This first box is a 1,200 word brief of the much longer article. Updated 7-16-2019. There is a lot to consider. I expand most sections in the full article.

| First, what is the Universal Basic Income (UBI) and how does it work. There are many variations of the UBI. However, the basics are that the government gives everyone, versus just the poor, regular payments. Although the idea is to make the payments high enough to live on, the amounts suggested are all over the board. They are as low as $1,000 and as high as $30,000, a year per person in the USA. Roughly $10,000- $15,000 per year is the norm. Another basic concept is that it takes the place of current welfare programs; however, that also varies widely from all to none. It is unconditional cash versus government paid-for services. |

| Currency is a service from free enterprise’s invisible hand keeping a ledger that facilitates one-sided provisions, yet two-party trades at different times, at different values, and the services provided going to and from the universe of all traders. An economy is everyone serving others and asking to be served in the same amount. There is a two-sided agreement, including yourself, on the amount of worth you provide and the amount of worth you are provided. |

| The UBI destroys the notion that people need to serve others at the same amount as they are being served. There is a senseless notion that if Person-A works for sixty hours serving others and Person-B works twenty hours serving others, we should take a percentage of the value of person-A’s work to allow Person-B to demand services. Is Person-A supposed to be happy that Person-B is demanding more of Person-A’s labor hours using Person-A’s money? If Person B wants to request more services, they can work more hours and increase the worth of their service. |

| The proponents from the Left of the universal Basic Income have economic theories that are erroneous and need to be challenged. The proponents from the Right concentrate on eliminating all the harmful programs that the UBI will replace; however, miss the significant damaging effects of higher tax rates and the harmful effects of giving people money they did not earn. There are positive effects of people earning their own living and debilitating effects of being dependent. |

| Most welfare programs concentrate benefits to the bottom 5%-20% of income earners and non-earners. Expanding the benefit to 100% of the people dramatically increases how much is needed so as not to spread the benefit too thin. High Progressive Tax Rates Bans the Rich from Serving the Poor |

Is It Socialism? The proponents try to stay away from the word socialism. There are two parts to socialism if done in conjunction with the free enterprise system. First acquiring the money and then providing for the people. The UBI is socialistic in acquiring the money, yet not so much in providing. Socialism takes a certain amount of income. That is undoubtedly part of the UBI. Where it differs from socialism is the distribution side. The UBI does this with cash to everyone without requirements. Socialism tries to own, control, manage, produce, and distribute what they give out. The UBI’s cash system is better than the substantial control of socialism. |

| Future Technology Future technology worries many people because they believe it will take a high percentage of jobs. Let us all hope that is true. While it is stressful to lose a job, the great benefits of lower prices to everyone outweighs those lost jobs. Labor hours freed up in one industry creates opportunities to start or expand new industries. While technology advancements over the centuries happened very slow, the last two centuries have shown rapid increases. Going forward, the pace will increase, and people need to learn to adjust with it rapidly. We should not give up on people by just giving them subsistence living. The Future of Work with Increased Technology |

| The notion of double taxing a robot is foolish. All robots are bought. Buying robots means people building robots earned money. Earned money is taxed. If a company bought a forklift for $75,000 and saved $100,000 in labor of its employees, the company still paid for $75,000 of labor hours, just not with their own employees. The other $25,000 is spent elsewhere in the company or manifests in lower prices to consumers. That $25,000 now funds labor hours doing new things that increase everyone's’ standard of living, including greater leisure hours. |

Living Off the UBI At $10,000 to $15,000 per person with roughly half that for children, innovative people will learn to live off that money. A mother and father with four children will be receiving $40,000 to $60,000. Many families are living off that amount right now. Both parents staying home would allow many cost-saving measures of no daycare expenses, no work clothes, no work travel costs, and couponing. Many families could make that happen. Four friends recently out of high school rent a small home comfortably on the UBI with plenty of money left for food and video games. Pooling their money together could enable the youth to ‘waste’ the most valuable years of their lives. |

| A big part of the problems of welfare and the UBI is that it enables people to live a destructive lifestyle. The need within the free enterprise system causes people to straighten-up their lives. Charities within the Haley2024 system allows help to those on hard times or those doing the right things. However, the most important part of charity is the ability to say ‘NO’ to those going down wrong paths. |

| Making It Easy to Quit a Job Many among the UBI advocates claim that the UBI would allow people to quit low paying or unpleasant jobs. They claim that those businesses would have to increase their wages to attract employees. They are certainly correct. However, they claim that is a good thing. It is not! The negative consequences would be more damaging than some possible benefits. |

| In conclusion, the UBI does inordinate damage in the effort of collecting the funds. The UBI does excessive injury to job opportunities for the inexperienced. The UBI does unnecessary harm to the work ethic. The UBI does needless destruction to the many aspects of the role of prices. The UBI enables destructive lifestyles and enhances a dependency mindset. The UBI advocates erroneously believe greater prosperity requires increased socialism. The UBI would foster irresponsibility and entitlement; whereas, the free enterprise system challenges everyone to increase their efficiency and productivity of serving their fellow man. |

How Does the government Pay for the Universal Basic Income?

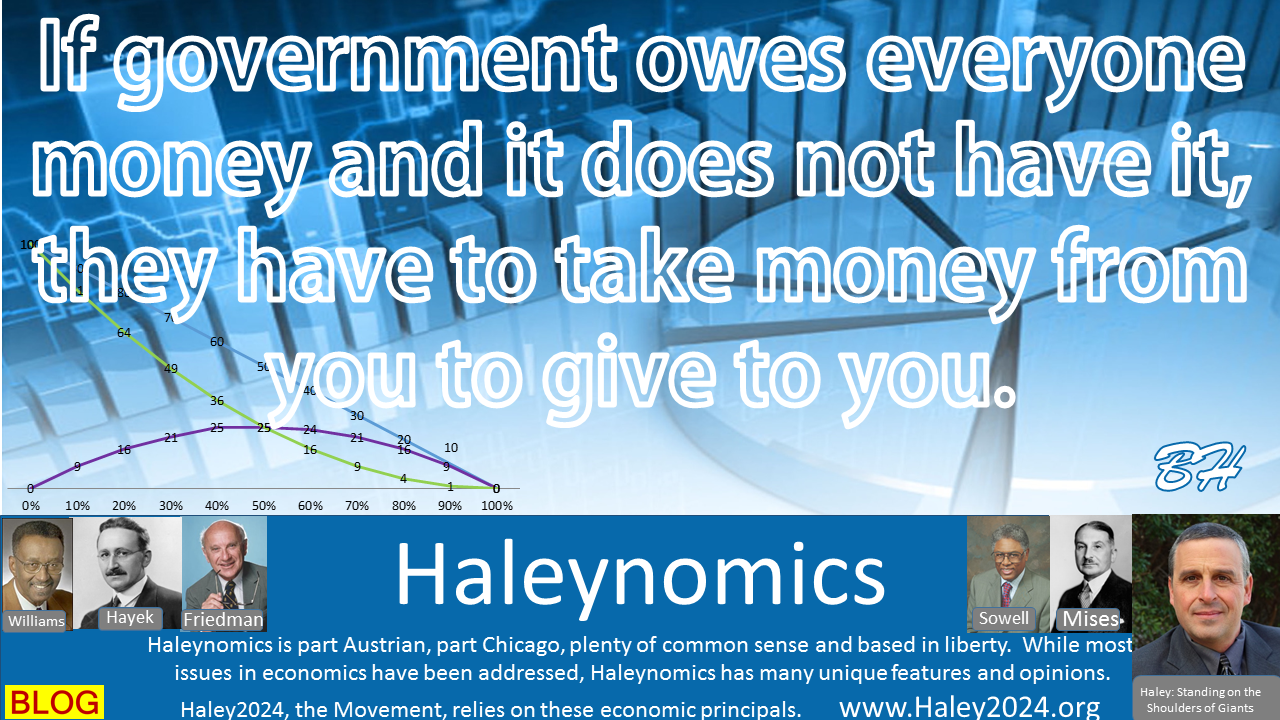

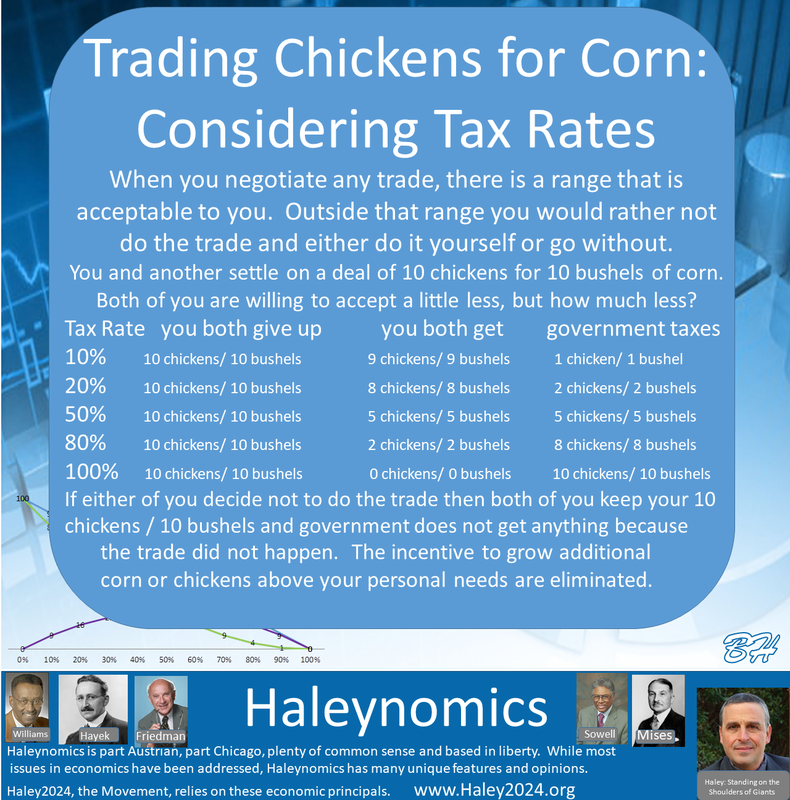

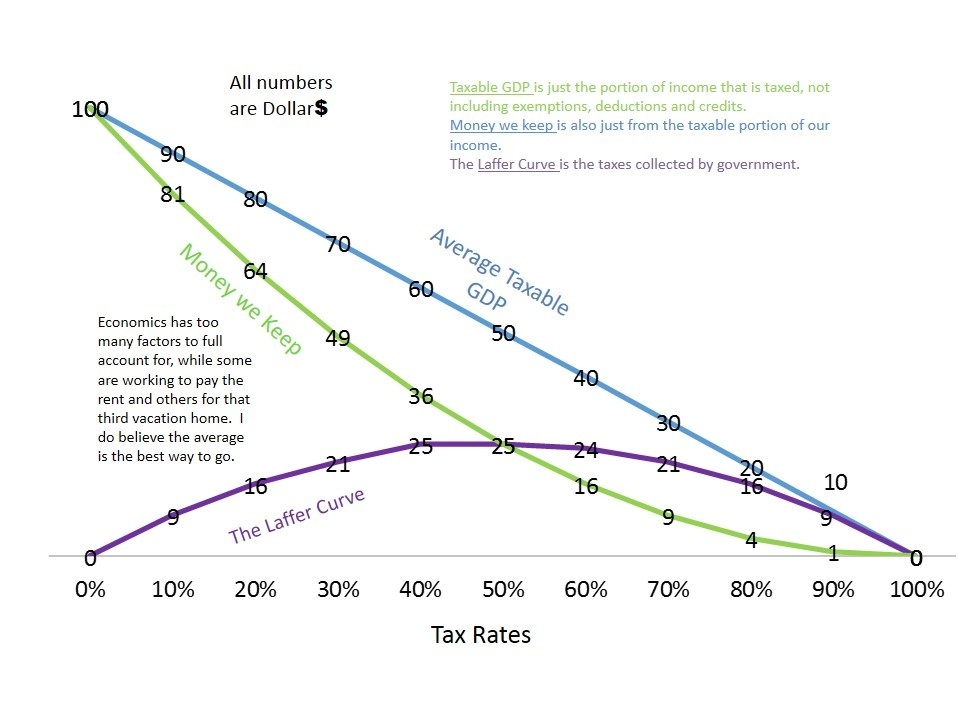

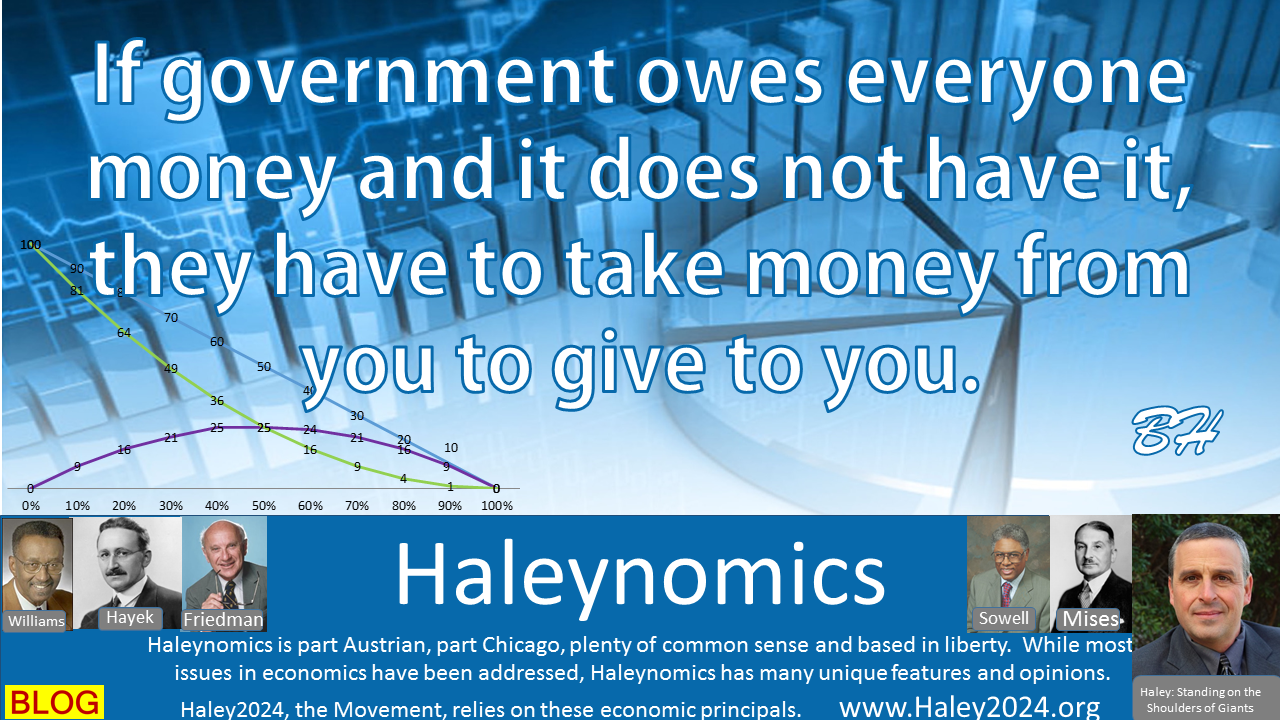

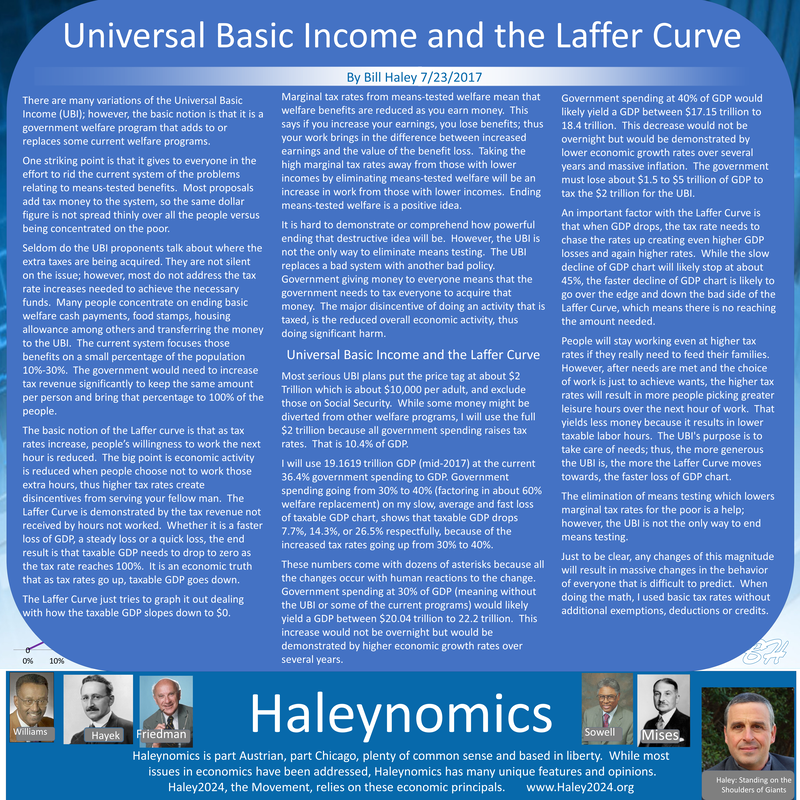

| It is an economic truth that people stop doing an activity that is taxed when the tax rate increases to a certain level. That tax percentage level is different for everyone. All taxable activity stops when the full amount is taxed at 100%. Therefore, the government revenue drops as well, reaching $0 at 100% tax rates. The lower range of $8,000-$10,000 UBI proposal ranges from $2 -$3 trillion or roughly 10% -15% of GDP. |

| The Laffer Curve demonstrates that $1.5 -$5 trillion of GDP will be lost depending on many factors by trying to collect the $2-$3 trillion. (the full GDP is about $20 trillion) Losings 10%-40% of GDP means higher tax rates and lower GDP. This catch 52 spirals out of control and sledding down the bad side of the Laffer curve/slope. |

| If the government gives everyone money, they first have to take it from everyone. That fact is not totally absent in the proponent’s advocacy; however, it is underappreciated. The biggest tax is the economic activity not engaged in, as stated above, and that harms the poor the most. Second, 100% of taxes collected from the business owner come from consumers, so at best; taxes are at even percentage rates. |

| If a tax is collected from a transaction, it does not matter who officially pays the tax, the role of prices ensures both parties to the trade share the tax burden. Those higher tax rates from businesses manifest in lower payroll budgets, more business failures, higher consumer prices, lower job opportunities, and lower wages. |

| Carbon Taxes Carbon taxes are a common additional tax that is proposed by advocates of the UBI. That very directly adds to power bills, and while the rich use more power on average, they pay a smaller percentage of their income on power, thus making this tax harm the poor the most. Carbon taxes also push high energy businesses outside the taxing authority, thus pushing those businesses overseas. A side note: China has much lower environmental controls and creates much higher pollution per item compared to producing in the USA; therefore, carbon taxes harm the environment as well as jobs. |

| Let’s say a USA company creates a widget with three units of pollution and a company in China produces that same widget with ten units of pollution, and both sides had a 50% market share. If regulations forced USA companies to reduce to 2 units of pollution per widget and the increased cost gave China 60% market share, the overall pollution would increase. The carbon tax would yield a 20% reduce tax base as well in that sliver of the economy. |

Just Create More Money Some proponents of the UBI call for creating money as part of the funding of a UBI. That would be devastating to the economy and hitting the poor and low-income elderly very hard. Money can be understood as proof you did work for somebody else and you offer that dollar to somebody to do work for you. Every time that dollar changes hands, service was done by the receiver of that dollar for the giver of the dollar. The monetary system breaks down rapidly if people are just given new money without that needed element of service for another. |

| The value of new fiat currency that is created out of thin air takes its value from the existing currency. Imagine if a small group of ten people brought their goods to trade every Saturday. Everyone brought ten items and had $10. Every item was $1. Everyone came with ten items and left with ten items. If the money creators gave all ten people $1 from thin air at the start of trade, everyone would have $11 thus 110-dollar bills will be trying to buy 100 items. |

| The following week, 120-dollar bills will be chasing those 100 items, and so on. If one does not raise their prices 10% a week, then they will be bringing ten items and walking away with 9,8,7,6,5… items every additional week. If one held that currency in saving, they would be losing value rapidly. Capitalism takes capital, which is savings. Nobody will want to save if the value of their currency is reduced every week. Without saving, many bad things happen. Savings is proof you served your fellow man in the past and have not demanded service in exchange yet. |

| The notion that those extra $10 would increase the demand in this small economy is foolish. Anybody that wanted to demand more products and services could work more hours without extra dollars in the system. If 5 of the 10 people worked more hours and brought 11 items; 105 items were brought to market, and everyone walks away with the number of items that match what they brought. |

| A Value Added Tax (VAT) A Value Added Tax (VAT) is often cited as a source of funding the UBI. The VAT is one of the fairest ways to collect taxes. The VAT does not add price to products; the VAT is an additional cost on top of the price of an item. Often the VAT is mixed up in inflation numbers. If someone walks into the store with $100, they can only buy $90 of products and effectively pay $10 in VAT taxes; although, the taxes were paid throughout the product’s lifecycle. |

| In conclusion, if the politicians want to give you $1,000 a month, the government must first take the money from you. The politicians will try to convince you that they are taking the money from other people to give you; however, remember the politicians are telling other people that they are taking money from you to give to them. If politicians state that they will take it from the rich, remember that you voluntarily ask the rich to serve you in exchange for your money. The only place the rich can get the money to pay taxes is from transactions with you. In a real sense, the rich will pay more taxes than the poor: however, the act of taking the money will make everyone much less wealthy. |

The Universal Basic Income Related to each Welfare Program

| There are many that state the UBI will eliminate ALL government welfare programs, including those within the tax code. To that ultimate end, we would end up with a head tax versus a tax rate. In that case, it would not matter what the UBI was because the head tax would take 100% of the UBI to fund the UBI, plus administrative costs. The government could have a $1 million UBI per person per year, and the only place to tax that much is a 100% UBI tax. |

| While that is not a real proposal, it shows the UBI cannot eliminate proposals that take from the rich to fund the poor such as the progressive tax code. However, one tries to look at it, the government has to take the money from the people to give money to the people. The Left will always propose ways to make the tax code as progressive as possible, not realizing that a progressive tax code ultimately does great harm to the poor. |

| A big part of ‘paying for it’ is eliminating certain welfare programs. That is a mixed bag, and each program needs to be looked at and evaluated on its own merit. Housing, cash welfare, food stamps are easy to transition; however, transitioning health care would create many problems. The left will state that some of the current welfare benefits will roll into the UBI. However, they will see a great need by some and add those welfare programs back into the system. |

| The Left will claim that some parents will not feed their children and renew student lunches and food stamps. Of course, pregnant mothers and infants should not be denied good food, and WIC will return. The Left will claim that people will not have enough for medical insurance, deductibles, or doctor visits, and Medicaid will return. The Left will see housing prices too high for the UBI and claim the need for the return of HUD. Many will use the UBI for wants, and the Left will demand the return of government provided needs. |

| Cash or Service There are good reasons why some benefits are given in cash and others in services. Cash works well in food aid; however, in medical, it does not. Aid for medical given in cash without strings will lead to many issues. Most will be responsible, and some will become burdens on society when there is a medical need. The laws that disallow a hospital to deny care to someone needing emergency-care or really any other care is not going to be repealed. If the hospitals get to garnish the UBI for unpaid bills, those people relying on UBI will not have money to live defeating the purpose of the UBI. Very soon the benefits will be added back into the system in addition to the UBI. |

The Public-School SystemReplacing the Public-School System with a UBI would be a tremendous improvement. Government control of education is one of the significant harms done to the people. Of course, everyone should also be able to exempt themselves from the benefit side AND the tax side of education. |

| Colleges and other forms of higher education should also go in this direction with the option of being out of the tax AND benefit side of higher education. Moving to a UBI for education would solve the control issue. Allowing people to take care of education on their own would take care of the massive tax disincentive issues. Yes, those outside the education tax and education UBI benefit would still have to pay for their own education; however, they eliminate the government taking the money from you and giving it back to you as part of the UBI. |

Social Security System

One of the best parts of the UBI is the elimination of means-tested benefits. However, those two things do not need to be linked. Social Security should not go into a UBI. Social Security is already very socialist. Switching it to a UBI only makes it more socialist and creates many problems. First, switching means that the government pours the funding and the benefits into the UBI.

The benefit will go from those in retirement to everybody, thus thinning out the benefit or substantially increasing the taxes. Means-tested Social Security will be a disaster. People will not save for their own retirement so they can qualify for means-tested benefits.

Second, the benefit under the current Social Security System bases benefits to some extent to money taxed over the years, meaning the more money earned and taxed means higher social security payments. The UBI gives the same amount to everybody, thus moving away from a program resembling a retirement plan.

Eliminating Means Testing

One of the best parts of the UBI is the elimination of means-tested benefits. However, those two things do not need to be linked. The government can stop means-testing without going to a UBI.

Means testing creates high marginal ‘tax rates’ for the poor. If you are receiving means-tested welfare benefits and increase your earnings over a certain point, you lose those benefits. Many programs work in many ways from a gradual loss to benefit cliffs. However, many poor get caught in this trap of not working to get the benefits, and that lack of work harms future work hiring opportunities.

Tax Deductions, Exemptions, and Credits Are Bad Economics

Many people try to help the poor with welfare in the tax code. This type of ‘help’ harms the poor. All deductions and exemptions from taxes push up tax rates because of a smaller taxable base. Higher tax rates discourage taxable activity; thus, lowering people’s level of serving their fellow man.

Tax credits act just like government spending. The level of government spending determines the tax rates. Increased government spending pushes up tax rates. The low tax base created by higher tax rates create a need to increase tax rates again. Chasing tax revenue up the good side of the Laffer Curve often takes the one over the hump and down the losing the tax base and tax revenue side of the Laffer Curve.

One of the best parts of the UBI is the elimination of means-tested benefits. However, those two things do not need to be linked. Social Security should not go into a UBI. Social Security is already very socialist. Switching it to a UBI only makes it more socialist and creates many problems. First, switching means that the government pours the funding and the benefits into the UBI.

The benefit will go from those in retirement to everybody, thus thinning out the benefit or substantially increasing the taxes. Means-tested Social Security will be a disaster. People will not save for their own retirement so they can qualify for means-tested benefits.

Second, the benefit under the current Social Security System bases benefits to some extent to money taxed over the years, meaning the more money earned and taxed means higher social security payments. The UBI gives the same amount to everybody, thus moving away from a program resembling a retirement plan.

Eliminating Means Testing

One of the best parts of the UBI is the elimination of means-tested benefits. However, those two things do not need to be linked. The government can stop means-testing without going to a UBI.

Means testing creates high marginal ‘tax rates’ for the poor. If you are receiving means-tested welfare benefits and increase your earnings over a certain point, you lose those benefits. Many programs work in many ways from a gradual loss to benefit cliffs. However, many poor get caught in this trap of not working to get the benefits, and that lack of work harms future work hiring opportunities.

Tax Deductions, Exemptions, and Credits Are Bad Economics

Many people try to help the poor with welfare in the tax code. This type of ‘help’ harms the poor. All deductions and exemptions from taxes push up tax rates because of a smaller taxable base. Higher tax rates discourage taxable activity; thus, lowering people’s level of serving their fellow man.

Tax credits act just like government spending. The level of government spending determines the tax rates. Increased government spending pushes up tax rates. The low tax base created by higher tax rates create a need to increase tax rates again. Chasing tax revenue up the good side of the Laffer Curve often takes the one over the hump and down the losing the tax base and tax revenue side of the Laffer Curve.

| |