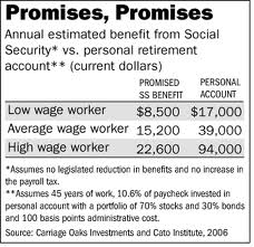

| The primary stated reason for Social Security and Medicare is that some people did not adequately plan for their retirement, so when they become elderly and lose their earning potential, they became a burden on society. Because a few did not save, government over-reached and made a disastrous plan for everyone. |

Examples of Some Retirement Plans

There would likely be a plan that is similar to the current Social Security plan. Retirement plans would be less expensive if all remaining funds are kept by the plan at death. The plans that allow the funds to be willed to family members would be more expensive. In free enterprise, there are annuities that have all sorts of features. |

| Some plans will take into effect life expectancy, medical condition, among other factors. Some plans will be firm and not easily changed, while others will be very dynamic and easily adjusted to reflect circumstances. Many plans would work closely with company pensions and others not. Just like many retirement plans currently outside of government, there is choice. |

| Non-monetary retirement planning will also be available under a dynamic rating system. If you have family that is close and willing to legally accept responsibility for you, that could be your retirement plan. There might need to be a separate insurance plan for the small percentage of families that cannot fulfill their obligations. Many models would be tried and evaluated. |

| The charity economy could have its own ‘currency’ where you give hours while you are productive and build up ‘currency’ to be used when you are elderly. This is unlikely to be one hundred percent, however a part of your retirement plan. Your hours when you are 40 years old helping at the nursing home, would translate to others assisting you when you have to live there. |