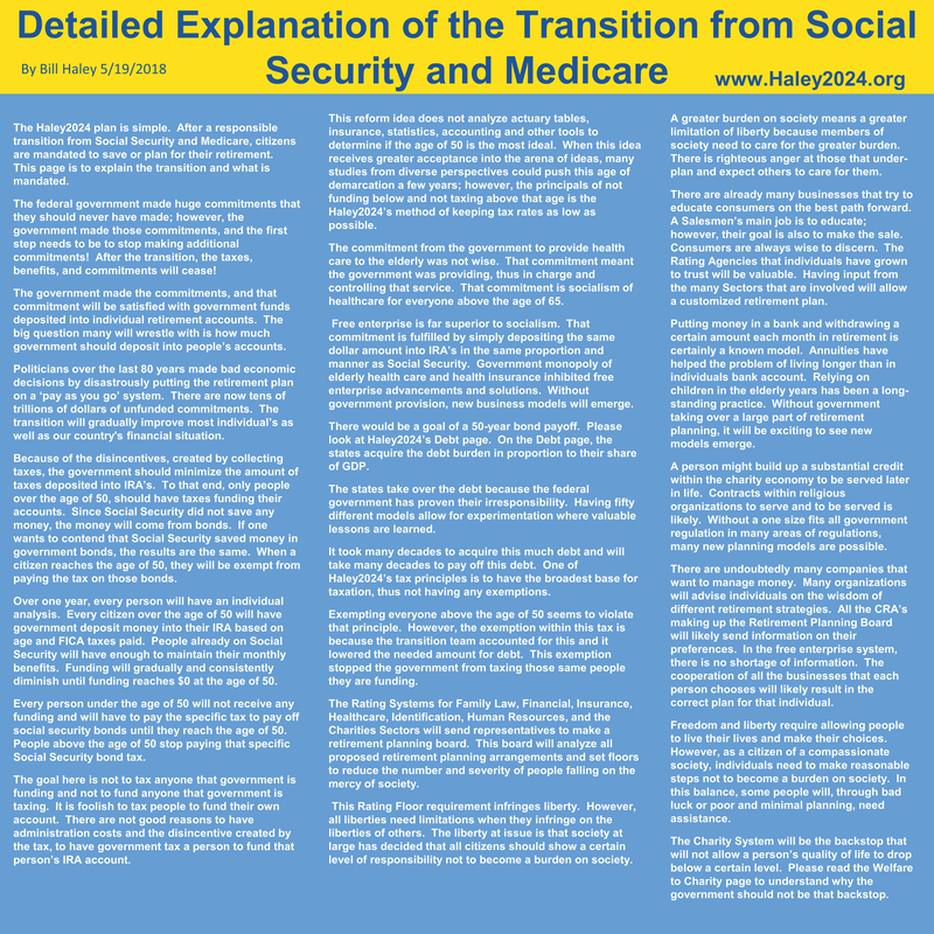

| The federal government made huge commitments that they should never have made; however, the government made those commitments, and the first step needs to be to stop making additional commitments! After the transition, the taxes, benefits, and commitments will cease! The government made the commitments, and that commitment will be satisfied with government funds deposited into individual retirement accounts. The big question many will wrestle with is how much government should deposit into people’s accounts. |

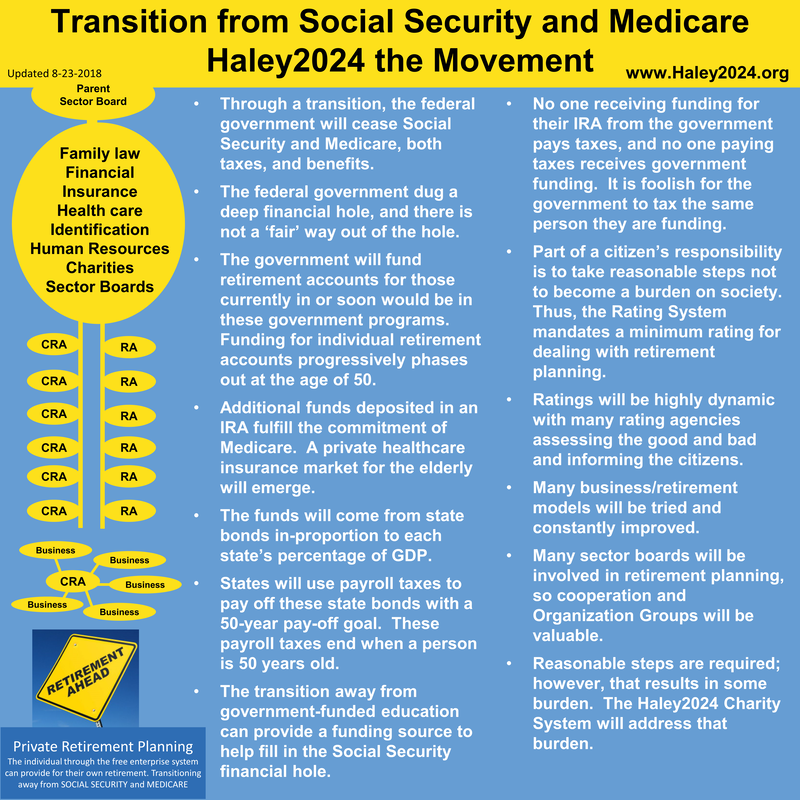

| Politicians over the last 80 years made bad economic decisions by disastrously putting the retirement plan on a ‘pay as you go’ system. There are now tens of trillions of dollars of unfunded commitments. The transition will gradually improve most individual’s as well as our country's financial situation. Because of the disincentives, created by collecting taxes, the government should minimize the amount of taxes deposited into IRA’s. To that end, only people over the age of 50, should have taxes funding their accounts. Since Social Security did not save any money, the money will come from bonds. If one wants to contend that Social Security saved money in government bonds, the results are the same. When a citizen reaches the age of 50, they will be exempt from paying the tax on those bonds. |

| Over one year, every person will have an individual analysis. Every citizen over the age of 50 will have government deposit money into their IRA based on age and FICA taxes paid. People already on Social Security will have enough to maintain their monthly benefits. Funding will gradually and consistently diminish until funding reaches $0 at the age of 50. Every person under the age of 50 will not receive any funding and will have to pay the specific tax to pay off social security bonds until they reach the age of 50. People above the age of 50 stop paying that specific Social Security bond tax. |

| The goal here is not to tax anyone that government is funding and not to fund anyone that government is taxing. It is foolish to tax people to fund their own account. There are not good reasons to have administration costs and the disincentive created by the tax, to have government tax a person to fund that person’s IRA account. This reform idea does not analyze actuary tables, insurance, statistics, accounting and other tools to determine if the age of 50 is the most ideal. When this idea receives greater acceptance into the arena of ideas, many studies from diverse perspectives could push this age of demarcation a few years; however, the principals of not funding below and not taxing above that age is the Haley2024’s method of keeping tax rates as low as possible. |

| The commitment from the government to provide health care to the elderly was not wise. That commitment meant the government was providing, thus in charge and controlling that service. That commitment is socialism of healthcare for everyone above the age of 65. Free enterprise is far superior to socialism. That commitment is fulfilled by simply depositing the same dollar amount into IRA’s in the same proportion and manner as Social Security. Government monopoly of elderly health care and health insurance inhibited free enterprise advancements and solutions. Without government provision, new business models will emerge. |

| There would be a goal of a 50-year bond payoff. Please look at Haley2024’s Debt page. On the Debt page, the states acquire the debt burden in proportion to their share of GDP. On the Debt page, the states acquire the debt burden in proportion to their share of GDP. The states take over the debt because the federal government has proven their irresponsibility. Having fifty different models allow for experimentation where valuable lessons are learned. |

| It took many decades to acquire this much debt and will take many decades to pay off this debt. One of Haley2024’s tax principles is to have the broadest base for taxation, thus not having any exemptions. Exempting everyone above the age of 50 seems to violate that principle. However, the exemption within this tax is because the transition team accounted for this and it lowered the needed amount for debt. This exemption stopped the government from taxing those same people they are funding. |

| The Rating Systems for Family Law, Financial, Insurance, Healthcare, Identification, Human Resources, and the Charities Sectors will send representatives to make a retirement planning board. This board will analyze all proposed retirement planning arrangements and set floors to reduce the number and severity of people falling on the mercy of society. This Rating Floor requirement infringes liberty. However, all liberties need limitations when they infringe on the liberties of others. The liberty at issue is that society at large has decided that all citizens should show a certain level of responsibility not to become a burden on society. |

| A greater burden on society means a greater limitation of liberty because members of society need to care for the greater burden. There is righteous anger at those that under-plan and expect others to care for them. There are already many businesses that try to educate consumers on the best path forward. A Salesmen’s main job is to educate; however, their goal is also to make the sale. Consumers are always wise to discern. The Rating Agencies that individuals have grown to trust will be valuable. Having input from the many Sectors that are involved will allow a customized retirement plan. |

| Putting money in a bank and withdrawing a certain amount each month in retirement is certainly a known model. Annuities have helped the problem of living longer than in individuals bank account. Relying on children in the elderly years has been a long-standing practice. Without government taking over a large part of retirement planning, it will be exciting to see new models emerge. A person might build up a substantial credit within the charity economy to be served later in life. Contracts within religious organizations to serve and to be served is likely. Without a one size fits all government regulation in many areas of regulations, many new planning models are possible. |

| There are undoubtedly many companies that want to manage money. Many organizations will advise individuals on the wisdom of different retirement strategies. All the CRA’s making up the Retirement Planning Board will likely send information on their preferences. In the free enterprise system, there is no shortage of information. The cooperation of all the businesses that each person chooses will likely result in the correct plan for that individual. |

| Freedom and liberty require allowing people to live their lives and make their choices. However, as a citizen of a compassionate society, individuals need to make reasonable steps not to become a burden on society. In this balance, some people will, through bad luck or poor and minimal planning, need assistance. The Charity System will be the backstop that will not allow a person’s quality of life to drop below a certain level. Please read the Welfare to Charity page to understand why the government should not be that backstop. |