| This is a simple concept yet is constantly misconstrued by the government. The government passes a law that gives everyone money. What they fail to understand is that they first must take that money from that person to provide them with that money. Often the politicians try to portray that they are taking money from corporations or the rich; however, that tax is always passed on to the consumer or others in a variety of ways. |

| US debt per taxpayer is $161,000 (May 2016). This is how much the government has to tax us in order to give it back to those of us holding US debt. State and local bonds are also a heavy burden on our system. All of this debt is not balanced with real assets, it is mostly backed with just the promise to tax citizens. |

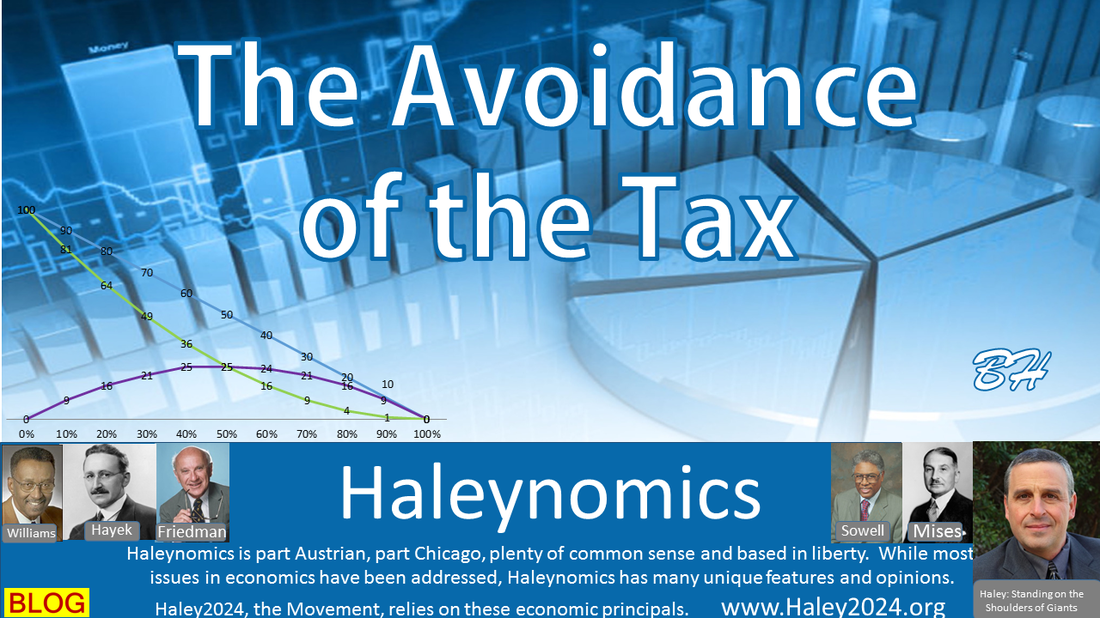

| Laffer Curve: the act of taxing an economic transaction, reduces the number of economic transactions due to the perception among some that the trade is not worth it. If the government is taking (TAXING) a large percentage of the trade, often times the trade is borderline ‘worth it,’ and the tax rate makes it not ‘worth it,’ thus the trade does not happen. |

| Since ALL trades make people on both sides of the trade better off; trades that do not happen because of the tax stops both sides of being better off. The Laffer Curve deals mostly with tax revenue dropping off as the rates go up. However, the more important lesson is economic activity drops off because the tax makes the trade not ‘worth it.’ |

| Retirement planning SHOULD be, that you build up assets during your working years to allow you to retire and live off those assets in your elderly years. The critical part here is that you build up assets. The government created a system where you pay into the Social Security system; however, they do not build up assets. They have to tax people at the time you need to collect your retirement, in order to give you your money back. |

| In 2007-2008 the government tried to ‘give’ everyone $300 through the tax code as a stimulus. This was mostly playing with timing. The taxes did not change; they just gave a lump sum one time and deducted a little extra in paychecks the rest of the year. This ‘giving’ of $300 was taken from them a little per paycheck. |

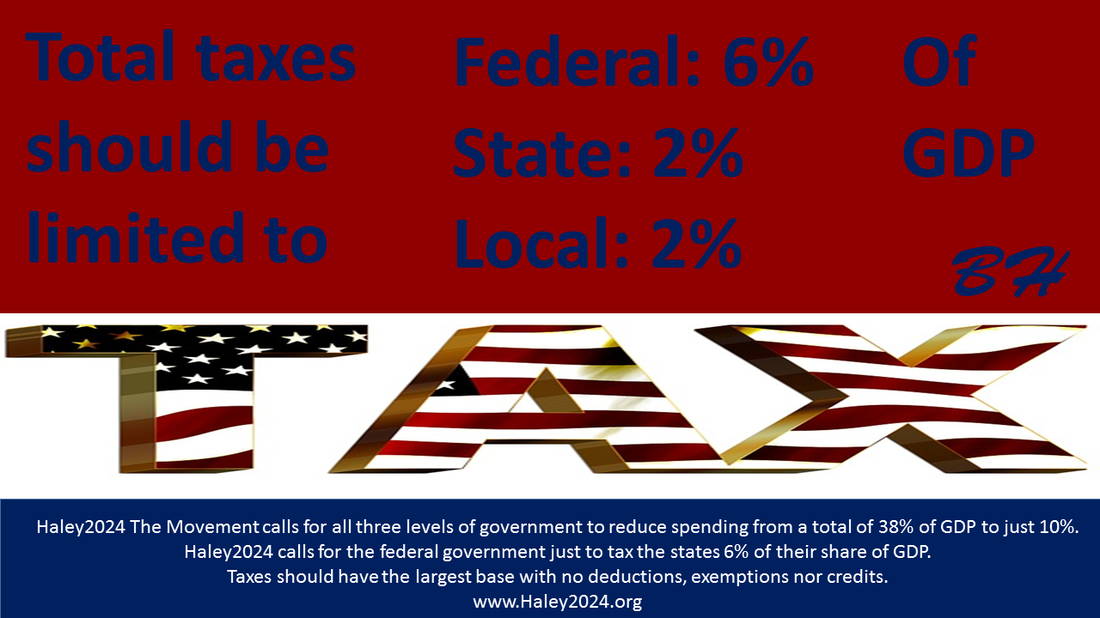

| In conclusion, the government should only be taxing us for the things only government can do. The Haley2024 plan has government spending roughly 10% of GDP total for all three levels. The tax code should just raise money, not redistribute wealth. The government should only go in debt to protect freedom in a war, and that should mostly be planned ahead. Retirement planning should not be run through government, but the point here is that assets should be accumulated, not a pay as you go system. |