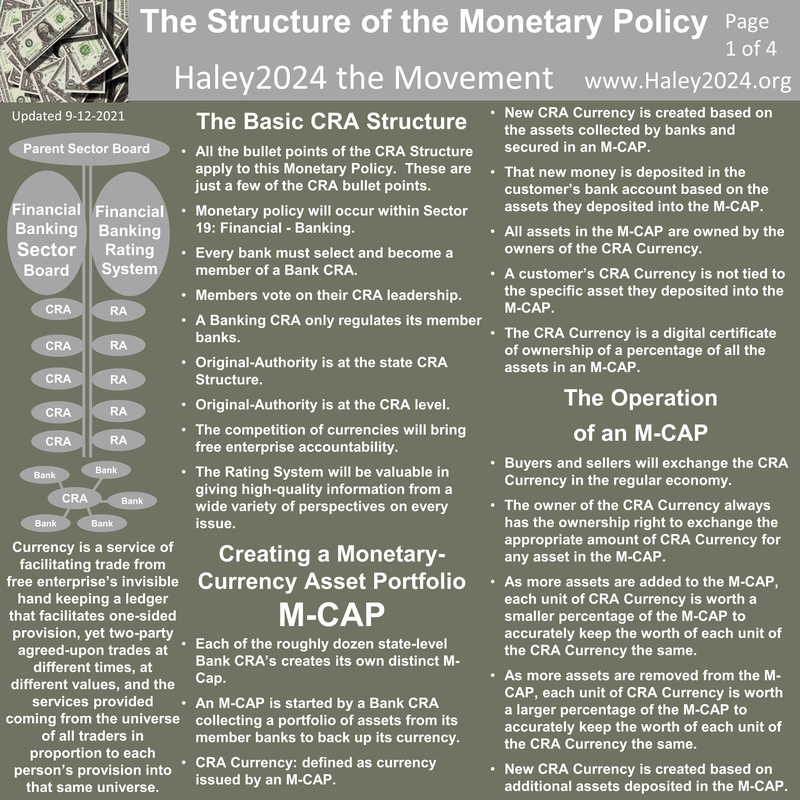

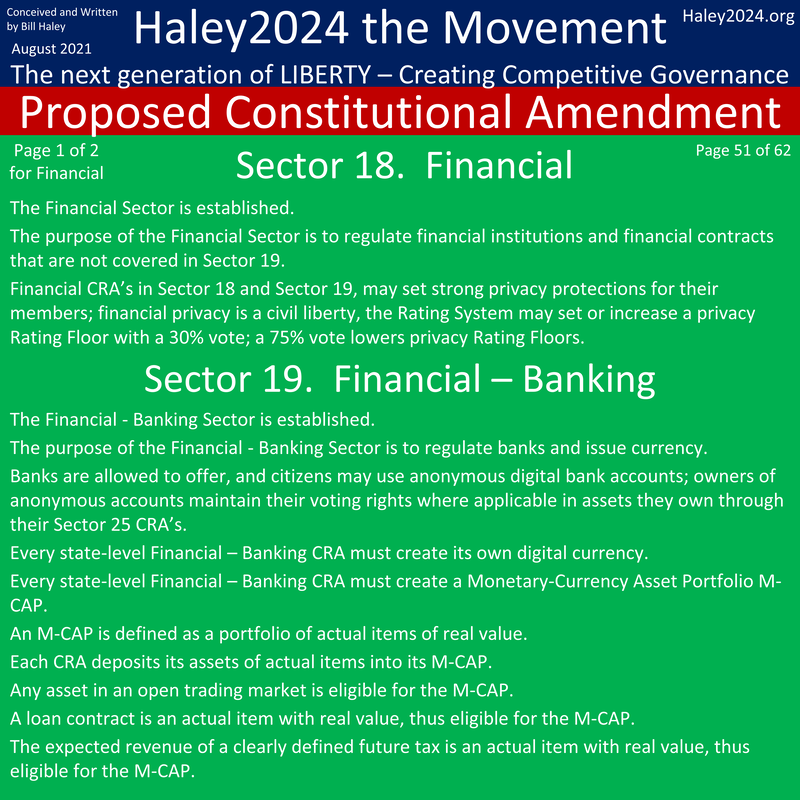

The two Financial Sectors

Competitive Governance within every geographic jurisdiction

|

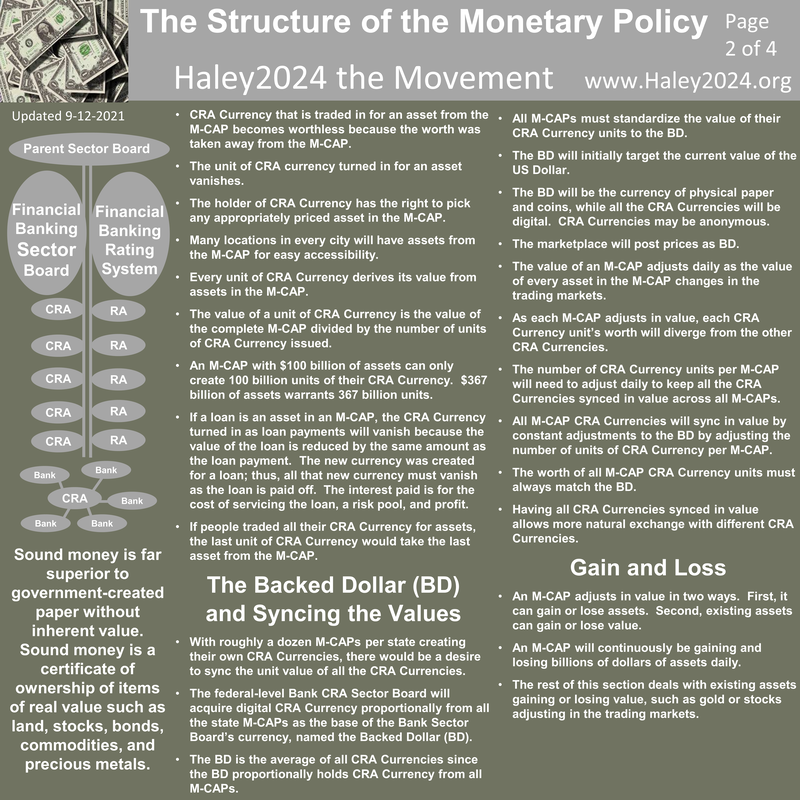

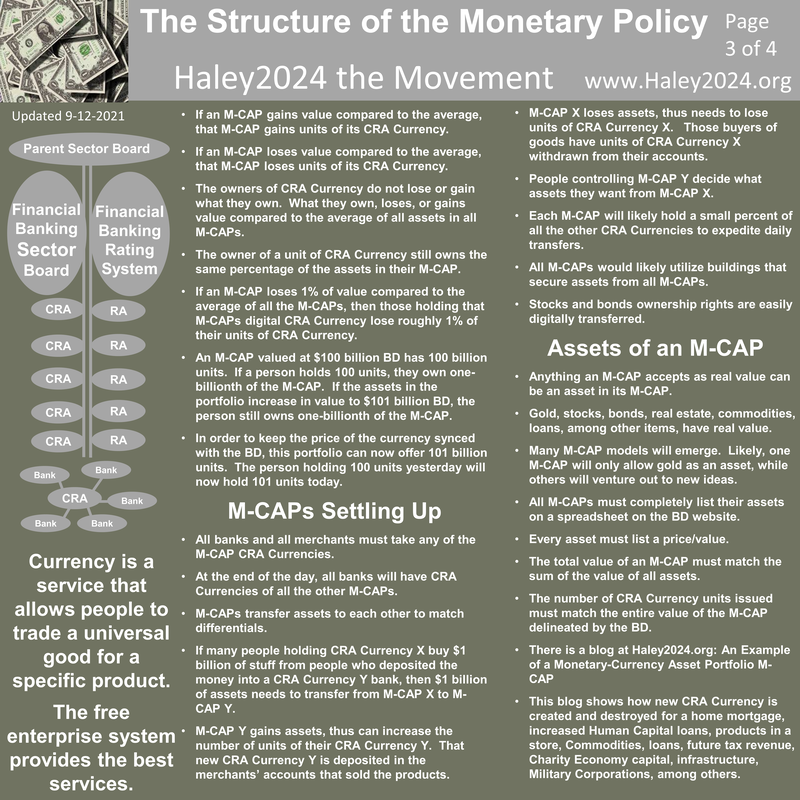

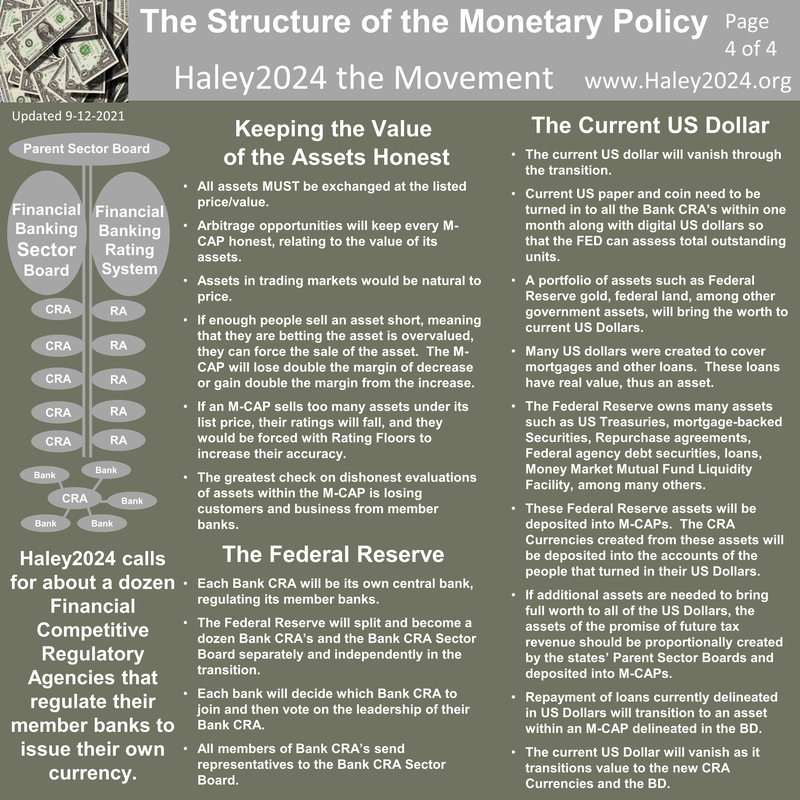

The Haley2024 CRA Structure separates all government power into thirty Sectors with distinct leadership per Sector. Financial regulations will have two Sectors. Banking and money will be one Sector, and all other financial regulations would fall under another Sector. Each Sector is made up of roughly a dozen Competitive Regulatory Agencies (CRA's). Every bank chooses which Financial Banking CRA to join. Every CRA regulates its members.

|

|

There is a lot of financial regulations that occur outside of banking and currency; Sector 18 Financial-Non-Banking deals with those regulations. There is currently one set of financial laws and regulations created by politicians. It is hard to see counterfactuals of different sets of regulations because we only live down one timeline. People and businesses have to follow all laws regardless if some of the laws are ineffective and hostile.

|

|

If society adopts the CRA Structure, everybody and every business will pick which set of regulations they wish to be regulated by out of about a dozen Financial CRA’s. Every CRA would be rated by the Haley2024 Rating System giving consumers quality information regarding its standards. Consumers want to do business with well regulated financial institutions and will punish businesses with low standards and reward businesses with high standards. Consumers, if well informed, always cause business standards to increase.

|

|

The banking Sector will regulate banks. The current Dodd-Frank set of banking regulations is said by many to protect banking customers, while others claim the monopoly set of regulations have adverse and detrimental effects. The CRA Structure allows banks to pick their regulators. Customers armed with quality information from Rating Agencies they trust will prefer higher rated banks over lower-rated banks; thus banks seeking customers would seek higher standards.

|

|

The left claims they are ‘protecting’ the little guy when the reality is that the free enterprise system forces financial companies to serve their customers well to get the peoples’ business. Every Banking CRA makes its own decisions regarding ‘FDIC’ protections; however, no CRA may make a claim on bailout money outside their CRA. CRA’s can contract with insurance companies for deposit insurance.

|

|

Failure is a critically required part of banking. Failures show what not to do and limit those that continually fail from the control of additional capital. Society currently has a massive problem of failed regulation staying on the books to do more damage. Banks currently do not have legal alternatives sets of regulation. Under the CRA Structure, there would not be one central bank, rather every CRA would act as their own central bank. Every bank chooses what CRA they will belong to, and every person will choose the bank they wish to bank with. Just like phones are improved by splitting up the monopoly in 1984, so will financial regulations.

|

|

The Financial Sectors would benefit significantly from Competitive Regulatory Agencies. These many CRA's would regulate differently, and people would, with the help of ratings, choose which banks to do business with. The different ways of regulating would clearly show success and failure. Bankruptcy laws will be at the CRA level. The 1977 Community Reinvestment Act is continuously being debated about whether it was good or bad for the economy, and there is no counter-factual to look at.

|

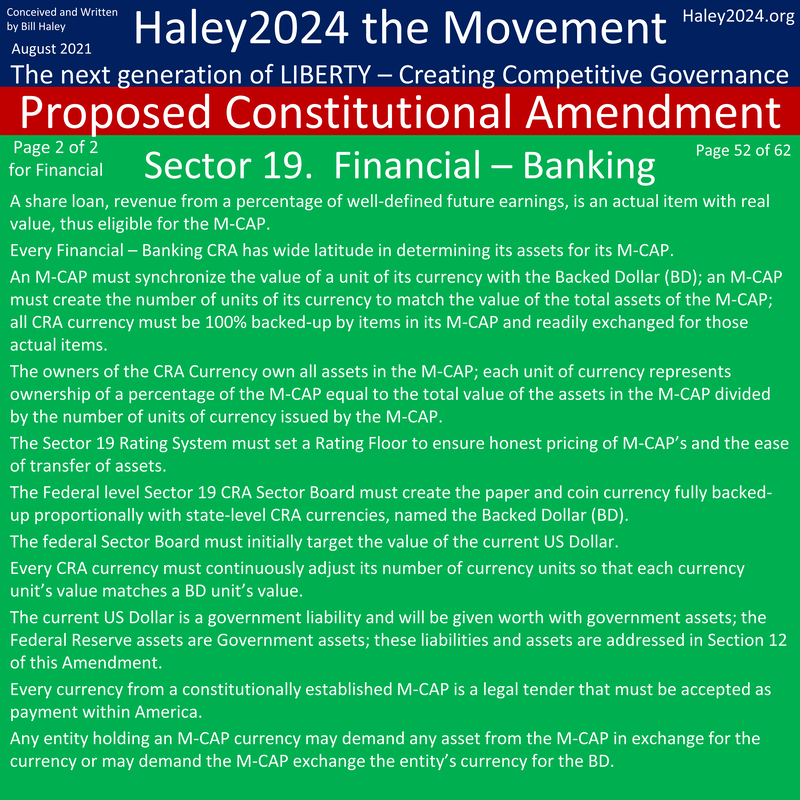

Monetary Policy

Please look at the Haley2024 Monetary Policy for a unique way of dealing with currency.

Having competitive Rating Agencies will be vital here because people have such varying views on the desired results.

Allow progressives to control some CRAs and conservatives to control other CRA’s. Of course, many others will become trusted by a certain percentage of the population as well. The best will continue to be surpassed, and standards and results will continuously increase.

Allow progressives to control some CRAs and conservatives to control other CRA’s. Of course, many others will become trusted by a certain percentage of the population as well. The best will continue to be surpassed, and standards and results will continuously increase.