| A Currency Portfolio starts out empty. The first person puts in 10 ounces of gold, and the currency portfolio creates and deposits $15,000 into that person’s digital account. The owner of that digital currency owns that gold. That gold holds its value well and is very divisible. That person buys bread, gas, and a used car with $9,000 of that currency. The people that received that money for the bread, gas, and car are now the rightful owners of 6 ounces of that gold. (assuming gold is priced at $1,500 per ounce) |

| They may just spend that currency on other items, in which the new owners of the currency own part of the gold. At any time, the owners of the currency may go to the storeroom and exchange their currency for their gold in the correct proportion to the amount of currency they turn in. Whenever currency is turned in, and assets are removed from the storeroom, that currency loses value because a portfolio may only have as much currency as assets in the storeroom. If $4,500 of currency is turned in for 3 ounces of gold, the portfolio only holds 7 ounces of gold and can only have $10,500 worth of currency issued. |

| If the gold changes value compared to the Backed Dollar (BD), which is the average of all CRA currencies, the value of each unit of currency does not change, the number of units of the currency fluctuates. If gold increases in value by 1% compared to the BD, then that portfolio can now issue 10,605 units of currency. Since the currency is digital, it would be easy to add 1% to every digital account. |

| If the value of gold drops by 1% compared to the BD, then the digital accounts would be lowered by 1%. In both cases, the ownership rights stayed the same; because the digital currency is real ownership rights to a percentage of the assets in the portfolio storeroom, thus people maintained the ownership of the exact amount of gold as they did before. |

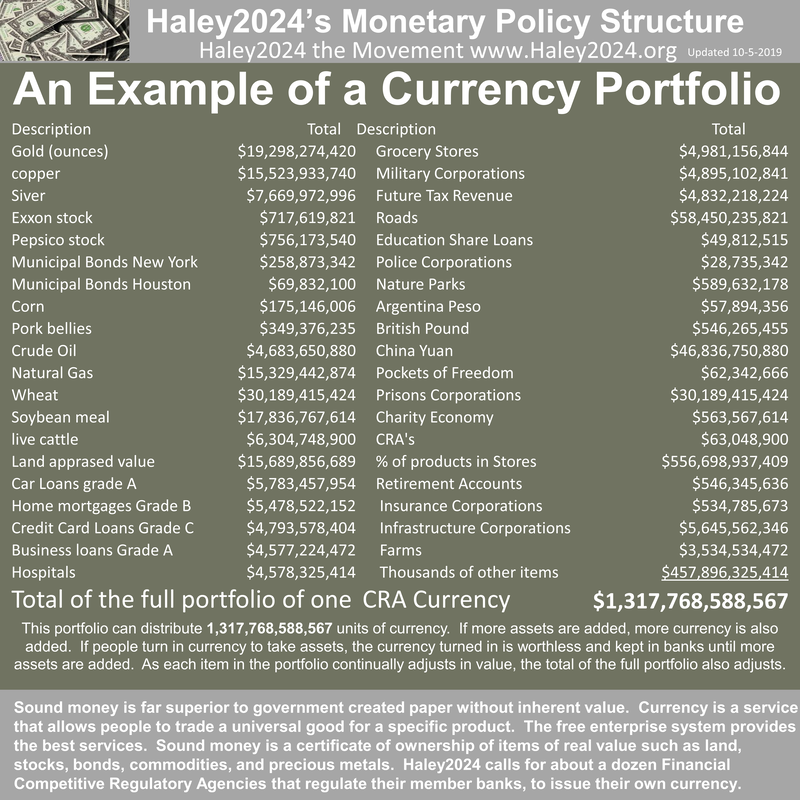

| While it is likely that enough people will desire a CRA with only gold in the portfolio to attain their own CRA, most CRA’s will add other items of real worth into their portfolios. There would not be any problems with adding silver or other precious metals into a storeroom. The portfolio would need to have a complete up to date list online that is fully and easily accessible. Each item in the storeroom will be listed with quantity and price. Each item’s unit price will be in constant adjustment to the trading markets. Items will continuously be added to or taken away from the storeroom. |

| Staying with just precious metals for a little while longer, as $8 billion of gold, silver, platinum, and palladium are added to the storerooms, 8 billion units of new currency are added to digital currencies accounts around America. The people that deposited the precious metals receive the currency. Every bank that is regulated by that portfolio’s CRA will have safes with precious metal coins that any rightful owner of that currency may exchange for the trusted coins. |

| If people turn in their currency for the trusted coins; those precious metal coins are out of the digital currency and not in sync with the BD, thus just coins holding a defined amount of precious metals that contain worth. These precious metal coins may be traded with others but do not have the mandate of acceptance that CRA currencies have. These trusted coins would likely be accepted readily into the banks to be turned back into digital currency. |

| On a daily basis, gold and other precious metal coins enter and exit the currency portfolio. The unit price of each coin is in flux. Therefore, the value of the portfolio is in constant flux; thus, the units of currency are also in continual flux to match the value, and that always matches the BD, which is the average of all currencies. |

| In some ways, this seems overly complicated, however, in a significant way, it is very straight forward. There is always a precise amount of gold in the storeroom, even if it is spread across thousands of banks in America. That gold always has a precise price per ounce in the trading market. If you multiply the exact ounces of gold by the price of gold per ounce, you have a precise value of gold. You do the same with silver, platinum, and palladium. The proper multiplication and addition yield a precise value of the portfolio. At all times, the units of currency must match the exact value of the portfolio. |