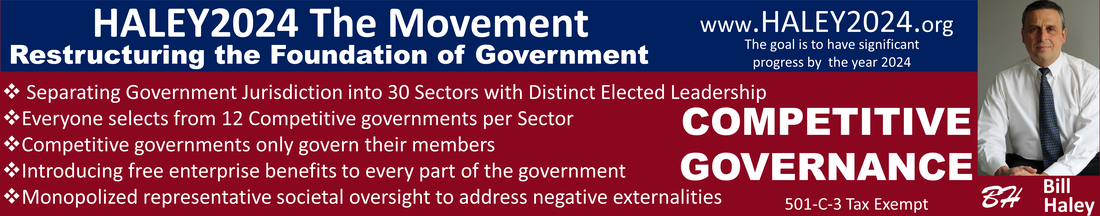

The Education Reform

Competitive Governance within every geographic jurisdiction

|

By Bill Haley

Created 2013 Updated yearly, last update 4-30-2022 It is essential to fully understand the complete structure of education and the entire CRA Structure. This page tries to explain the reasoning, whereas the structure page explains more of the mechanics of the reforms. This abbreviated version calling for Competitive School Boards does not entirely separate each school board from the general government budget; however, resolves 90% of the issues. The full version creates a complete separation. |

|

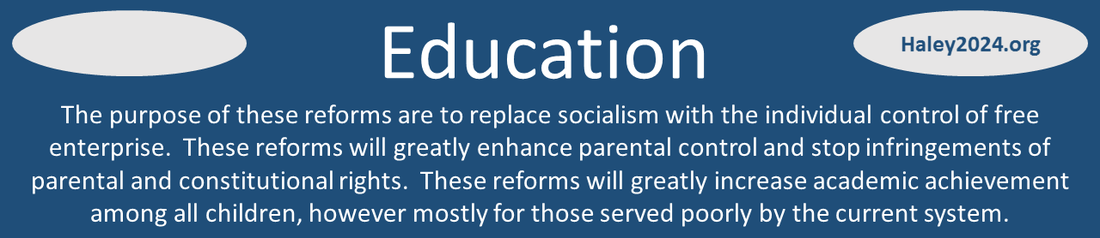

The purpose of this reform is to restore parental rights and religious liberties.

It is fundamentally wrong for politicians to tax you to allow them to offer to fund your child’s education only if you give up your parental rights and religious liberties by enrolling in public schools. This overall reform consists of several new ideas. Many aspects could be tried individually. Every facet has variations that are worthy of contemplation. The crucial elements are choice, free markets, religious liberty, and parental rights. |

Socialism and ControlThe education sector in America has a high level of socialism. Government spending, administration, subsidies, laws, tax codes, certificates, and regulations create avenues of significant government control. Requirements from the government to legally work in certain professions create monopolistic adverse effects surrounding that profession’s educational requirements. From birth through college, the government’s massive role affects the lives of our infants, toddlers, young children, pre-teens, teens, young adults, and adults.

|

|

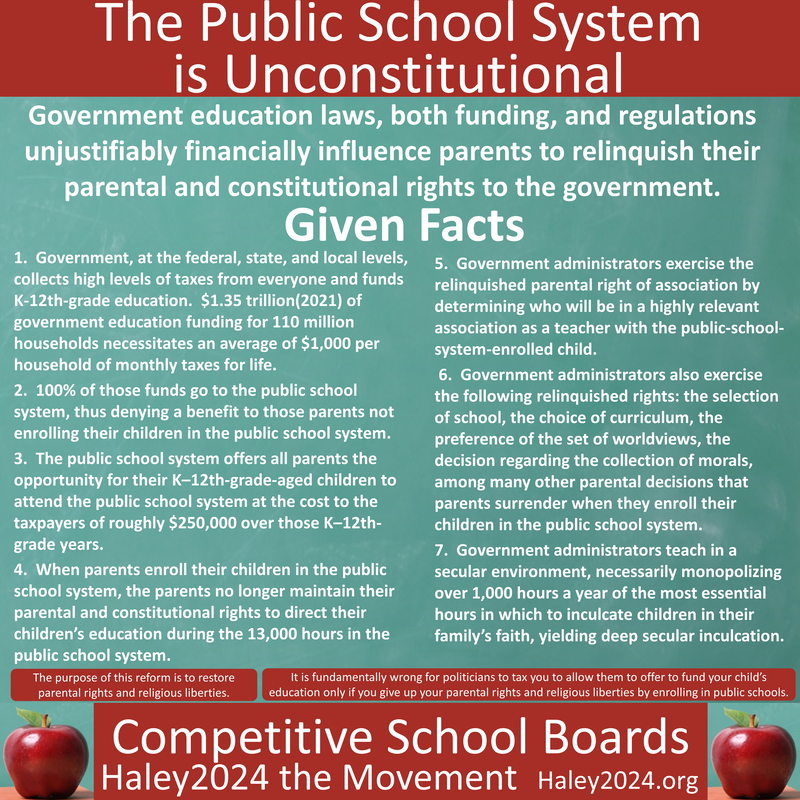

The government’s control dramatically compromises parental, religious, and constitutional rights. It is wrong for the government to fund the education of 85% of the children and not the other 15% while taxing everyone. It is fundamentally wrong for the government to offer funding to educate children only if they are enrolled in the public school system. This funding allows the government bureaucrats to financially force children into the public school system, where the government has disproportionate control. This exclusion is an attack on everyone paying taxes because the government takes those tax dollars to only offer to fund the education of those that they control.

|

Religion Who controls the education of children is highly essential on many levels. The government’s control of education results in the vast majority of education occurring in the shade created by the massive wall of the separation of church and state. God’s light of truth rarely penetrates the massive wall. The religious environment that children are in for 6 hours a day and 180 days a year is very profound. The many teacher/ student associations are foundationally formative in a child’s life throughout education.

|

|

The overall worldview taught during academic education develops philosophical fundamentals. The teachings of items hostile to the parent’s religion and worldview undermine the most important aspects of parenting. The attempt to stay neutral cannot be achieved and is not desired by many that want their schools to favor their collection of beliefs about life. The solution is profoundly NOT for the monopolized government to introduce religion.

|

The Injustice of the Current SystemThere has been a great injustice to families outside of the public education system in that they paid education taxes and did not receive the public benefit of government-funded education. Government officials tax citizens and then use the money to buy parental, religious, and Constitutional rights. Parents currently need to relinquish serious parental, constitutional, and religious liberties and rights to obtain the public benefit of government-funded education.

Parents pay an average of about $1,000 per household per month in lifetime education taxes. Then the government officials offer parents the opportunity to enroll their children in government-paid education at no additional costs. Parents who decline that offer must pay the cost of private education without the exemption of the heavy education taxes. Parents that enroll in government schools must relinquish many parental rights. |

|

|

Many US Supreme Court decisions underscore centuries-old and an obvious understanding that parents have the right to direct their children’s education. It is also very understood and enshrined in the US Constitution that parents control the inculcation of religious views concerning their children. Throughout history, religion has been intertwined with education. It is impossible to educate without teaching a worldview. The simple act of enrolling children in public schools results in turning these parental rights to government officials and bureaucrats such as legislators, school board members, principals, and teachers.

|

|

|

|

Government’s Interest

|

|

There is great worth in every parent’s struggle of attaining education for their children and great value in every person starting at the age of 13 to struggle to attain their own education. Necessities, struggles, and personal/ family responsibilities are the foundation of inventions and new business/education models. Through a family’s Education, Family Law, Financial, Charity, Identity, and other CRA Organizations, needs are fulfilled through the struggle.

|

|

The solution is to remove the state from education. The government should not be the provider of education as a last resort or when all else fails. The Charity System needs to handle hard cases. Every person chooses what organizations (CRA’s in all relevant Sectors) to associate with; therefore, enough citizens will associate with organizations that will cover everyone. Current Government involvement crowds out many free enterprise alternatives.

|

|

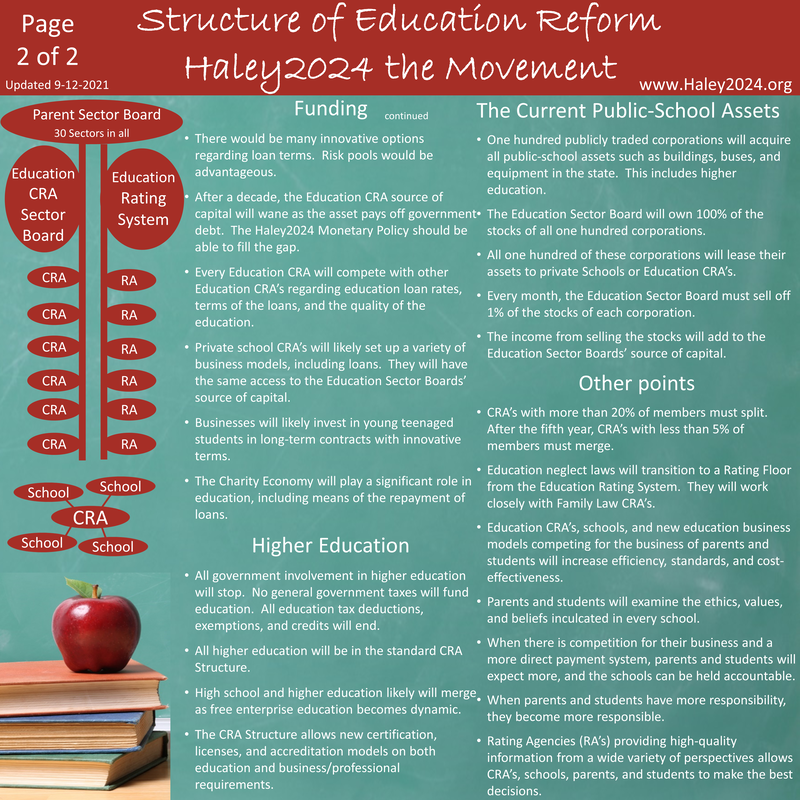

The Haley2024’s education reform creates an Education Sector in the CRA Structure and has a five to 10-year transition. Roughly a dozen Education CRA’s will emerge. Every parent and every person starting at the age of 13 must associate with an Education CRA. The transition calls on the public schools to separate into six CRA’s per state. Six Education CRA’s will exist for parents and teenagers outside of public education.

|

|

Current elected state and local leaders will select the initial public Education CRA leadership. Current private education leaders will select the initial private education CRA leadership. Every parent of children before their teenage years picks the public or private Education CRA they wish. Teenagers start advancing their level of control as their teenage years progress. A family’s chosen Family Law CRA will have a certain level of control over the responsibility levels of parents and teenagers.

|

Funding ChangesThe current education taxes are turned over to the Education Sector Board as a source of capital for individuals, schools, and Education CRA’s to access. Over the five to ten-year transition, every individual, school, and Education CRA will develop their own sources of capital in the free enterprise system. Haley2024’s Monetary System could create new currency for new or increased human capital. Education CRA’s could provide the upfront funding and require lifetime repayment of their members, similar to the current public-school system. Many new funding models would emerge.

|

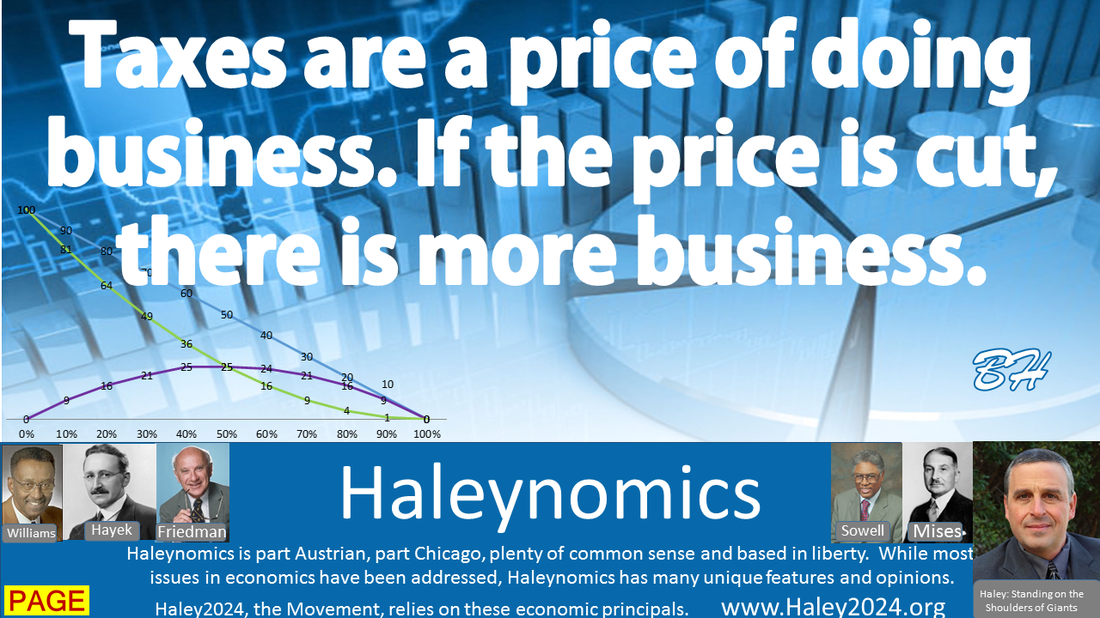

A New Paradigm of Viewing Current TaxesEducation taxes can be correctly looked at as a lifetime repayment of government funding for a citizen’s education. One-half of that funding should be viewed as funding a parent’s responsibility for a child’s education until the age of thirteen. The other half should be viewed as funding a teenager’s responsibility for their secondary and post-high school education. The citizens not receiving the government education benefits are exempt from the education taxes because the government did not fund their education. Thus no repayment is warranted.

|

|

This reform alone is a superior school choice plan. Most school choice plans involve government funding of those outside the system, such as vouchers or tax credits, which still involve a certain level of control. The tax discouragement of collecting an average of $12,000 per household every year for life is profound. The education tax exemption for those outside of government funding eliminates the tax discouragement. This allows citizens not paying the tax to fund their own family’s education.

|

Education Taxes Offsetting Social Security DebtA case is made that education taxes repay government spending, and social security taxes prepay government spending. Socialism in education and retirement planning has done great harm in both segments of the economy. If both government programs transition to free enterprise, the debt in the social security system can be partly fulfilled by the repayment of education taxes.

|

|

The education taxes will naturally end as those taxes only apply to those that received the benefit of government-funded education. The money collected should fund the underfunded government-run pension system called Social Security. The roughly 10%-15% of citizens not accepting education funding will be exempt from the education taxes. Taxes are Prorated based on partial acceptance of government education funding.

Haley2024 Debt Page |

Exemptible TaxesThe education taxes would need to adjust to an easily exemptible form. Certain taxes are easily exempted, and others are more difficult to exempt. City and state governments would have highly segregated lifetime education taxes that are only applied to those in the current public education system. The tax rate would be different for everyone based on how many years they attained education funding or were provided services from the government. A lifetime share loan, a percentage of income, or real estate, would likely work best.

|

|

When parents and students have choices and a more direct payment system for their education, they have a greater sense of responsibility and a greater ability to expect more for their money. Education providers must compete for the business of serving parents and students with other providers. The monopolistic nature of the public school system has negative monopolistic externalities.

|

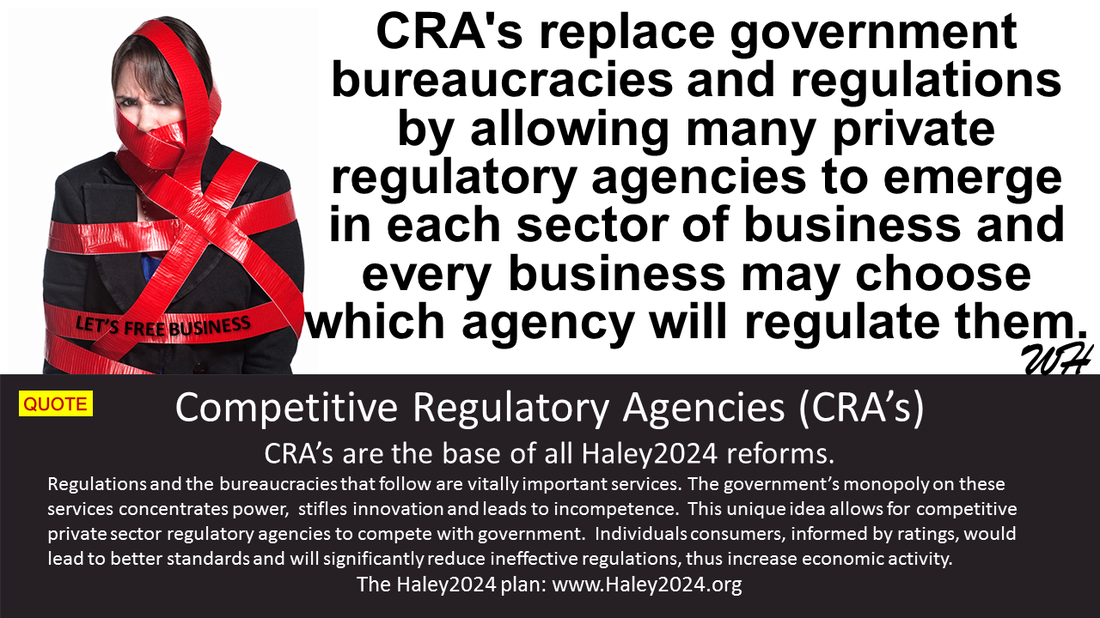

Removing Government Regulations of Private SchoolsThe move to Competitive Regulatory Agencies (CRA’s) will remove the government’s monopoly control of regulating private schools. CRA’s also control accreditations, certifications, and licenses required to work in specific jobs. Please read the CRA reforms. The move from government control of welfare to a charity model would open up many options for those with lower financial abilities.

|

Each Public-School Education CRA Goes Its Own WayMembers vote on their education CRA’s leadership. Each CRA will start going in its own direction. Parents and teenage students choose which school to associate with. Each school must belong to a CRA. After the five to ten-year transition, public and private Education CRA’s just become Education Competitive Regulatory Agencies.

|

|

The business models will be dynamic. One could envision two or even ten schools in one building. One could predict several schools sharing teachers. One could see evening classes to better utilize classroom space. One could foresee superior online learning where classmates are spread over the state. One could imagine the Charity Economy supplying labor, mentors, teachers, and others to the schools. One could envision Jewish schools intermixing with Catholic schools in certain subjects and other subjects learning separately. The business models are genuinely abundant when the government does not interfere.

|

The Education Age DivideTeenagers gradually increase their level of responsibilities and liberties. Before a child turns 13 years old, all agreements and contracts for educational funding must be made by the parents contracting with the parent’s future income or educational tax. After turning 13, the teenager must be included and agree on any contracts of future income by way of the lifetime educational tax as the contract shifts to the teenager. Teenagers will demand to be taught when they comprehend that they are paying for the education.

|

The Public Education AssetsEvery state has a considerable amount of public education buildings, equipment, and other assets. Those assets will still be needed. Each school or Education CRA will need to buy those assets. During the transition, many new publicly traded corporations will be responsible for leasing and selling these assets. The money raised by selling those assets go into the source of capital controlled by the Education Sector Board. Over time that money funds the debt created by Social Security.

|

|

|

|