| If one examines a small 100-person closed economy, it is easy to see the effects of counterfeiting. Once a week, everyone brings the product of his or her labor to a central marketplace and then they do trades with currency. Services are ordered at this time. If there is counterfeiting, people will see the effect very quickly because that person is not bringing ‘things of worth’ to the marketplace. |

| People will readily see the unfairness of the counterfeiter acquiring ‘things of worth’ and not supplying goods and services. Let us take away or call it even, the concept of people saving, and spending saved currency, to make this concept more obvious. People are working hard to earn their currency, and the counterfeiter is not. |

| As the great Walter Williams stated: money is the representation that you served your fellow citizen so that you can demand service in exchange. Someone just printing up currency from a printer is not serving their fellow citizen and thus mocking and destroying the currency as a medium of exchange because they are not producing anything of value on their side of the exchange. |

| If the counterfeiter ‘gets away’ with this for a while, the effect will be more money than ‘things of worth.’ Some of this can be hidden within savings for a while; however, if the saving level is steady, meaning people adding and spending from savings is equal, significant effects are seen quickly within a small population. Usually, on the trading day, all the goods and services traded were exhausted. |

| Normal trading means that every person bought the same dollar amount as they sold. A person selling $100 of grapes can buy a little of everything they needed equaling $100. The effect, when counterfeiters added dollars and did not provide any goods or services, the extra money equals the amount of counterfeit money. |

| In a one-hundred person economy and a single trading day, this devaluation becomes quickly apparent. Because there is extra money left over on the trading-day, people would provide more labor for goods or services to fulfill the demand. If an extra 10 percent of counterfeit currency is added, all the people as a whole would work an extra ten percent more and still collectively only receive the same amount of ‘things of worth’ for themselves. |

| Human nature results in everyone raising their prices yielding a ten-percent price increase. If the counterfeiting continues, the prices will also continue to increase at the same rate of counterfeiting. The counterfeiters are in reality stealing the labor of others. If someone chooses not to do the extra labor, they will acquire roughly 10% fewer goods and services in exchange for their labor. That 10% of goods and services go to the counterfeiter. |

| Currency that does not hold its value because of the theft of counterfeiting does not make for a useful savings instrument. People dissuaded from savings leads to many ills, such as the lack of capital needed for capitalism and not having savings for retirement. An unstable dollar is also very problematic for long-term contracts for obvious reasons, which leads to reduced long-term planning and economic growth. |

| We do not have just 100 people, rather over 300 million and 20 times that around the world. Much of these dollars can be hidden within not just thousands, but millions of financial instruments. Much of these financial instruments are hidden away and very difficult for anyone to have any understanding of how much worth is out there. Something is only worth what someone is willing to pay for it, and people constantly change how much they value things. |

| All this being said, the economy is way too complex for anyone to understand. However, this small closed economy gives us the understanding of the cause of inflation or better said the devaluation of the dollar. We see similar damaging effects to our large economy, and we need to understand the cause. |

| The FED ‘states’ they are going to pull the money back out in the future. However, that does not stop the damaging effects from happening. In fact, if the damaging effects ripple through the economy with enough time, the value of the currency changes. Once the adverse effects are realized, pulling the money back out will have its own ill effects. |

| The harmful effects do not get reversed, pulling the money back will create all new adverse effects. The value of the money changing is the cause of the ill effects. Stability is the best. Long-term contracts, including employment, can be terrible for one side when the value drops and terrible on the other side when the value goes up. |

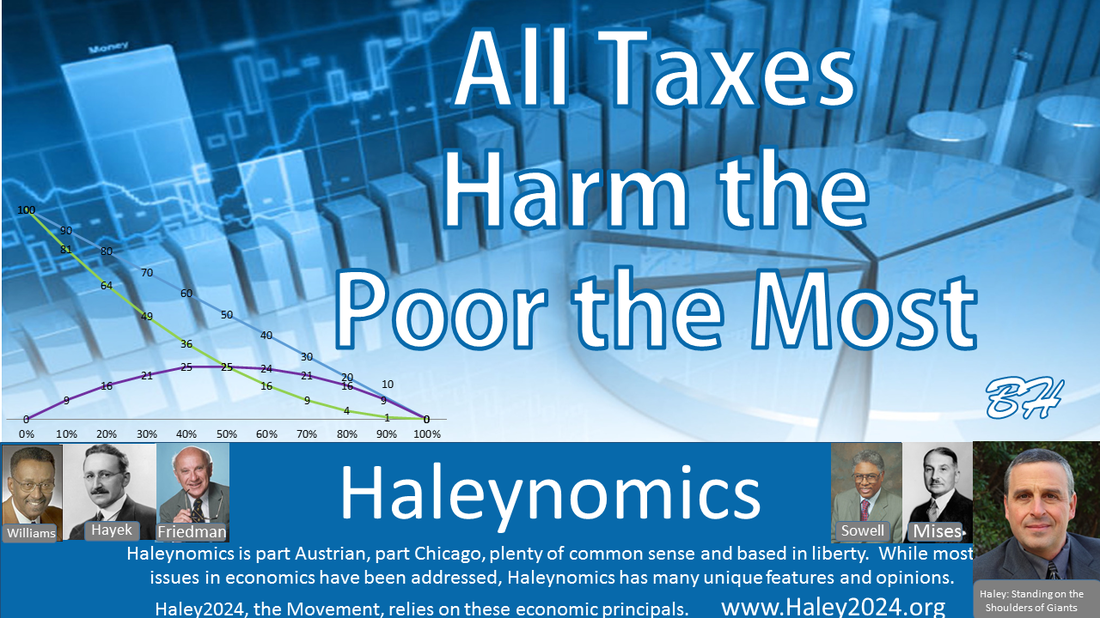

| The left and Keynesians will look at the extra work that needs to be done when people spend the extra money. They will rejoice in the false notion that more jobs are created and the economy is growing. They completely miss the theft of real worth coming from every dollar, either paper or digital. The left misses that they are changing the value of employment contracts, mortgages, and retirement accounts. |

| The left misses the point that long-term business plans are hampered by unstable money. The left misses the fact that the devaluation is often hidden until a 10 to 20% jump is realized and markets are negatively impacted. The left misses the cause of the unfortunate effect of lower savings rates. The left misses the catch 22 dilemmas created when easy money started investments that cannot produce the income at market interest rates. |

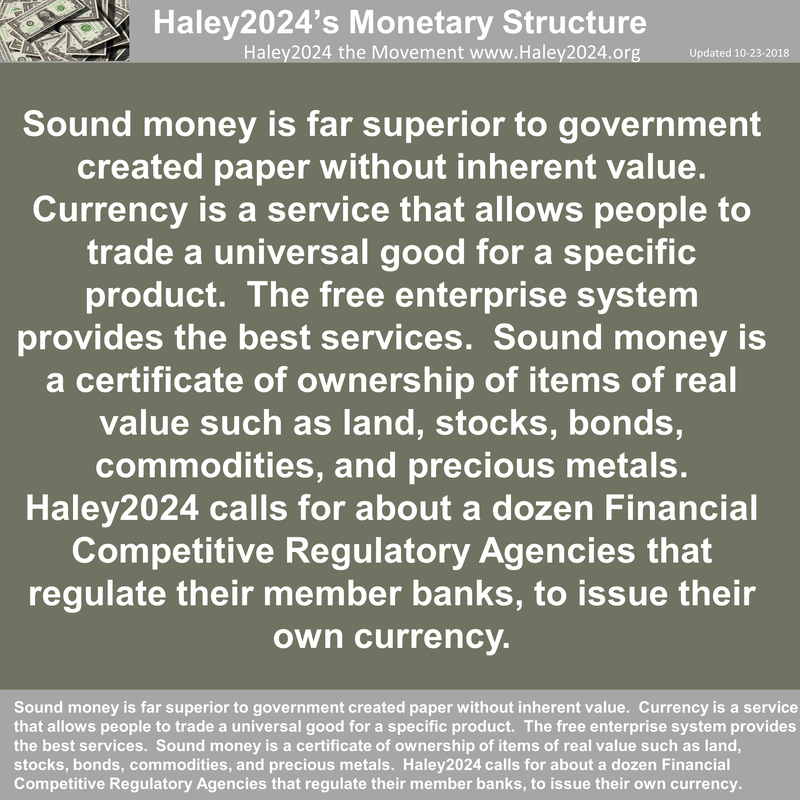

| The left misses the FACT that millions of people are holding trillions of dollars that have no intrinsic value behind it. Saving is theoretically a store of value that can be turned into goods and services. If someone had savings that are real products such as stocks, real estate, gold, commodities or other items that hold real value in the marketplace, that wealth would allow trading of the stored wealth for new goods or services. |

| If one has backed dollars as in the Haley2024 Monetary Policy, where there is stored wealth to back up the dollars, a quick audit will reveal there are more dollars than the value in the storeroom. The counterfeit dollars will be identified and the product taken from the counterfeiter. If we have fiat currency without the dollar being backed up, the percent value of the currency drops equals the old amount divided by the new higher amount of money. |

| The left misses the low-interest rates pushing up housing prices which harm the poor the most. The left misses the fact that an economic crash which always comes from QE created bubbles hit the housing market heavy and drops housing prices, putting many middle to low-income houses underwater (meaning the loan is higher than the value of the house). |

| The left misses that the middle to low-income income demographic lose their jobs based on wild swings in housing prices due to jobs in that sector of the economy. The left misses the fact that massive layoffs due to the wild swings, push up mortgage foreclosures, leading to more catch 22 effects when housing prices fall more significantly due to a glut of foreclosures and thus more layoffs in the housing sector, and there is spillover in many other sectors as well. |