| The Left constantly states that they need to tax the rich more to help the poor. Please look at the Haley2024 Welfare to Charity page to find out the best way to help the poor. This page is to explain how higher taxes harm the poor. It is very true that higher tax rates harm everyone; however, the poor’s well-being and living standard diminishing is much grimmer than the rich losing 10% or even half of their wealth. Lower taxes increase GDP, meaning that many more of the poor are employed, thus moved into the economy and at higher levels. |

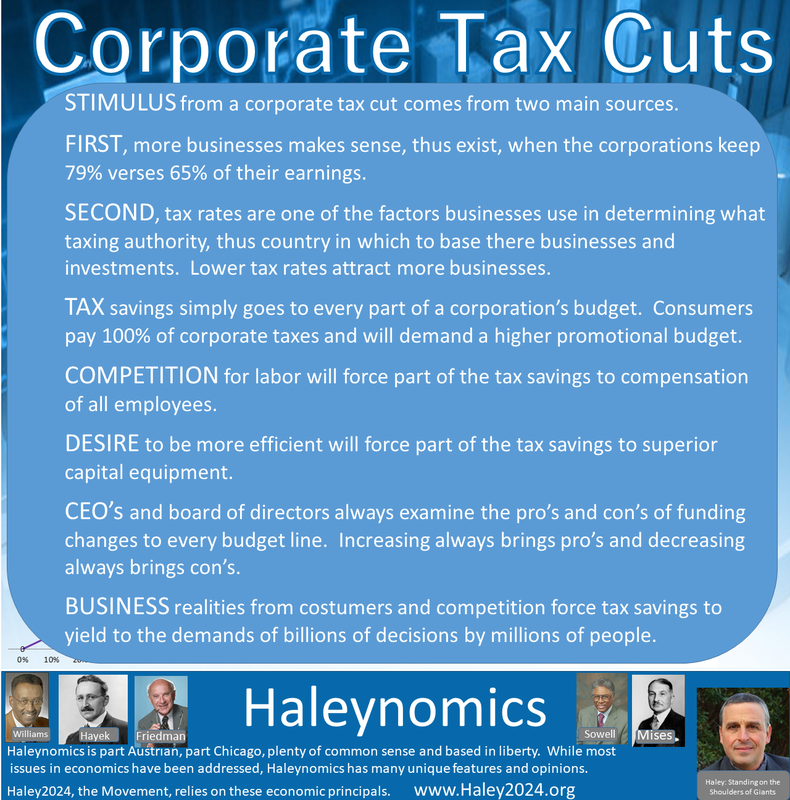

| The economic principal for supply and demand applies to the labor force as well. On average, the poor are less experienced, less educated and has a lower product or service output per hour compared to those making average wages. In an economic or business recession, the poor disproportionally lose their jobs, have their hours reduced and accept lower pay rates. When businesses and the economy thrive, the poor reap much of that increase. Many more opportunities come available, and upward mobility prospects are enhanced. There is a certain amount of taxes that need to be collected to do vitally essential tasks such as national defense and creating the rule of law. However, because all taxes do harm, it is vital that we, the citizens of each state and of America turn over as much to the free enterprise system as possible. |

| Congress once passed a massive yacht tax thinking it would only affect the rich. Many of the rich bought, serviced and lodged their yachts outside the taxing authority and within a very short time, many thousands of yacht-related businesses closed or scaled back; thus significant job losses at all income levels occurred. |

| On a side note, the new tax brought in very little and overall taxes decreased due to all the businesses and employees losing their earnings, thus paying fewer income taxes. YES, the poor were harmed the most. Blog: The Poor are Harmed the most by the Effects of the Laffer Curve It did not take long for the tax to be lifted when the effects were very evident. |

| While this example was clearly seen, most are not as evident, although they are still very real. There are many businesses that have never been started because they could not get a loan. In many cases, they could not get a loan because of the excessiveness of the existing national debt consuming available capital. |

| Uncle Sam borrows so much that would otherwise be lent to start businesses. For many good reasons, the poor are on the bottom of the list to get loans to start businesses. The more capital available, the further down that list has their businesses funded. The poor are harmed most by greater government debt. |

| Income taxes, sales taxes, real estate taxes, payroll taxes, gas taxes, business taxes, death taxes, sin taxes, wealth taxes, inflation taxes, and value-added taxes are all taxes that collectively take 38% of GDP. The issue here is not what tax is the best, but that all taxes do harm. As tax rates rise, fewer transactions and fewer businesses make sense. |

| When fewer businesses make sense, jobs become less plentiful. The poor are usually hit first and the hardest. Lower economic activity leaves those less experienced and talented out of work or needing to drop their wages to keep their job. When businesses are plentiful because of the lower prices of doing business (tax rates), companies need to bid up their job offers to attract better talent. A few percentage points of jobs available create much higher pay for everyone, giving those with less skill and experience more opportunities. All wages go up when more businesses are open and thriving. |

| Every tax is built into the price of the transaction. Taxing the rich means taxing the transaction of the poor trading with the rich. The only place the rich can attain the money for the tax is that transaction. In conclusion, the poor pay for much of the tax because it is priced into the products. Higher prices for the products the poor buys harm the poor. Lower economic activity created by greater disincentives of higher tax rates disproportionally hurts the poor. |