The Structure of Education Reform

Competitive Governance within every geographic jurisdiction

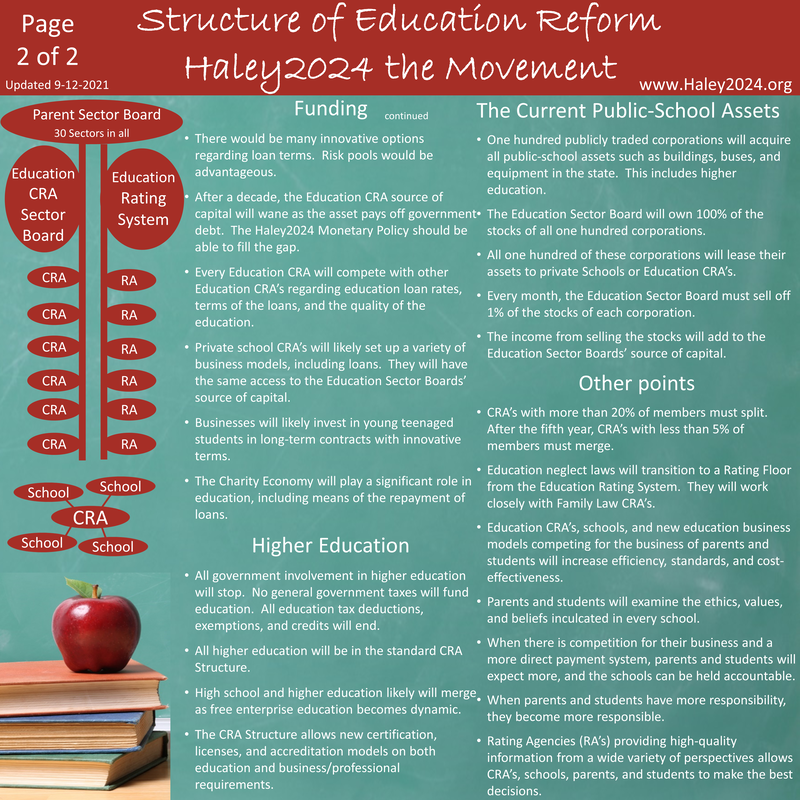

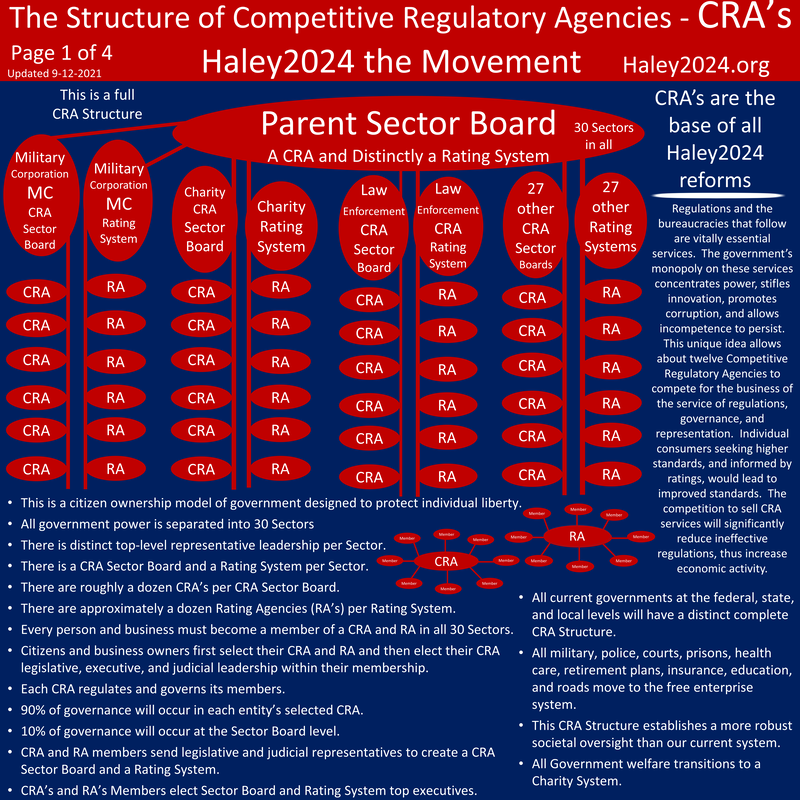

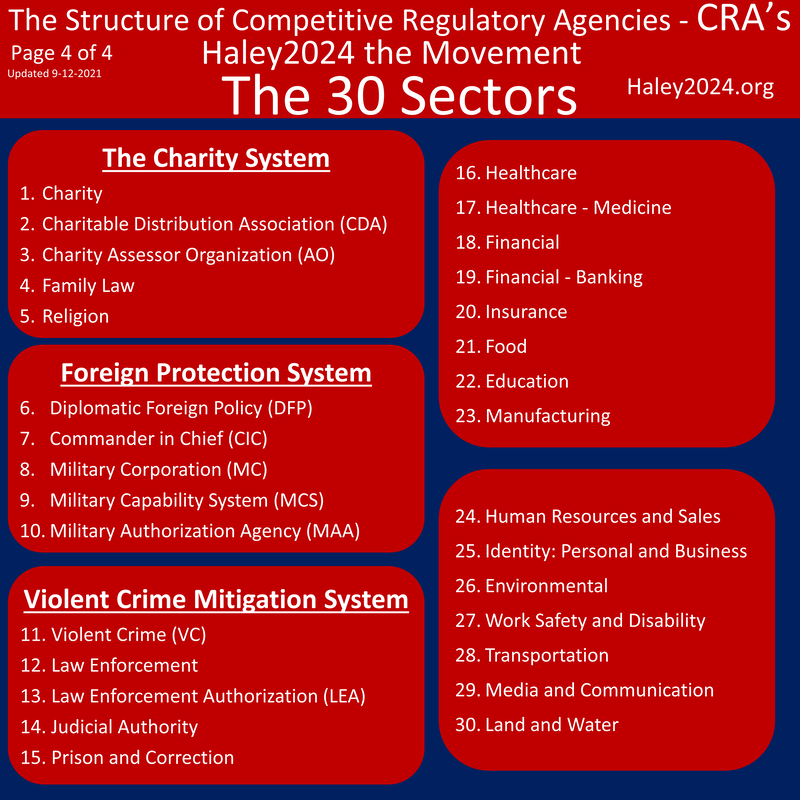

Before describing the structure of the education sector, one should fully understand the structure of CRA’s. Haley2024 proposes transitioning all government responsibilities into 30 sectors.

|

|

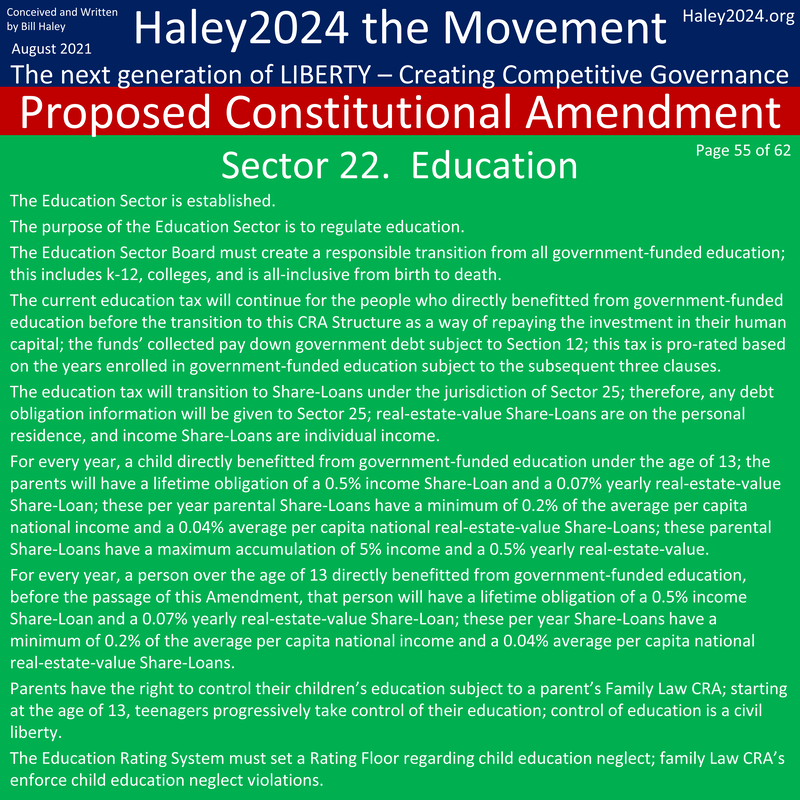

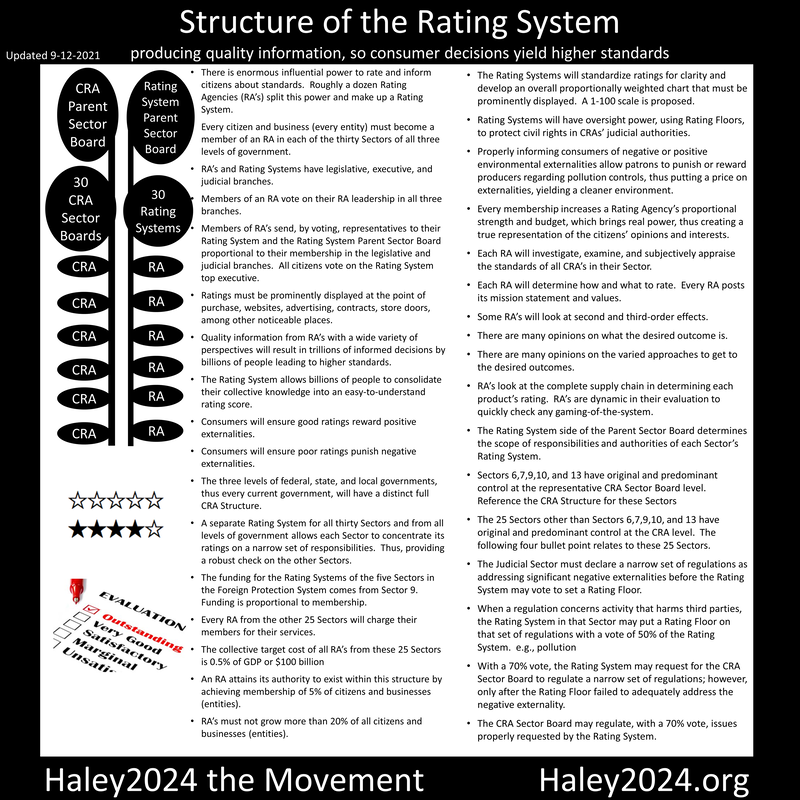

When CRA’s cannot suitably handle an issue at the CRA level; CRA’s send representatives proportionally to the Sector Board level to govern the full sector with a 70% rating system vote. Education should not require representative control.

It is essential to understand the basic structure of the system. All thirty sectors have a rating system that provides high-quality information that citizens can use to punish or reward negative and positive externalities. |

|

A healthy understanding of how all Sectors could transition to the CRA structure allows a better idea of how education could interact with other sectors. Identity, the charity system, and the financial sectors would likely intertwine with education.

|

|

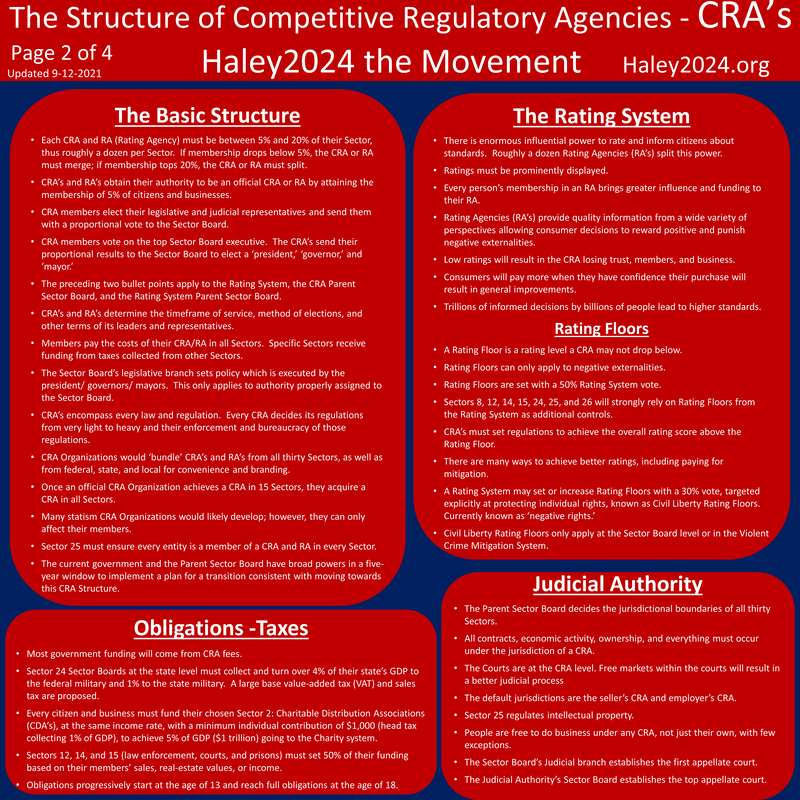

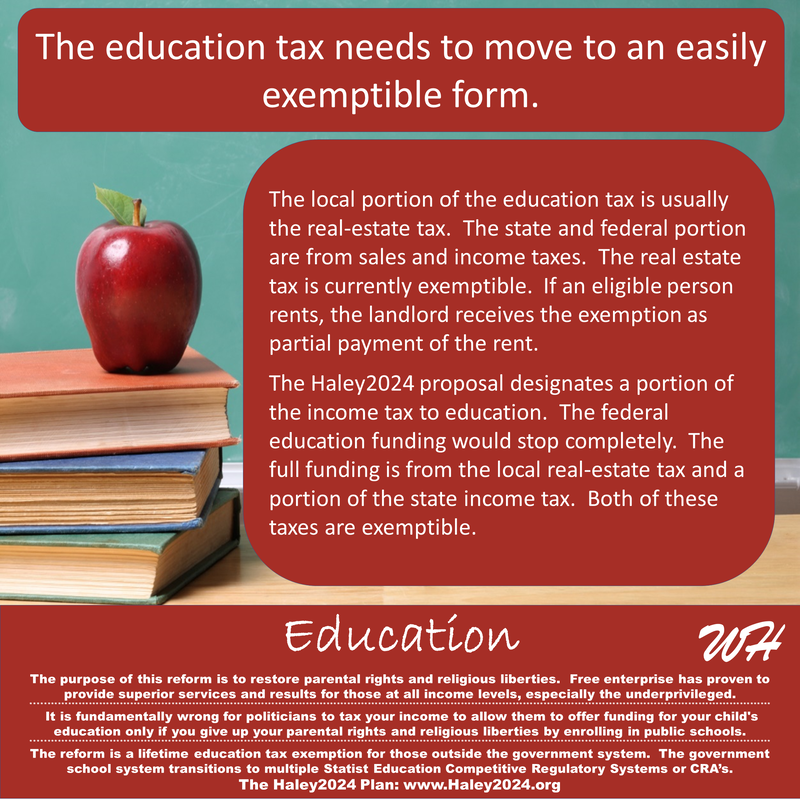

The education tax needs to move to an easily exemptible form.The local portion of the education tax is usually the real-estate tax. The state and federal portion are from sales and income taxes. The real estate tax is currently exemptible. If an eligible person rents, the landlord receives the exemption as partial payment of the rent.

The Haley2024 proposal designates a portion of the income tax to education. The federal education funding would stop completely. The full funding is from the local real-estate tax and a portion of the state income tax. Both of these taxes are exemptible. |

Parents that forwent or pledge to forgo, public school benefits for their children under 13 years old, will be exempt from 8% of the lifetime education tax for every year government did not spend money on them or pledge they will not, yet was eligible.One half of the education tax should be compensation as a result of the government funding a parent’s responsibility to educate their young children. The parents that did not accept government funding by way of enrollment in the Public School System should not have to pay half the lifetime education tax.

If the parents enrolled their children a percentage of the time, the parents would receive a percentage of the exemption to match. The parents are responsible for the lifetime education taxes or funding their children’s education outside the public school system until their child reaches the age of thirteen. |

Teenaged students that forwent public school benefits will be exempt from 8% of the lifetime education tax for every year government did not spend money on them, yet was eligible.One half of the education tax should be compensation as a result of the government funding a teenager’s responsibility to educate themselves. The teenagers that did not accept government funding by way of enrollment in the Public-School System should not have to pay half the lifetime education tax.

If the teen were enrolled a percentage of the time, the teen would receive a percentage of the exemption to match. The teen is responsible for the lifetime education taxes or funding their education outside the public school system starting at the age of thirteen. Indeed, parents could assist their teenagers. |

If a person does not or did not receive the benefit, they do not pay the tax.A Haley2024 principal is if a person can take care of their own expenses regarding the purpose of a government benefit, they should be exempt from the tax. With the exception of national defense, portions of criminal justice, and very few others, most people can take care of what government provides directly or through free enterprise. Education is indeed one of these areas.

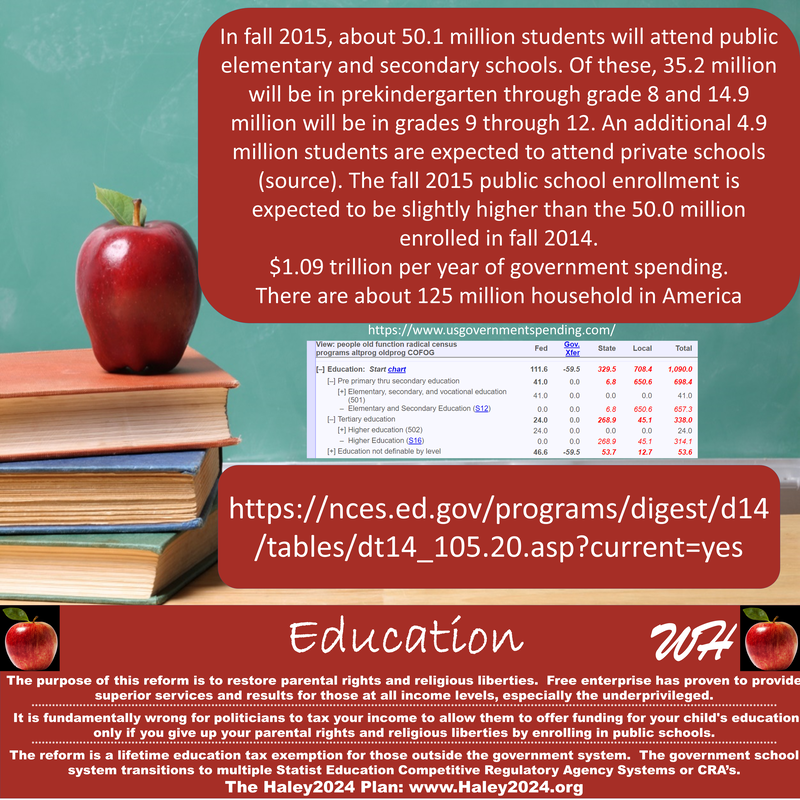

Over 10% of parents send their children to private schools, and over 1% teach their children directly. The roughly $8,000 average household education tax per year is a massive drain on many household budgets. Roughly $1 trillion of government education spending divided by 125 million households is $8,000 per year for life. If parents are exempt from this tax, they would be in a much better financial situation to pay for their own children’s education. |

The lifetime education tax will continue for twenty-five years and is turned over to the Education Sector Board.The government’s taxing and spending on education are almost the opposite of Social Security. The government pays for education first than taxes for the next fifty years as repayment. Social Security collects taxes for fifty years than funds retirement benefits.

The government already paid for the education of over 200 million people that should still compensate the government for that education. Ultimately, Haley2024 proposes the education taxes will help fund social security accounts as they transition to private free market retirement accounts. Until the full transition, the Education Sector Board will play a significant role. |

The education tax creates a source of capital for education loans.The education tax should yield about $900 billion a year, given the exemption of roughly 12% of the people for not enrolling in the public-school system. There is a separate Education Sector Board per state. Each state’s Education Sector Board would receive the tax revenue.

Those funds would be used as a source of capital for education loans to any Public-School Education Competitive Regulatory Agency. Multiple Public-School CRA’s will replace school boards. Parents and teenagers select to become a member of one of roughly six Public School CRA’s. The amount of tax revenue should cover all education loans from Public School CRA’s. |

Public school CRA’s can borrow from the Education Sector Board for current expenses and repay the loans with their parents/students education taxes.In the current system, education has current expenses, and then the government collects taxes for life. The Haley2024’s proposed system is similar in that Public Education CRA borrows money for current expenses, and then collects education taxes as repayments.

The Education Sector Board replaces government regarding funding and the collection of education taxes. Private education CRA’s could also access this source of capital and develop their own capital and possible loan terms. All loans go through financial institutions. |

Every public school CRA will transition over several years to set the education tax rate and terms for their new members and build up their own education CRA source of capital.The power and authority will quickly transition to each Public Education CRA. Each of the six-public education CRA’s set their own funding levels and tax rates. Six different examples will show sub-par, par, and excellent results regarding funding and taxing. An important factor is that each public education CRA is repaid by the students/parents that went through their CRA.

Additional funding now might result in higher education tax rates for their students/parents. The higher funding might lead to better education and earning potential, thus keeping tax rates down because of the increased tax base due to increased wages. Lower funding might yield decreased average incomes, and a decreased tax base, thus pushing tax rates up. |

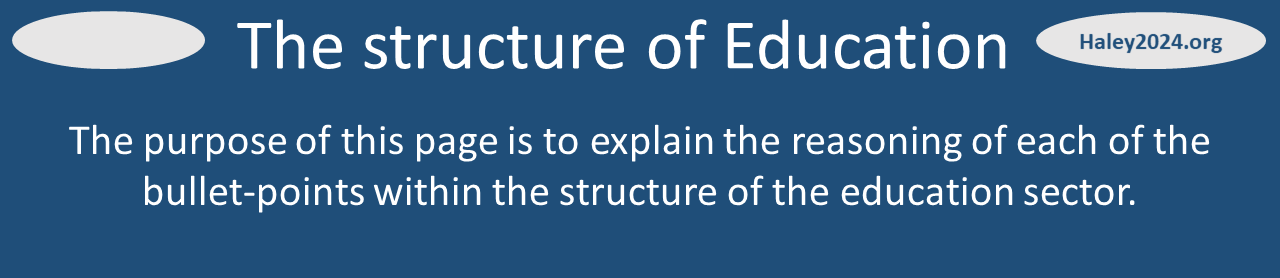

One hundred publicly traded corporations will acquire all public school assets such as schools, buses, and equipment in the state. The Education Sector Board will own 100% of the stocks of all one hundred corporations.A big issue is what happens to all the public-school assets. How should the public education CRA’s distribute the asset among all new CRA school boards? Should some of the assets go to private schools? There are trillions of dollars in buildings, buses, ball fields, equipment, among other assets.

Haley2024 proposes that the Education Sector Board for each state, set up one hundred publicly traded corporations. The current Public-School assets are divided equally among all one hundred corporations. The Education Sector Board is the source of capital, and these assets add to that source of capital. |

All one hundred of these corporations will lease out their assets.The role of prices will shine as it properly distributes all the assets. Public and private schools will need these assets. With a strong fiduciary duty to their corporation to stop abuse and corruption, leaders of these corporations are tasked with leasing out their assets to have the highest financial return.

Parents and teenaged students will have the ability to change their educational arrangements every year; therefore, there would be many growing, and shrinking issues in the early years. Leasing assets will be wise in the first few years. However, buying assets will soon make sense. Billions of decisions by millions of people will set prices and adequately distribute assets to their highest use. |

Every month the Education Sector Board must sell off 1% of the stocks of each corporation.To accurately assess and attain the true worth of educational assets; Haley2024 proposes that the education asset corporations sell off their stocks over a nine-year time frame to the public and education CRA’s.

These education asset corporations will all be on public trading markets. Parents could invest in these corporations. After 50% of the stocks are available on the public trading market in about five years, these corporations can go through mergers and acquisitions. Current state legislators will control voting rights on board of directors with rating system oversight until the stocks go public. |

The income from selling the stocks will add to the Education Sector Boards source of capital.The Education Sector owns the stocks, and the ownership of these stocks are part of the source of capital. Selling stocks in these corporations transitions the source of capital from stocks to currency, now directly deposited in the Education Sector Board.

This capital is leveraged for Current education expenses. Strong rating floors are set to reduce corruption on many fronts. Rating floors allow more business models from multiple CRA’s compared to one set of regulations that distort prices and free markets. |

After a decade, the remaining capital and ongoing cash flow to the Education Sector Board will pay off a portion of state debt created by the Social Security liabilities.As the Education Sector of all fifty states collects about a trillion a year in education taxes, they will accumulate a significant source of capital. Much of that capital transitions to loans to public school CRA’s. Some personal education loans and private school loans will utilize that capital as well.

Loans are assets as well. The Education Sector Board will start a transition out of loans after about a decade. Every education CRA will become interdependent with their financial partners. The assets, the ongoing education tax income, and the repayment of education loans fund individual retirement accounts created in the transition from Social Security to private accounts. |

Private school CRA’s will likely set up a variety of business models including loans.CRA’s are competitive by definition. Every private school education CRA will compete for the business of regulating every private school. Part of that set of regulations is facilitating finances. Many CRA’s will attempt various business models.

Many sources of capital will be available. Better ratings from the rating system will be essential to attain favorable interest rates. The factors are numerous; however, billions of decisions from millions of people will yield the ever-increasing standards and outcomes. |

Every parent of a student under 13 years old, every teenaged student, and every school becomes a member of one of roughly a dozen education CRA’s.As a condition of being a citizen of the state and the country, Haley2024 proposes that everyone starting at the age of 13 become a member of a CRA and RA in all 30 sectors.

Every education CRA will put out their educational philosophy, and every person would select the CRA that most closely matches their own. There are many factors involved such as religion, political, moral, ethical, and other aspects of worldview. |

Members vote on the leadership of THEIR education CRA.It is crucial that members solidify their education CRA’s philosophy by voting on the leadership of their CRA. Some CRA’s might micro-manage, and others will allow wide latitude for the schools under them.

Many education CRA’s and schools will have different approaches to music, sports, technical training, liberal-arts, among others. Many CRA’s will change the structure of education regarding hours in school versus hours at home. Some will introduce night classes to utilize classroom availability. Some CRA’s and schools will move to more online classes and others to computer AI to help teach. Certain highly popular and highly successful teachers will emerge online. The options are endless. |

The current Public-School System will start with six CRA’s. Private school and homeschool families will have six CRA’s to start. Public School CRA’s will replace school boards.During the transition, the current Public-School System will split into six public-school CRA’s, per state. Some of these would allow local units and others would stay state-based. These public school CRA’s would replace current state and local school boards.

Private and home schools start with six education CRA’s as well for the first five years. Many private schools and many in the homeschool community want to be left alone, so an education CRA with great liberty will gain many members. However, private school education CRA’s seeking and competing for a school’s membership could bring value within a school’s or parent’s philosophy and acquire members. |

Every parent of a child under the age of 13 and teenaged students enroll in the school they or their child wish to attend.Under the current Public-School System, parents are told where, how, what, when and who will teach their children. Without taking the huge financial penalty for leaving the government system, parents and teenage students have no choices, and very little say in their children’s or their education.

The undermining of many aspects of parental values is frequent and numerous. The current socialist system does not benefit from free enterprise. This Haley2024 education structure yields many business models competing for the business of every parent and teenaged student. |

Individuals, schools and CRA’s always reserve the right to reject an application or end any association.There is a large enough population of citizens that values never turning away a student. All it takes is 5% of citizens to control an education CRA. There are many respectable and admirable reasons why a school or education CRA might end their association with a parent or student.

The Freedom of Association is an important US Constitutional Right. While most people frown on discrimination, they also value their right to honorable discernment. The Education Rating System will use subjective determination in rating on this issue, yielding quality information. Everyone has a different value system. Everyone should allow others to live within his or her values, so everyone does not try to force everyone to live within one set of values. |

CRA’s above 20% of members must split. After the fifth year, CRA’s under 5% of members must merge.There is a five-year transition period where the normal range of 5%-20% is relaxed. The range starts at 1% to 50%; However, over the five years, the percentages narrow to the 5%-20 range. This time frame allows business model experimentation.

Indeed, the five to ten-year transition will see many changes, and phenomenal people in business will be of immeasurable value. A loss of membership points toward disappointing results and a growth in membership indicate success. |

One public school CRA must stay secular. However, all other education CRA’s, after the fifth year, now all private, may introduce or allow religion.One of the great detriments of the current Public-School System is the tall wall of separation of church and state removing religion from education. Indeed, the inculcation of a specific religion should not be forced by the government.

Likewise, the government should not ban parents from inculcating their religious beliefs by removing it from education. The hours of education is perhaps the most crucial time for the religious and moral inculcation. The current Public-Schools inculcate a worldview that many parents are not comfortable with or find offensive. Schools and education CRA’s will compete based on the worldview that is inculcated. |

Education neglect laws will transition to a rating floor from the Education Rating System.One of the significant reasons for the government take-over of education is that some parents did not educate their children. Government profoundly overreached by taking over the vast majority of the system. Socialism in education has created many problems and is oppressive.

The public at large has a vested interest in ensuring children are educated. The Education Rating System is given the responsibility to set rating floors. The RA’s have the needed ability to have dynamic ratings. The vast majority of students could have their school vouch for their progress. However, the small minority of children of concern could be referred to their family CRA and the charity system to make a plan for improvement. With a 70% vote from both the family and education rating system representatives, the RA’s will have real authority to force change. |

Education CRA’s competing for the business of parents and students will increase efficiency, standards, and cost-effectiveness.The current Public-School System spends an average of $10,000 to $20,000 per student. A public-school classroom of 20 students represents $200,000 to $400,000. Many business models would emerge driving down the cost and increasing the quality of education.

Billions of decisions by millions of people will produce the most cost-effective systems. Many parents and students value many matters regarding education. The financial cost is just one factor. Many CRA’s producing many education products and services will attract different customers. |

Parents and students will examine the ethics, values, and beliefs inculcated in every school.The most important part of education is what is being taught. Most people can agree that math, reading, and writing are essential. However, the ethics, values, and beliefs inculcated while learning to read are imperative. It is impossible not to teach a worldview; the attempt is teaching a neutral worldview.

Most parents want good morals and values taught. There is a vast gulf between people of what is moral and what is good values. Given that the wall of the separation of church and state casts a dark shadow over the current Public School System; God’s light of truth is blocked from shining on the students. Many parents believe teaching morals void of their foundation in the Bible is depraved. |

Parents and students will expect more when there is competition for their business and a more direct payment system.When people pay taxes into a general government fund and government funds many programs out of that fund; people have a hard time connecting the taxes to the benefits. It is a well-known economic fact that people spend their own money on services they directly receive much more carefully than politicians providing government benefits.

In government, the needed care and attention is not present. When parents and students can take their hard-earned money to other schools, they expect more. When they demand more services, they realize the money for those additional services is being charged directly to them. |

ALL government involvement in higher education will stop. No general government taxes will fund education. All education tax deductions and credits will stop.For this transition to be the most successful, the current government system must stop completely. Any involvement only disrupts the role of prices. Means-tested benefits encourage people to be within the government-mandated income levels to gain benefits.

These means-tested benefits often create dangerous benefit cliffs and unhealthy government dependency. Tax deductions, exemptions, and credits drive up tax rates which increase the discouragement of doing the taxable activity. These tax features negatively interfere with the role of prices, yielding inferior results. |

All higher education will be in the normal CRA structure.Everything above also applies to higher education, other than there is no public higher education CRA’s. The private education CRA’s would handle higher education. The Education Sector Board will own all the stock of all public higher education assets and sell them off at 1% a month.

The colleges or students would be able to tap into the source of capital. Schools or individuals would have to apply for the loans through financial institutions. Many banks would have various terms. These banks would all seek to ensure the education is resulting in additional earning potential as a way to ensure repayment. |

The CRA structure allows new certification and accreditation models both on the education side and the business/professional requirement side.All laws regarding certifications, degrees, and other accreditations to work in certain professions would transition to competitive regulations of CRA’s of the appropriate sector. New higher-education/business models will lower cost and increase efficiency. New certifications models could allow more work/education/apprenticeship models.

|

When parents and students have more responsibility, they become more responsible.Fundamental human nature is that if someone or some organization takes over a person’s responsibility, they become less responsible in the area taken over. If parents need to spend their hard-earned money directly on their children’s education, they start to increase their attention in that area.

In the current Public School System, parents vote for the school board and can only make comments at school board meetings. Parents can not freely change their children’s school. The government removes most of the parent’s responsibility. The Haley2024 structure ensures every child receives an education without taking away the parental responsibility. |

Businesses will likely invest in young teenaged students in long-term contracts with innovative terms.A business or business trade association might fund the education of a young teenager in a long-term contract where the teenager agrees to work in that business or trade. Many new terms could develop. Parents of the teenager would likely demand terms of a more well-rounded high school type classes.

The rating system would yield high-quality information so businesses could develop advantageous terms. Parents and teenagers need to see the good ratings of a successful model. Many businesses currently site the lack of appropriate knowledge of high school graduates. Businesses or trade groups could fund programs that yield the correct knowledge. |

The Charity Economy will play a large role in education.The charity economies would play several roles in education. First, most adults have the knowledge to tutor children. When someone needs to provide services into the economy, tutoring or mentoring needs would be abundant. When a parent needs services for their child or teen, an abundant supply of tutors and mentor would be available. The role of prices in the charity economy would even out the supply and demand.

The second role of the charity economy is by being a part of the terms of an education loan. When someone is without a job, thus not paying back the loan; the terms could state a certain number of hours need to be worked in the charity economy. |

|

|

|