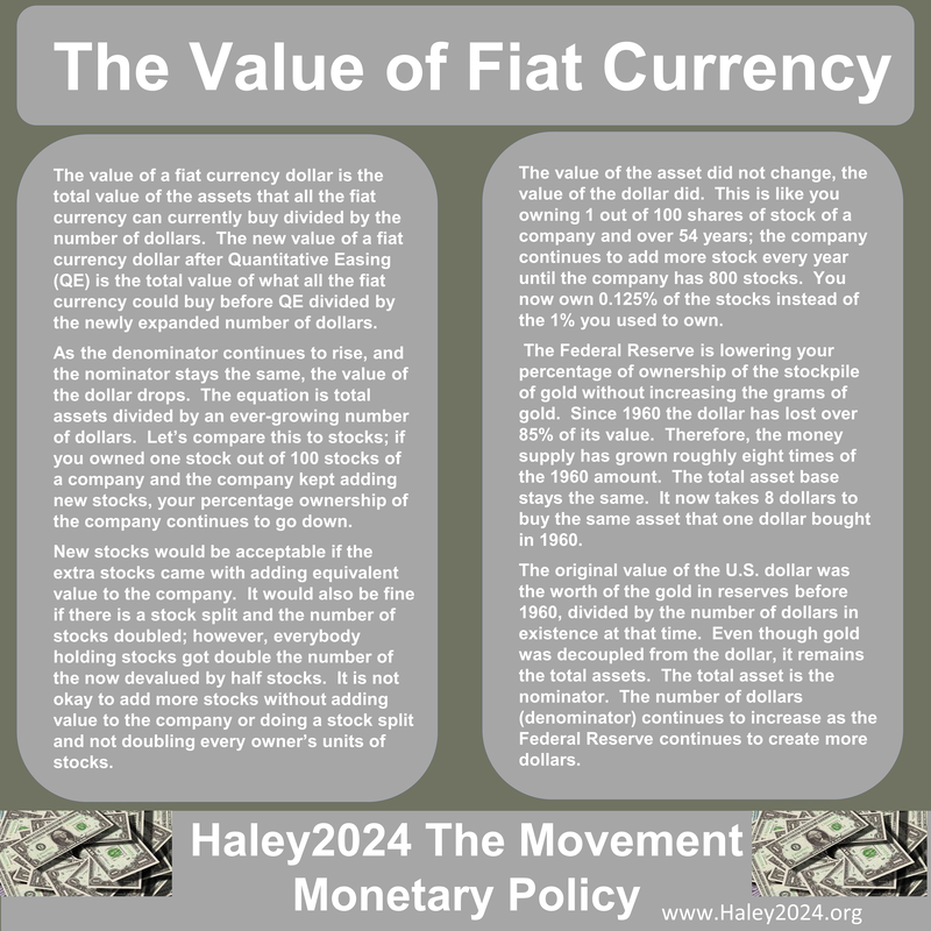

| The value of a fiat currency dollar is the total value of the assets that all the fiat currency can currently buy divided by the number of dollars. The new value of a fiat currency dollar after Quantitative Easing (QE) is the total value of what all the fiat currency could buy before QE divided by the newly expanded number of dollars. |

| As the denominator continues to rise, and the nominator stays the same, the value of the dollar drops. The equation is total assets divided by an ever-growing number of dollars. Let’s compare this to stocks; if you owned one stock out of 100 stocks of a company and the company kept adding new stocks, your percentage ownership of the company continues to go down. |

| New stocks would be acceptable if the extra stocks came with adding equivalent value to the company. It would also be fine if there is a stock split and the number of stocks doubled; however, everybody holding stocks got double the number of the now devalued by half stocks. It is not okay to add more stocks without adding value to the company or doing a stock split and not doubling every owner’s units of stocks. |

| The value of the asset did not change, the value of the dollar did. This is like you owning 1 out of 100 shares of stock of a company and over 54 years; the company continues to add more stock every year until the company has 800 stocks. You now own 0.125% of the stocks instead of the 1% you used to own. |

| The Federal Reserve is lowering your percentage of ownership of the stockpile of gold without increasing the grams of gold. Since 1960 the dollar has lost over 85% of its value. Therefore, the money supply has grown roughly eight times of the 1960 amount. The total asset base stays the same. It now takes 8 dollars to buy the same asset that one dollar bought in 1960. |

| The original value of the U.S. dollar was the worth of the gold in reserves before 1960, divided by the number of dollars in existence at that time. Even though gold was decoupled from the dollar, it remains the total assets. The total asset is the nominator. The number of dollars (denominator) continues to increase as the Federal Reserve continues to create more dollars. |