The Transition from Social Security and Medicare

The main stated reason for Social Security and Medicare is that some people do not properly plan for their retirement; thus, when they are elderly and lose their earning potential, they become a burden on society. Because a few did not plan well, the government overreached, resulting in a disastrous plan for everyone. While everyone is harmed by this current system, the poor have the greatest disadvantage. Haley2024's plan greatly improves everyone's retirement planning and results.

|

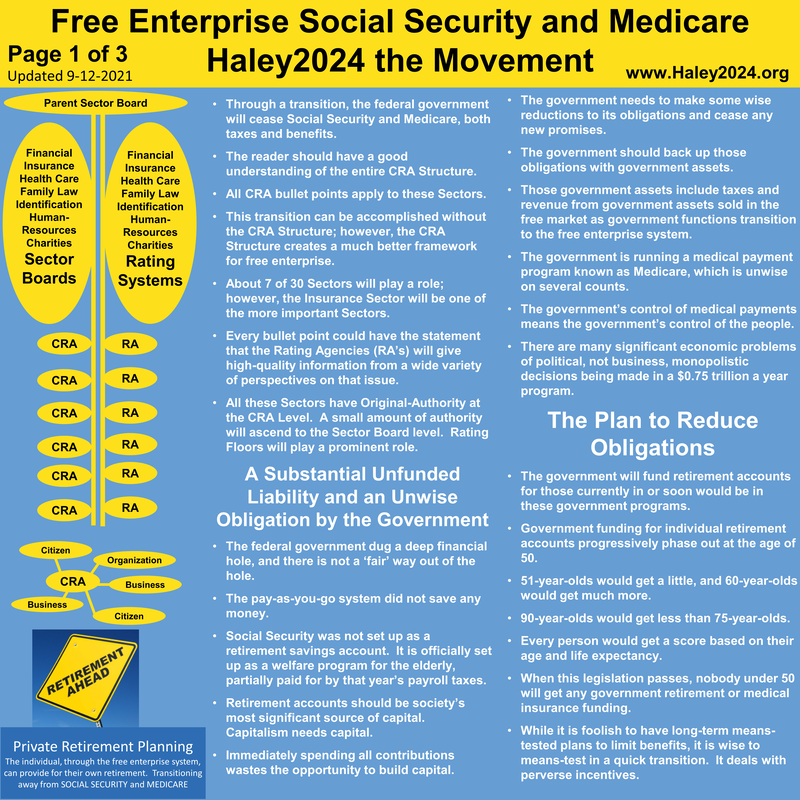

Why Current Social Security Does Not Work

|

|

1. Your money is not held in a special account for when you retire.All contributions to Social Security and Medicare are added to a general fund. The elderly welfare program comes out of this general fund, but many other agendas are able to tap into the general fund, and there is no guarantee the money that was intended for your retirement pension will actually be available when needed.

|

2. Individuals do not have rights to a Social Security account.Every year, Congress appropriates funds for the next year’s benefits. If they choose not to do this, then they are not obligated to pay any funds out. The Supreme Court has ruled that individuals do not own or have any legal right to any benefit. |

3. The benefit for future retirees depends on future laborers (similar to a Ponzi scheme).Demographic changes can create major issues. A one year increase in the average lifespan raises social security spending by roughly ten percent. Government/ politicians should never be in a position to have financial incentives to lower the average lifespan. |

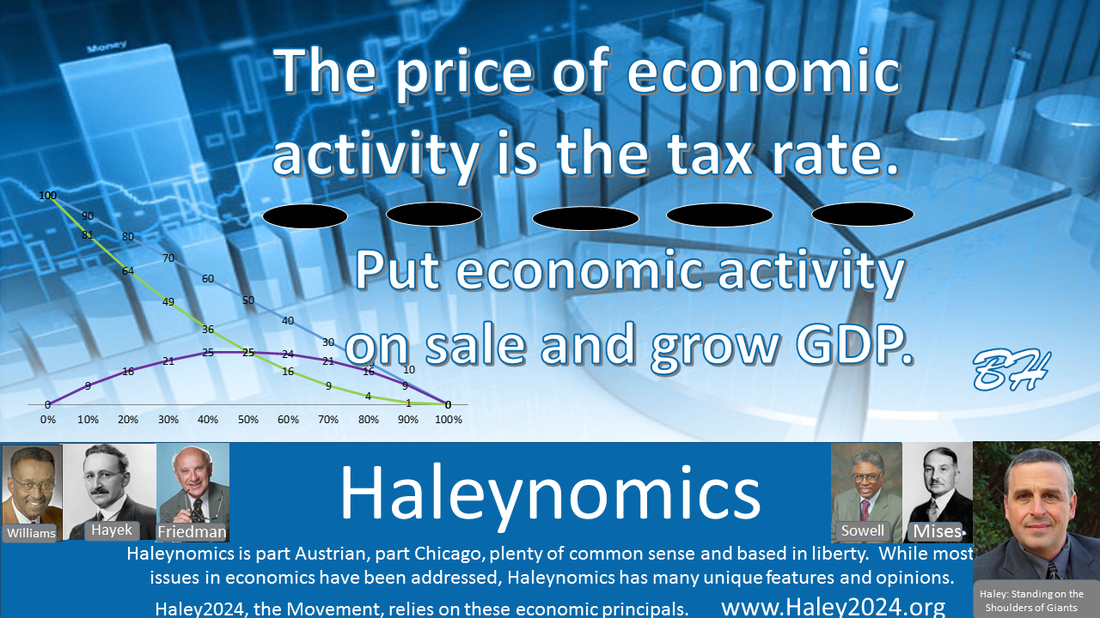

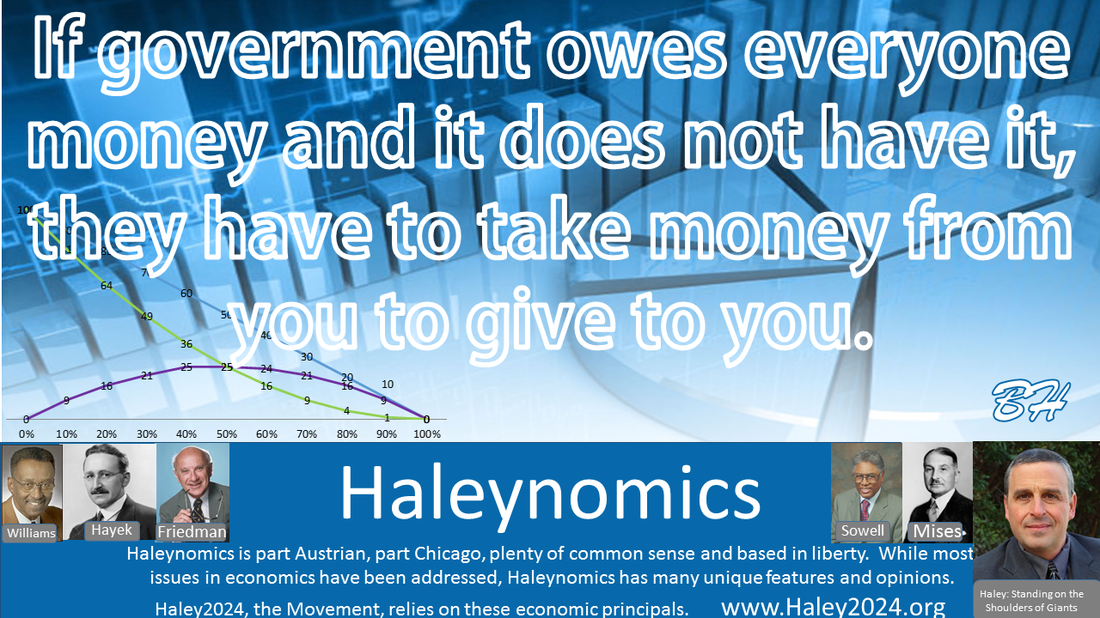

4. Immediately spending all contributions wastes the opportunity to build capital.Capitalism runs on capital, which is anything of worth. Retirement savings (stored up by individuals) is an excellent source of capital. The investment of saved funds helps businesses start, expand and become more efficient. It is misleading that the government “owes” citizens money. They must first take that money (through taxes) from them in order to give it back to them.

More Problems With the Current System |

A New Plan

|

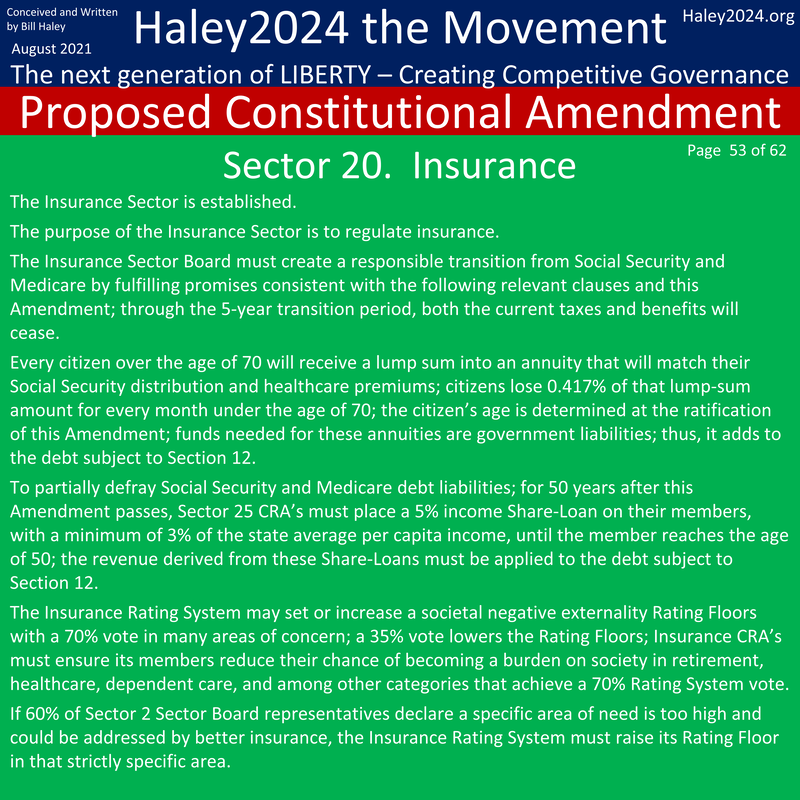

The Haley2024 plan does not dictate a certain method of retirement planning. There are many ways to do it, and no method should be excluded. However, people should not become a burden on society. Therefore, the plan will require everyone to have a retirement account that must meet a certain minimum rating. Ratings are very dynamic and will include all relevant concerns of someone becoming a burden on society. This planning will fall under the Insurance Sector Board

|

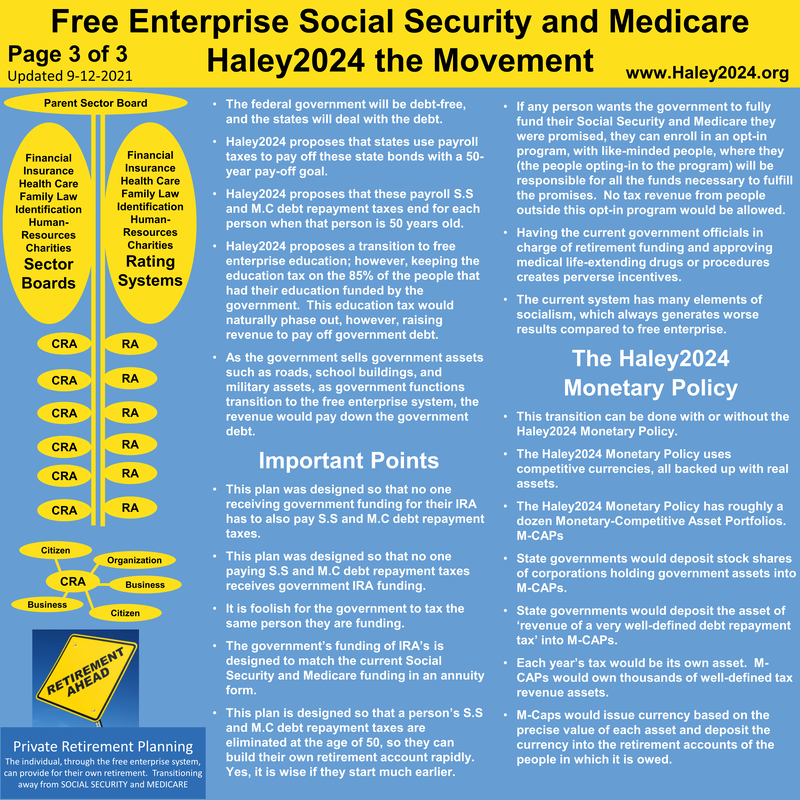

How to Get There: The Transition Stage

|

The Federal Government is not constitutionally authorized and woefully inept in running a retirement program; however, has made very large financial commitments. The federal government will turn over to the states, data on all money collected from citizens of their state. Every state will take out bonds payable to every person at appropriate years, to fulfill the federal government commitments. The federal government will stop the tax for these programs, and the states will have to have a temporary tax to pay off the commitments in the form of bonds. After that, everyone would have their own retirement plan.

|

|

Every state will determine how much they will go into debt in the form of bonds for each person's retirement plan. A big economic debate will occur in every state over the notion and wisdom of having to tax a citizen to fund their own retirement bonds. If the government owes you money, they have to tax you, to give you the money. Wisdom would emerge that the funding would taper off at ever younger ages and higher incomes.

Realistically, the young and wealthy will be financially better off forgoing some or all social security benefit promises. Higher debt requires high tax rates, which decreases growth and average household income. If your demographic group pays disproportionally higher taxes, your taxes will fund your own account. The new plan is to lose your promises, lose the tax and begin your own retirement plan. |

|

Many people within an age and income range will be able to elect to give up their promised benefits and be exempt from the new tax. All fifty states would try out different plans.

Detailed Explanation of the Transition from Social Security and Medicare |