| The Haley2024 Monetary Policy relies on an understanding of Competitive Regulatory Agencies (CRA) and Financial CRA's. During the construction of a house, a long-term durable good is being created and gaining worth. A bank could recognize the value and create currency reflecting that value. The house becomes part of the worth that backs up the currency. The owners of the currency would have a real ownership interest in the house, exercised by the bank. |

| As a house is built, a long-term durable good is created and gaining worth. A bank would recognize the value and create currency reflecting that value. The house becomes part of the worth that backs up the currency. The owners of the currency would have a real ownership interest in the house, exercised by the bank. |

| The mortgage contract would state that the worth is really future labor equaling the dollar (BD) value agreed upon in the loan. The house is collateral if the mortgage is not paid. As the mortgage is paid off each month, the money returns to the bank, lowering the worth of the mortgage contract, thus to the currency and adding the worth to the home buyer/owner as equity. |

| Let’s recap: As the house is built, worth is established, and the bank creates currency based on that worth. That currency pays the home builders, and the ownership of the house belongs to the bank as part of the overall worth of the currency. At this time, all those that own currency from this CRA has ownership interests in this house. |

| The bank creates a mortgage exchanging the worth of the house to a contract of future labor with interest as the worth backing up the currency. Over time, the home buyer buys all the worth of the house reflected as equity. Every month when the money goes to the bank from mortgage payments, the future contract is reduced in value because less is owed. |

| As every monthly payment is made, the ‘homeowner’ buys greater equity in the house. The mortgage payments are subtracted from the value belonging to the currency thus the currency vanishes. The worth is now in home-equity belonging to the homeowner. Currencies can only have the number of units of currency that matches the worth of the portfolio. |

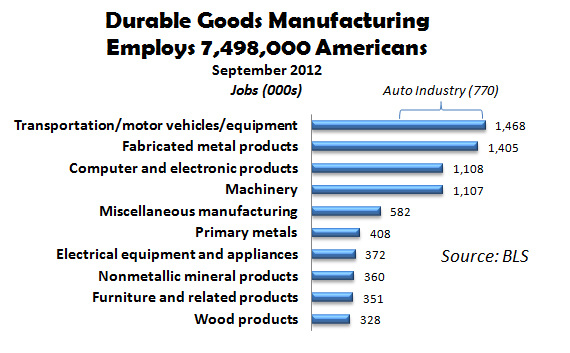

| This model works with many durable goods such as factories, cars, equipment among many other durable goods. Each bank and Financial CRA would have guidelines on this kind of loan. Given that each currency would be on the trading market, everyone would determine the value of the items backing up the currency. |