| Education builds a person’s potential to earn a more significant income. Human capital is something of real worth. Currency is backed up by a wide variety of things of real worth. A person’s increased human capital should be considered as part of the base of currency under Haley2024’s Monetary Policy. People who own the currency has part ownership in that educated person’s increased income. |

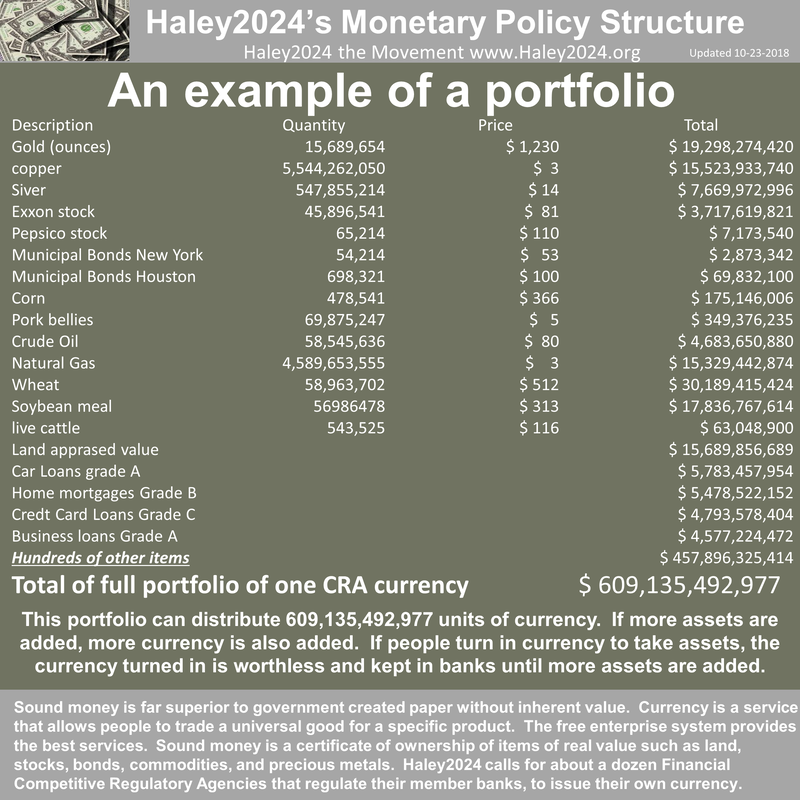

| Under Haley2024’s system of multiple competing currencies, every Financial CRA would decide what items of real value back up their currency. A good understanding of Competitive Regulatory Agencies (CRA’s), and Financial CRA's are helpful. The educated person is in reality trading a percentage of their lifetime income for increased education that leads to increased income. |

| As a person is educated, a long-term durable service-ability is being created and gaining worth. A bank would recognize the value and create currency reflecting that value. The person’s potential income becomes part of the worth that backs up the currency. The owners of the currency would have a real ownership interest in the person’s additional earning potential, exercised by the bank |

| The human capital contract would state that worth is really future labor equaling the dollar (BD) value or percentage agreed upon in the loan. The future earnings are collateral. Each bank and Financial CRA would have guidelines on these. Given that each currency would be on the trading market, everyone would determine the value of the items backing up the currency. The Haley2024 Monetary System allows every item in a monetary portfolio to be on a trading market. |

| If a person wishes to take time raising children, specific policies could apply such as taking a percentage of pay for the wage earner in the family. The possibilities are endless to work these out in the free enterprise system. CRA’s have judicial authority to ensure people respect the rights of others |

| Under Haley2024 reforms, the government reduces control over education, yielding responsibilities and authorities to the free enterprise system. A possible business model for higher education institutions would be to cover the college cost in exchange for 5%-20% of a student’s future income. This business model could provide incentives for colleges to provide better education that yields better job skills. Many varieties of contracts will emerge. |