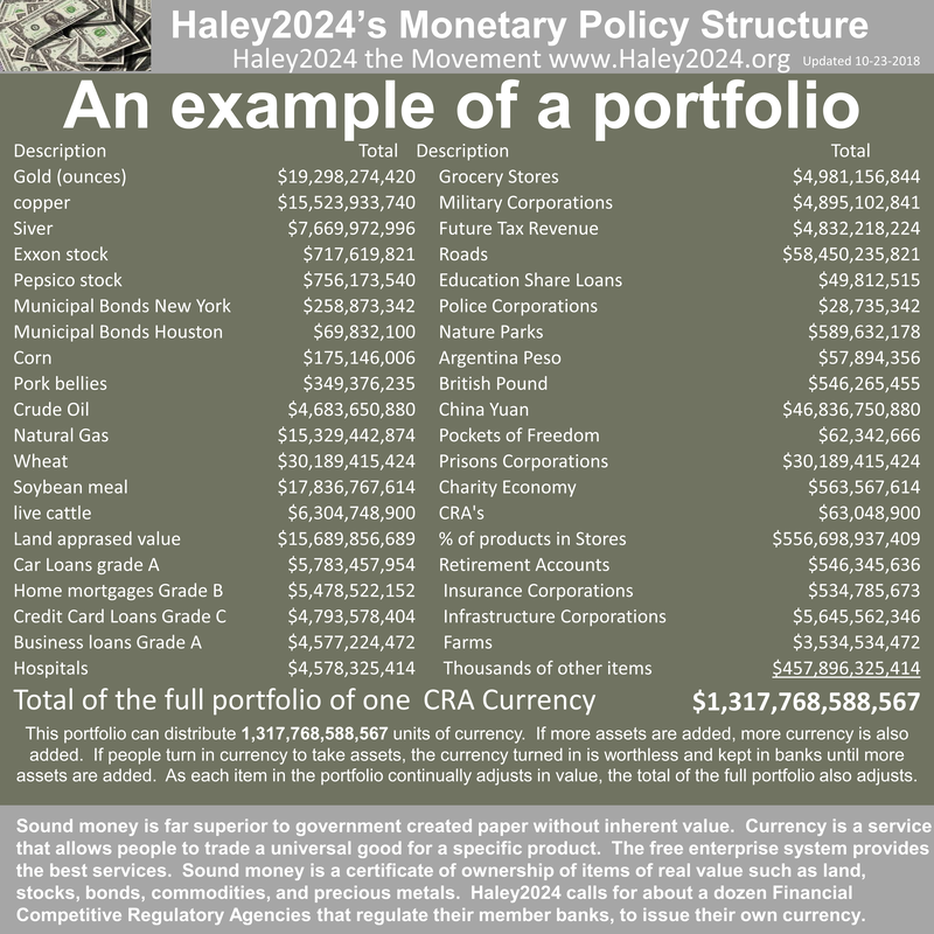

| There would be a natural concern of a currency portfolio having the correct valuation of all its assets. If all other currencies are mandated to accept every CRA currency, they must trust the value. If a portfolio lists an asset on the low side, people would quickly buy the asset on the low side and sell it at a higher price; thus, the low side is not a concern. A portfolio would not want to give away worth and lose people using its bank and currency. People holding a currency performing poorly lose value by losing units of currency. |

| On the high side, if a CRA list its gold at $10,000 per ounce when it is on the trading market at $1,500, it would be ‘cheating’ the entire system. One easy solution is that when someone takes something out of the portfolio, it does not take the overpriced items. However, that does not adequately address the issue. There are several ways in which individuals, organizations, and other CRA portfolios can address the issue of portfolios overpricing an item. |

| First, there can be a mandate that an asset in trading markets needs to be at the market price. However, there will be many items that are not in the trading markets. If a CRA regularly needs to sell assets at a lower price than what was listed, they will be rated low in the Rating System. A low rating could result in a reduced valuation of a subset of the portfolio. |

| Every day, all portfolios are transferring assets from one to another, depending on how people spend their currency. If an asset goes ‘stale,’ meaning an asset is not bought for a specific length of time, the portfolio must reduce the value of the stale asset until the asset is requested by another Portfolio. |

| Selling an asset or a set of assets short has been a long-established method of forcing an overpriced asset to a more reasonable price level. If someone sells an item short, they need to risk their own money claiming, for example, an item is worth $90,000 when it is listed at $100,000. Selling an item short can force the sale of the asset to reveal the true price. If the item sells at $100,000, the person selling short loses money to the portfolio. If the item sells below $90,000, the portfolio pays the person making the short sale. |

| Maybe one method would be sufficient, or several of the methods could be used. Other methods and there are many, could be proposed and tried. The regulations regarding those methods would be at the Financial CRA Sector Board level. A Rating System floor will be in place. The methods used will increase until the ratings are high enough that prices are stable. The goal is a low-cost method of every CRA currency portfolio being honest with their valuations. |