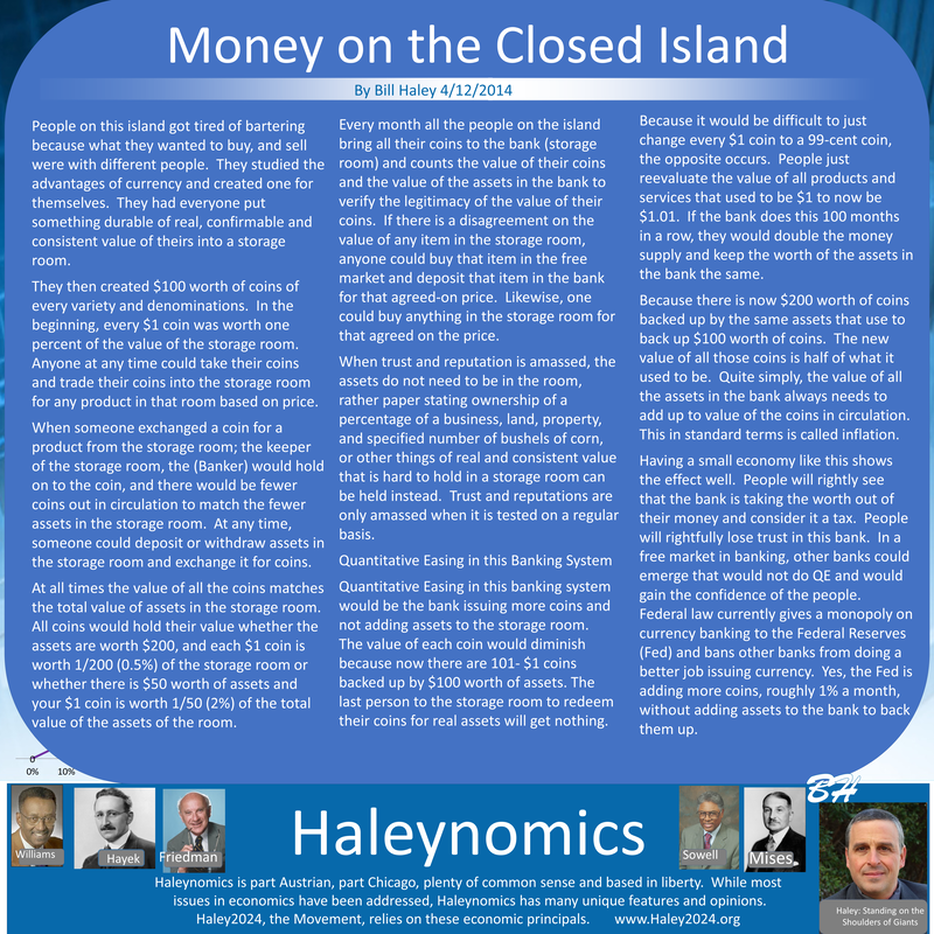

| When someone exchanged a coin for a product from the storage room; the keeper of the storage room, the (Banker) would hold on to the coin, and there would be fewer coins out in circulation to match the fewer assets in the storage room. At any time, someone could deposit or withdraw assets in the storage room and exchange it for coins. |

| At all times the value of all the coins matches the total value of assets in the storage room. All coins would hold their value whether the assets are worth $200, and each $1 coin is worth 1/200 (0.5%) of the storage room or whether there is $50 worth of assets and your $1 coin is worth 1/50 (2%) of the total value of the assets of the room. |

| Every month all the people on the island bring all their coins to the bank (storage room) and counts the value of their coins and the value of the assets in the bank to verify the legitimacy of the value of their coins. If there is a disagreement on the value of any item in the storage room, anyone could buy that item in the free market and deposit that item in the bank for that agreed-on price. Likewise, one could buy anything in the storage room for that agreed on the price. |

| When trust and reputation is amassed, the assets do not need to be in the room, rather paper stating ownership of a percentage of a business, land, property, and specified number of bushels of corn, or other things of real and consistent value that is hard to hold in a storage room can be held instead. Trust and reputations are only amassed when it is tested on a regular basis. |

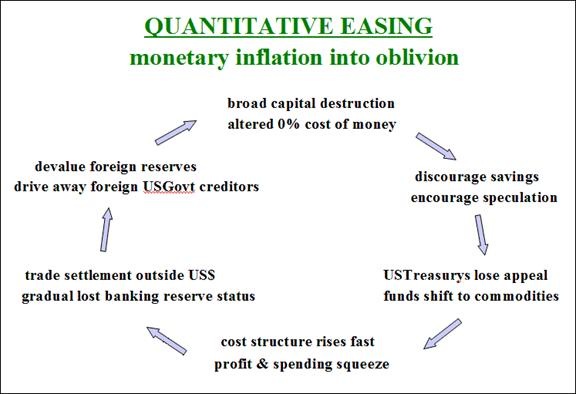

| Quantitative Easing in this banking system would be the bank issuing more coins and not adding assets to the storage room. The value of each coin would diminish because now there are 101- $1 coins backed up by $100 worth of assets. The last person to the storage room to redeem their coins for real assets will get nothing. |

| Because it would be difficult to just change every $1 coin to a 99-cent coin, the opposite occurs. People just reevaluate the value of all products and services that used to be $1 to now be $1.01. If the bank does this 100 months in a row, they would double the money supply and keep the worth of the assets in the bank the same. |

| Because there is now $200 worth of coins backed up by the same assets that use to back up $100 worth of coins. The new value of all those coins is half of what it used to be. Quite simply, the value of all the assets in the bank always needs to add up to value of the coins in circulation. This in standard terms is called inflation. |

| Having a small economy like this shows the effect well. People will rightly see that the bank is taking the worth out of their money and consider it a tax. People will rightful lose trust in this bank. In a free market in banking, other banks could emerge that would not do QE and would gain the trust of the people. Federal law currently gives a monopoly on currency banking to the federal reserves and bans other banks from doing a better job issuing currency. Yes, the Federal reserve is adding more coins, roughly 1% a month, without adding assets to the bank to back them up. |