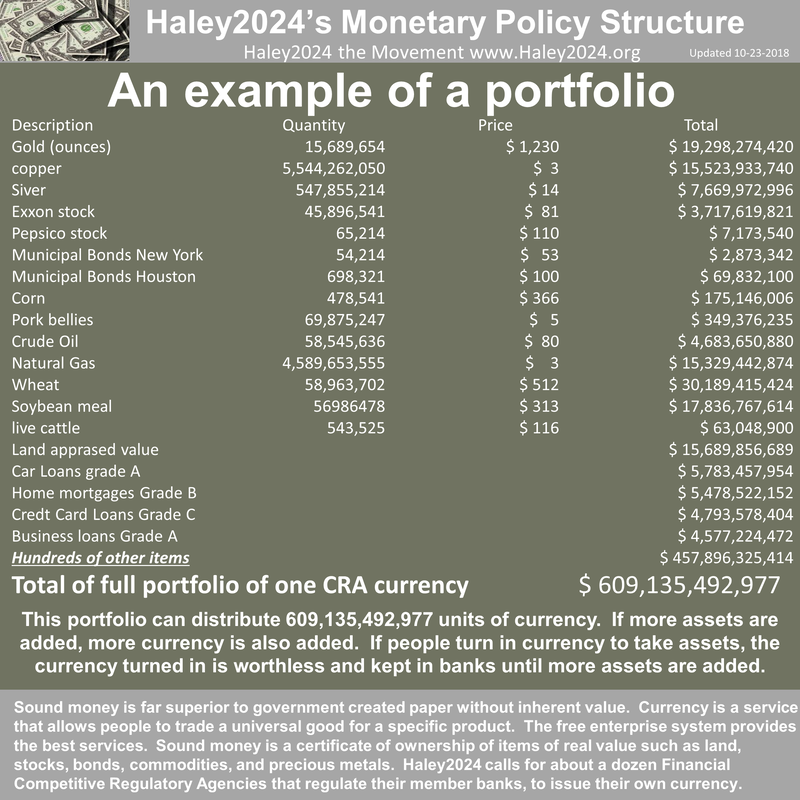

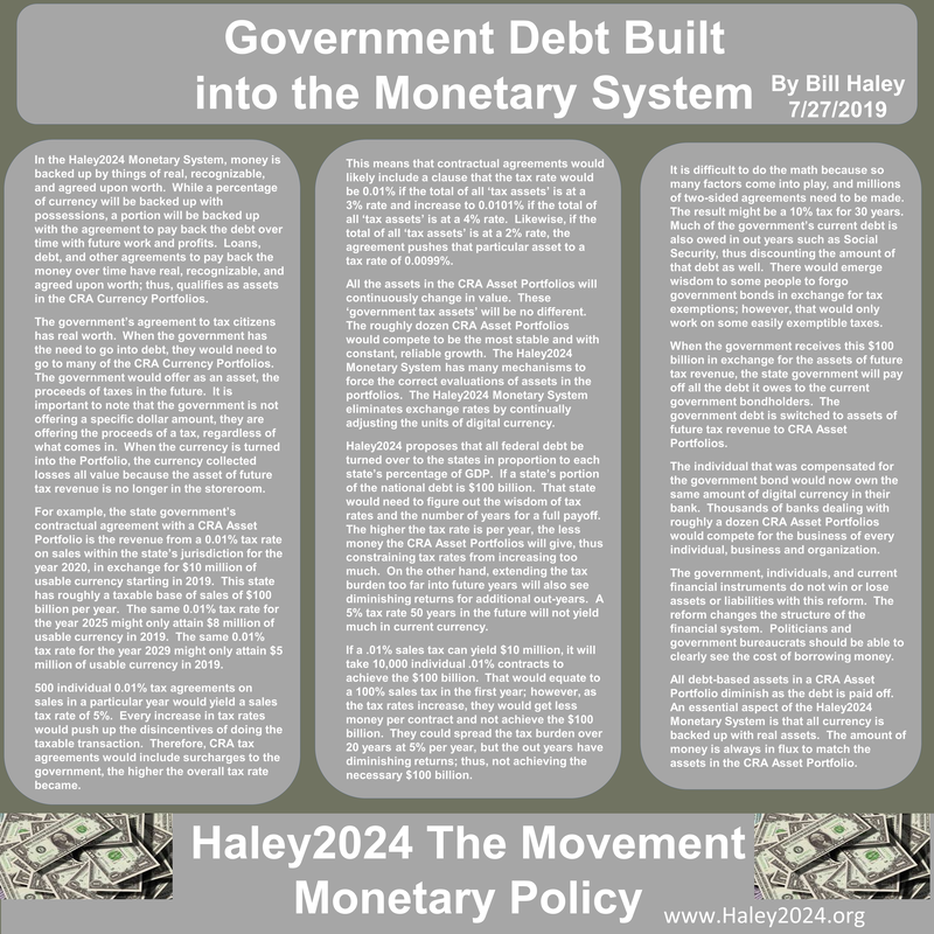

| In the Haley2024 Monetary System, money is backed up by things of real, recognizable, and agreed upon worth. While a percentage of currency will be backed up with possessions, a portion will be backed up with the agreement to pay back the debt over time with future work and profits. Loans, debt, and other agreements to pay back the money over time have real, recognizable, and agreed upon worth; thus, qualifies as assets in the CRA Currency Portfolios. |

| The government’s agreement to tax citizens has real worth. When the government has the need to go into debt, they would need to go to many of the CRA Currency Portfolios. The government would offer as an asset, the proceeds of taxes in the future. It is important to note that the government is not offering a specific dollar amount, they are offering the proceeds of a tax, regardless of what comes in. When the currency is turned into the Portfolio, the currency collected losses all value because the asset of future tax revenue is no longer in the storeroom. |

| For example, the state government’s contractual agreement with a CRA Asset Portfolio is the revenue from a 0.01% tax rate on sales within the state’s jurisdiction for the year 2020, in exchange for $10 million of usable currency starting in 2019. This state has roughly a taxable base of sales of $100 billion per year. The same 0.01% tax rate for the year 2025 might only attain $8 million of usable currency in 2019. The same 0.01% tax rate for the year 2029 might only attain $5 million of usable currency in 2019. |

| 500 individual 0.01% tax agreements on sales in a particular year would yield a sales tax rate of 5%. Every increase in tax rates would push up the disincentives of doing the taxable transaction. Therefore, CRA tax agreements would include surcharges to the government, the higher the overall tax rate became. |

| This means that contractual agreements would likely include a clause that the tax rate would be 0.01% if the total of all ‘tax assets’ is at a 3% rate and increase to 0.0101% if the total of all ‘tax assets’ is at a 4% rate. Likewise, if the total of all ‘tax assets’ is at a 2% rate, the agreement pushes that particular asset to a tax rate of 0.0099%. |

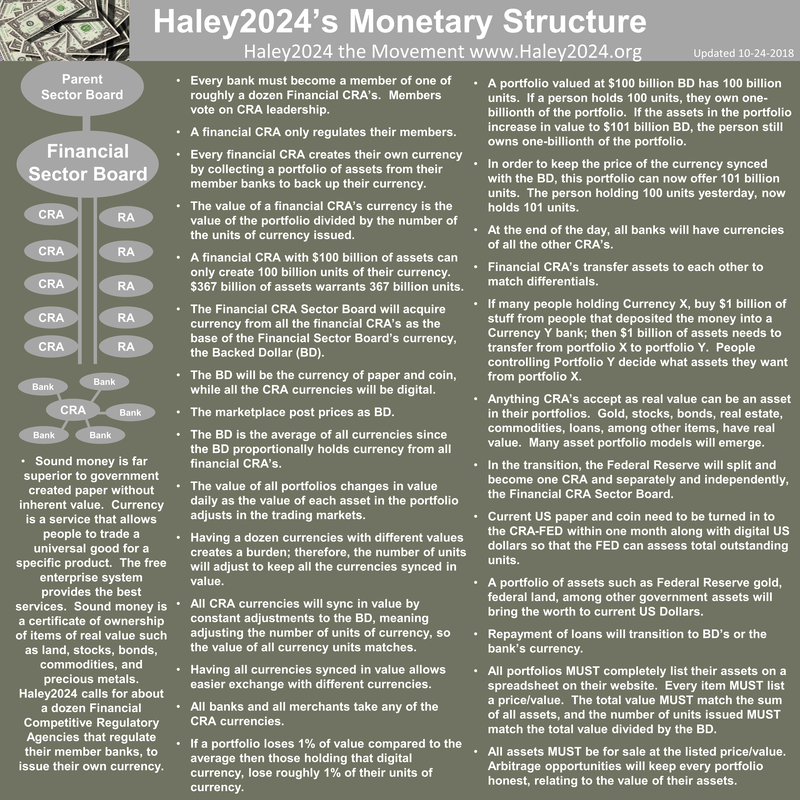

| All the assets in the CRA Asset Portfolios will continuously change in value. These ‘government tax assets’ will be no different. The roughly dozen CRA Asset Portfolios would compete to be the most stable and with constant, reliable growth. The Haley2024 Monetary System has many mechanisms to force the correct evaluations of assets in the portfolios. The Haley2024 Monetary System eliminates exchange rates by continually adjusting the units of digital currency. |

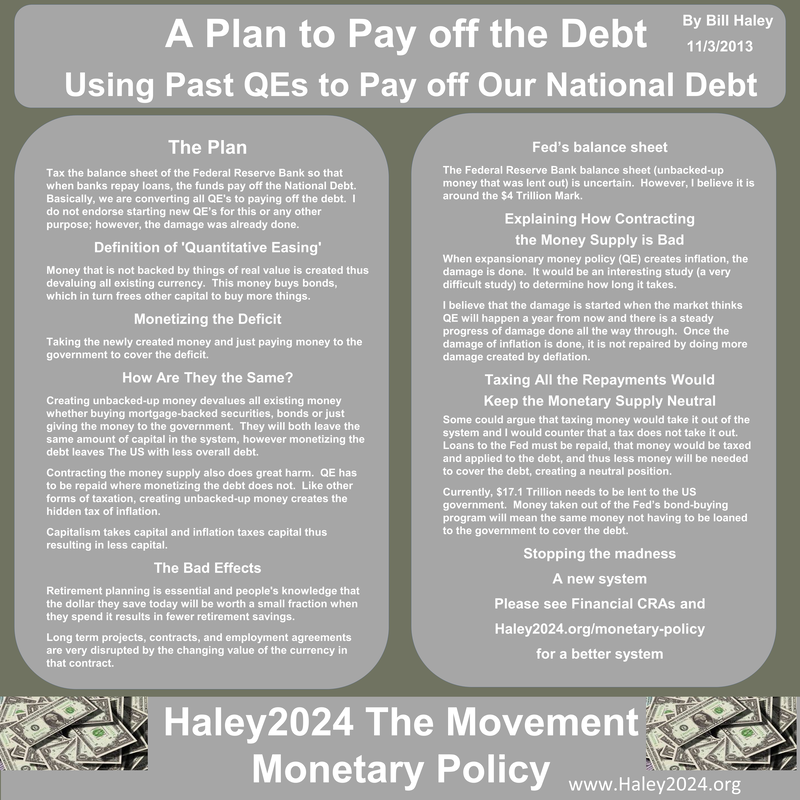

| Haley2024 proposes that all federal debt be turned over to the states in proportion to each state’s percentage of GDP. If a state’s portion of the national debt is $100 billion. That state would need to figure out the wisdom of tax rates and the number of years for a full payoff. The higher the tax rate is per year, the less money the CRA Asset Portfolios will give, thus constraining tax rates from increasing too much. On the other hand, extending the tax burden too far into future years will also see diminishing returns for additional out-years. A 5% tax rate 50 years in the future will not yield much in current currency. |

| If a .01% sales tax can yield $10 million, it will take 10,000 individual .01% contracts to achieve the $100 billion. That would equate to a 100% sales tax in the first year; however, as the tax rates increase, they would get less money per contract and not achieve the $100 billion. They could spread the tax burden over 20 years at 5% per year, but the out years have diminishing returns; thus, not achieving the necessary $100 billion. |

| It is difficult to do the math because so many factors come into play, and millions of two-sided agreements need to be made. The result might be a 10% tax for 30 years. Much of the government’s current debt is also owed in out years such as Social Security, thus discounting the amount of that debt as well. There would emerge wisdom to some people to forgo government bonds in exchange for tax exemptions; however, that would only work on some easily exemptible taxes. |