| By Bill Haley November 26, 2015 I hope that I am wrong; however, the policies we currently have, make normal ‘bubble popping’ crashes have far worse results than normal. The 2008 crash could look mild in comparison. What government leaders ‘know’ that just is not so, is very dangerous. We are sitting on top of some big bubbles like normal; however, monetary policy has never been this insanely dangerous. |

| When might this happen is a question that is difficult to answer because it is unknowable. Many people are amazed that the money bubble could grow so high. The issue is that a critical mass of people need to have a significant enough awareness of the problem before the cascade occurs. Often it is triggered by a small event that dominos a few medium size events. A few key people in the media throw up caution flags, and small snowball now begins to show the true reality, and the cascade begins and becomes an unstoppable force. |

| How fast and how much is always a result of the primary law of economics, (something is only worth what someone is willing to pay for it). Timing on crashes is always a knowledge and acceptance issue by a critical mass of people. If enough people are willing to suspend belief on reality, the trading, as usual, can continue; however, the underlying problem is getting worse and often the economy is being hallowed out beneath their feet. Delaying the inevitable only causes the fall to be more harmful when it happens. |

| What would happen if people woke up to a realization that their dollars were now valued 10% less than the day before? This could start a cascade that could Avalanche down in a big way. Most other stock market crashes did not take the money down; however, this is the first time in a century that within a decade the Federal Reserve quadrupled our currency base. |

| Just consider, if you owned 10% of a company and you were told that company managers got carried away and keep selling 10% of the company each to 50 people. Yes, this is illegal; however, in the end, you would now only own 2% of the company, as well as the other 49 people. All stockholders lost 80% of the value of what they thought they owned. |

| About once a decade, a shock to the system happens and bubbles burst. People in-mass start to see just some of the devaluation and a cascade starts. A new dynamic will occur during the next crash. Rapid inflation, or better put, rapid realization of inflation that has already occurred over the last eight years come to light. |

| People will first notice gas prices jump. Then they come out of the grocery store shocked of a general 10-15% spike. They hear on the news that Japan and China stopped buying American debt and in fact demanding to cash in trillions in existing debt holdings. The government or the Federal Reserve simply does not have that money, so they begin massive QE, meaning printing up new money. |

| The Fed and most people still do not realize that the new money’s value can only come from the existing dollars, thus debasing the currency further. At this point, people are not willing to accept the true fact of how much the currency has dropped. At the two week point, the currency is flowing in at such a rate as to keep pushing up prices, and we surpass 20%. |

| Gold spikes by 50% as people try to hedge their losses. Other precious metals and collectibles also see significant gains. People try to use up all their currency before it is devalued further. Retired folks on very fixed incomes start to panic when they can only afford 70% of what they acquired just a month before. |

| People start to understand the contracts, debt, loans, investments, and salaries they have, are all delineated in dollars. These contracts and agreements in dollars very rapidly are seen as no longer making sense. One side loves it, and the other side does not. People start breaking contracts and demanding inflation adjustments. |

| Laws suits fly and ultimately the courts rule the Federal Reserve violated the constitution by changing the value of the currency thus changing contracts. The damage was done, and there are no remedies that can make people whole. Employees demand inflation-adjusted salaries, however in the middle of a crash and all other expenses escalating, companies find it impossible to keep up. |

| Businesses that mostly supply ‘needs’ are having a rough time dealing with increased cost; however, since everyone is consolidating their spending on needs and even stocking up for future needs, they are making it. Conversely, those in businesses of services of pleasure, vacation, leisure, entertainment or others in the ‘wants’ economy are losing massive business as people are panicked. Many business models are no longer viable, and many employees lose their job. |

| Oversea markets quickly move away from using the dollar and start to ‘cash in’ the dollar holdings by buying real things with those dollars meaning cargo ships full of goods start to move away from our shores. While many think that greater exports are good, one needs to realize that means we in America are doing labor for people in other countries. Typically, this is well balanced, and everything is fine; however, when vast amounts of foreigner quickly dump their American dollars, shocks to the system cause significant problems. |

| Massive layoffs, people quitting because their pay is not keeping up with inflation and businesses just going out of business, cause the cascade of house foreclosures, business loans defaults and others debt issues cause the banks to fall in an overwhelming financial avalanche. The housing market plummets, trapping many people from moving to better employment opportunities. Many people take advantage of a very misguided law that allows people to walk away from a house and their underwater mortgage. Retirement funds that were based on the repayment of those mortgages lose double-digit percentages. |

| Because of the underlying unrealized devaluation of our currency created by long-term very low interest rates and QE, the prices continue to rise and hits 30% by the end of the fifth week. The budget deficit hits all-time highs as business profits vanish, a smaller workforce reduces payroll and income taxes. Many of the newly unemployed people join the welfare rolls. |

| Those in the inner city and mostly on state assistance are no longer going to get the ‘needs’ with the same nominal level of benefits and increased prices. Thus social unrest unfolds and calls and ‘demands’ of increased aid stress the now over-budgeted public sector that is also seeing more significant needs. The higher expense for police is not in the budget, and the rule of law is in retreat. |

| All these events exasperate all other issues listed here, make everything worse, and the cascade continues. Saving rates fall, and in fact, most people are emptying their retirement accounts as not to see it just lose 5% a week. More QE is ‘needed’ to make the budget, and the leaders in Congress and the Federal Reserve are clueless that the money presses running 24/7 and now at the three-month mark making only $100 bills is the cause of the problem. Prices are now 50% higher, and the lack of control creates more panic. |

| People on a fixed income have their buying power greatly diminished and frightened into bad decisions yielding great long-term harm. Most people do not know how to handle hyperinflation. Thus many end up in awful circumstances. Many people are starting to realize they have to live with a much lower standard of living. |

| The people panic and call politicians to ‘do something.’ The government in their extraordinary levels arrogance that is matched only by overwhelming ignorance attempts price controls that limit people from allowing prices to equalize to stability. Prices always find a way to its own level, however very often with significant adverse side effects if fighting price control laws. |

| People desire to save, remains high, however the conventional ways of doing that are vanishing or made illegal by arrogant government officials. If the Federal Reserve keeps rates super low they would have to print up massive amounts of new currency to accomplish this, thus acting as a QE and continuing at a more substantial pace to debase the currency. At low rates, people do not want to save since massive inflation eats away at their savings. |

| If the Fed allows the interest rate to go high enough, to get enough of the money to flow into savings, the interest on the federal debt will swallow the entire budget. High debt levels really have a major effect. It is regrettable that the effect of high debt is not seen continuously and realized by the people because when the effect is hidden for a decade in bad monetary policy, the built-up effect could be massive. Ongoing adjustments, while still having harmful effects, is far better than a sudden realization that totally wipes people out financially. |

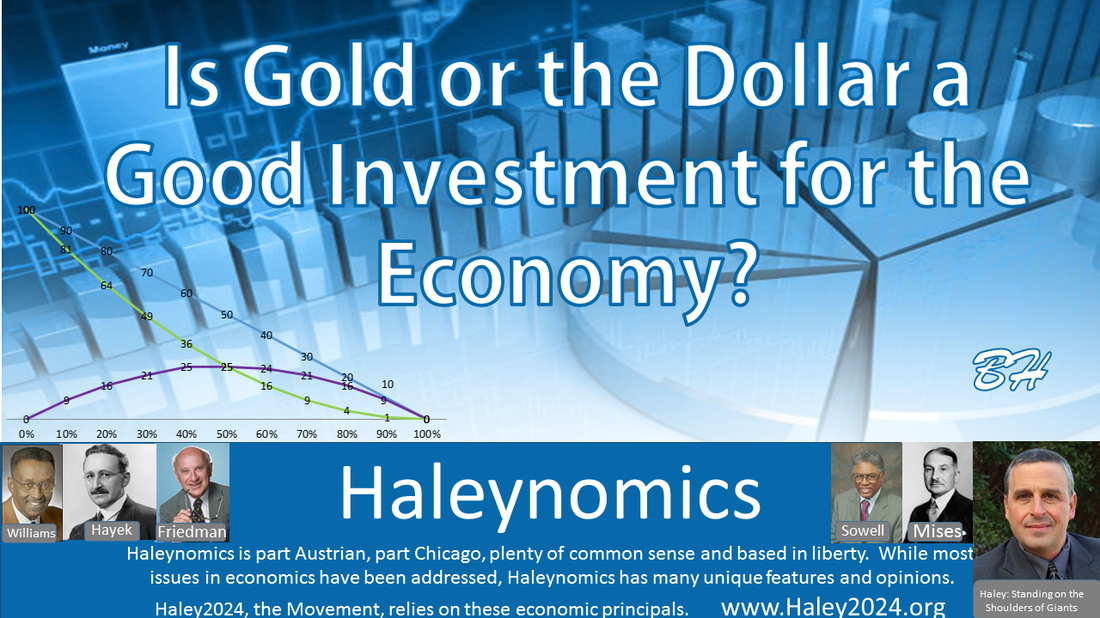

| In conclusion, while much of these storylines, while started here and going in a negative direction, have an unknowable finish. One would hope that good lessons (Haleynomics) and (Monetary policy) are learned so that free enterprise can reach down and pull this economy out from the profoundly adverse effects of government control. |

| The people in government learned the completely wrong lessons after 2008, so the future lies in whether enough people can be educated correctly after wrongheaded lessons were learned in the vast majority of colleges. Economics have so many factors that often, conclusions are forced into fundamentally misguided paradigms and errors are repeated and compounded. This is indeed a battle of fundamental beliefs of free enterprise versus politician control. |