|

Just to make it very clear, The Haley2024 plan for colleges, is for a full transition to free enterprise. This means no more state colleges, nor government funding of colleges, nor government involvement in student loans, nor government requiring accreditation for specific trades, nor education credits through the tax codes, nor control of curriculum, nor issue diplomas. The government will be 100% out, after the transition. This expressly means the government reducing their tax rates to match what they are not spending directly or through the tax code.

|

|

All these will be the responsibility of individuals, parents, families, colleges, Competitive Regulatory Agencies (CRA’s), Charitable Distribution Associations (CDA's), banks and among others in the free enterprise system. The free enterprise system is very dynamic, and when people find worth, they see opportunity and if not hampered by government, will bring that worth to realization.

|

|

Many people will claim that the poor will not be able to access higher education without government money. This is profoundly ignorant of the reality of the countless ways that people with a desire, will create a way. There are countless stories of people working their way through college and emerging without debt. There are many charities, scholarships, businesses, banks, and among others that will help the poor achieve higher education in dynamic ways. People recognize the value of increasing human capital and invest for future return.

|

|

Our current system is exceedingly unfair to the poor and those that do not receive a college education. Because taxes are paid by everyone and harm the poor the most, the poor are paying for others to get an education when not gaining the human capital, thus the future earning potential. Yes, this means that those currently gaining higher education and more significant income potential are being subsidized by those that are not. Free enterprise student loans link the increased earnings potential to repaying the loans.

|

|

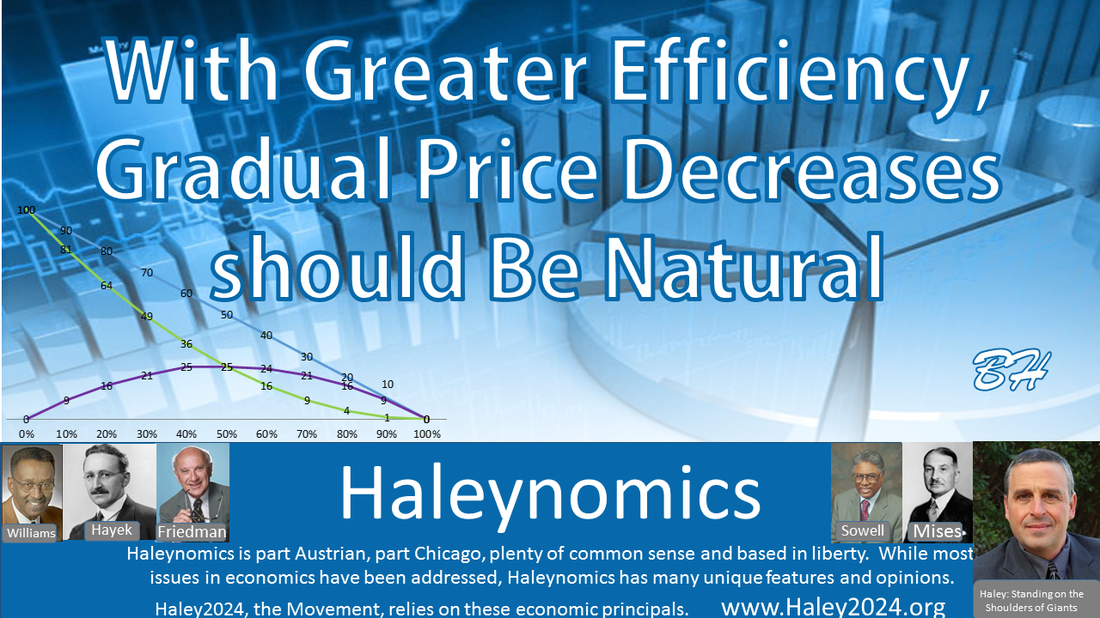

If the government is not funding higher education, the government would require far fewer taxes, thus leaving more money for the individual or others to fund their own education. The Laffer Curve demonstrates that decreased tax rates would increase economic activity; therefore, more jobs, and higher earnings.

|

|

People going to college have on average higher motivation, higher IQ, higher dedication and smarter than those not going to college (on average). Is this really the group of people that needs socialism and substantial government control? Banks, colleges, charities, and businesses will all be in CRA’s and will all be competing to have the best ratings on the poor having access to higher education. Free enterprise is dynamic and always finds a way.

|

|

Under Haley2024's new Monetary Policy, smart people realizing the real worth of increased human capital could monetize that worth in new currency. When government gets out of the way, it is astonishing how dynamic free enterprise can be, even utilizing monetary policy to put someone through college.

|

|

Five Big Reasons Why Free Enterprise is Superior to Government Provision

1. Lower Tax Rates 2. Political Decisions 3. Experimentation 4. Evolution 5. Evaluation |

|

Licenses and accreditations are protectionist policies by government and can be abused by the few politicians and is a way to benefit cronies. With CRA’s taking over diplomas, licenses, and accreditations; businesses will have to cater to customers to have high standards and will compete with other CRA’s to get the correct level for these standards. Please look at the structure of CRA’s and the rating system to fully understand how the competitive nature of the free enterprise system can handle these better than the government.

|

|

Yes, there are free MOOCs; however, that is only part of the story. Trying to put together the whole package will take a lot of effort by the student. There would still be the need for many for a ‘coach’ or a ‘consultant.’ There could be low-cost colleges that have most of the work done by MOOC’s and other online classes where these coaches group students and oversee their work. Many of these would likely find businesses within their field of study that could gain real worth from an intern like arrangement that would fund these low-cost coaches.

|

|

These coaches would ensure the students are achieving the required knowledge and experience to achieve certificates for their fields of study that are rated high enough to attract employers. This example is just showing the dynamic nature of free enterprise versus the hard and fast rules from the government that inhibits new business/ educational models.

|

|

Many people feel an increased motivation to get the most out of education when they have to pay for the classes themselves. Often, when the government or a third-party funds, the student does not feel they can hold the college accountable because it is not their money paying. Yes, it is always beneficial for the student to increase their human capital; however, the motivation is different depending on who is funding.

|

|

A lot of science is funded through colleges, and that is likely to continue. Haley2024 advocates the government entirely stopping the funding of science and turn that over to the free enterprise system. CRA’s would be rated on how much advancements their businesses make in the sciences, and if the level dropped too low, they could set a floor on those ratings, thus ensuring more money and advancements are made. It is not likely the Rating Floor will be needed as businesses are always looking for advancements to achieve new products and business advantage. Consumers are also likely to buy from a higher-rated business, thus creating natural motivations to advance science.

|

|

Once this bill is passed, the government will create a publicly traded corporation for each government-owned college or other groups of assets. In the beginning, the government will be the sole owner of all stocks. Each month they will have to price the shares of the stock to sell off an additional one percent of the corporation. As long as the government owns the stocks in the colleges, each legislator will have voting rights for a percentage of the stocks that the government owns.

|

|

Government subsidizing education does not reduce the cost to consumers as is often claimed. The colleges just see the opportunity to acquire more money and raise prices. Guarantee government college loans, as well as tax credits, are also opportunities for colleges to increase the price. Politicians love to claim they are funding higher education or giving significant tax breaks; however, college tuitions and other education-related fees always go up faster than the average inflation, even with more substantial government funding.

|