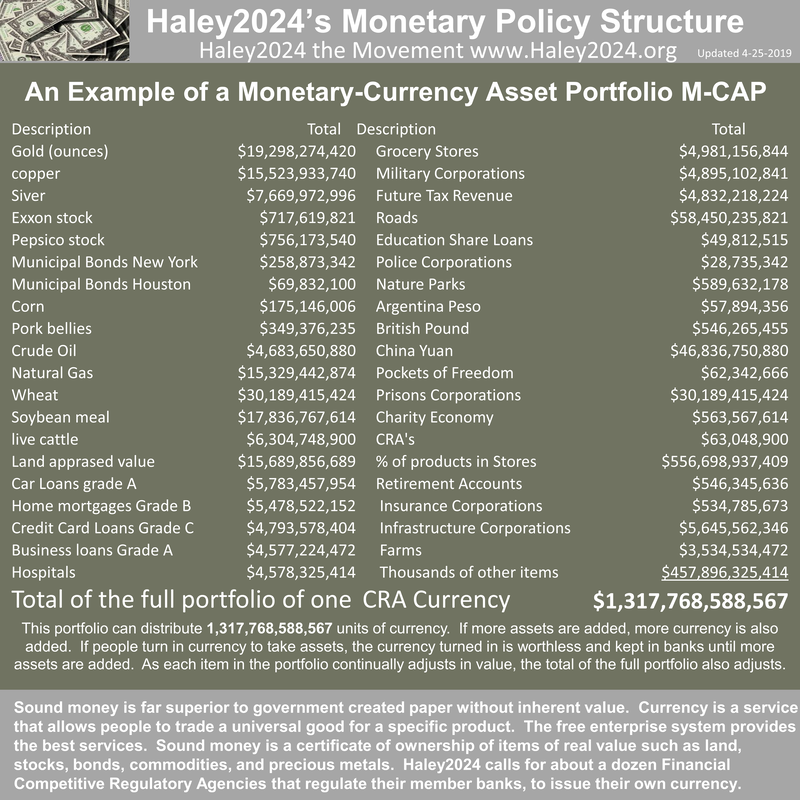

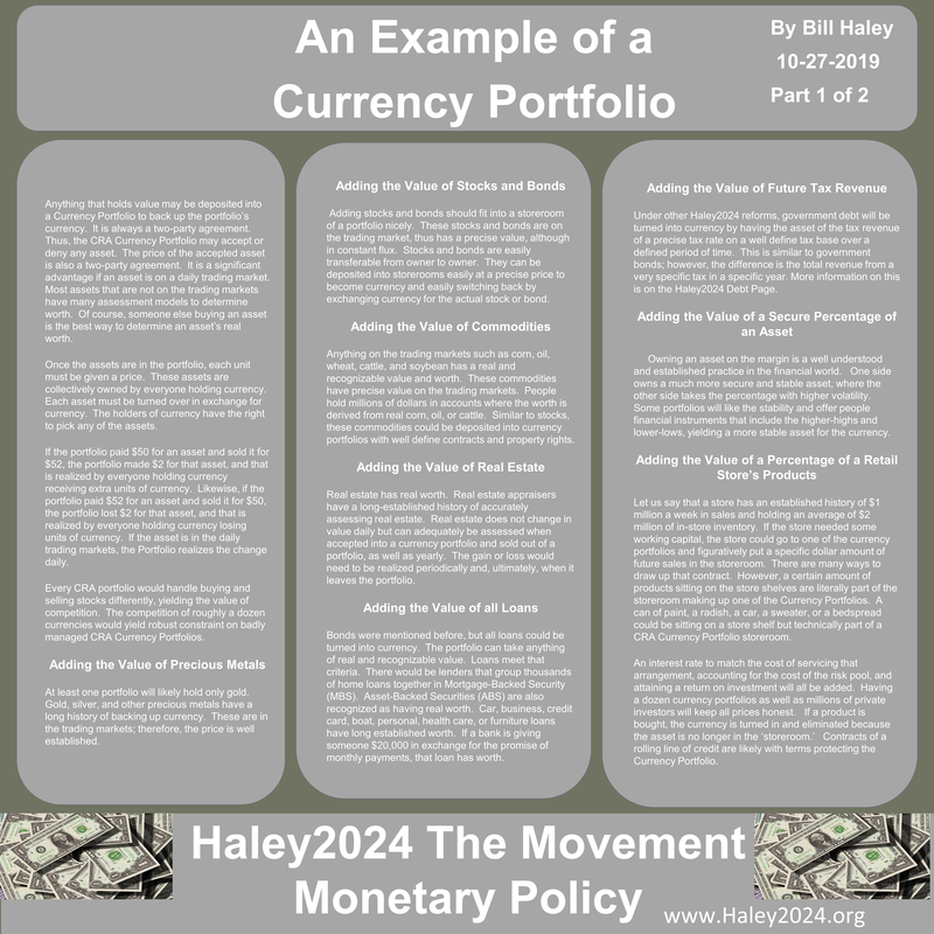

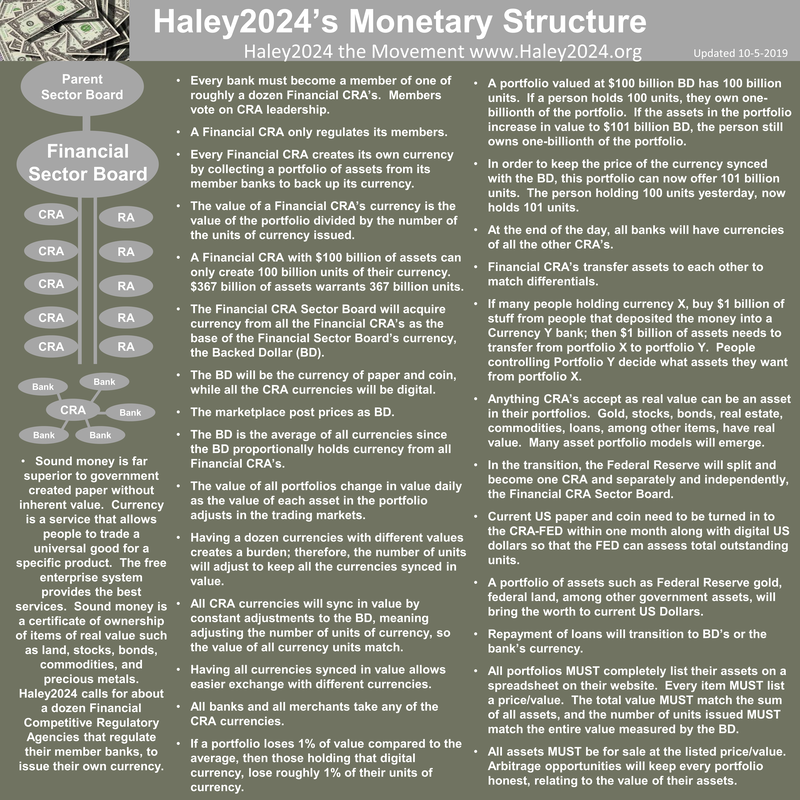

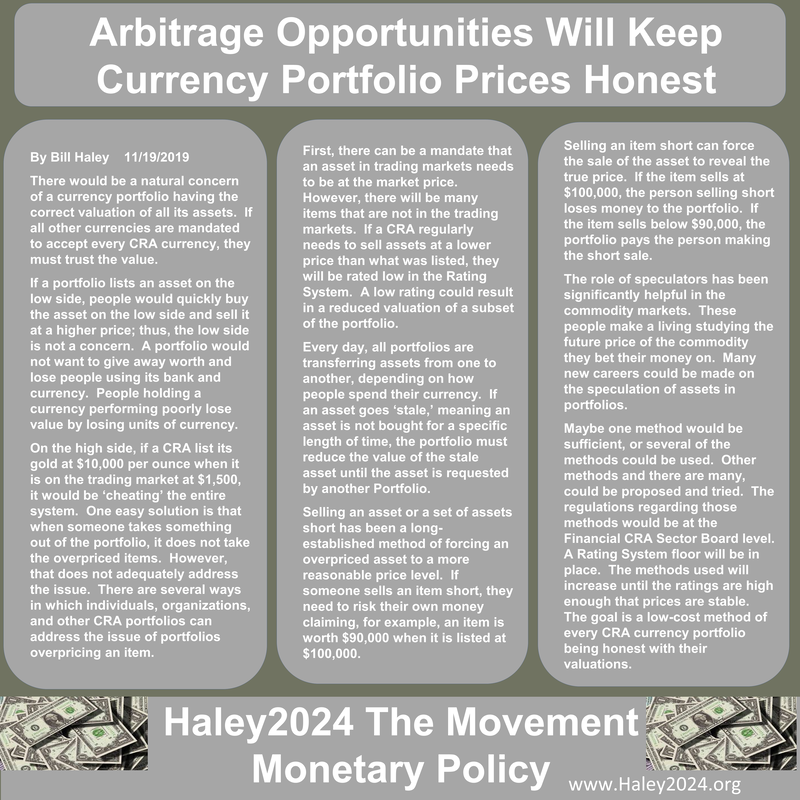

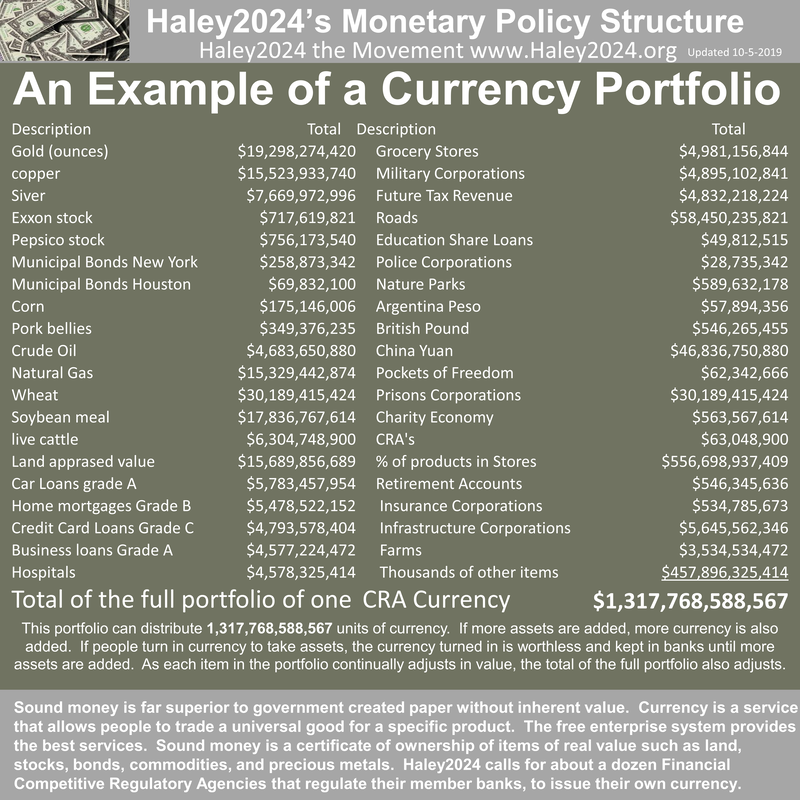

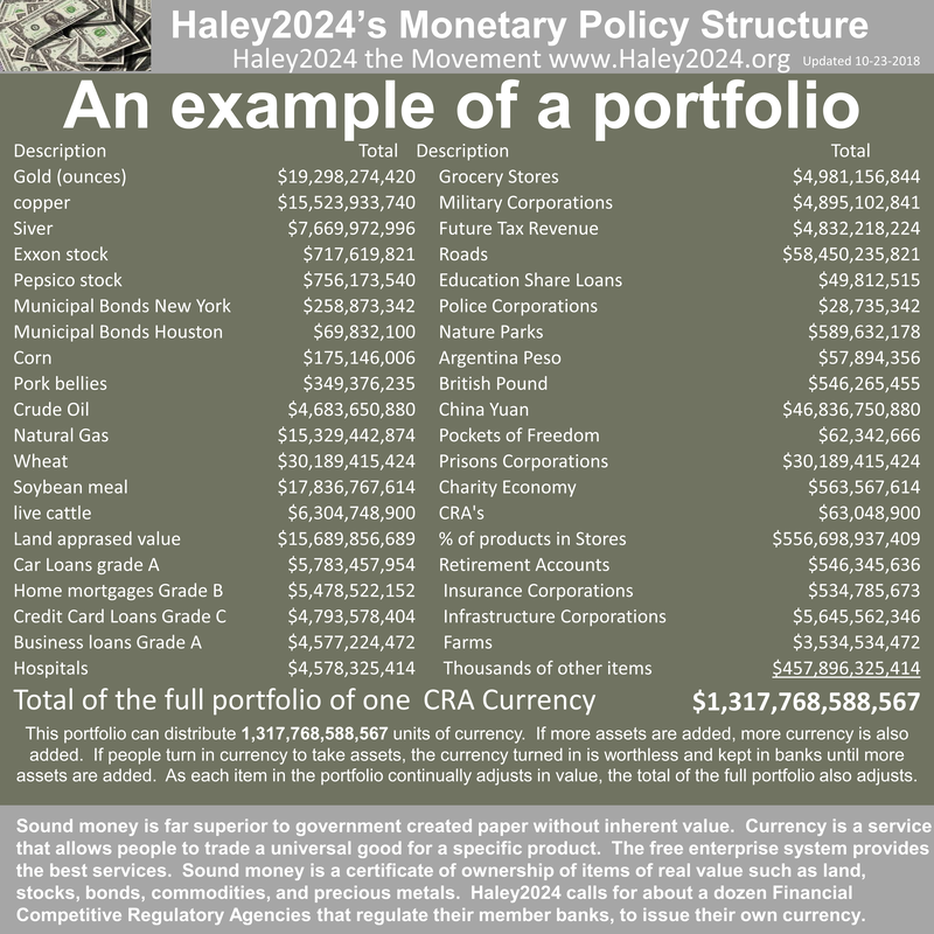

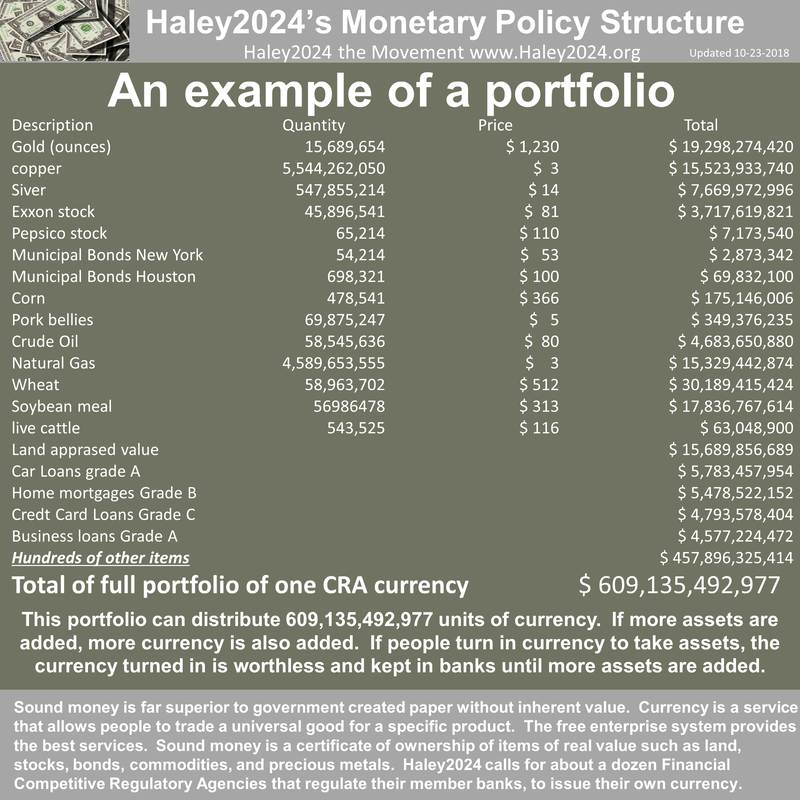

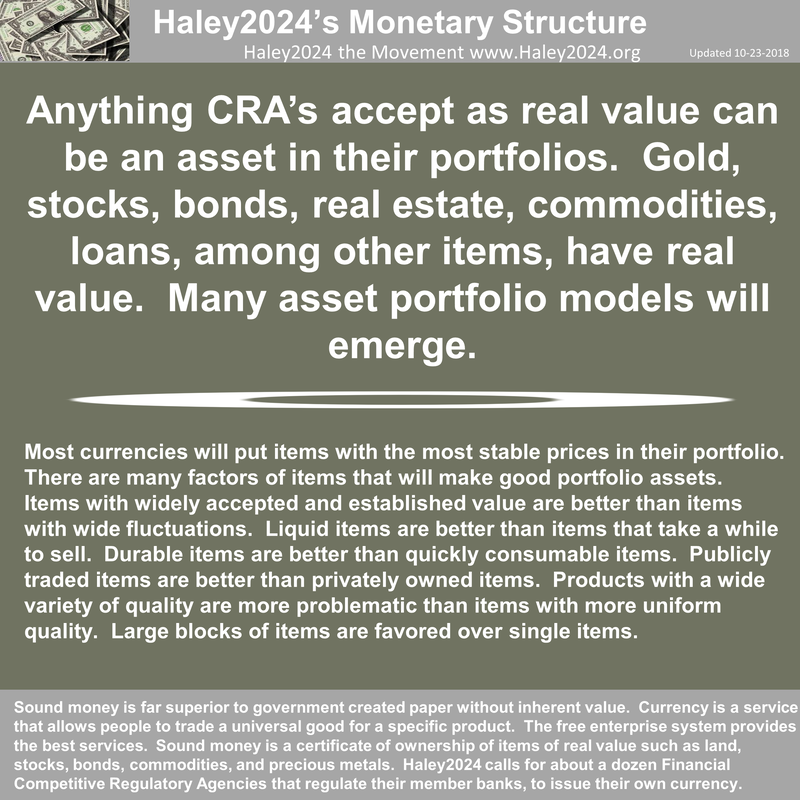

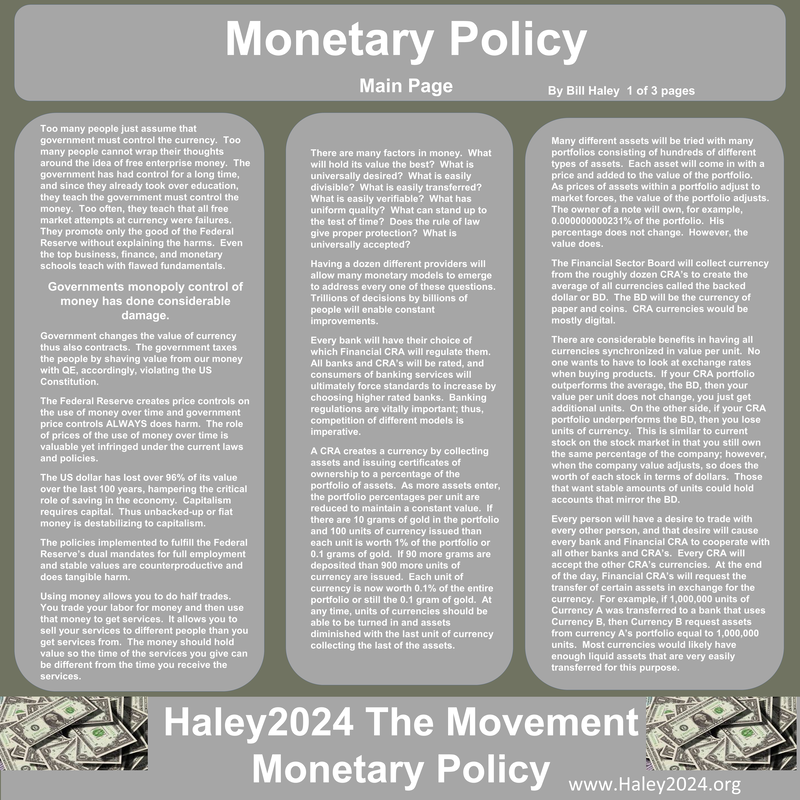

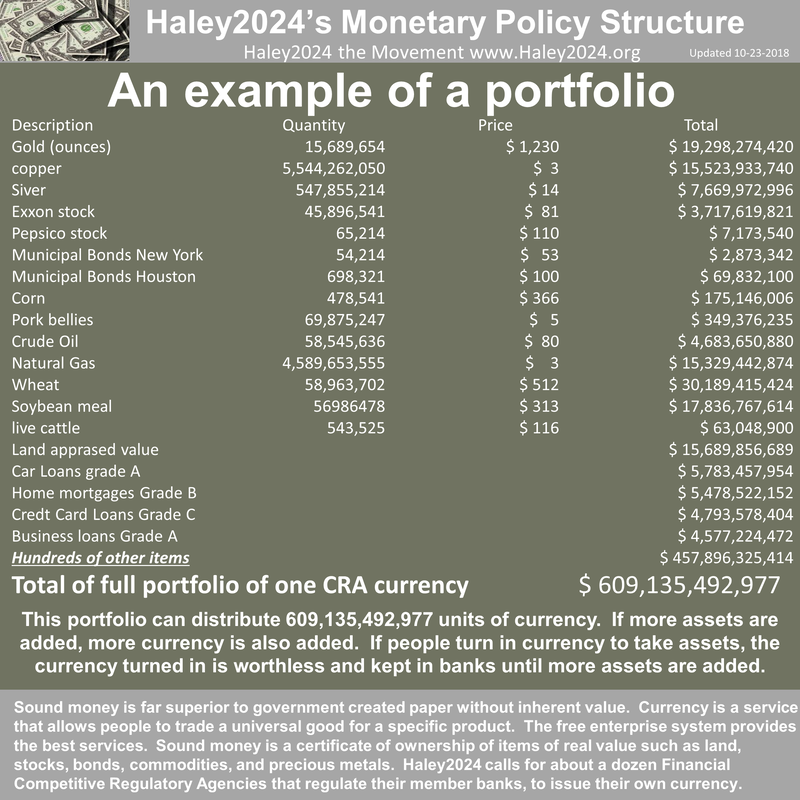

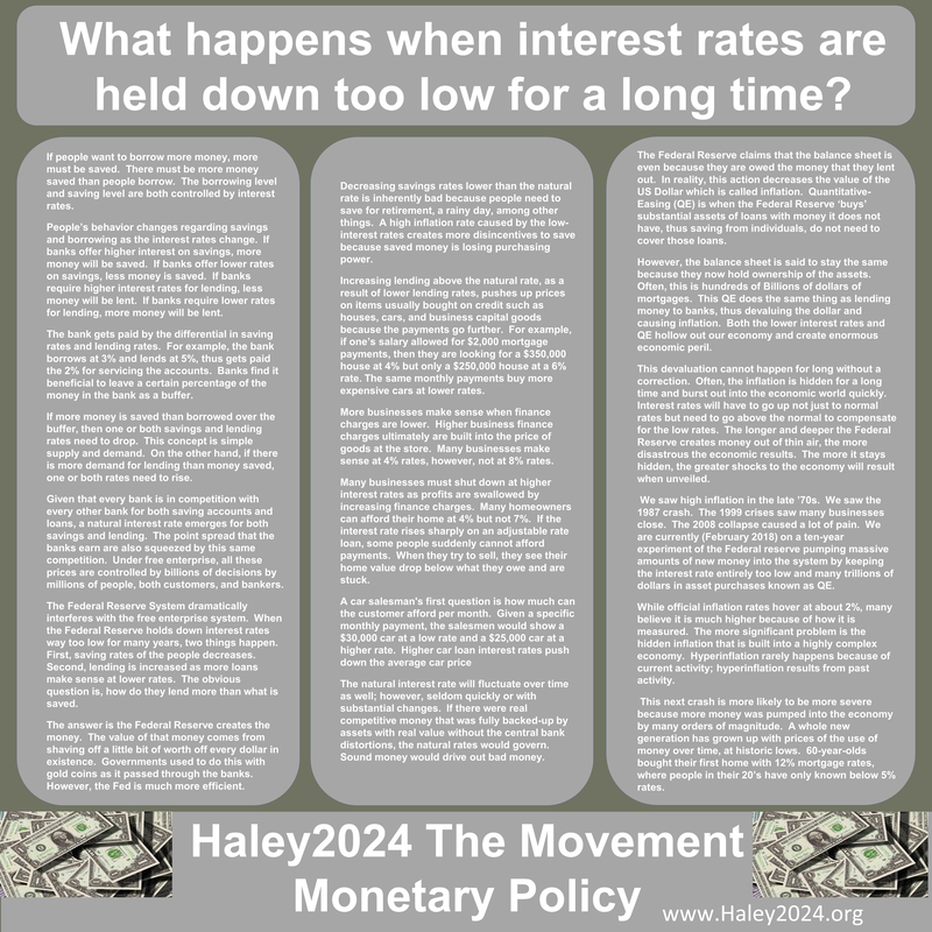

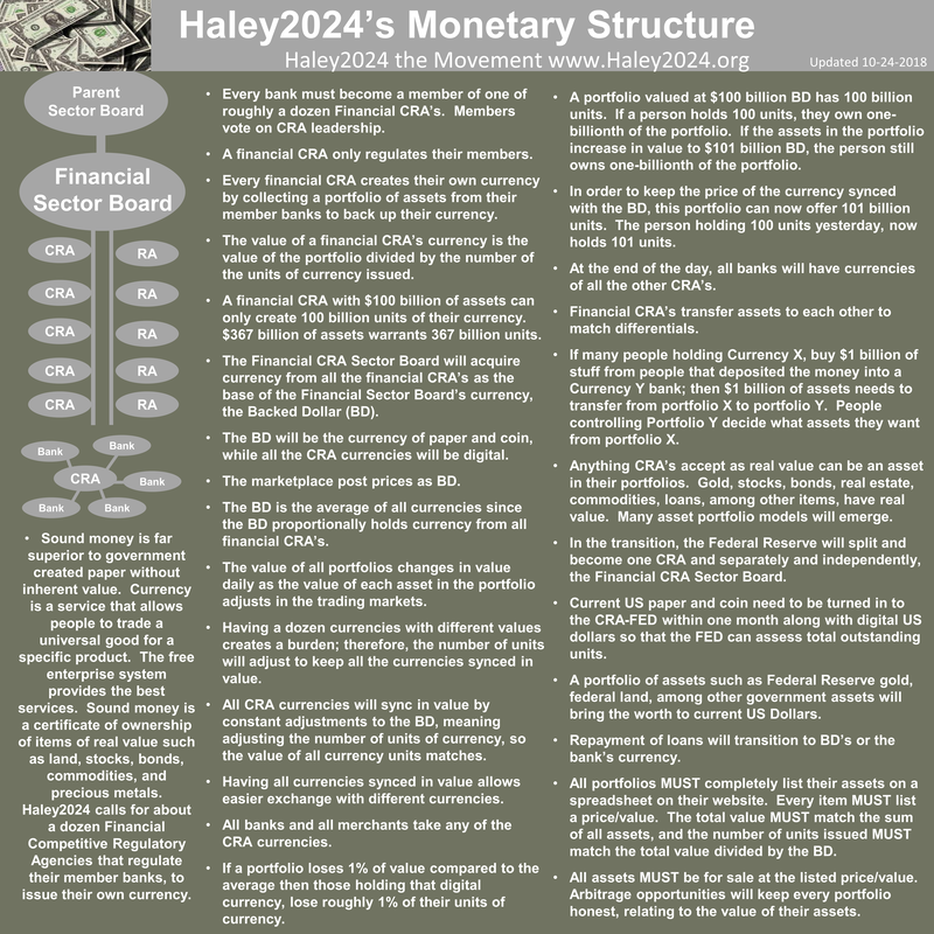

| Anything that holds value may be deposited into a Currency Portfolio to back up the portfolio’s currency. It is always a two-party agreement. Thus, the CRA Currency Portfolio may accept or deny any asset. The price of the accepted asset is also a two-party agreement. It is a significant advantage if an asset is on a daily trading market. Most assets that are not on the trading markets have many assessment models to determine worth. Of course, someone else buying an asset is the best way to determine an asset’s real worth. Once the assets are in the portfolio, each unit must be given a price. These assets are collectively owned by everyone holding currency. Each asset must be turned over in exchange for currency. The holders of currency have the right to pick any of the assets. |

| If the portfolio paid $50 for an asset and sold it for $52, the portfolio made $2 for that asset, and that is realized by everyone holding currency receiving extra units of currency. Likewise, if the portfolio paid $52 for an asset and sold it for $50, the portfolio lost $2 for that asset, and that is realized by everyone holding currency losing units of currency. If the asset is in the daily trading markets, the Portfolio realizes the change daily. Every CRA portfolio would handle buying and selling stocks differently, yielding the value of competition. The competition of roughly a dozen currencies would yield robust constraint on badly managed CRA Currency Portfolios. |

Adding the Value of Stocks and BondsAdding stocks and bonds should fit into a storeroom of a portfolio nicely. These stocks and bonds are on the trading market, thus has a precise value, although in constant flux. Stocks and bonds are easily transferable from owner to owner. They can be deposited into storerooms easily at a precise price to become currency and easily switching back by exchanging currency for the actual stock or bond. |

Adding the Value of CommoditiesAnything on the trading markets such as corn, oil, wheat, cattle, and soybean has a real and recognizable value and worth. These commodities have precise value on the trading markets. People hold millions of dollars in accounts where the worth is derived from real corn, oil, or cattle. Similar to stocks, these commodities could be deposited into currency portfolios with well define contracts and property rights. |

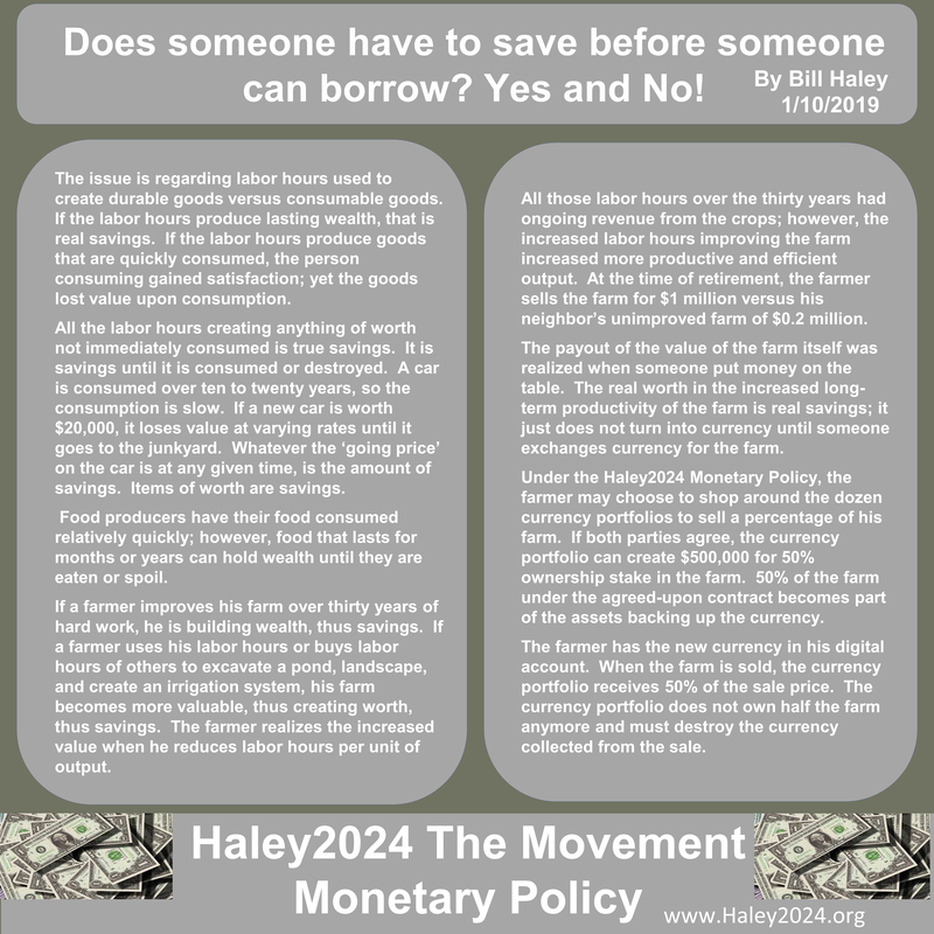

Adding the Value of Real EstateReal estate has real worth. Real estate appraisers have a long-established history of accurately assessing real estate. Real estate does not change in value daily but can adequately be assessed when accepted into a currency portfolio and sold out of a portfolio, as well as yearly. The gain or loss would need to be realized periodically and, ultimately, when it leaves the portfolio. |

Adding the Value of all LoansBonds were mentioned before, but all loans could be turned into currency. The portfolio can take anything of real and recognizable value. Loans meet that criteria. There would be lenders that group thousands of home loans together in Mortgage-Backed Security (MBS). Asset-Backed Securities (ABS) are also recognized as having real worth. Car, business, credit card, boat, personal, health care, or furniture loans have long established worth. If a bank is giving someone $20,000 in exchange for the promise of monthly payments, that loan has worth. |

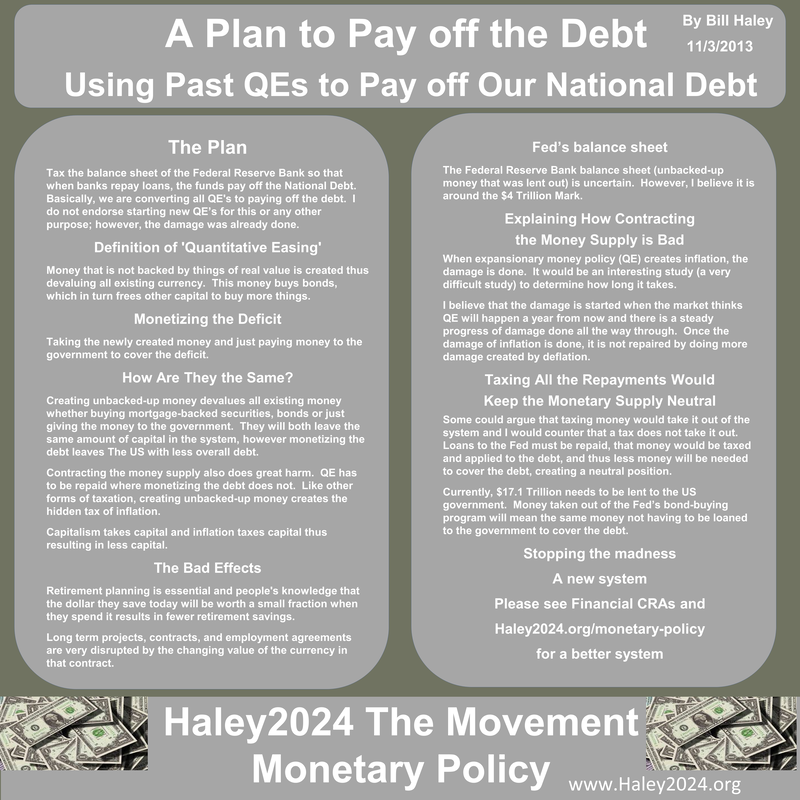

Adding the Value of Future Tax RevenueUnder other Haley2024 reforms, government debt will be turned into currency by having the asset of the tax revenue of a precise tax rate on a well define tax base over a defined period of time. This is similar to government bonds; however, the difference is the total revenue from a very specific tax in a specific year. More information on this is on the Haley2024 Debt Page. |

Adding the Value of a Secure Percentage of an Asset Owning an asset on the margin is a well understood and established practice in the financial world. One side owns a much more secure and stable asset, where the other side takes the percentage with higher volatility. Some portfolios will like the stability and offer people financial instruments that include the higher-highs and lower-lows, yielding a more stable asset for the currency. |

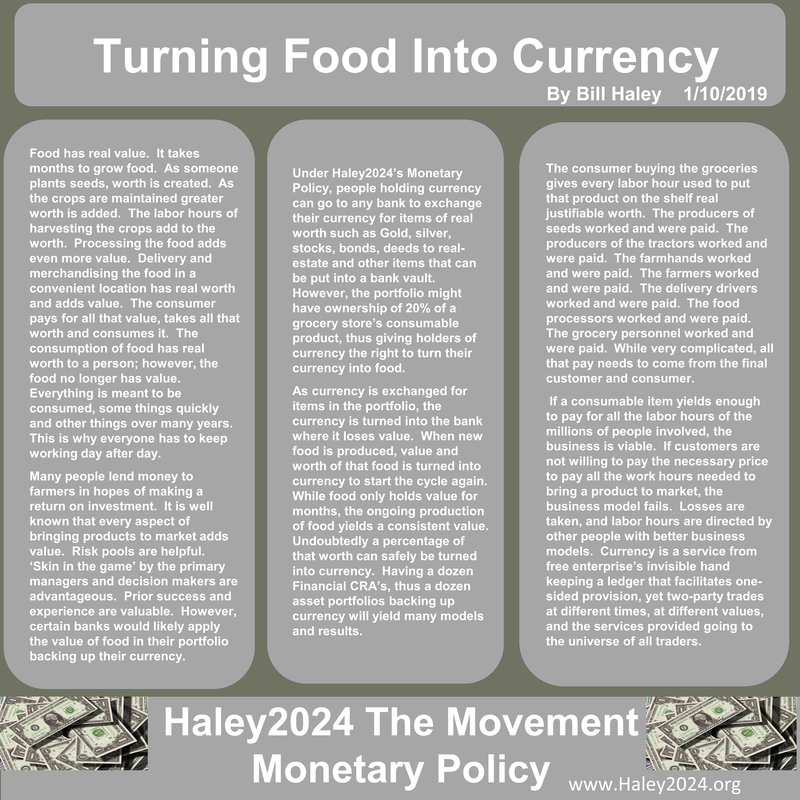

Adding the Value of a Percentage of a Retail Store’s ProductsLet us say that a store has an established history of $1 million a week in sales and holding an average of $2 million of in-store inventory. If the store needed some working capital, the store could go to one of the currency portfolios and figuratively put a specific dollar amount of future sales in the storeroom. There are many ways to draw up that contract. However, a certain amount of products sitting on the store shelves are literally part of the storeroom making up one of the Currency Portfolios. A can of paint, a radish, a car, a sweater, or a bedspread could be sitting on a store shelf but technically part of a CRA Currency Portfolio storeroom. |

| An interest rate to match the cost of servicing that arrangement, accounting for the cost of the risk pool, and attaining a return on investment will all be added. Having a dozen currency portfolios as well as millions of private investors will keep all prices honest. If a product is bought, the currency is turned in and eliminated because the asset is no longer in the ‘storeroom.’ Contracts of a rolling line of credit are likely with terms protecting the Currency Portfolio. |

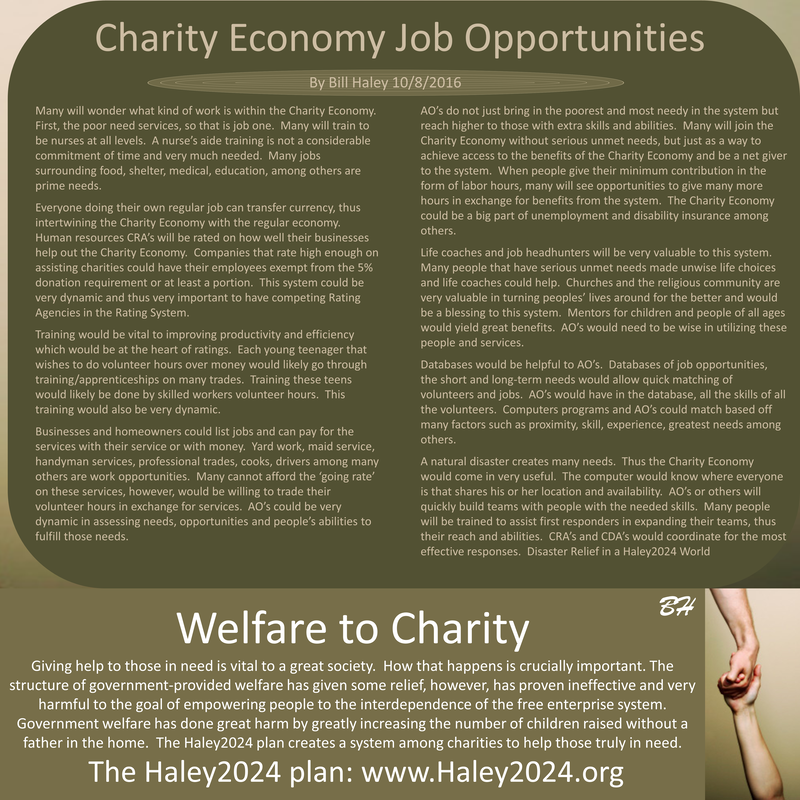

Adding the Value of the Charity EconomyMany people will give charitable labor hours while they are able so they may receive others doing labor for them when they need assistance. Some people will receive aid before they make ‘deposits’ of charitable hours when they will ‘owe’ future charitable work hours. Anyone may pay their mandatory charitable contribution with charitable hours. There would be about a dozen Charity Economies all handling charitable hours differently as well as the combined Charitable Economy at the Charity Sector Board. Many people will have employment insurance that is cheaper because the day after they lose their job, they will immediately start working in the Charity Economy. |

| Many loans will incorporate mandatory charitable hours if payments are late. Court-Ordered terms for late child support payments require mandatory Charity Hours. Charitable Hours in the Charity Economy can fulfill the required payment of the military or police funding when the situation warrants. Work done by prisoners as part of restitution can be part of the Charity Economy. All CRA’s and RA’s would likely allow Charitable Hours to pay for CRA and RA fees. It is hard to comprehend the magnitude and direction of unhampered free enterprise Charity Economies with extensive CRA experimentation. A price can be put on anything, and future charitable labor hours will have real worth. |

Adding the Value of Foreign CurrencyForeign currency holds real value because the country of origin bought products from Americans in exchange for their currency. They will accept that currency back in exchange for Americans purchasing products from that country. Most Currency Portfolios will likely hold enough foreign currency from all countries in order to easily trade with them. When Americans buy products from other countries, the other countries can take just their currencies out of the CRA Portfolio. Of course, they have a right to take any asset from the CRA Portfolio that matches the correct amount. |

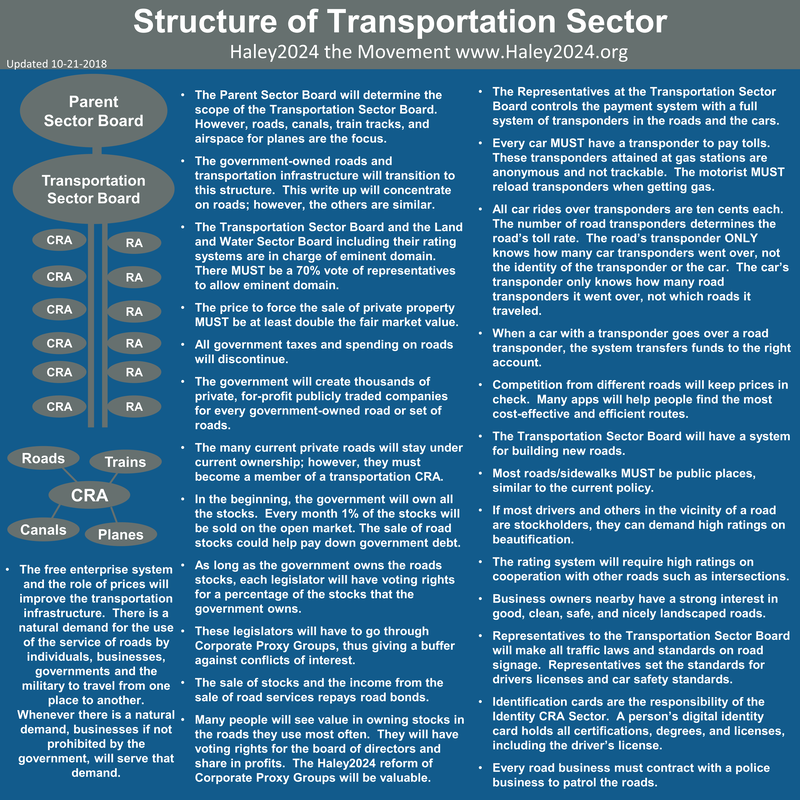

Adding the Value of InfrastructureRoads, waterways, lakes, bridges, airports, water treatment plants, electric plants, the electrical grid, among other infrastructure assets, will become private entities. Most infrastructure assets will become corporations with stocks that the general public will own. These assets have real worth and will be on the trading markets; thus, easily added to CRA Currency Portfolios. |

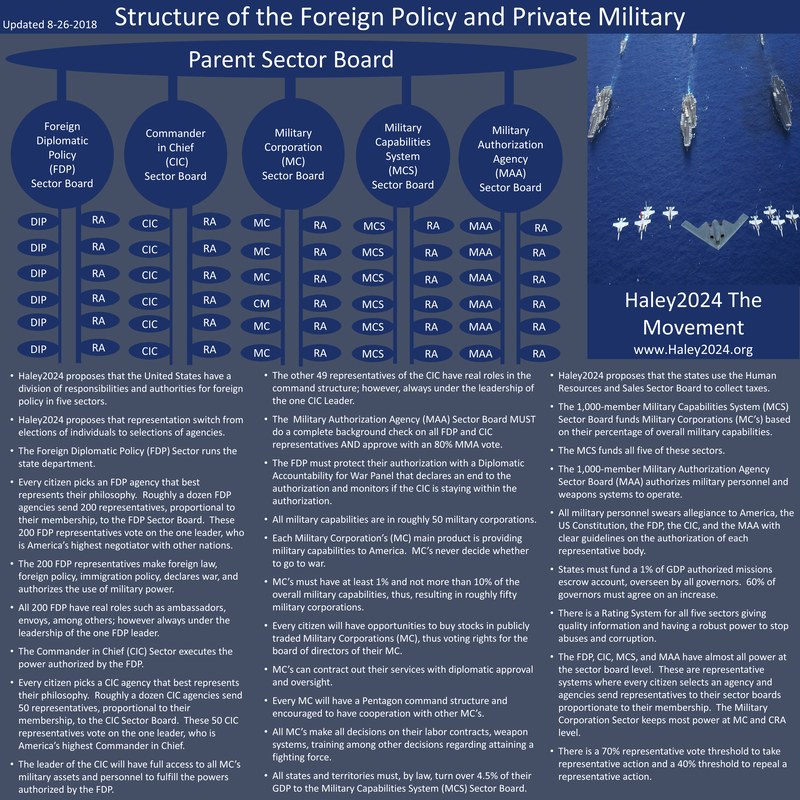

Adding the Value of the MilitaryThe military will become private with elected leadership directing missions and oversight. About 50 private Military Corporations will hold all military assets. The full worth of these military corporations is in stocks held by the American people. Many of these stocks will be deposited in CRA Currency Portfolios. These corporations have a steady income flow and hold real worth. These corporations will be having daily, or weekly assessments, and the stocks will be in the daily trading markets; thus, ideal for a CRA Portfolio. |

Adding the Value of Nature ParksThe city, state, and federal levels of government will each have a Land and Water CRA Sector. Each CRA at all levels will have a Rating Floor on proper levels of nature parks. As a member of a Land and Water CRA, every citizen must pay CRA fees. Part of those fees will fund the upkeep and improvements of nature parks. The majority of these nature parks will be owned by private corporations with stocks that the citizens would own. These nature parks have real worth and will be on the trading markets; thus, ideal for CRA Currency Portfolios. These nature parks will have high Rating Floors for environmental standards and general population accessibility. |

Adding the Value of Pockets of FreedomPockets of Freedom will need some up-front cash to start. People settling in the Pockets of Freedom will sign a contract to pay a percentage of their income for several years to compensate for the initial investment. The up-front money will quickly create the real worth of a future income stream. It might take a while to get the value right, but the unhampered free enterprise system within these Pockets will allow the evaluation of the proper value. Haley2024 assumes a citizen ownership model of government. In a real way, new citizens will need to ‘buy-in’ to their new neighborhood, city, state, and federal governments. |

Adding the Value of Human Capital LoansHuman capital loans or sometimes called share loans is when a financial institution invests in a person’s education in exchange for a percentage of the educated person’s future income. Many terms can be considered, including having the college take some of the risks. Charitable hours will likely be a mandated term if a person is without work. Broad groupings of these loans would yield an adequate risk pool. It would be hard to imagine the broad innovation that free enterprise education along with free enterprise regulations would yield. In the transition away from government-controlled education, trillions of dollars are at stake. This has the potential of being the most substantial part of a Currency Portfolio through the education transition. |

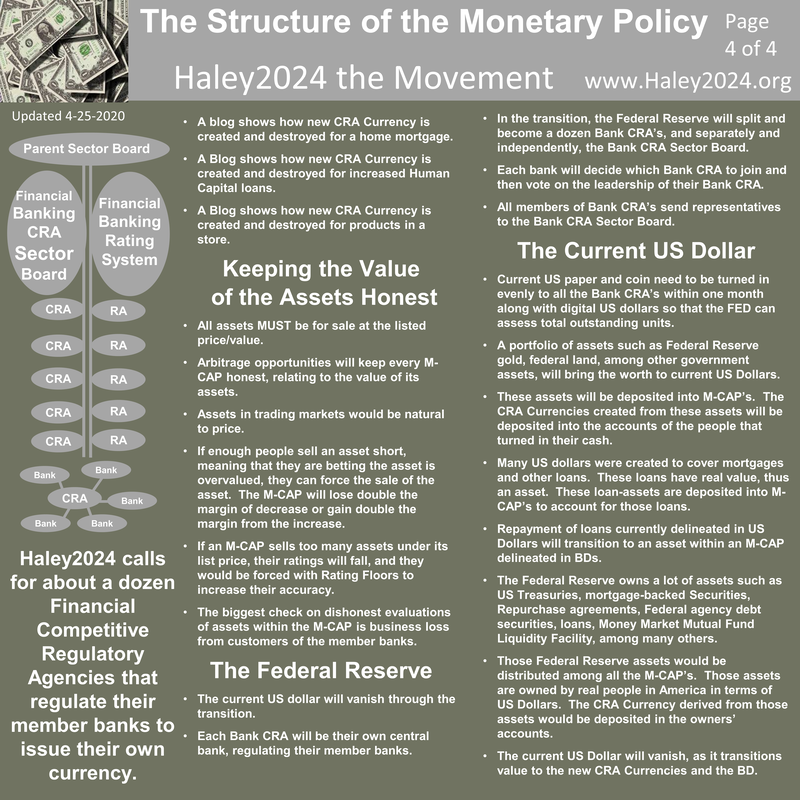

The Current US DollarsThe US dollar responsibly disappears in the transition to the new currency. The Federal Reserve and the federal government gives real worth in the form of gold, government land, the receipts of future taxes, loans owned by the Federal Reserve, and stocks of government-owned assets transitioned over to the private sector, as assets to match the worth of all existing dollars. Those assets are in the CRA Currency Portfolio for the Financial CRA controlled by a part of the former Federal Reserve. |

Closing a CRA Currency PortfolioWhen a CRA drops below 5% membership, they must close shop. All member banks would then become members of other Financial CRA’s. The portfolio would have a few months to divest of all its assets. Since they will not have member banks, they would not have any currency coming in. As the holders of currency spend money, other Portfolios would request assets. The people that had accounts in the closed Portfolio would have a limited time to transfer their currency to their new banks. The last asset should be bought by the last unit of currency. |