of the governors must agree to increase funding to the military and funded by the states. The Haley2024 reforms could take 5 to 30 years to understand the assets or liabilities fully. However, debt and liabilities will be divided by all the states proportionate to their state’s portion of GDP. States would be given assets and liabilities as evenly as possible to match their portion and their citizens.

|

|

If the Debt is determined to be 30 trillion dollars and Florida’s portion of GDP is 6%, then Florida must take on 1.8 trillion dollars in debt. All states take their portion of the debt, and the federal government would be debt free. Other than the 5% of GDP mandated to the Foreign protection System, proportionally from every state; the federal government cannot spend any additional money.

|

|

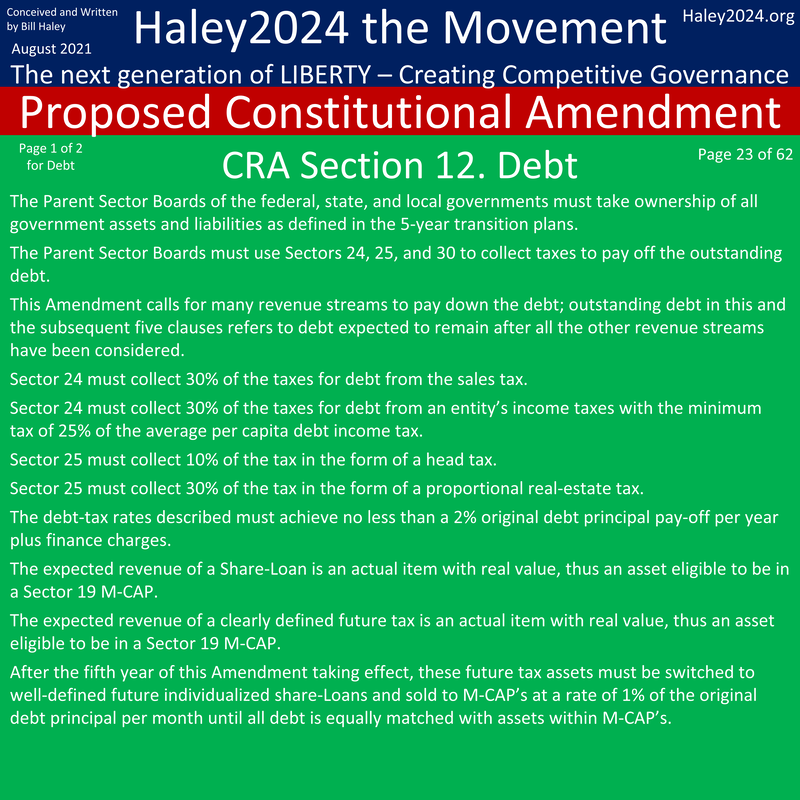

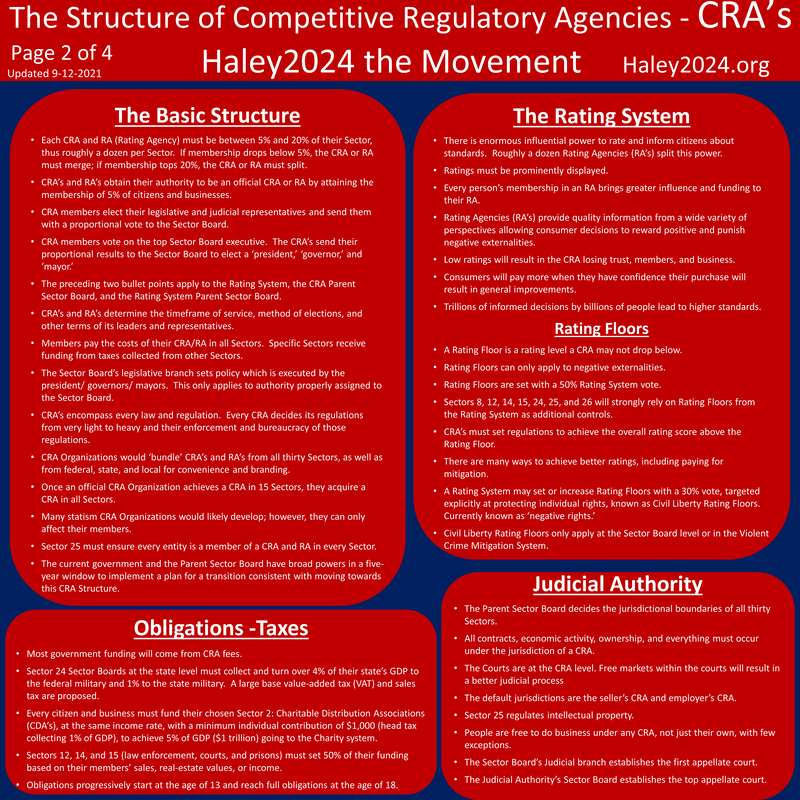

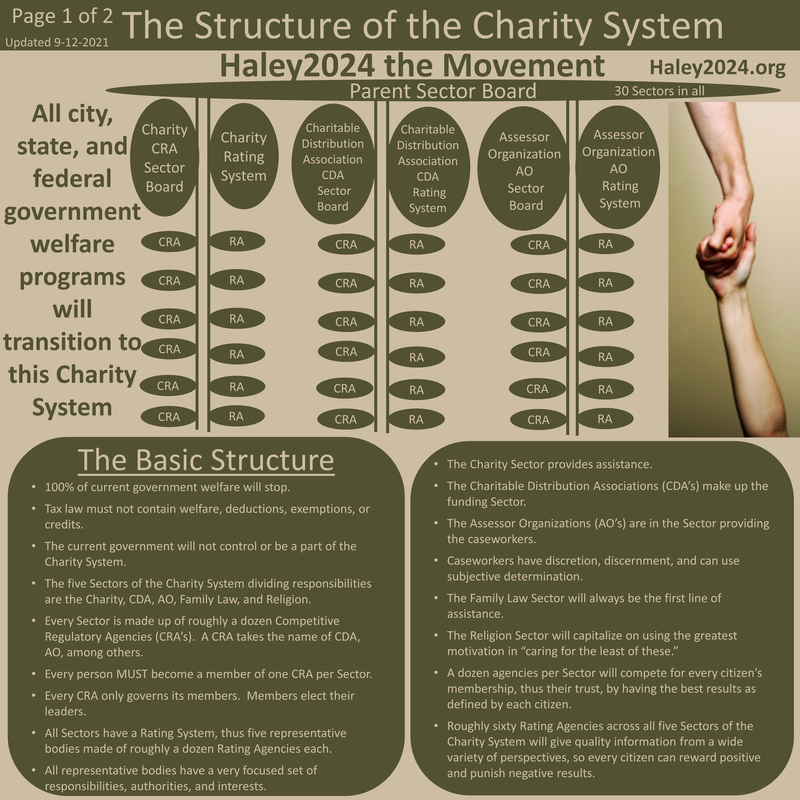

The Haley2024 CRA Structure puts the Human Resources and Sales Sector in charge of taxing. That Sector deals with retail sales and employment, thus suitable for sales taxes and income taxes. The Charitable Distribution Association taxes just for the Charity System, and the Land and Water Sector can require real-estate taxes. All three of these sectors can be involved in paying off the debt.

|

|

Citizens can pay some of their portion of the debt in the Charity Economy. Real-estate taxes can contribute to some of the debt payments. Sales tax and income taxes are both options. Many people were promised retirement funding from the government and will be able to trade partial tax exemptions for forgoing Social Security and Medicare. Every state decides the distribution of debt to different tax methods.

|

|

The current education system is set up to fund a person’s education in their early years and then to tax that person an average of $8,000 per household, a year for the rest of their lives. The Haley2024 Education Reform transitions to a free enterprise education system. Haley2024 proposes that people who were educated by the government continue with the education tax for 25 years. That tax will build tremendous assets for education loans that mimic the current system. However, that will transition to different education funding models as the education free enterprise system matures. A tremendous asset accumulates that will eventually help pay down the debt.

|

|

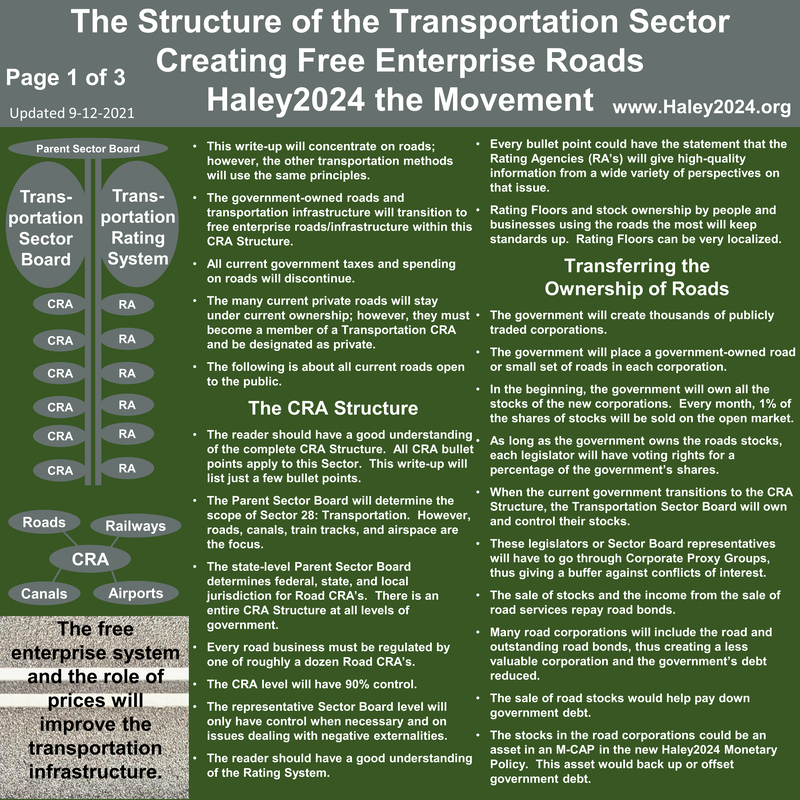

The Haley2024 Road and Transportation reform propose selling all the roads in the free enterprise system yielding the funds to pay down part of the debt. Haley2024 recommends selling roads in a 9-year dollar cost average method to private road businesses. Each road business would be a publicly traded corporation. Thus selling-off stock in these road businesses would pay down part of the debt. Other infrastructure assets would likely bring additional funding.

|

|

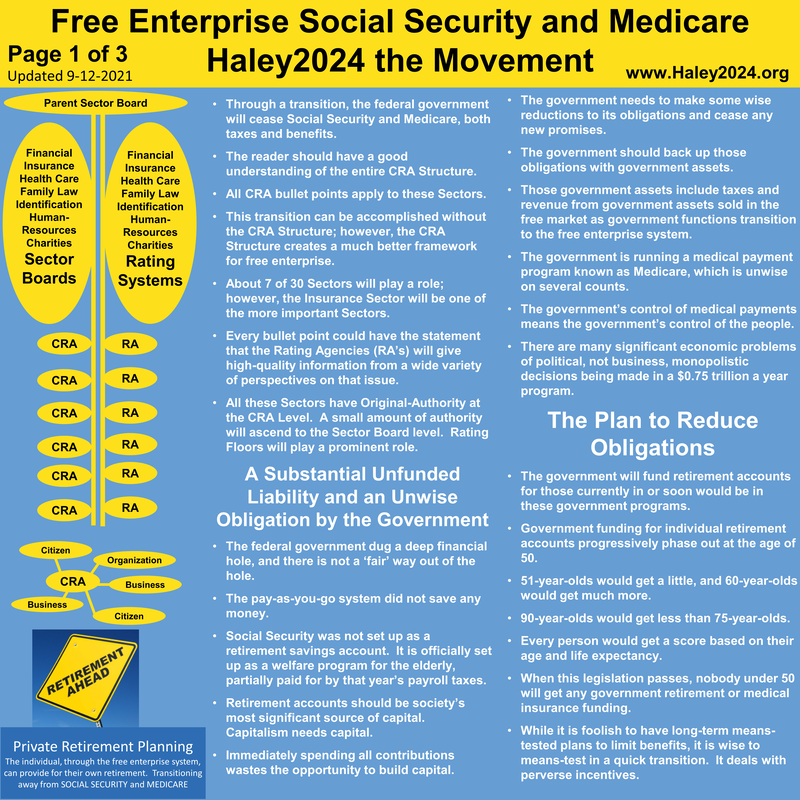

Social Security and Medicare will likely add to America’s debt considerably. The Haley2024 Social Security and Medicare reform will mitigate the amount. Under this reform, citizens start to fund their own retirement accounts. It is foolish for the government to tax someone just to fund their own account. Haley2024 proposes reducing promised benefits the younger a citizen is until all promises are eliminated for anyone under the age of 50. Anyone below the age of 50 pays the Social Security tax until the age of 50. Actuarial tables would set the tax rate and how many years this tax would continue.

|

|

Haley2024 proposes transitioning to real money backed up by real assets. The federal government needs to put assets of real worth behind our current dollars. There is a lot to unpack with the Federal Reserve. How much gold do they own? How much assets from the big banks to they possess? Can the federal treasury bonds be written off? Over a few years of transition to real money, the Haley2024 Monetary Policy reform will flush out those answers. The monetary reform might add or subtract from the total debt, but the critical issue is that we have a stable monetary system by backing up our currency.

|

|

The promise of future tax revenue is something of real worth. The Haley2024 Monetary System allows banks to turn in anything of real worth into assets. The states would need to ‘sell’ percentages of a future year’s tax revenue to these asset portfolios. The taxes would be well defined because it would be a contractual agreement. The out-years would likely yield less to compensate for the cost of the use of money over time.

|

|

Most of these contracts would likely have clauses that increase tax percentages if the overall tax rate for a given year is increased to compensate for the Laffer Curve effects. The state would likely try to even out the percentages over the next twenty years knowing that high tax rates lower the value of all taxes and extending taxes too far in the future yield diminishing returns. If a state cannot sell its future tax revenue to cover all its debt, they will need to make some tough decisions on the value of Social Security accounts and extending out education taxes further.

|