To get the best understanding of this economic point, please fully understand the Laffer Curve

|

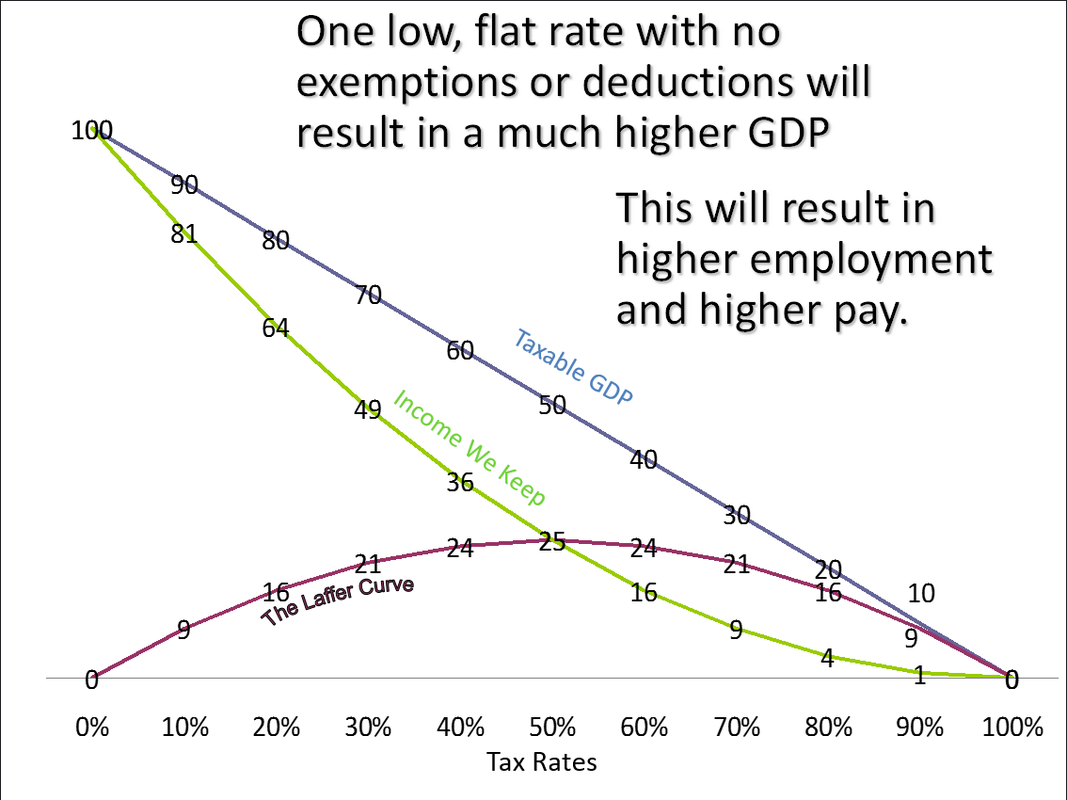

If the government needs $10 in tax revenue and has an economy of $100 the simple and best way forward is to collect a 10% tax. With the full comprehension of the Laffer Curve, we know that higher tax rates reduce economic activity. To get that $10 we need to tax at around 12% because the GDP of the economy has dropped about 12% to roughly $88.

|

|

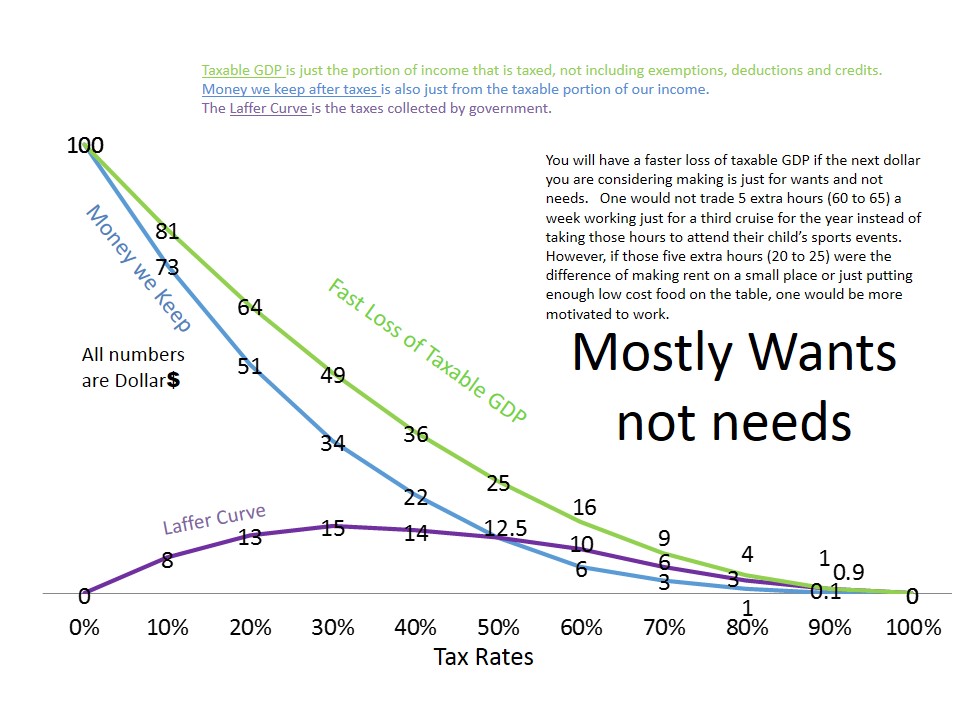

If we exempt or allow the deduction for the first 50% of peoples earnings; we now have an economy of $50, and taxing wants not needs. People are much more willing to work with a higher tax rate if their needs are not met. Once extra income is just for a third vacation in a year, higher tax rates disincentivize extra work hours.

We must now move to the faster loss taxable GDP Laffer Curve chart, and we see that the most we could collect after a 51% loss of economic activity (thus people’s earnings) is $15 at a 30% tax rate. Please note, $50 was the full taxable GDP after exemptions and credits; thus, we need to cut all the dollars in this chart in half. |

|

Watch the whole thing to get a better understanding of the Laffer Curve, although the lesson on deductions is at 7:25

|

|