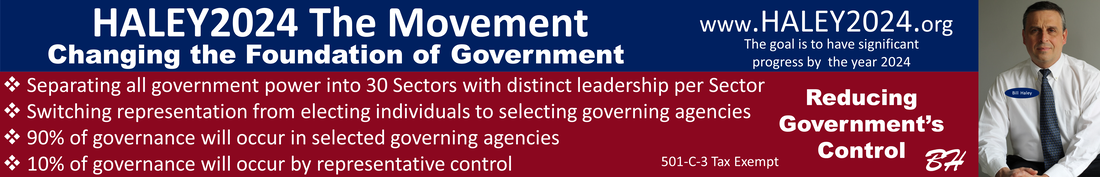

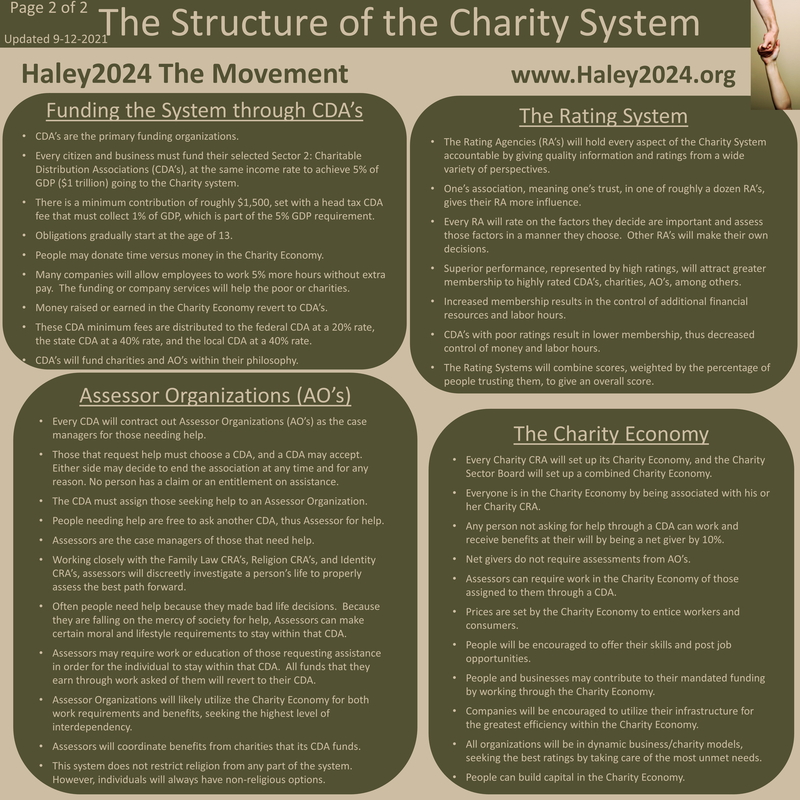

The Charitable Distribution Association - CDA Sector

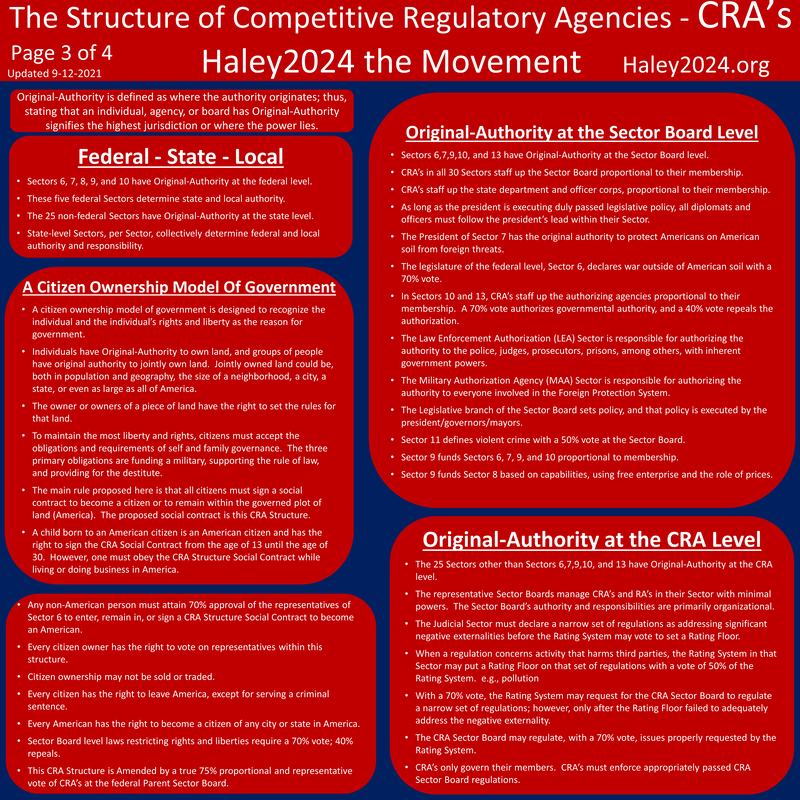

Competitive Governance within every geographic jurisdiction

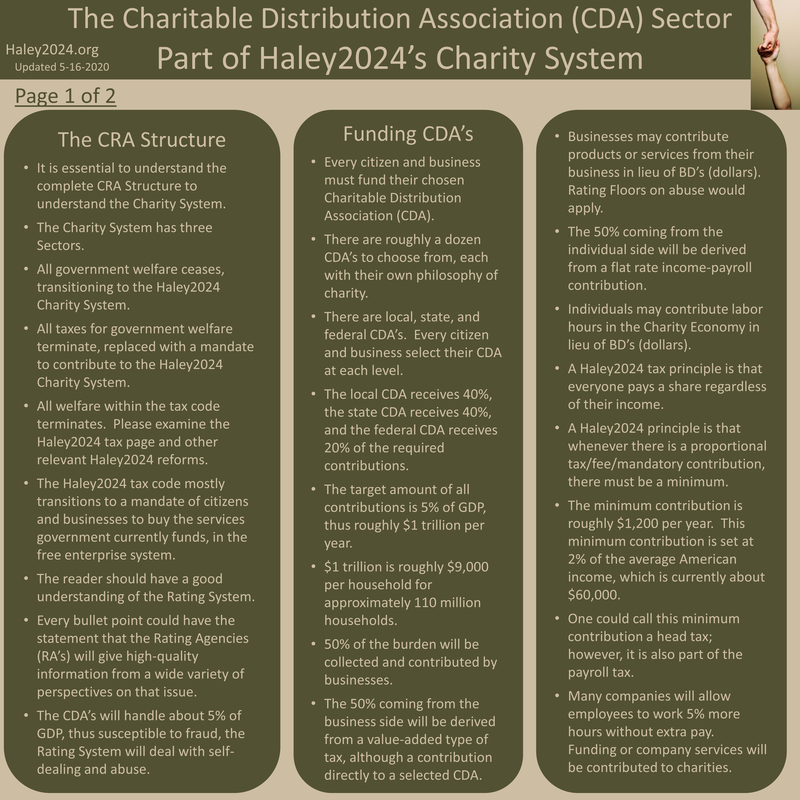

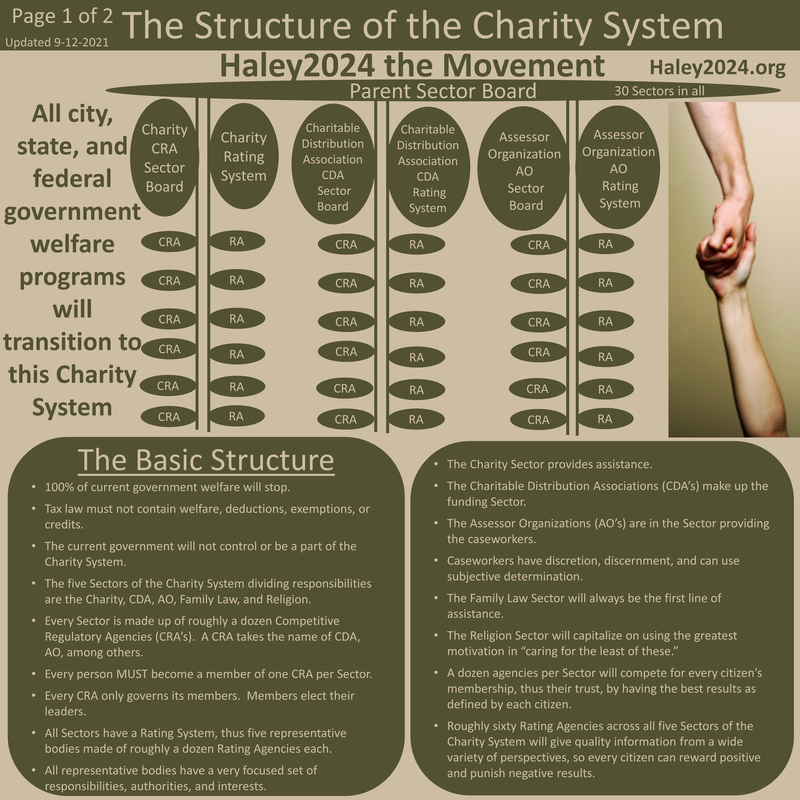

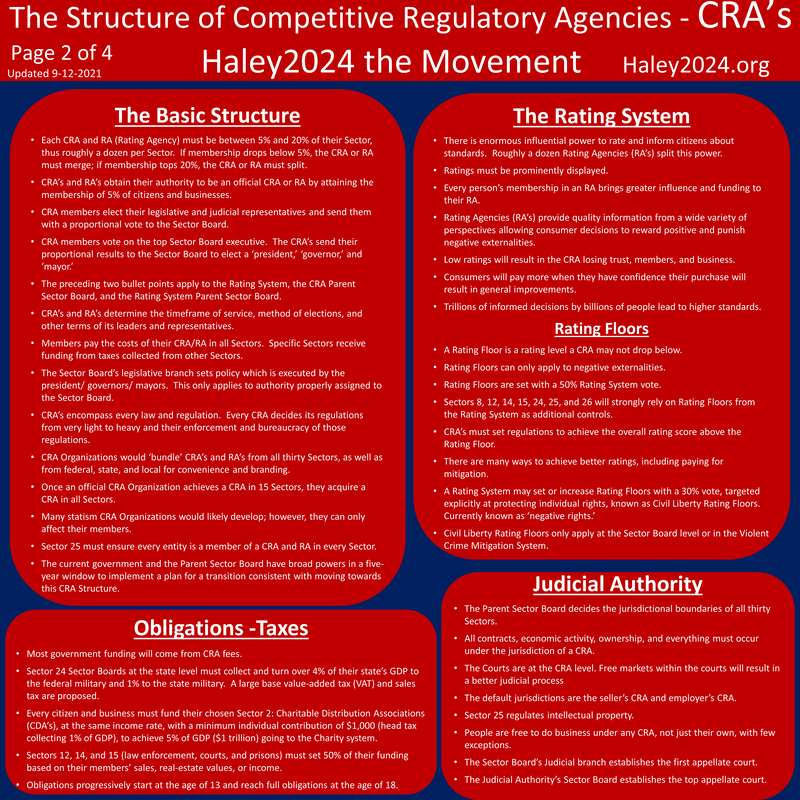

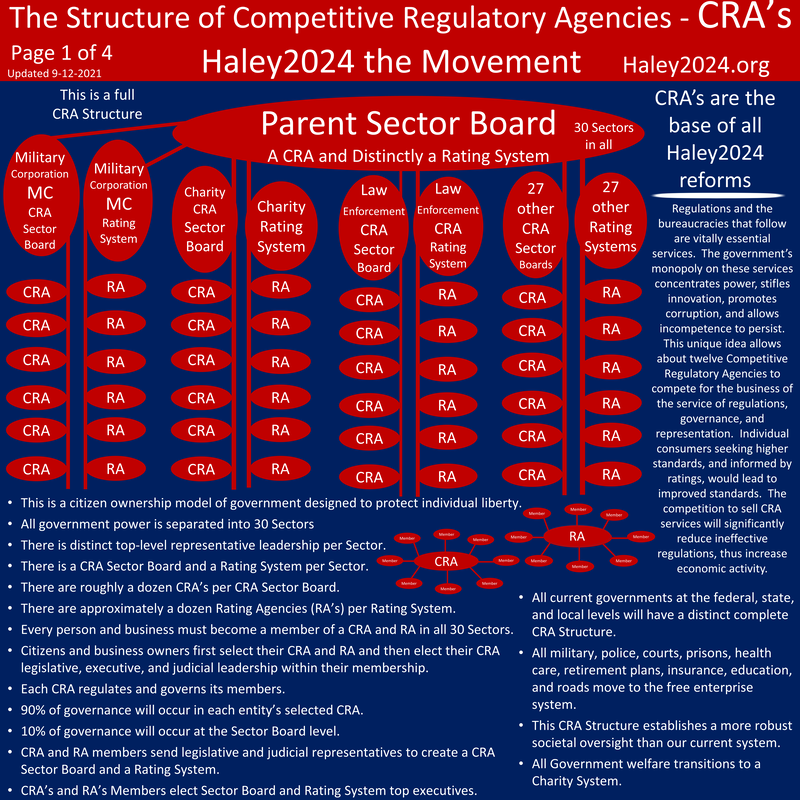

The CRA Structure

•It is essential to understand the complete CRA Structure to understand the Charity System.

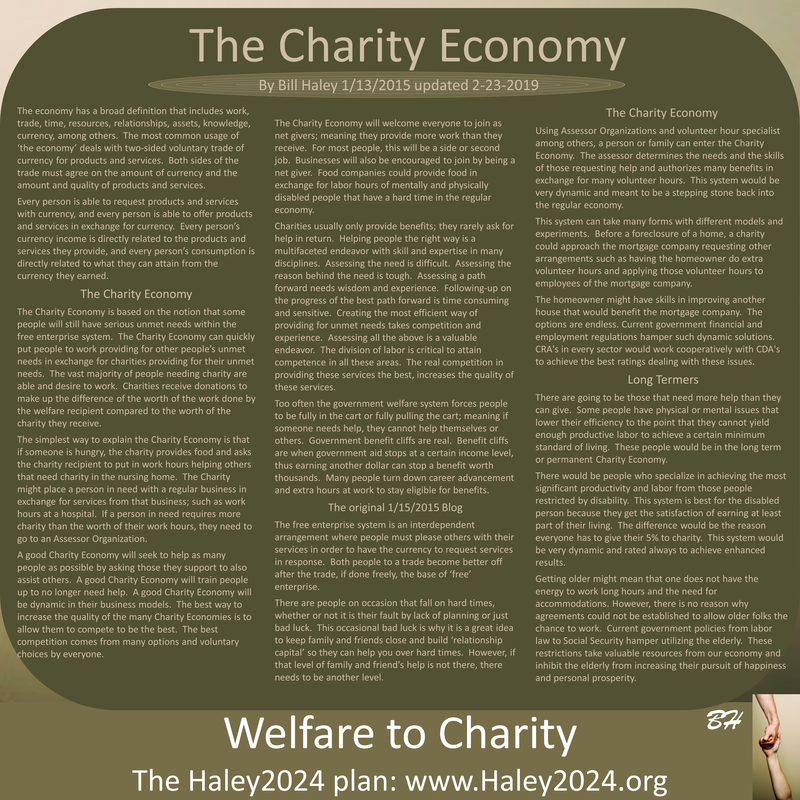

•The Charity System has three Sectors. •All government welfare ceases, transitioning to the Haley2024 Charity System. •All taxes for government welfare terminate, replaced with a mandate to contribute to the Haley2024 Charity System. |

|

•All welfare within the tax code terminates. Please examine the Haley2024 tax page and other relevant Haley2024 reforms.

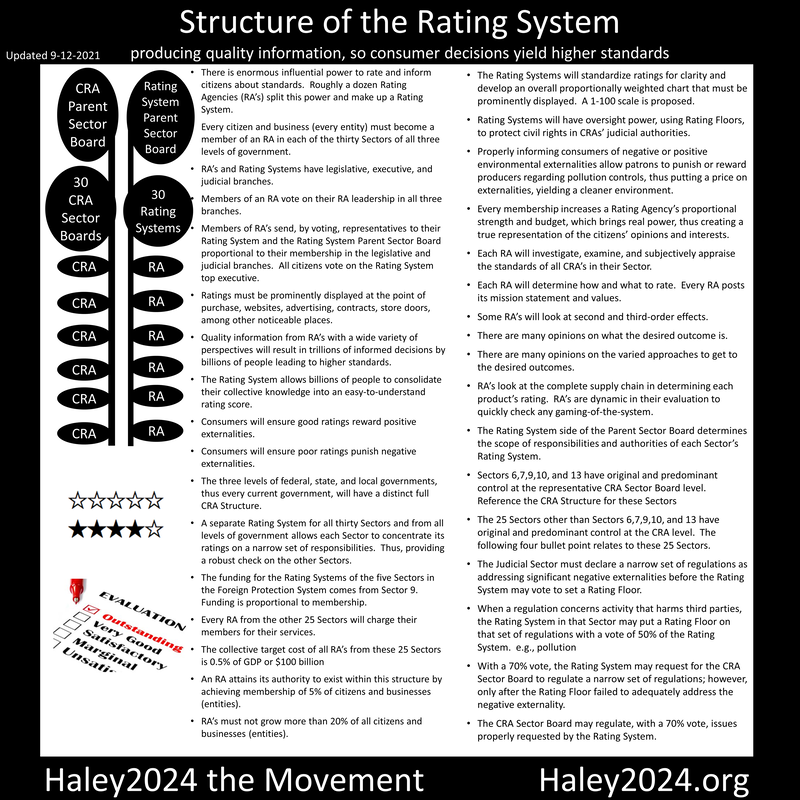

•The Haley2024 tax code mostly transitions to a mandate of citizens and businesses to buy the services government currently funds, in the free enterprise system. •The reader should have a good understanding of the Rating System. •Every bullet point could have the statement that the Rating Agencies (RA’s) will give high-quality information from a wide variety of perspectives on that issue. •The CDA’s will handle about 5% of GDP, thus susceptible to fraud, the Rating System will deal with self-dealing and abuse. |

Funding CDA’s

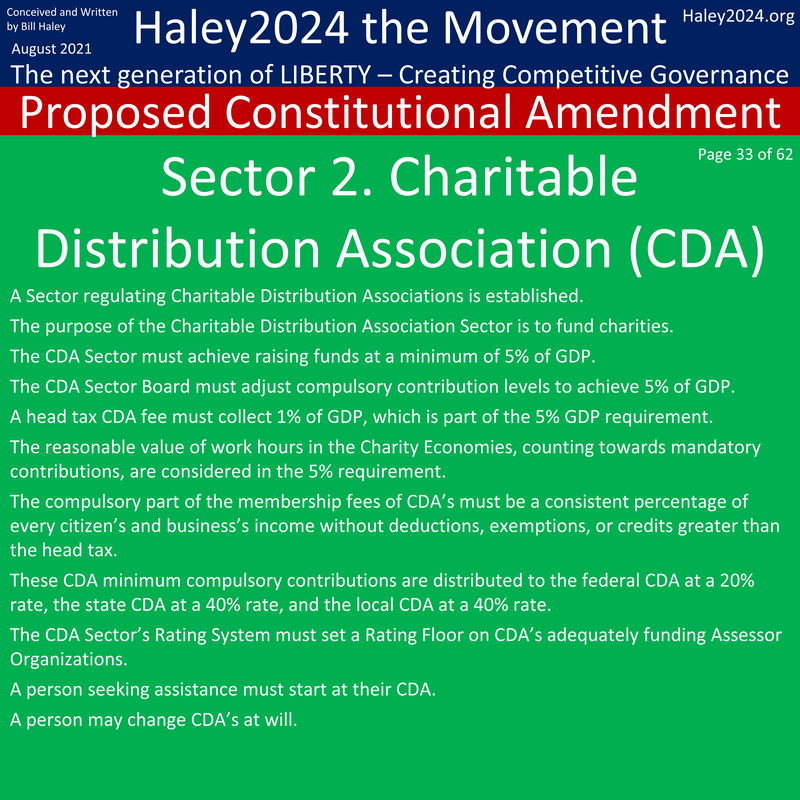

•Every citizen and business must fund their chosen Charitable Distribution Association (CDA).

•There are roughly a dozen CDA’s to choose from, each with their own philosophy of charity. •There are local, state, and federal CDA’s. Every citizen and business select their CDA at each level. •The local CDA receives 40%, the state CDA receives 40%, and the federal CDA receives 20% of the required contributions. •The target amount of all contributions is 5% of GDP, thus roughly $1 trillion per year. •$1 trillion is roughly $9,000 per household for approximately 110 million households. |

|

•50% of the burden will be collected and contributed by businesses.

•The 50% coming from the business side will be derived from a value-added type of tax, although a contribution directly to a selected CDA. •Businesses may contribute products or services from their business in lieu of BD’s (dollars). Rating Floors on abuse would apply. •The 50% coming from the individual side will be derived from a flat rate income-payroll contribution. •Individuals may contribute labor hours in the Charity Economy in lieu of BD’s (dollars). •A Haley2024 tax principle is that everyone pays a share regardless of their income. |

|

•A Haley2024 principle is that whenever there is a proportional tax/fee/mandatory contribution, there must be a minimum.

•The minimum contribution is roughly $1,200 per year. This minimum contribution is set at 2% of the average American income, which is currently about $60,000. •One could call this minimum contribution a head tax; however, it is also part of the payroll tax. •Many companies will allow employees to work 5% more hours without extra pay. Funding or company services will be contributed to charities. |

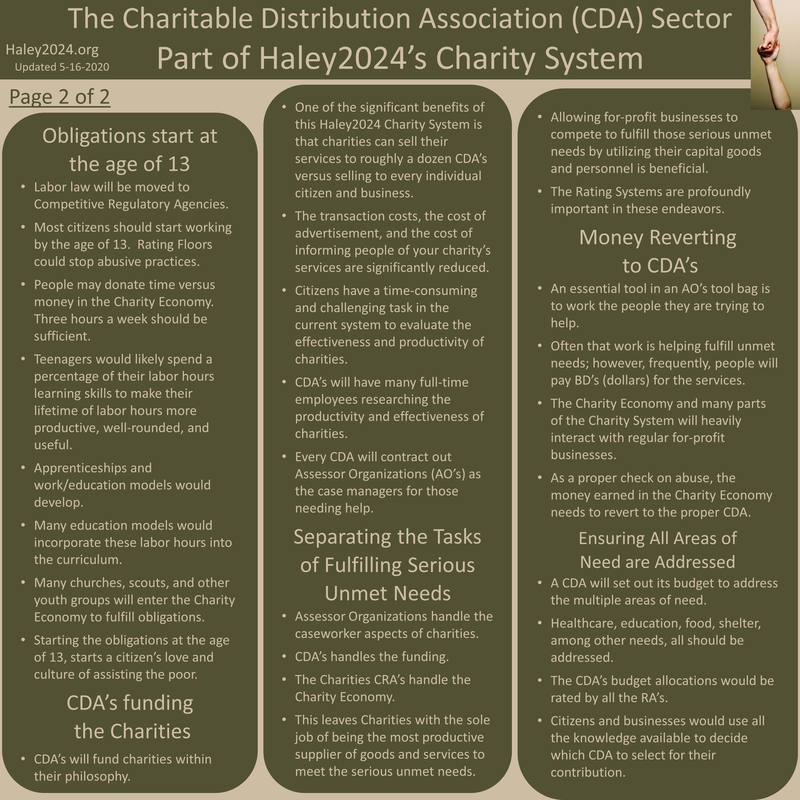

Obligations start at the age of 13

•Labor law will be moved to Competitive Regulatory Agencies.

•Most citizens should start working by the age of 13. Rating Floors could stop abusive practices. •People may donate time versus money in the Charity Economy. Three hours a week should be sufficient. •Teenagers would likely spend a percentage of their labor hours learning skills to make their lifetime of labor hours more productive, well-rounded, and useful. •Apprenticeships and work/education models would develop. •Many education models would incorporate these labor hours into the curriculum. •Many churches, scouts, and other youth groups will enter the Charity Economy to fulfill obligations. •Starting the obligations at the age of 13, starts a citizen’s love and culture of assisting the poor. |

CDA’s funding the Charities

•CDA’s will fund charities within their philosophy.

•One of the significant benefits of this Haley2024 Charity System is that charities can sell their services to roughly a dozen CDA’s versus selling to every individual citizen and business. •The transaction costs, the cost of advertisement, and the cost of informing people of your charity’s services are significantly reduced. •Citizens have a time-consuming and challenging task in the current system to evaluate the effectiveness and productivity of charities. •CDA’s will have many full-time employees researching the productivity and effectiveness of charities. •Every CDA will contract out Assessor Organizations (AO’s) as the case managers for those needing help. |

Separating the Tasks of Fulfilling Serious Unmet Needs

•Assessor Organizations handle the caseworker aspects of charities.

•CDA’s handles the funding. •The Charities CRA’s handle the Charity Economy. •This leaves Charities with the sole job of being the most productive supplier of goods and services to meet the serious unmet needs. •Allowing for-profit businesses to compete to fulfill those serious unmet needs by utilizing their capital goods and personnel is beneficial. •The Rating Systems are profoundly important in these endeavors. |

Money Reverting to CDA’s

•An essential tool in an AO’s tool bag is to work the people they are trying to help.

•Often that work is helping fulfill unmet needs; however, frequently, people will pay BD’s (dollars) for the services. •The Charity Economy and many parts of the Charity System will heavily interact with regular for-profit businesses. •As a proper check on abuse, the money earned in the Charity Economy needs to revert to the proper CDA. |

Ensuring All Areas of Need are Addressed

•A CDA will set out its budget to address the multiple areas of need.

•Healthcare, education, food, shelter, among other needs, all should be addressed. •The CDA’s budget allocations would be rated by all the RA’s. •Citizens and businesses would use all the knowledge available to decide which CDA to select for their contribution. |