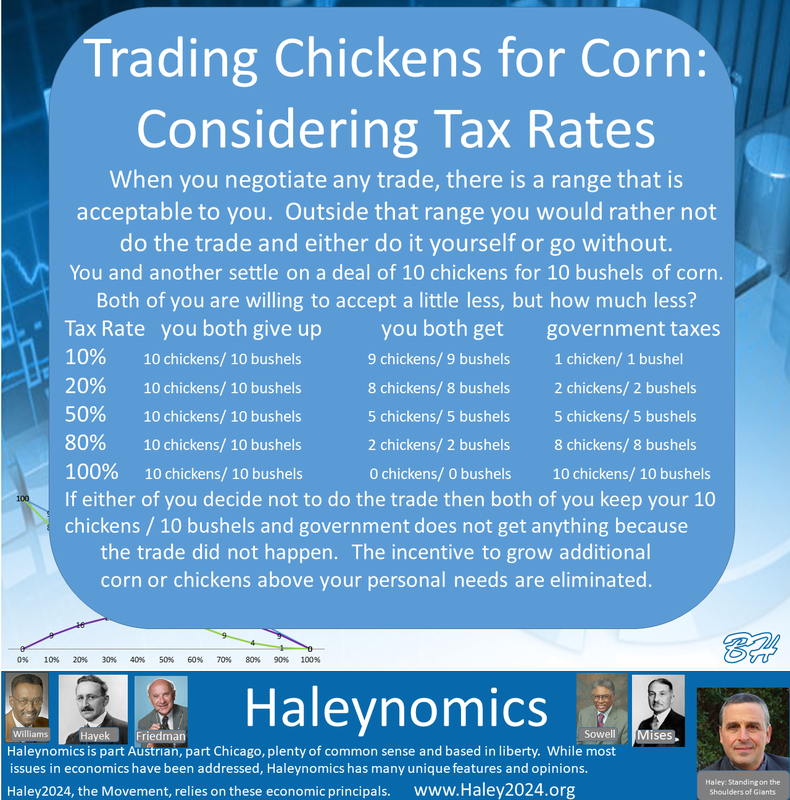

| If you want full employment for yourself, you may create all your own products and do all the services you desire all on your own. As soon as you trade with one other person; you are depriving yourself of doing the labor yourself. One trades their chicken for someone’s bushel of corn because it would make them better off. Let us say that it takes the corn farmer one hour to grow that extra bushel of corn, and it takes you two labor hours to grow the corn. Similarly, let us say that it takes you one labor hour for you to raise another chicken and the corn farmer takes two hours. You both realize that if you both use one extra hour to make an extra bushel of corn or raise another chicken and trade; you both would save an hour each while attaining the same products. You both free that hour up for leisure or creating new and different products for yourself. |

| Once you add a third person to your trading universe, a new dynamic enters. The third person can take business away from you. The new person may sell rabbits, sheep, or cows for meat. The person you were selling your chickens to, now has other options to buy their meat products. However, you now have a potential new customer to sell to and new products to purchase. You might need to have a discussion about what they both want and explore if you wish to compete to provide that service. All three people will have that discussion, and there would be real competition to see who can serve the other two the best. As more people enter the trading universe from three to dozens, then hundreds; many people will provide products and services that you were offering, and you gain a more extensive potential base of people to buy your product. |

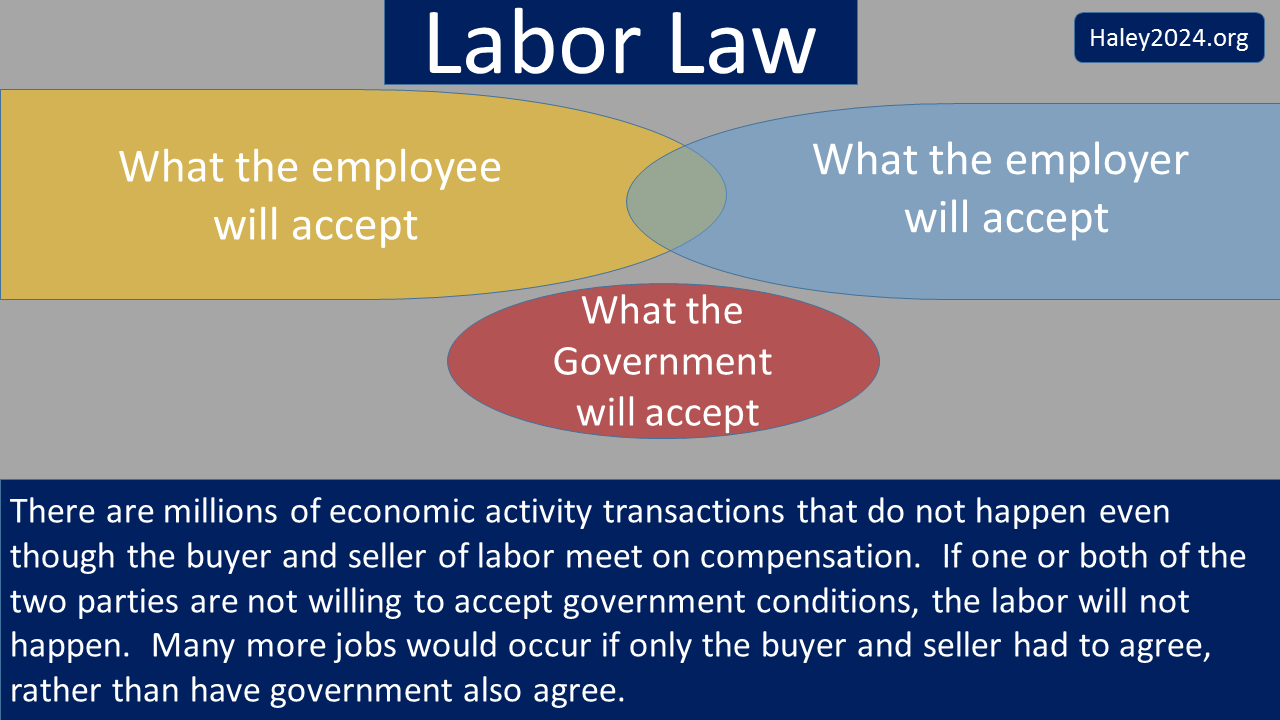

| There will always be new producers that come in and impact a small percentage of producers. Some new producer will out-compete or under-sell a few people. Those people negatively affected will be angry and try to come up with reasons why society should ban by law the new producers. They will claim the new producers need to be protected by forbidding them from selling at low prices (minimum wage laws). There are dozens of similar laws framed as protecting the new producer that result in putting the new producers out of business. Every new entrant into your trading world gives you a larger market in which to sell your product and potentially someone that will produce what you sell and beat you in the competition of serving their fellow man. |

| If two neighboring 500 person towns who both had complete protectionary law, decide that they should allow trading, many people will lose their jobs to others in the neighboring town doing a better job. Consumers immediately see the benefit of better products and better prices. All the people that lost their jobs now need to seek out additional products or services that the population of 1,000 will likely buy. As more product options are at the market place, all 1,000 people will have a greater consumer choice. If individuals buy across town lines, it is foolish to state that Town A bought from Town B. It is foolish to think that if people from Town A bought $500 of product from people of Town B, that those people in Town B doing the labor and serving the people in Town A; would not want products and service in exchange. Outside of personal relationships; people only serve others when they have a valid expectation of offering the money they earned in exchange for being served. |

| As your thousand-person economy grows to millions of people, a more significant division of labor is possible to gain efficiencies and greater productivity. Almost everyone is outcompeted by the economy of producers and consumers growing thousands of times larger. We went from a neighborhood to a large city. Everyone needs to continually change how they are going to produce to out-compete everyone else. With a million-person economy, everyone can win in that competition. They just need to produce products or get good at providing a service that has a history of being bought. Prices develop; however, the nature of prices and business is that consumers are always trying to find better products at lower prices. Every producer must always strive to meet that demand for lower prices, increased quality, and greater convenience, to fend-off other producers. This is the base of competing to serve your fellow man better than others. |

| As the million-person city grows into a ten-million-person state economy; competition and choices expand as well as your market to sell your products and services to ten times the consumers. Business models of successful companies tend to be bigger companies. A higher percentage of people see their best option is to provide services to a company as an employee. Big corporations specialize in creating a well-planned division of labor so that each employee can concentrate all their work efforts to just one aspect of creating a product. Big corporations are always looking at every aspect of their company to be the most productive. Often times, that means a vendor can produce a product or service better than direct in-house employees. There are many situations where former employees saw better opportunities to start their own business, creating the same function as they did as employees, even becoming a vendor for their previous employer. |

| As the ten-million-person state moves into allowing trade among 330 million people in all of America, the circumstances change significantly. 33 times more competition and 33 times more customers. The consumers have 33 times as many options. People’s quality of life grows. No longer do the people in Maine need to pay the high prices of orange producers that required greenhouses. No longer does a car company need to source all their parts from within its state. No longer does a potato farmer in Idaho under-utilize their land because of the limited market within the state. Silicon Valley can utilize many labor hours creating great products, and mass produce copies very inexpensively; thus, the greater consumer markets reduce the per unit price. There is a need for exceptional talent within companies; thus, these companies need the ability to offer jobs to talented people from across America. |

| Without a doubt, the US Constitutional provision regarding the requirement of free trade across America advanced this nation’s living standard significantly. Zero people survived their job being destroyed by competition. Every year business models transition. Every job, by the necessity of competition needs to gain productivity; and productivity is by definition making the same item with fewer labor hours, and that means total labor hours of the thousands of inputs of a product. There is nothing legitimately different from expanding your trading universe from 1,000 to 200,000, compared to 200,000 to 8 million or 8 million to 330 million. Going from 330 million to 7.5 billion is just another expansion. All trades are still from person to person. Money, if done right, always returns the services and products to the people who provide services and products. |

| There are about 7.5 billion people on earth and about one-third billion people in America; meaning about 4.4% of people on earth live in America. About 23 times more people live outside of America versus inside America. All the gains of free trade in America can expand to trade with people outside of America. Other than serious issues of foreign policy where leaders of other countries are destabilizing other countries or harming their own people; there should be free trade. The only fair trade is free trade. A tariff to give needed services to facilitate the trade should be considered; however, those services should mostly be provided for in the free enterprise system. A matching tariff program with the goal of having the other country reduce their tariffs should be explored. |