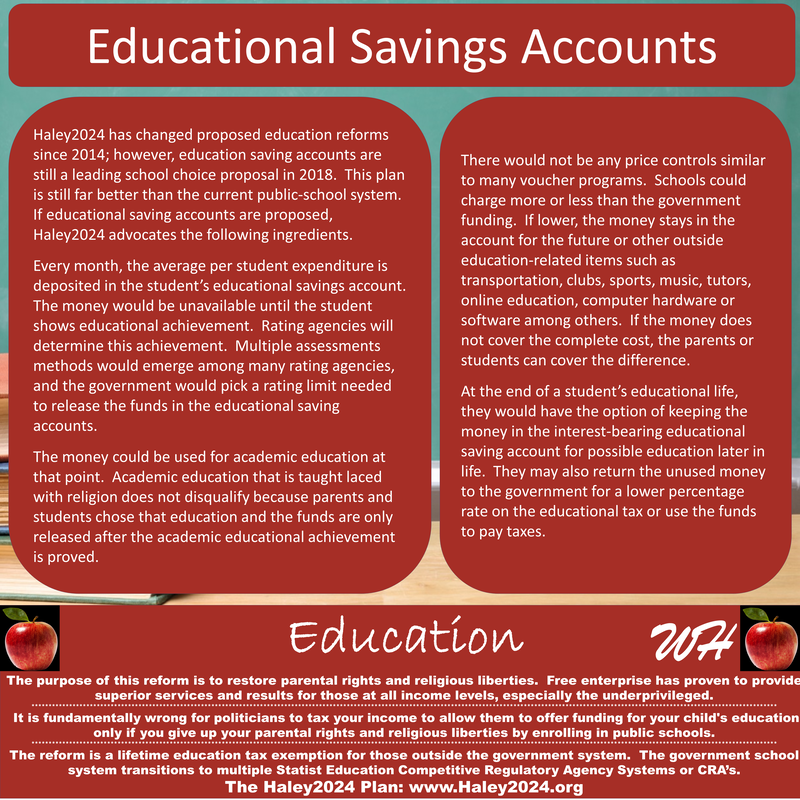

| Haley2024 has changed proposed education reforms since 2014; however, education saving accounts are still a leading school choice proposal in 2018. This plan is still far better than the current public school system. If educational saving accounts are proposed, Haley2024 advocates the following ingredients. |

| Every month, the average per student expenditure is deposited in the student’s educational savings account. The money would be in unavailable until the student shows educational achievement. Rating agencies will determine this achievement. Multiple assessments methods would emerge among many rating agencies, and the government would pick a rating limit needed to release the funds in the educational saving accounts. |

| There would not be any price controls similar to many voucher programs. Schools could charge more or less than the government funding. If lower, the money stays in the account for the future or other outside education-related items such as transportation, clubs, sports, music, tutors, online education, computer hardware or software among others. If the money does not cover the complete cost, the parents or students can cover the difference. |

| At the end of a student’s educational life, they would have the option of keeping the money in the interest-bearing educational saving account for possible education later in life. They may also return the unused money to the government for a lower percentage rate on the educational tax or use the funds to pay taxes. |