| Lower Tax Rates Government provision necessitates government taxes. Taxes always reduce the activity taxed, thus economic activity (GDP) is reduced. -Laffer-curve -Deductions, Exemptions and Credits create a faster loss of economic activity |

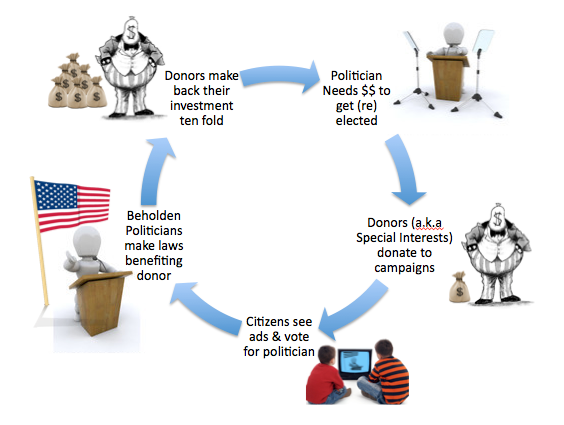

| Political Decisions When the government spends versus when the free market spends, political decisions are made. Power is taken from all citizens and given to a select few. Government spending crowds out the free market and diminished individual choices. -Knowledge and Corruption -Campaign Finance Reform -Using Government Money for Political Gain |

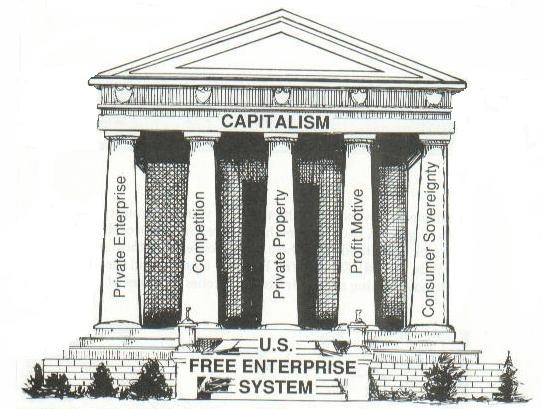

| Experimentation Government provision is a monopoly with one business model, thus making experimentation very limited and lacking in legitimate counterfactuals. Therefore, proper evaluation of government services are limited. Free enterprise requires people to satisfy their fellow citizen to earn their money. Peoples' desire to receive the best deal requires a lot of effort to be more efficient than the competition. New business models and advancements in all areas flow fastest from the free market because many private sector businesses experiment and have legitimate competition. The best businesses stay in business with an eye on the rest looking to regain their market share of satisfying customers. Private Market Benefits |

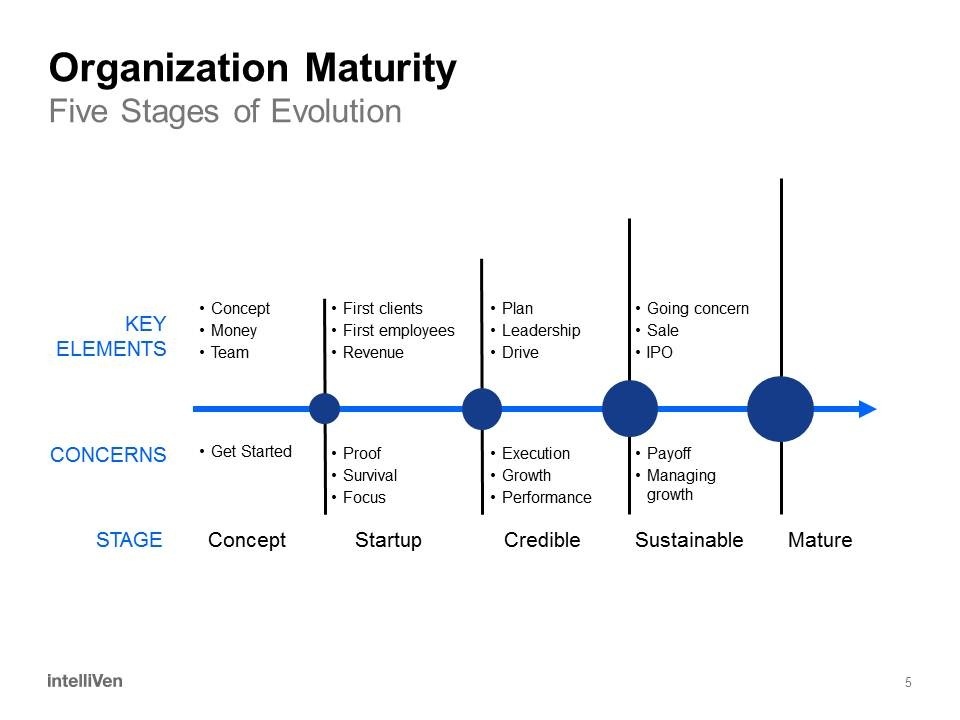

| Evolution Government provided services naturally evolve into greater government control, more dependent citizens, and complicated bureaucracies. Separation of powers, while important for reducing corruption, is not conducive to running an ever fluctuating and complicated organization. The free market naturally and by necessity exists to serve the people more efficiently, creating greater individual choices and reduced bureaucracies. |

| Evaluation Evaluation is vital for a business. It usually comes from profits and loss, customer acquisition, capital buildup, market share, or various other results. There are certain signs and patterns that demonstrate whether or not a business has potential and value. People have to risk their own money in this endeavor, which sharpens their focus on serving their fellow citizens. The government's evaluation of their services is much more opaque. Government services using tax payer funds crowd out private sector competition. Tax payer money from the general fund obscures the evaluation of benefits with the cost. Politicians using other taxpayer funds diffuses their focus on how best to serve their fellow citizen effectively. |