The Human Resources and Sales Sector

|

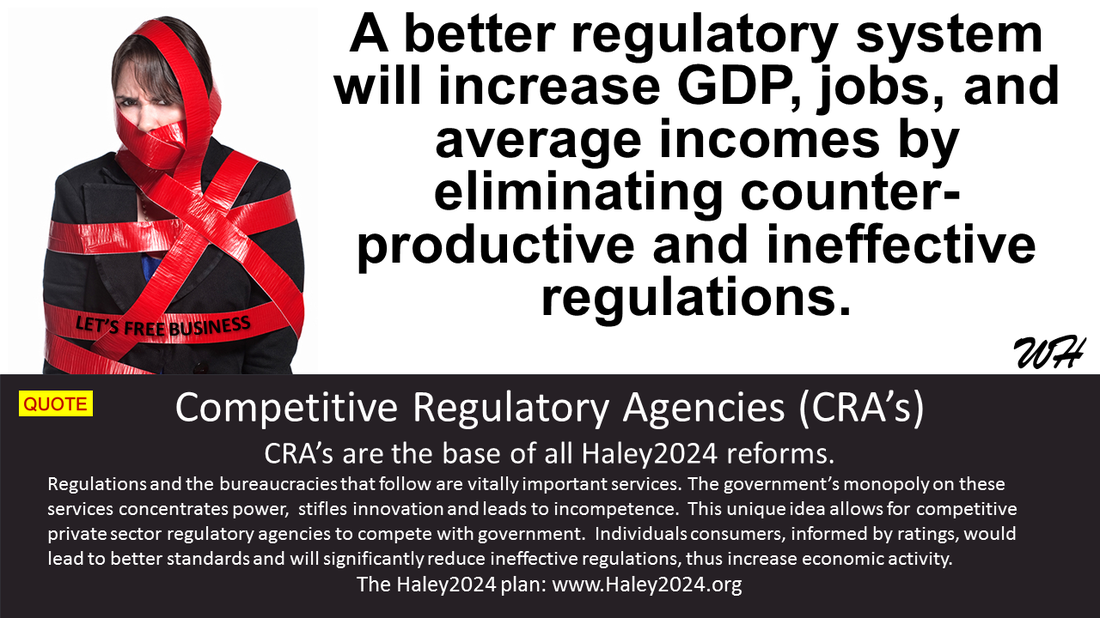

All human resources regulations (labor Law) will be taken away from the government and given to the Competitive Regulatory Agencies (CRA's). Please see the structure of CRA's and CRA's Judicial Authority. Labor law ratings will play a role in consumers’ decision to purchase goods and services, bringing higher standards to labor laws.

|

|

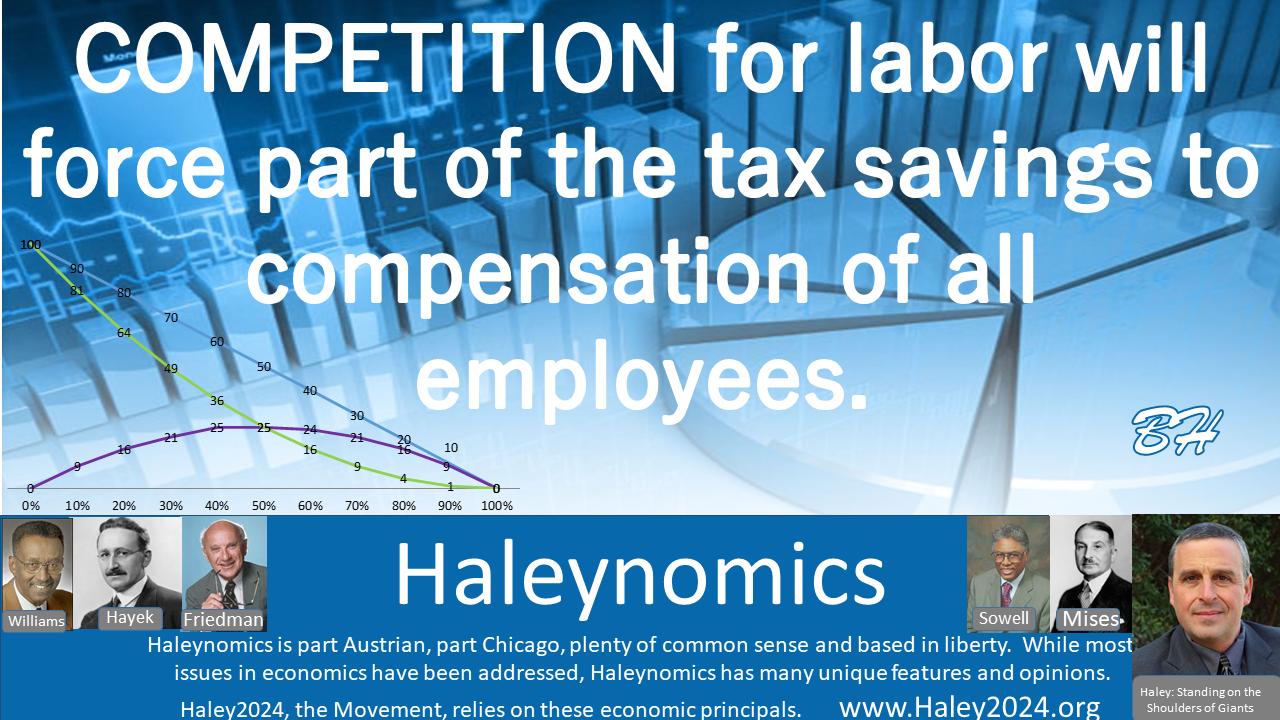

Many state and federal agencies cover human resources. Do these agencies have the best policies? Would competition help? If employers are appropriately rated, employees could sell their labor to any employer knowing full well their policies and how they rate with others. Policies, just like products, improve when there is competition and informed consumers.

|

|

Problems of the current monopoly system and items that could be adjusted by CRA's

|

|

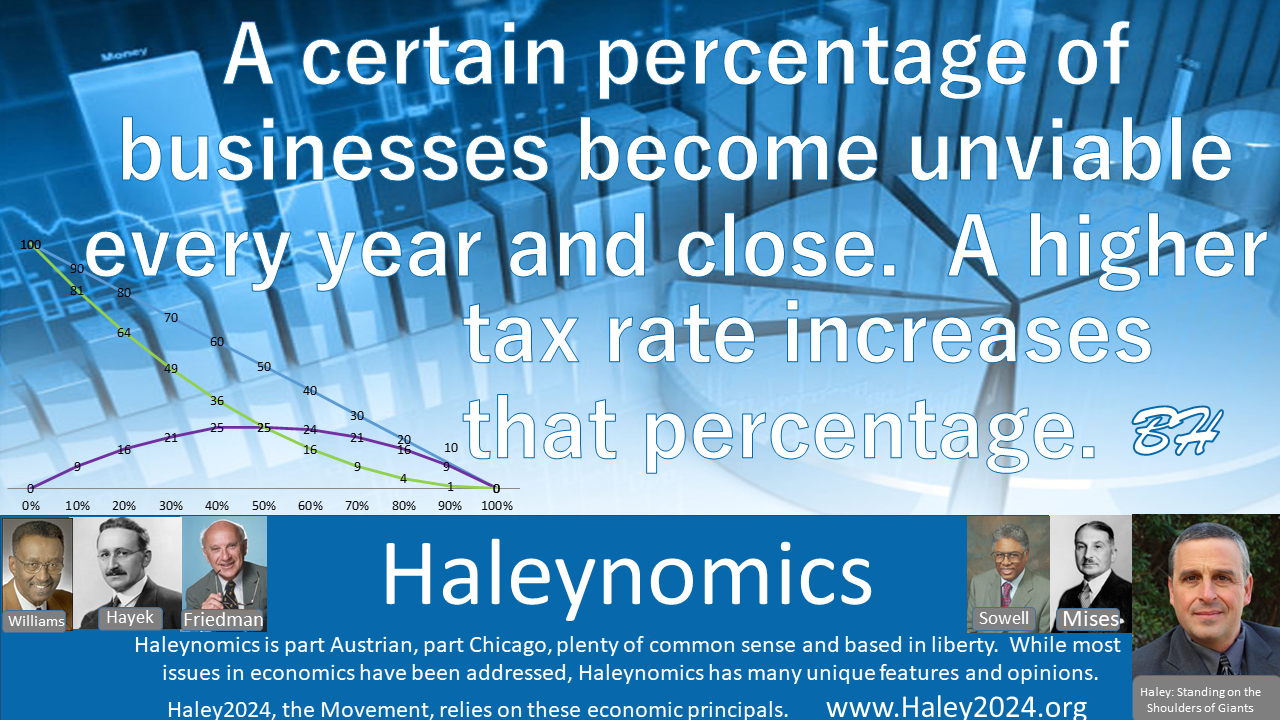

A contract between one person, a company or other entity and yourself, does not affect others outside the contract. Every person is competent to make their own labor contracts. The company wants/needs labor (mental and physical) and is willing to pay for these services up to a certain amount. Any more than their maximum and they start to lose money. If the business cannot attract labor for that amount, then the company is not viable in that form.

|

|

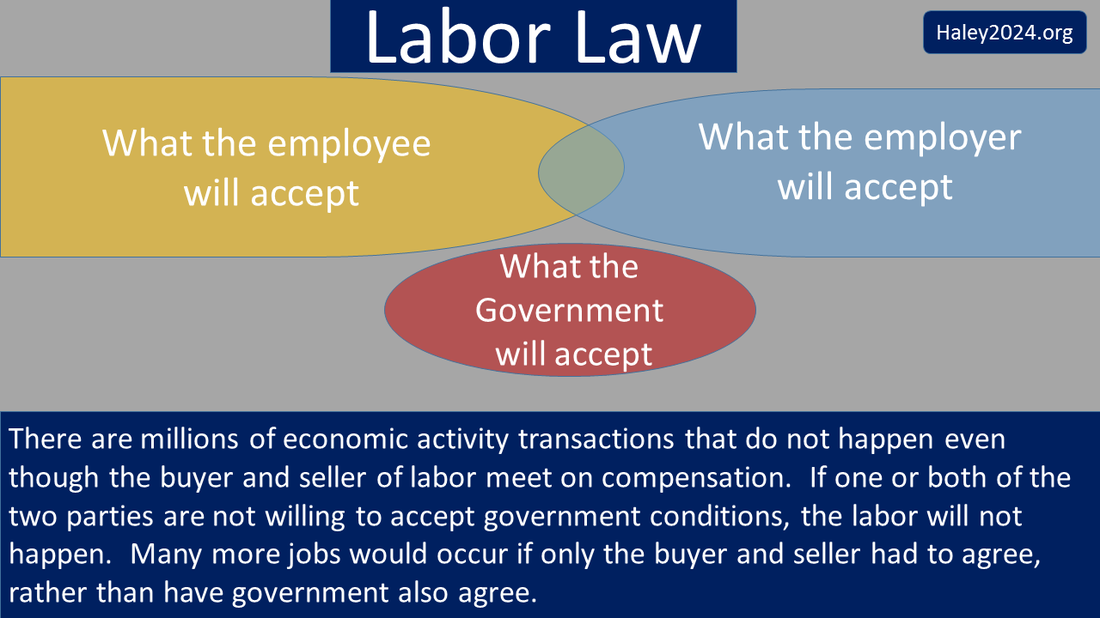

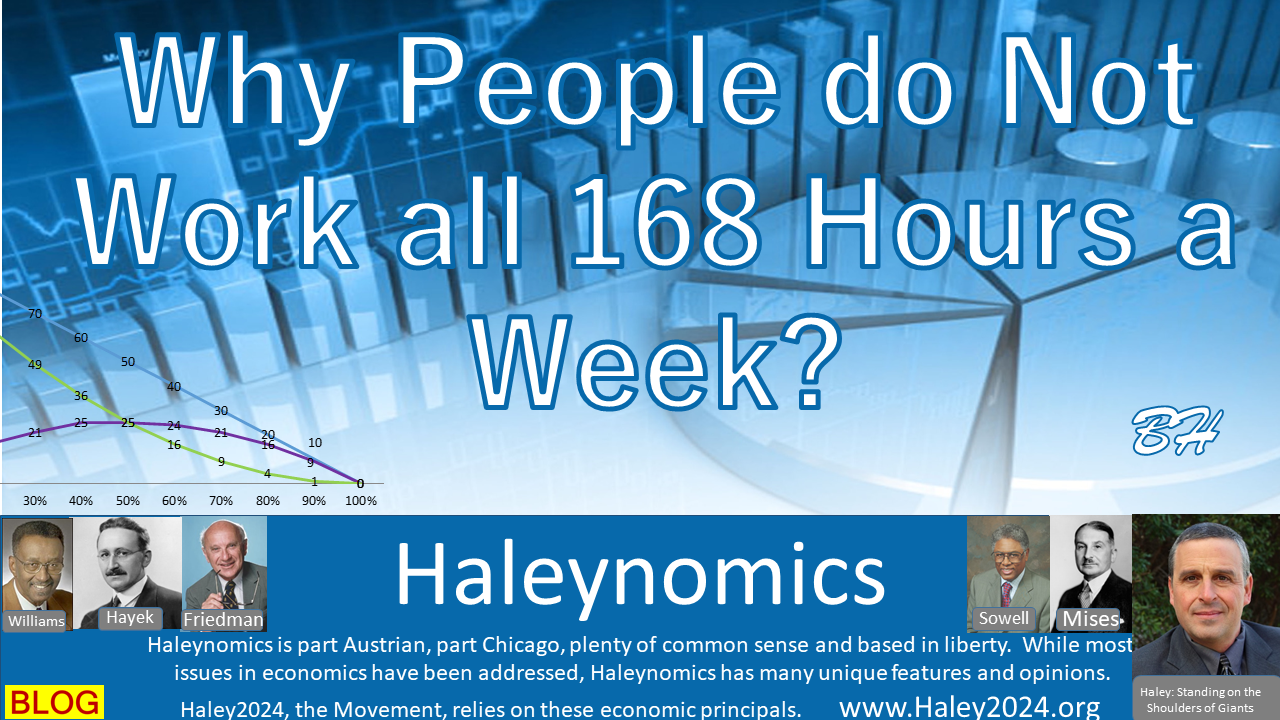

The person wanting to sell their labor has a minimum price for their labor they are willing to contract for, any less and their time is better utilized elsewhere. Both sides of the contract are trying their best to make the best deal for themselves. One is trying to bid up the contract and the other, down. Please keep in mind; there is much more to an agreement then strictly money. Work conditions, benefits, travel time among others are significant factors. Only when there is overlap in total compensation between the buyer and seller, will a labor contract be signed.

|

|

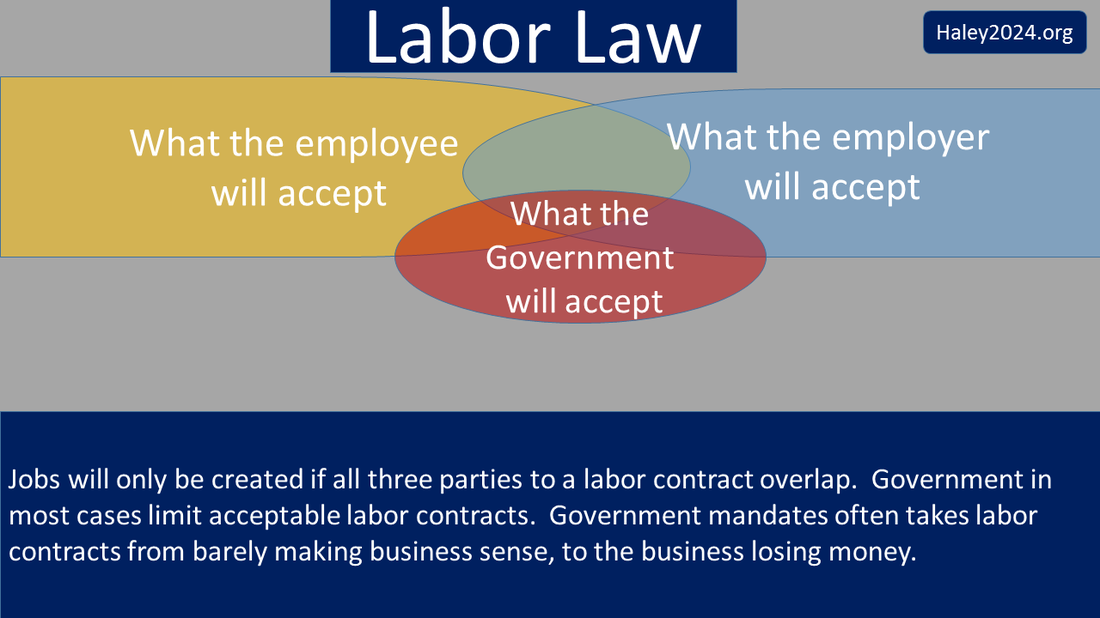

When there is a third party, the government entering into the negotiations, they limit the scope of a legal contract. Thus, fewer contracts will happen. Quite simply, a seller of labor has their circle of acceptable contracts, and a buyer has theirs. To have a deal both circles must overlap, and the contract is within the overlap. When the government inserts another sphere of acceptable arrangements, now all three must overlap. This third circle significantly limits the overlap and often eliminates the overlap completely. When all three circles do not overlap, there is not a labor contract signed, and no labor is done. A person is without a job, a company is without labor, the government is without additional tax revenue, the government pays additional welfare, and there is downward pressure on wage rates.

|

|

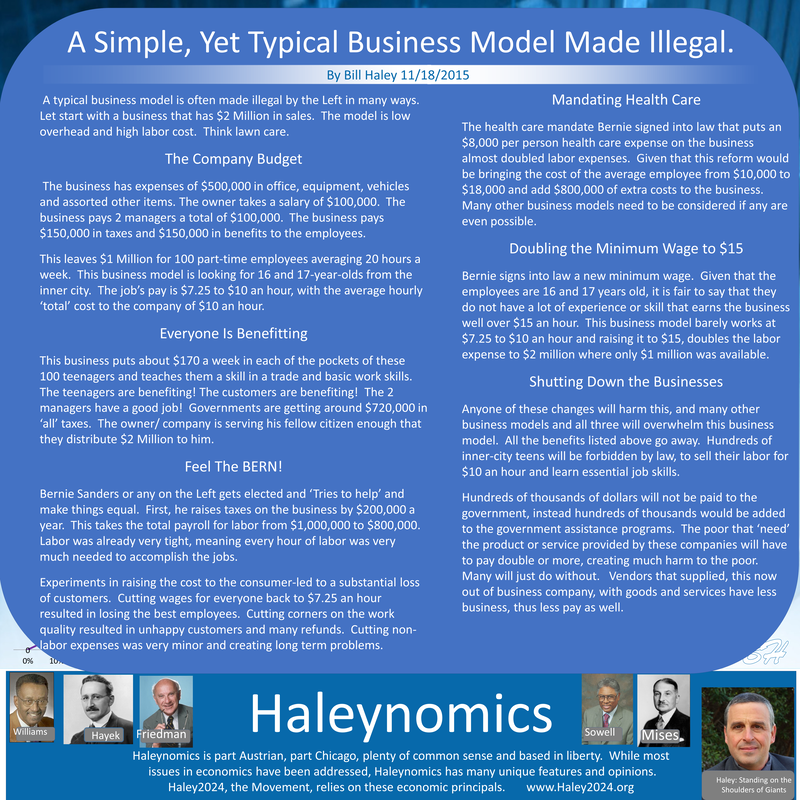

When a company creates a product, they do their best to price their goods and services at the optimal price. Then the company sets a specific cost to every part of production to ensure a profit. Every job provides a certain amount of ‘worth’ to the production of the goods or service. Some jobs are ‘overhead,’ and others provide services with more direct payment per service or product. Labor costs of every job must fit within the budget, or the business model must change.

|

|

For the next several sections, let’s consider an example of a very directly tied ‘work to compensation’ model. A widget sells wholesale for $10 and the overhead/ materials per widget is $5. The company needs to earn a return on investment of at least $1 per widget for the investors to keep the business open. The maximum amount the business can pay (total compensation) the widget assembler is $4 per widget.

|

|

Overtime: Let's say, a skilled employee can make eight widgets an hour, thus creating $32 per hour of worth to the business. If the company offers $30 an hour (full compensation) to try to retain high-quality employees, the business would not be able to allow overtime. Every hour of overtime means that the company would lose $13 per overtime hour at the same productivity. Overtime labor-law forbids the employee from signing a labor contract where he would be paid $30 per hour for hours over 40 per week. If the employee needed to earn more money, he would have to sell his labor to another employer at a second job, thus not where he could use his skill and experience and likely earn far less than the $30 per hour.

|

|

Mandatory 1.5 times wages, limits labor contracts, and the worker's desires and needs. Proof of this is the millions of employees taking second jobs at the same or lower pay rates. Many of these employees would assuredly take the 1.5 times regular pay if offered; however, many business models do not work at the higher pay rate. Two people working 29 hours each is less expensive than one at 58 hours.

|

|

Many employees would enjoy making $45 an hour after 40 hours per week. If an employer’s business model works with pay rates at 1.5 times the regular pay, the employer is significantly underpaying the employee for the first forty hours. Companies that regularly offer overtime build that extra pay into the full compensation plan. Many employers have an unwritten and often an unstated agreement that a 10% decrease in the pay rate comes with an agreement to work for 50 hours per week. 50 hours times $30 is $1,500. 50 hours times $27.28, with the last ten hours at overtime rates, is $1,500. Employers and employees should not need to develop workarounds.

|

|

Minimum wage: If an employee cannot make enough widgets to cover the minimum wage, he is forbidden by law from bidding his wages down until he gains the experience, skill, and speed to make enough widgets to cover his wage. There are countless reasons why an employee cannot be as productive as necessary to have his work, be worth to the business, enough to cover the minimum wage. One does not help these people by forbidding them from lowering their wage rate until they gain the productivity to ‘be worth’ higher earnings.

|

|

Mandated paid leave: businesses need to lower the wage rate to cover the cost of paying for employees that are not working. The employee under government regulations would not be allowed to negotiate a higher wage rate if they gave up mandated paid leave. Since employees would understand that part of their compensation package is paid leave, they would not leave it on the table. Just like most take their paid vacation, now that it is part of their compensation package, they would also find a reason to maximize paid medical leave.

|

|

If a business plan allows $20,000 per day for the labor of 100 people, each of the employees receive $200 per day. If an average of 10% of employees were out per day, the company would have to have about 111 employees on the payroll. If all the employees had to get paid whether or not they worked, the employees’ average daily pay drops to $180. Employers might find that employees would enjoy that trade-off of less daily pay in exchange for paid time off; however, it should not be mandatory.

|

|

A requirement from the government, to add medical benefits to the labor contract does not increase the total compensation package that businesses can offer an employee. If a business model includes $60,000 for a skilled employee, the contract factors in the cost of medical benefits. The offer of a $40,000 with $10,000 of medical insurance, $3,000 for FICA, $5,000 for paid time off temp-help, and $2,000 for dental insurance equals a total compensation package of $60,000. The employer and employee should be able to sign a contract that pays the full $60,000 directly to the employee and then have the employee pay for insurance, save for retirement, and take unpaid time off.

|

|

If the employment is for a low-skill and low-wage job, the $10,000 extra medical insurance acts as an increase in minimum wage. This increase often will not work within the business model. Either a company is forced out of business, or the business model changes to increase capital goods to supplement labor which increases productivity. This business model uses more skilled labor and fewer labor hours. The low skilled employee does not gain health insurance because his skill level is no longer in the business model.

|

|

Many companies change business models not to be subject to as many requirements, leaving employees with many fewer options and often without jobs or fewer hours then they would otherwise wish. A recent law (ACA, or Obama-Care) made most labor contracts illegal. These new restrictions on labor laws influenced many to cut hours under 30 per week or stay below a certain number of employees to forgo the extra expense. Months after the ACA was passed, the entire Virginia higher education part-time workforce was strictly limited to under 29 hours a week, so the state did not have to pay for health insurance. Many state employees lost hours they needed to pay for their own health insurance.

|

|

Monetary Policy: Many may not see the significant negative externalities of bad, and yes, we have very bad, monetary policy on labor law. Labor contracts are measured in dollars. Long-term labor contracts are affected significantly because monetary policies change the value of the dollar, thus unconstitutionally changing the contracts. If a contract makes sense when the dollar is worth X, it is not likely to make sense in a few years when the contract is worth 0.9X. Most people think a yearly pay raise gives them more money. However, it is usually just keeping up with inflation. Without the pay raise, the devalued dollar results in the employee having lower buying power.

|

|

Equitable pay laws: These are perhaps the most damaging laws, depending on enforcement. More proposals of intrusive laws occur regularly. These laws are a significant way lawyers could harass companies. Employers will identify women or minorities as more likely to bring this type of lawsuits. Thus, women applicants would look less favorable. Using statistics to prove discrimination or pay equity is highly problematic. A business can do everything as fair as possible and have the natural choices of men and women employees create a wage gap.

|

|

There are simply no help-wanted ads that offer men and women different pay. Men and women naturally migrate to different jobs. Men have on average greater physical strength and a desire to use that strength in their occupations. Women migrate towards ‘caring’ positions. The list of differences is very long. Men also, on average, desire longer work hours, thus correlating with different professions. Women, on average, are in the workforce for fewer years due to child care decisions. Longer hours and more years directly mean more experience.

|

|

When someone earns hundreds of millions or billions of dollars, no one person or small group of people ‘pay’ them. These super-rich people grow companies that many people are willing to spend their hard-earned money on. For many reasons, men dominate the list of the super-rich by over 20 to 1 over women. These super-rich significantly change the average male/female income. If researchers filter out the super-rich, the gender income disparities diminish.

|

|

Often, less than half of what the employers must pay to employ an employee is seen in the final paycheck. Taxes, state and federal, both sides of S.S. and Medicaid, Benefits, retirement, unemployment compensation, and others either come out of the gross pay or is paid on behalf of the employee but still part of the overall compensation package, which is the bottom line for the employer and employee. Competition of all these provisions could bring new ideas and methods that continue to be improved.

|

Blogs Related to Human Resources