The Charity System

|

The vast amount of Americans' volunteer giving goes towards private charities rather than government welfare. These choices are because people understand charities are more effective in relieving hardship. While attempting to help, government welfare has done much harm to those that they are attempting to help. The greatest harm stems from government welfare influencing mothers to not marry or live with the father of their children.

|

|

|

The benefits of those living in the free market are well documented and clearly seen. The structure of the free market encourages people to serve others so that they may be served as well. The competitive market both entices people to work and gives value to products. Those on various types of welfare are often entrapped in poverty because of how government welfare is structured. Harm is not the motivation of government politicians; harm is still the result.

|

|

For over fifty years, the government has held the responsibility of alleviating poverty. The results, however, do not reflect the potential held by these resources. The solution is to cut government out and allow citizens to use these resources to fund charities who have a much more effective system. The structure in the plan below will enhance the effectiveness.

|

|

|

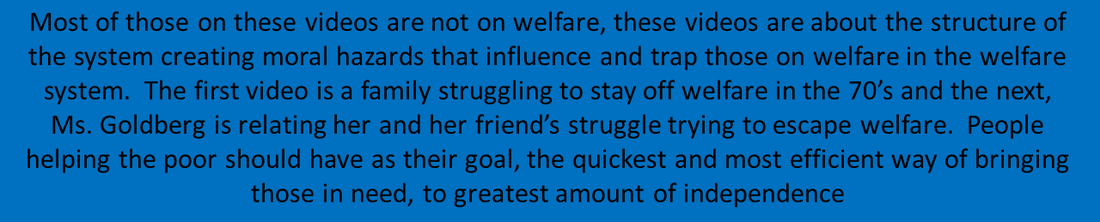

In order for the government to fund welfare, money needs to be taxed away from the private sector, creating three harms to the poor. First, the money taken in the form of higher tax rates creates a disincentive to create businesses and jobs in the first instance (Laffer Curve). Second, people will not have the money that is taxed to help the poor themselves or through charity. Third, many feel if the government is taking their money and helping the poor, that is fulfilling their duty to help. The last two demonstrates the effect of government crowding out the private sector

|

|

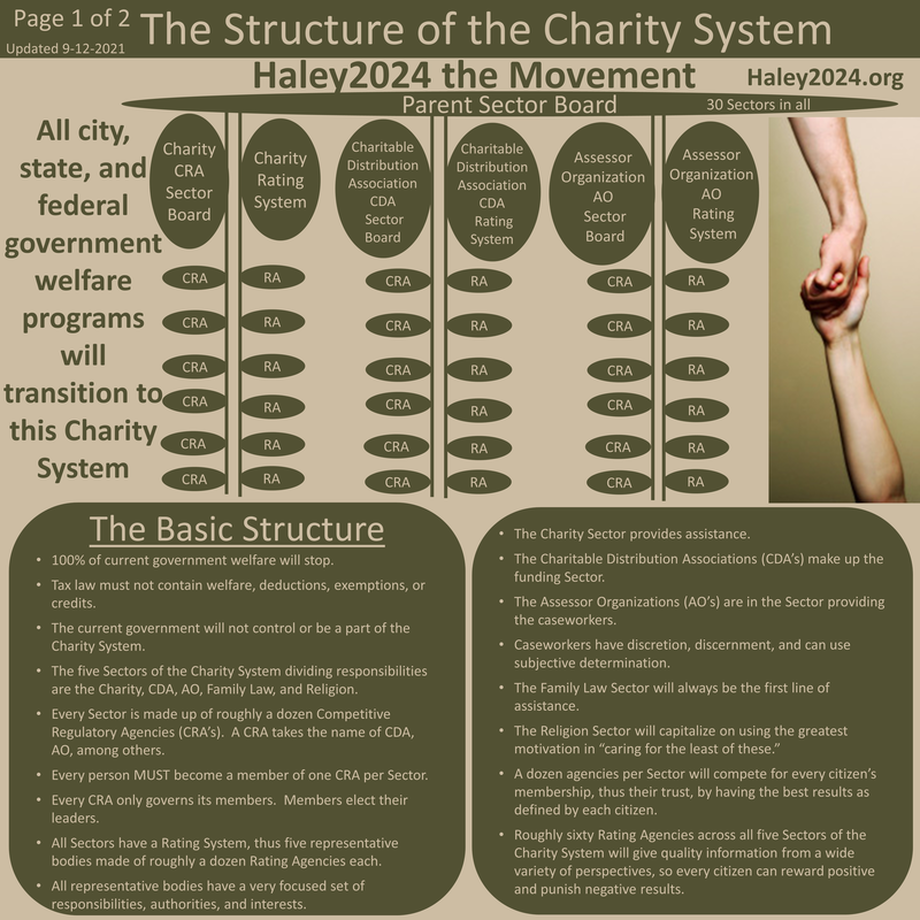

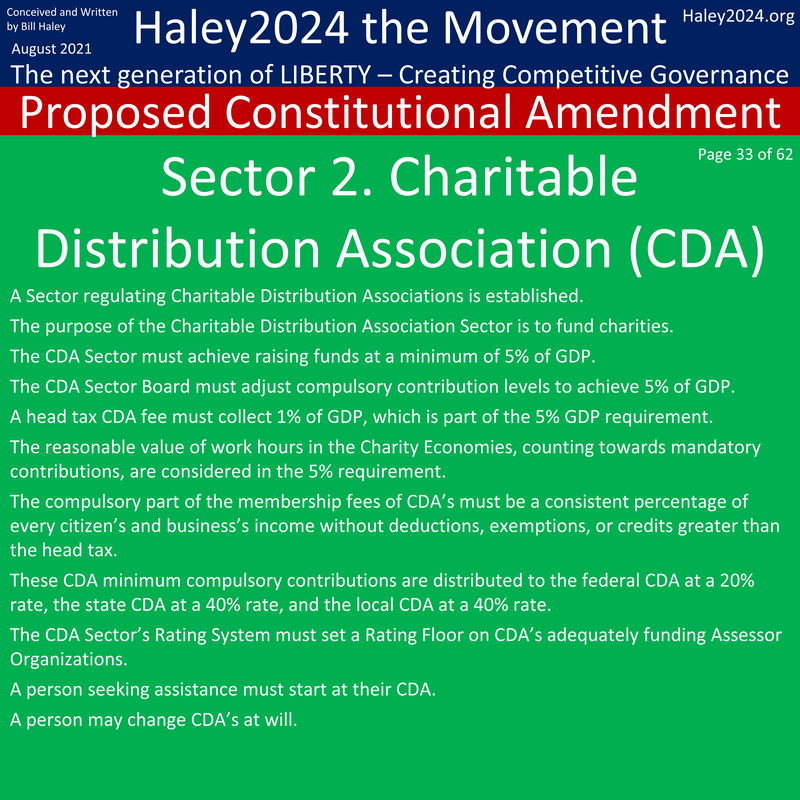

Once the government sets up the structure, they are out of charity altogether. The Parent Sector Board could make some minor adjustments with super majorities if necessary and will oversee the entire system. The system will have sufficient judicial authority with two levels of appellate courts. This system has significant representative control.

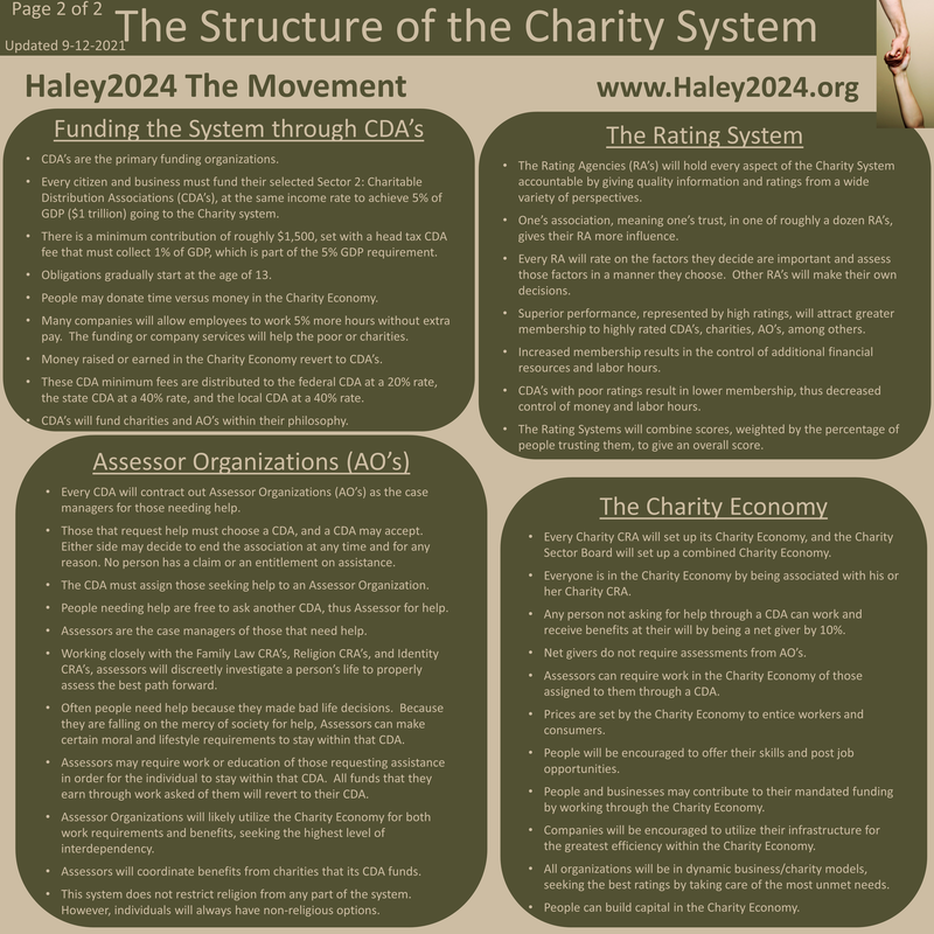

The system encourages significant experimentation and high-quality evaluations of new charity models. Bad results could be punished quickly by people switching which CDA receives their required donations. People down on their luck could be put to work quickly through the charity economy that gives the dignity of earning the benefits they receive. When a person feels that they need help from a charity, they go to their chosen CDA, and their CDA assigns them to an AO. The AO will assess and makes a plan to help. |

Checks and Balances.

|

This plan has four strong strands of checks and balances. This plan has significant representation from the people in that everyone picks which CRA, AO, CDA, and Rating Agency he or she chooses to associate. Rating agencies that every citizen trusts will evaluate and rate everything they deem important. CDA's will only have money from those that choose them. The assessor will have to show good results or be replaced with other assessors. Charities will have to be effective and efficient when competing for funds. Experiments that succeed will replace others that did not. The whole system is designed to quickly weed out bad ideas and utilize funds and labor hours to the best effect. The system is set up to have as many people working as much as possible to meet their own needs and to gain the pride of earning most of their living.

|

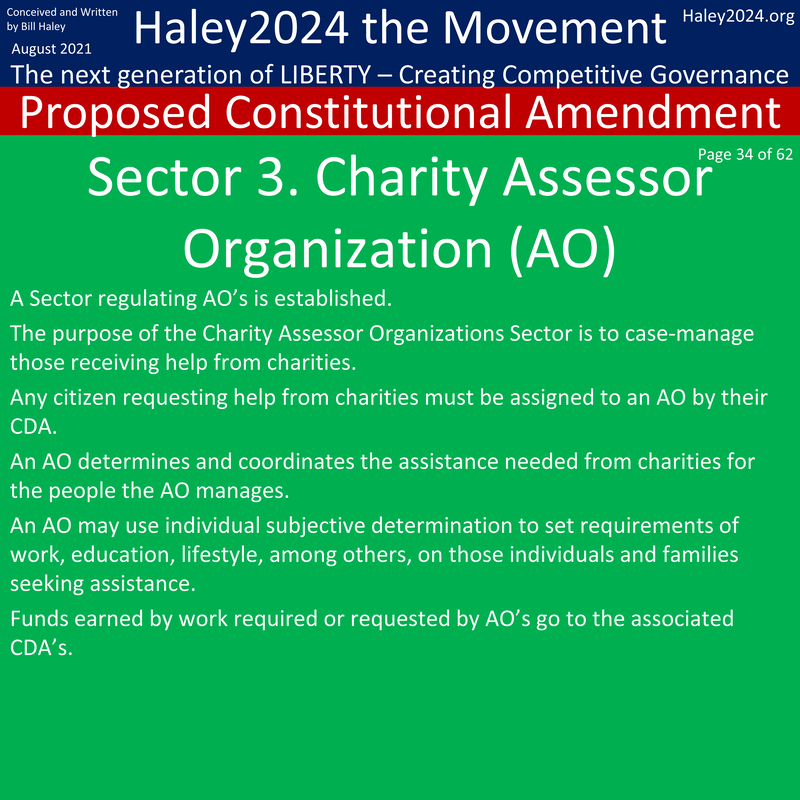

Assessor's Organizations-AO's

Is my ‘Help’ ‘Helping'?

Is my ‘Help’ ‘Helping'?

|

Many people will look very hard at which CDA they will volunteer with or fund. A large part of the evaluation is the structure, philosophy, values, ratings, and results of Assessor Organizations (AO’s) that CDA uses, which could be called case managers. These AO’s would vary widely, each appealing to different populations of people with unmet needs.

An AO’s job is to help develop a plan for those in need. They will both direct benefits and require work, education and life choices within their philosophy. AO's will work closely with Charity CRA's Charity Economy. |

|

An AO’s job is to determine that people are not ‘gaming the system, nor enabling dependency. An AO will case manage, meaning finding the best path to independence or at least the greatest level of independence. An AO could and most likely will require those that need help, help others. Please look at the Charity Economy to see the likely possibilities. People seeking help will choose a CDA. CDA's will assign those seeking help to an Assessor Organizations. Assessors have the authority to mandate work, education and lifestyle decisions from those seeking help. If those seeking help do not like the instructions, they can seek another CDA, thus AO.

|

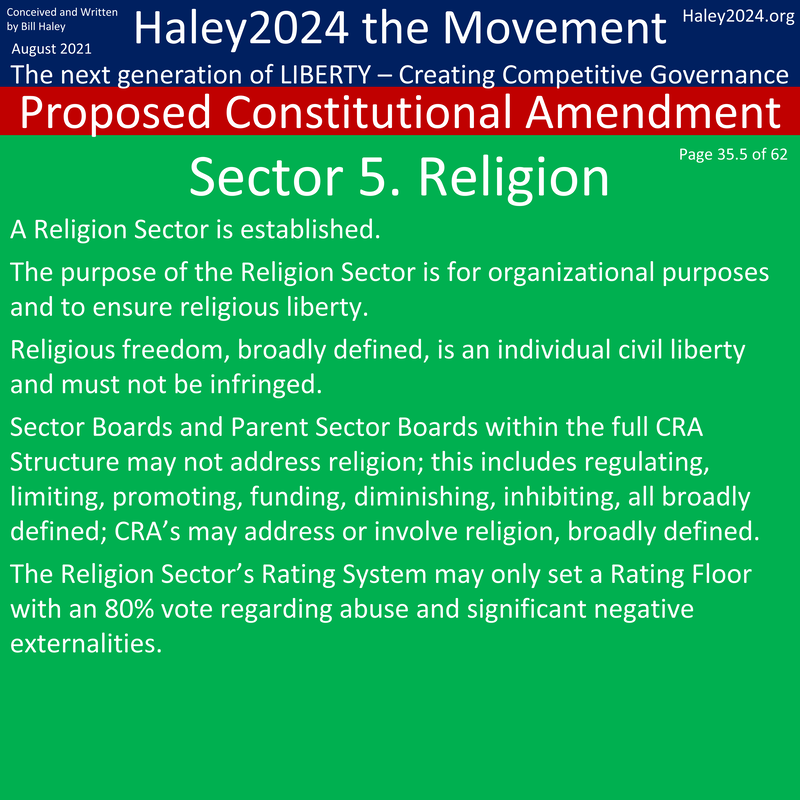

God - The Church - Religion

|

Some people do not want religion to be part of helping the poor and others think it is crucial. Both can have their request. A secularist can donate to a CDA that shares their Godless philosophy, associate with an AO that shuns religion, trust a nonreligious rating agency, volunteer in a secular charity economy, and vote on nonspiritual leadership to their charity CRA. With roughly a dozen organizations under each of the five sector boards, there will be plenty of options for everyone.

No one should be able to force another to be secular nor religious. How much religious activity in the charity system is up to billions of decisions of millions of people. However, we can be sure that everyone will be represented by five organizations that share his or her values and philosophy. The system is designed to move away from bad results as determined by EVERYBODY quickly. |

Charitable Hours as Currency

|

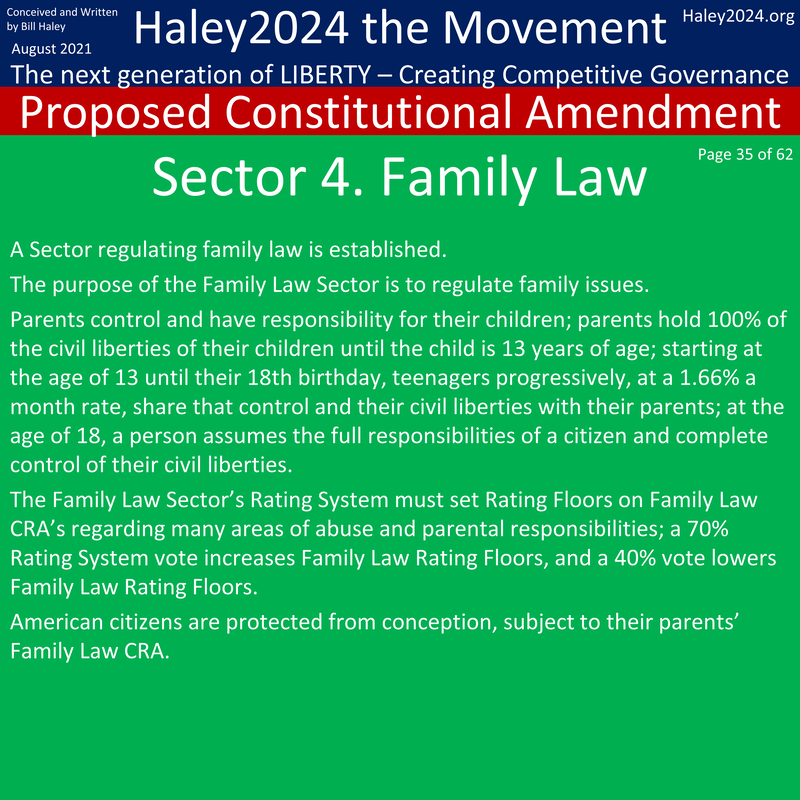

Everyone, age 13 and above, is mandated to donate 5% of their income with a minimum of $1,500 a year. Many people might have difficulty with the $1,500 a year for many reasons so for the first $1,500 can be given in labor hours in their charity economy. Every charity CRA will have different approaches in their charity economy. However, the idea is to train teens and help the poor. The blog, charity-economy-job-opportunities, explores how dynamic this economy can become. $1,500 a year ends up being roughly three hours a week in the charity economy. However, it is not limited to only the first $1,500 a year. The blog, charity-volunteer-hours, goes further in explaining this idea.

|

|

CRA's will be charged with disaster relief in their respective industries. Whenever there is a disaster, it does not make sense to have the government come in and control jobs and labor hours it does not regularly have control over. The Competitive Regulatory Agency's structure will foster companies that feed, house and provide medical care to do so quickly and accurately. Mandatory volunteer hours and charitable volunteer hours will be very useful in these times. Government-paid police and first-responders will also be involved. This system creates the most benefit with the greatest efficiency, with everyone competing to do better and a rating system that informs and encourages better policies.

|

|

Advantages of the

New System Charities will be able to look into a situation and know when aid is needed. They will also be able to customize assistance plans, so families have the incentive to stay together. In the current government system, a working family member can disqualify an entire family from welfare. This result in government welfare is a disincentive for family members to get jobs. Charities and AO's can check up with families to ensure they are seeking employment and make certain earning a paycheck will not make them worse off. Until they get a job, they can work in the Charity Economy.

|

|

The Future of the System

Is this a tax or a donation? It is both. A certain amount is required by law, but there is still a lot of flexibility in where the money is donated. In the future, the mandate may be able to be reduced without stopping the flow of contributions. In the meantime, a mandate is necessary to set up the new structure and ensure the public the money will be available in charities so they would be willing to stop government welfare.

|

|

Transitions

The first step is to remove the federal government from being involved in helping the poor. Because of their deep involvement, it is wise for them to set up an eight-year schedule where the federal government will stop taxing and funding welfare programs. Every year 15% of the programs should be eliminated and the tax reduced to match. The state governments need to set up this structure and match the federal government by stopping funding and stopping taxing for welfare within the same eight-year schedule. Please see an expanded definition of the transition at setting-up-the-structure.

The Transition from Welfare |

|

Each CDA will develop their own philosophy to help the poor before they advertise their CDA to the public. Through a secure method, each person will decide which CDA in which to contribute. Everyone will be mandated to associate with an Identification CRA's, and their ID company will need to know their CDA association. This transition will be a two-year process before the first program switches. However, the system is being developed. Every welfare program has a current cost. When the programs switch, the cost will equal a certain percentage of government tax income. The taxes will go down (percentage rate drop) equivalent to the cost of the program. That same percentage would be required to be donated to the CDA of every citizen’s choice.

|

|

As each program switches, the tax burden lessens, and contribution levels increase. The mandate is limited to 5%. Individuals will be encouraged to continue raising their donations to CDA's. Work and extra charitable hours requirements along with empowering people to be productive would reduce the amount required to help those in need.

|

|

|

|