| The dominant question in the debate regarding the corporate tax cuts of 2017/2018 was who was going to get the money corporations ‘saved’ by having tax rates drop from 35% to 21%. I believe it is the wrong question. However, it does deserve an answer. How that ‘savings’ is distributed does not relate to stimulus. |

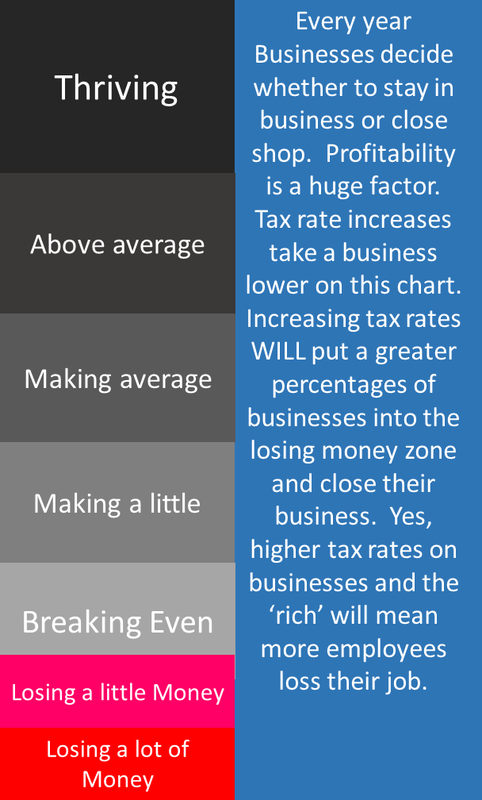

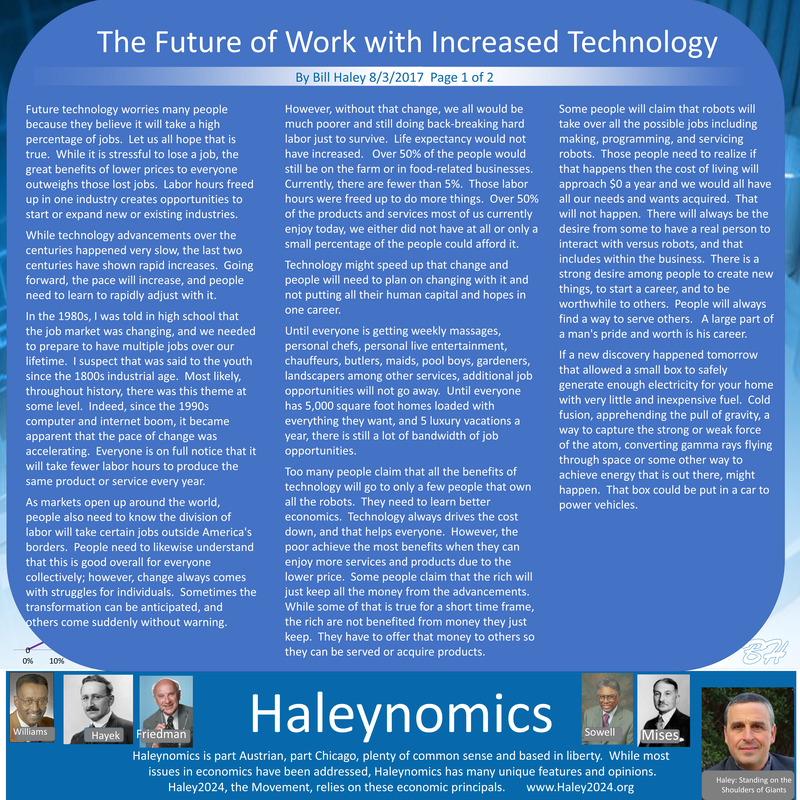

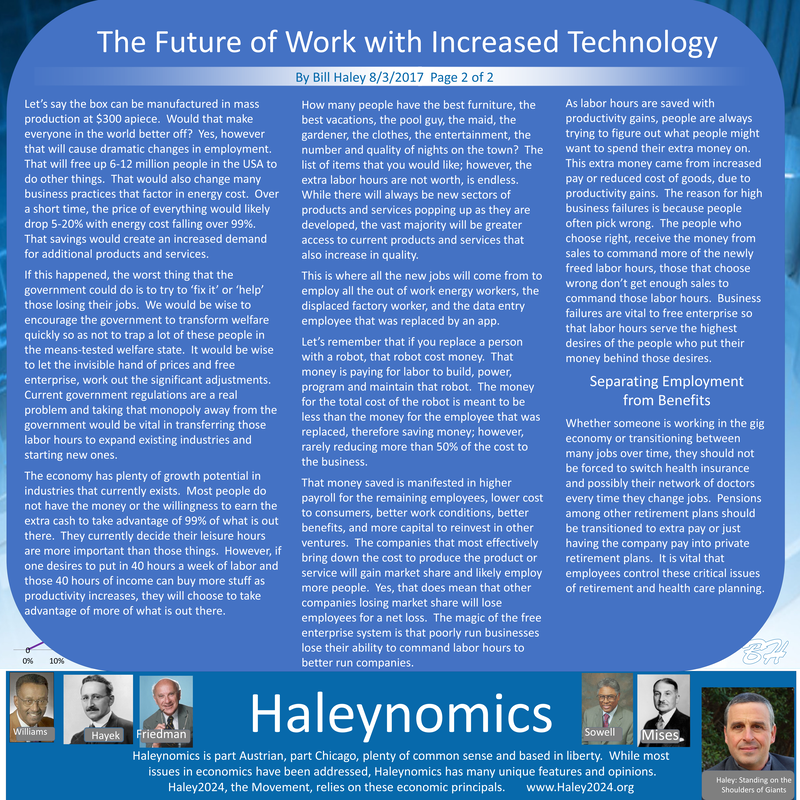

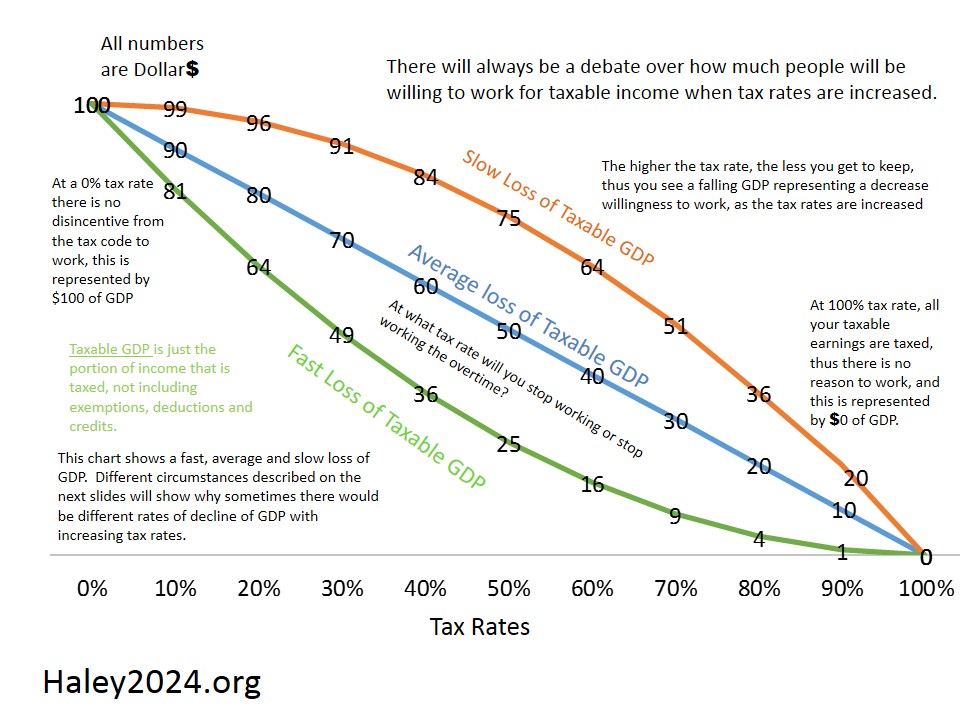

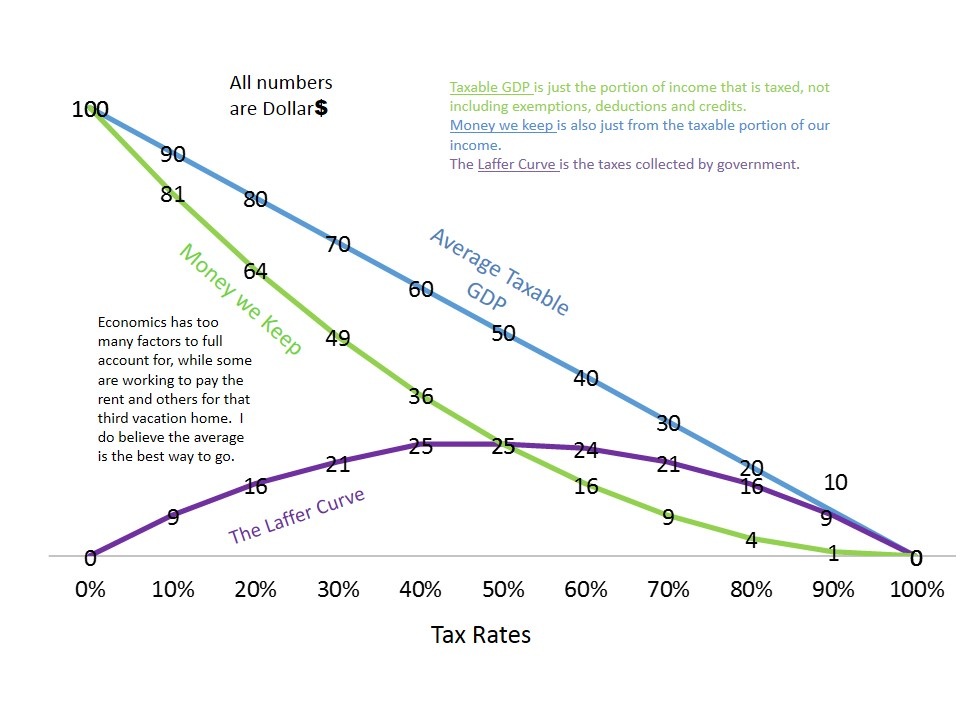

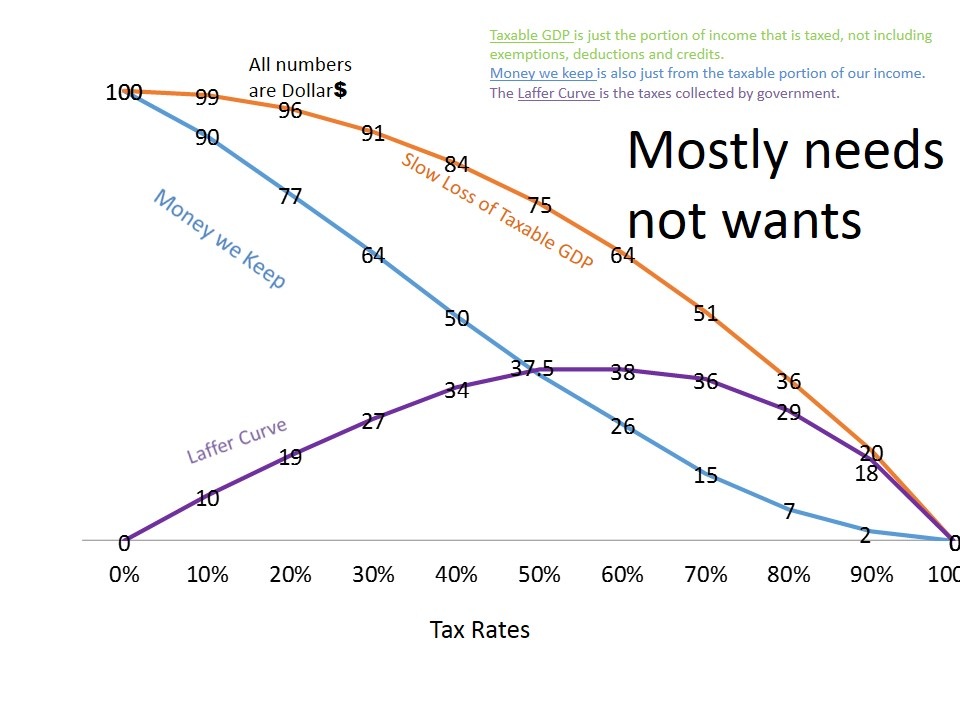

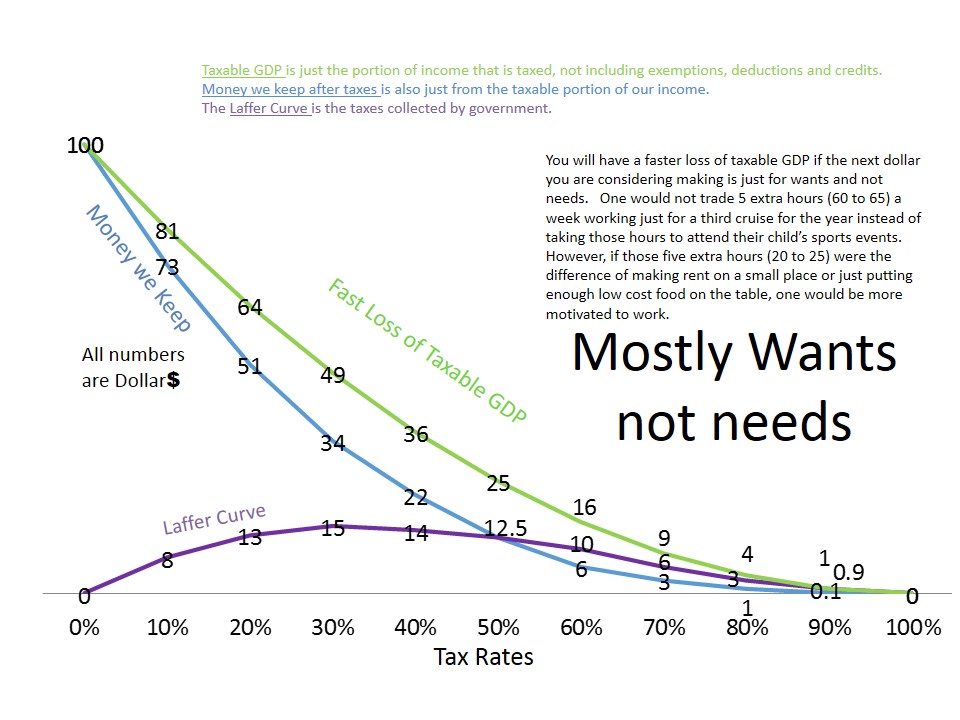

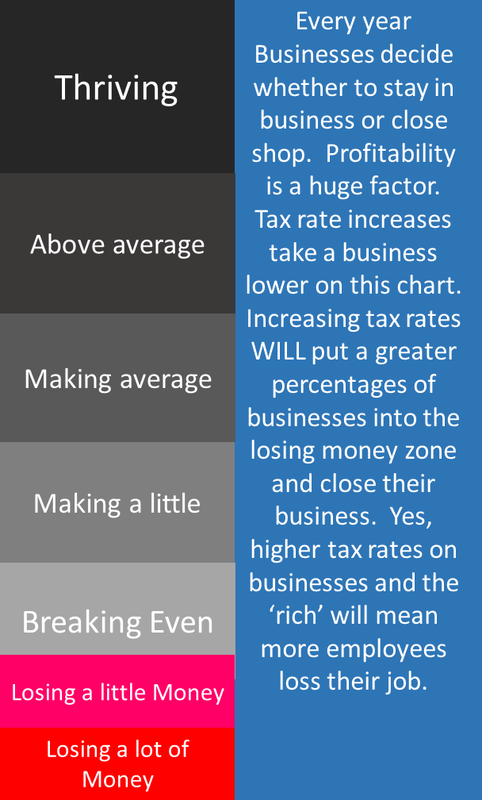

| Stimulus effects come from a higher percentage of businesses being viable. Roughly 20% more businesses make sense when tax rates drop 14% from 35%. That is manifested in fewer business contractions and closures. It is also manifested in more start-ups, and expansions. Some people would take leisure hours instead of starting a business when they can only keep 65% of their earnings. Retaining 79% changes the equation and will incentivize a start-up. |

| Within a month of the tax cut, reports are coming in fast that significant money is being invested in this taxing authority of America that was held overseas for many years. All countries compete for businesses. There is a whole industry within accounting, built on avoiding higher tax rates by doing the economic activity outside the taxing authority and that avoidance is reduced when the tax rate is reduced. |

| There are good reasons why every company does not pay every employee minimum wage, only a few percent of employees receive the minimum wage. There is an open competition for useful labor. Better compensation packages yield higher quality employees. To retain their good employees, businesses are announcing raises and bonuses on their employees based on projected growth and tax savings. |

| Companies always look at the return on investment of new or improved equipment. Are you going to get better quality or faster output with a new machine? Can you improve safety? Can you give your employees an enhanced work experience? Savings from any budget line item, including taxes, can push the answer to a yes. On average, tax savings will partially go to capital equipment. |

| A corporation has a budget. Every part of that budget is scrutinized. Every part of the budget can be reduced or increased. Reducing a part of the budget has bad effects, while increasing has positive effects. The amount going to each part of the budget has a bell curve where disastrous results happen when funding gets very low. |

| On the other side, increasing any budget item way over necessity has large diminishing returns on the positive side. There is a sweet spot at the top where the job gets done, and you avoid the downsides. A good CEO and the board of directors’ responsibility is to find that sweet spot on every budget category. That sweet spot is often controlled by competition on many fronts. |

| If a corporation does $100 million in sales and has $90 million in expenses, their tax liability drops from $3.5 million to $2.1 million with the tax cuts taking the rates from 35% to 21%. The $1.4 million in savings will be swallowed rapidly with customers, and business needs demanding parts of the $1.4 million. |

| It is claimed by the Left that directing money from the rich to the poor will stimulate the economy because the poor will spend the money faster. That is misguided on many fronts. Saved money is a very valuable part of the economy. Saved money is lent out, usually meaning building capital goods that hold worth and potential. |

| Therefore, saved money does get spent, thus going to paychecks. Spending and savings both result in the money being spent. Spending is consumption resulting in depletion while saving is spending that results in a valuable asset. Both are necessary, and the level of each should result from billions of decisions from millions of people. |