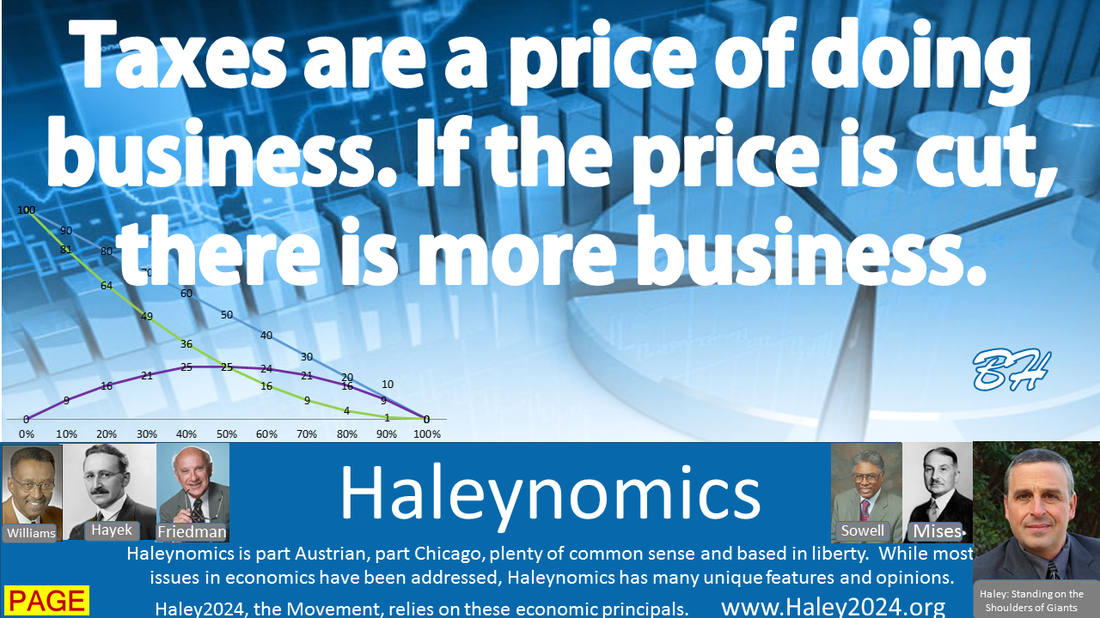

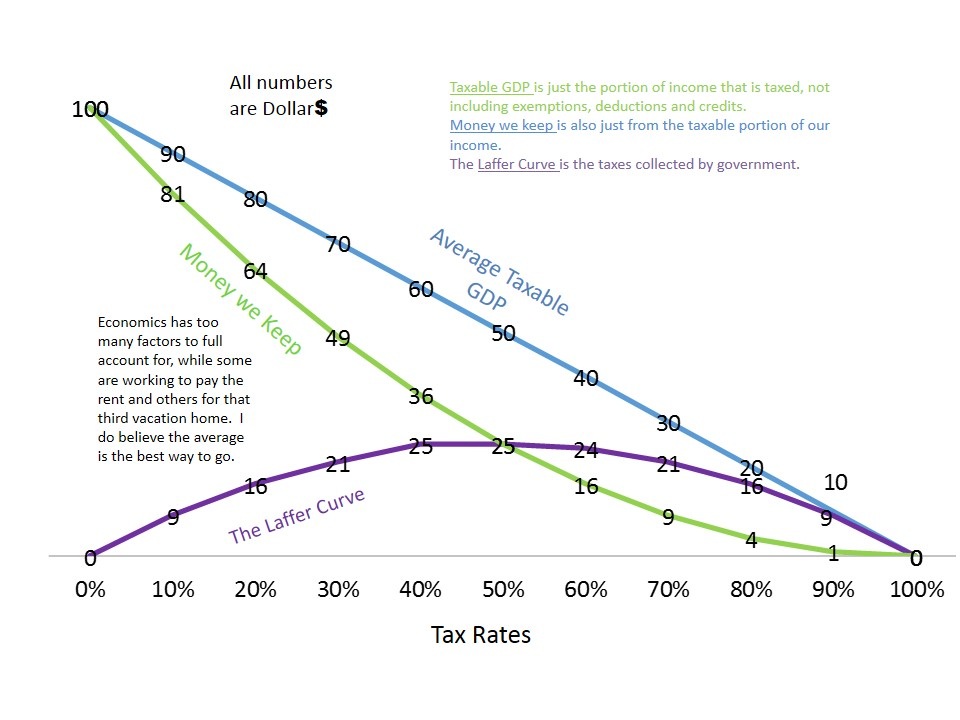

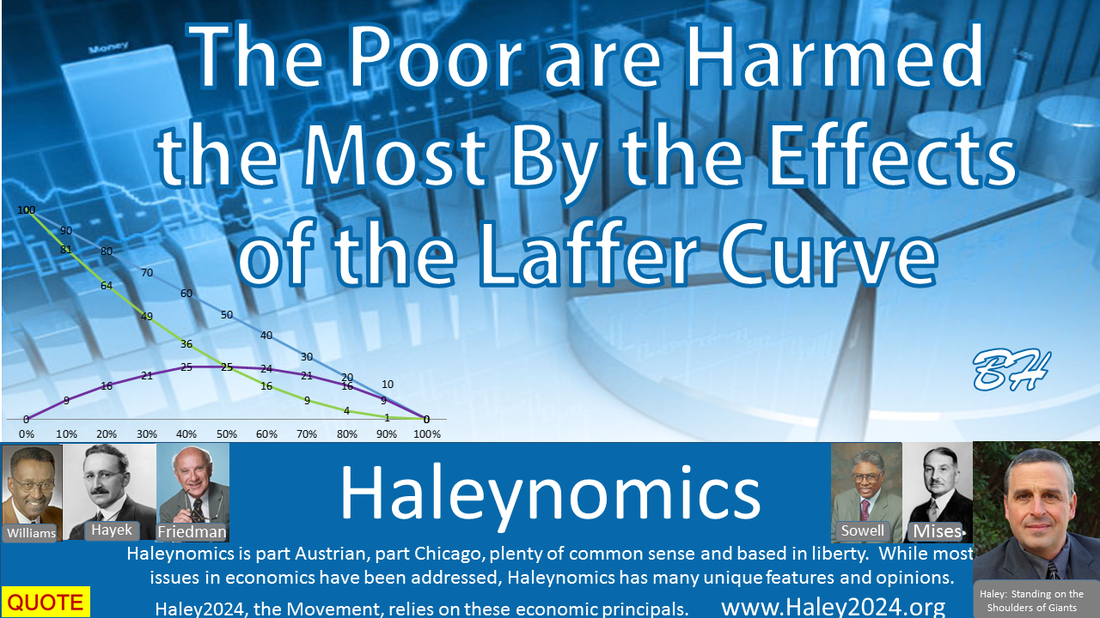

| Everyone should recognize the main lesson of the Laffer Curve. That lesson is that higher tax rates create higher disincentives to do the taxable exchange. A taxable exchange means the government takes a portion of an exchange between two people or businesses. Higher tax rates result in decreasing collective incomes. A complete understanding of the Laffer Curve should compel everyone to keep the tax rates as low as possible. |

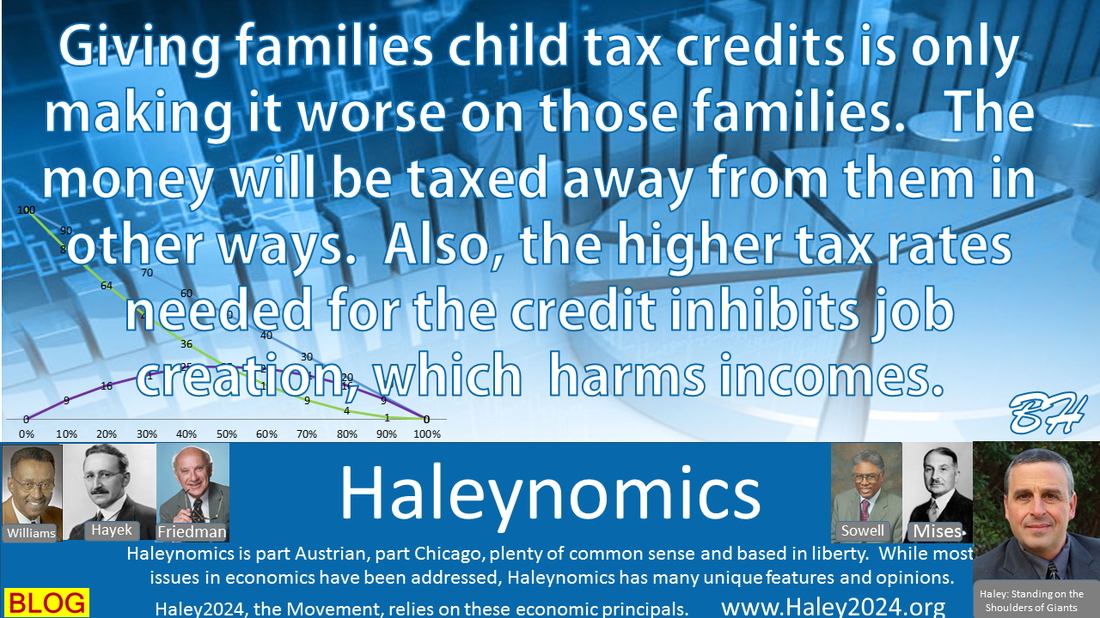

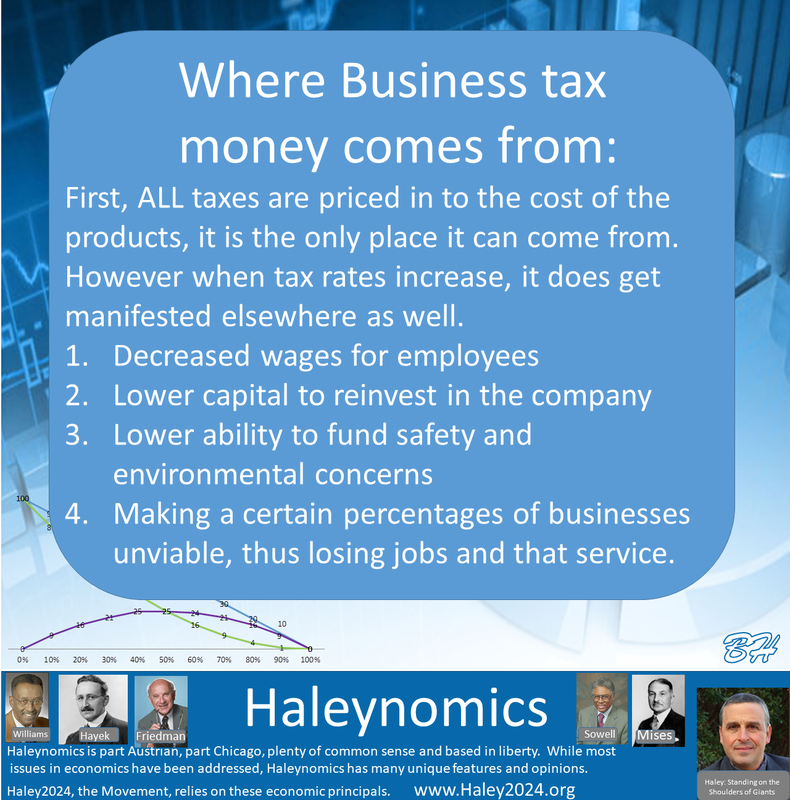

| Let’s look at a small community of 100 people of varying incomes, resulting in a $1,000 economy at a 20% tax rate. If the Government needs $200, they do not do a head tax of $2 per person, they do a 20% tax. Now if government exempts $200 of the income (collectively) and allow $200 of deductions (collectively) and gives everyone a $.50 tax credit (collectively equaling $50), then the tax rate of 20% will only result in $70. Government services still require $200, so the tax rate would have to rise to 41.66% in the static analysis. |

| Let’s look at the math on smaller deductions, exemptions, and credits. Let’s half the previous example at $100, $100, and $25. At 20% rates, the results are $135 of tax revenue. ($1,000-200) x 0.20 = $160 -$25=$135 of tax revenue. Doing the math with the Laffer Curve logic, the tax revenue maxes out at 40% with only $195 collected. 40% versus 20% tax rates drops GDP by 25%. $750 minus $200=$550 x 0.40%=$220 minus $25= $195 in tax revenue. |

| Let’s reduce the deductions and exemptions to a total of $125 and keep the credit at $25. Doing the math, the tax rate needs to go up to 30%, dropping the GDP 12.5% to $875. The taxable income is now $750 ($875-$125). At 30% that is $225 then take away the $25 credit to equal the $200 needed for the government. This means to just get 12.5% of GDP worth of deductions and exemptions, and then 2.5% of GDP of a tax credit means a reduction of overall collective incomes (GDP) of 12.5% |

| To get the 20% of GDP worth of deductions and exemptions and then 2.5% of GDP of a tax credit means a reduction of overall incomes (GDP) of 25%. (Tax rate increasing from 20% to 40%) and we still were a little shy of the tax revenue needed and higher tax rates cause tax revenues to slide down the bad side of the Laffer Curve. |

| To get the 40% of GDP worth of deductions and exemptions and then 5% of GDP of a tax credit means never coming close to being able to raise rates enough to reach the $200 or the tax revenue at 20% without the deductions, exemptions, and credits. The only place a rich man can get the money to pay taxes is from his many exchanges including exchanges with the poor. The attempt to only tax the rich always affects the poor with the greater cost of goods. |

| If the government NEEDS a certain amount of money, the best practice is to take the amount needed and divide it by the greatest possible tax base with a percentage coming from a head tax. This broad tax base results in the lowest tax rates and the lower disincentive of taxable transactions. If there are current deductions, exemptions, or credits, eliminate them and lower the tax rates to match. |

| Over time, the GDP growth rate will increase, allowing further rate decreases. Indeed, we need some government, however, after a 20% tax rate, the negatives of decreased GDP certainly outweigh the extra government revenue. Total of all government tax rates, meaning spending should max out at 10% of GDP. |