|

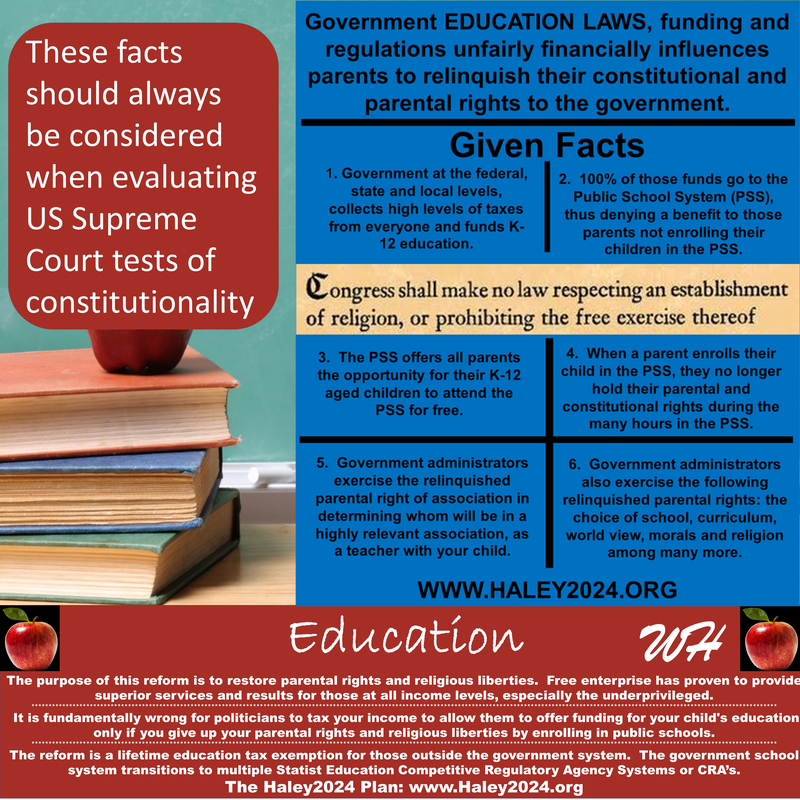

Government taxes everyone roughly one trillion dollars across America’s roughly 110 million households; resulting in roughly an average education tax of $9,000 per household. These taxes are spread over many different taxes including hidden taxes within every item a person purchases. This tax takes roughly 5% of a household’s income. Without the government spending on education, taxes would drop the same. The elimination of the increased disincentive created by the education taxes would yield roughly a 6% increase in economic activity, resulting in higher wages, lower prices, and increased living standards. Without the education taxes, the vast majority of the people would have the money or the ability to finance their children’s education on their own.

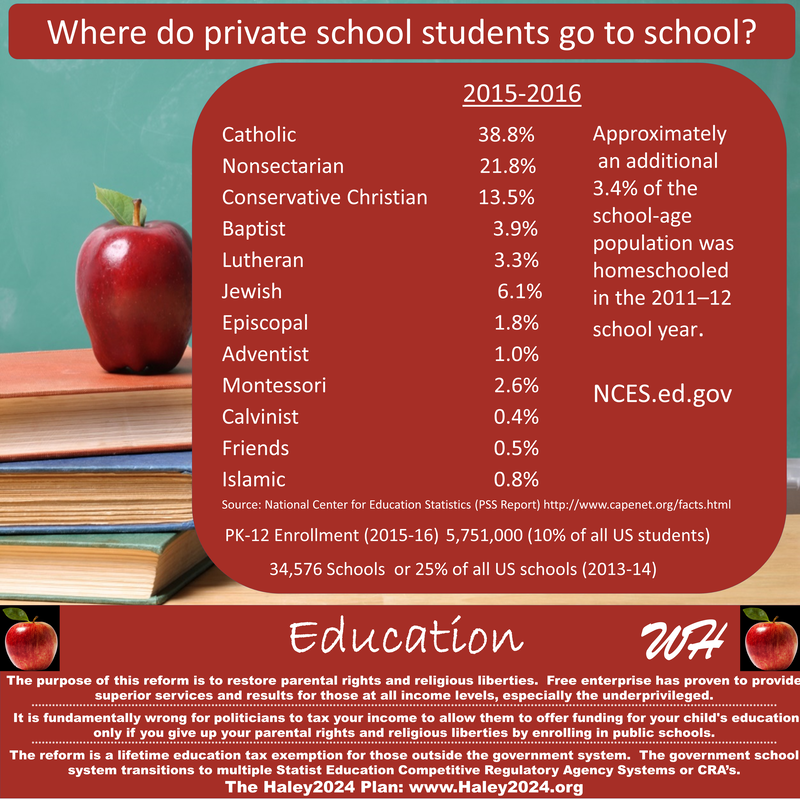

Private School Enrollment |

|

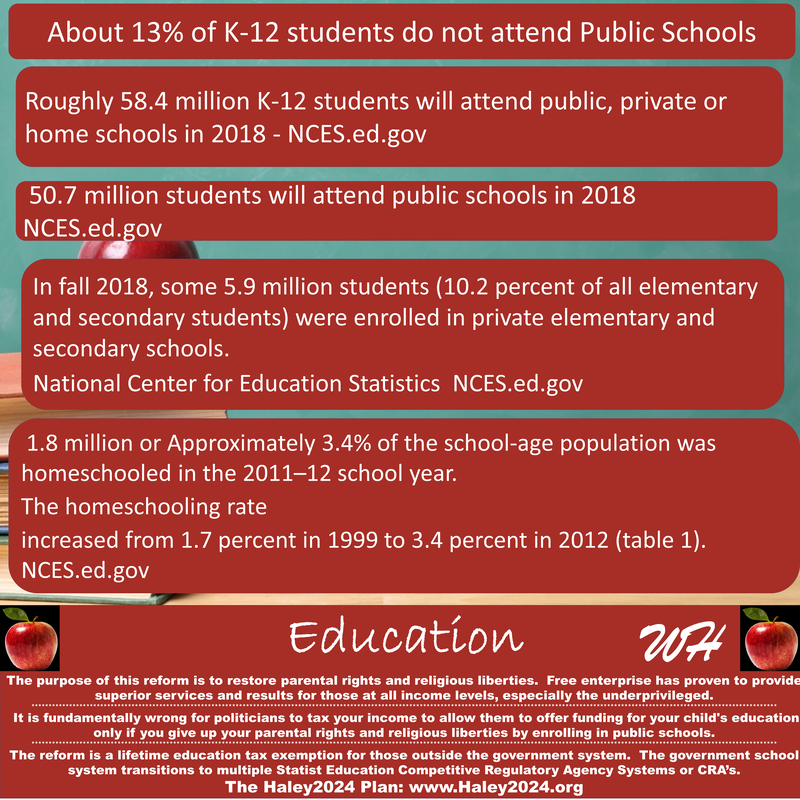

With this $9,000 per household tax, the government collects 1 trillion dollars. They use these dollars to educate about 50 million K-12 students and some going to colleges. K-12 is sourced to be about $12,910 per student for 2018-19. Different states and different cities have vast differences based on many issues. If parents choose to enroll their child in the public school system; the government will fund that education in the amount of $12,910 per child. If parents make any other choice than public schools, they receive ZERO government funding; although the parents still pay the $9000 per year lifetime education tax.

|

|

The parents still have to educate their children which is a considerable cost. Two families living next door to each other with similar incomes of $80,000 per year and four school-aged children are both given the same two options from the government. One family decides to enroll their four children in their local public school in which government fully funds their four children’s education in the amount of $52,000 per year. The other family chooses a similarly priced private school and pays $52,000 per year in private school tuition. One family lives off the $90,000 minus $9,000 of education taxes. The other family lives off $90,000 minus $9,000 of education taxes and $52,000 of private school tuition. As one can plainly comprehend, the choice of public or private education is far from freely chosen.

|

|

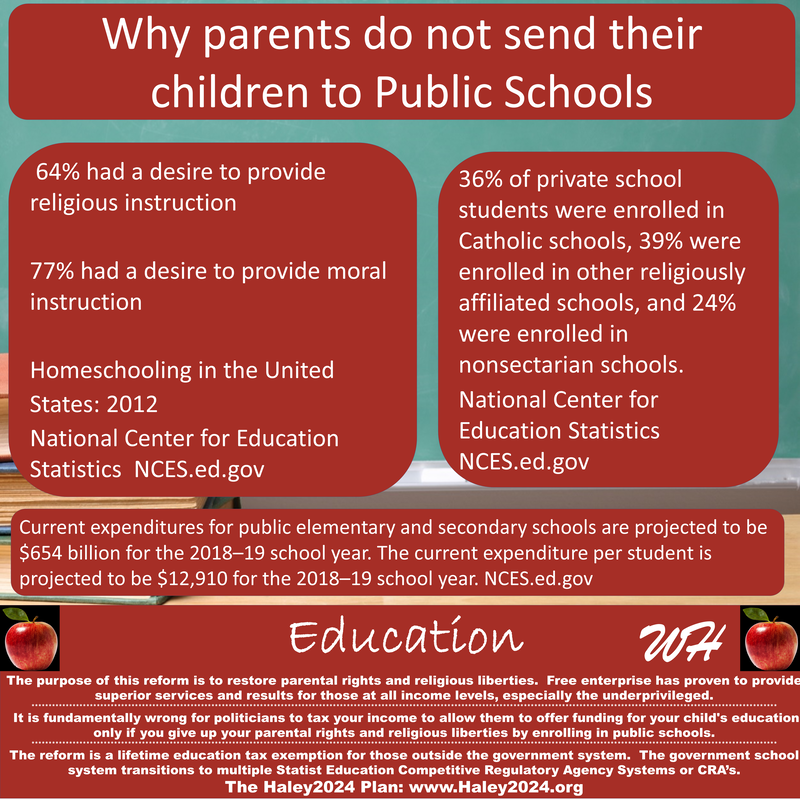

According to the National Center for Education Statistics NCES.ed.gov; roughly 13% of K-12 children do not attend public schools. Of those that are not in government schools, about 24% of the children go to nonsectarian private school. Religion is not banned, and values are taught in nonsectarian private schools. However, these nonsectarian schools are not primarily concerned with religion. The vast majority of private schools have a significant focus on religious education; although the range of religious seriousness is broad. The vast majority of private schools that put religious teaching first still put a high value on reading, writing, and arithmetic academic instruction.

Evaluation of the Florida Tax Credit Scholarship Program Participation, Compliance and Test Scores in 2016-17 Learning Systems Institute Florida State University July 2018 |

|

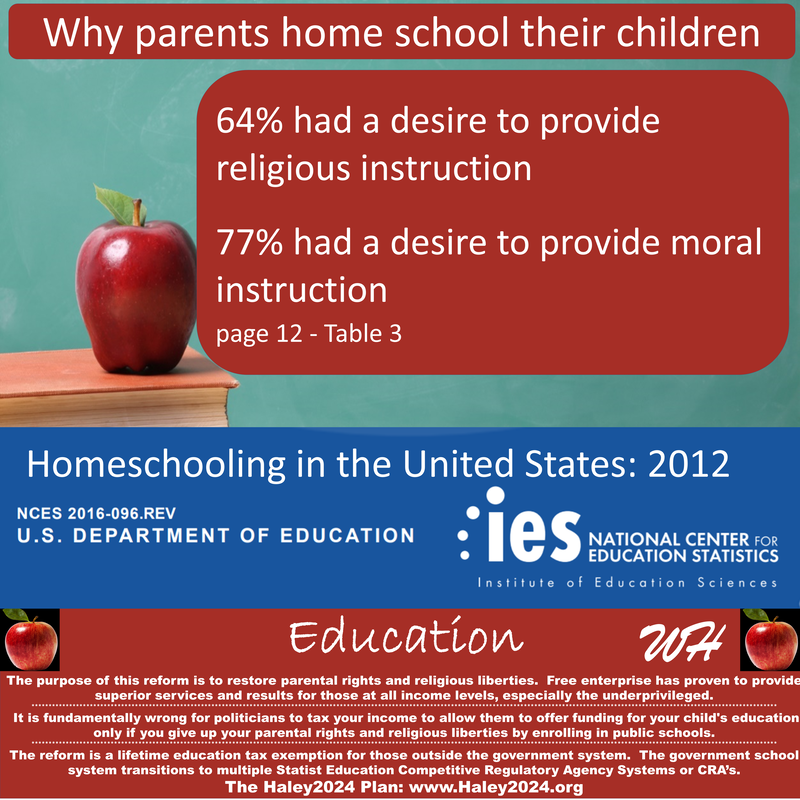

According to the National Center for Education Statistics NCES.ed.gov; 64% of parents homeschooled because of a desire to provide religious instruction, and 77% of parents had a desire to provide moral instruction. Given the government funding, these parents gave up in the form of a government-funded education, the desire for religious or and moral values must be strong. A monopoly on the conveyance or inculcation of values in the public schools yields immoral values especially in the shade of the wall of the separation of church and state.

|

|

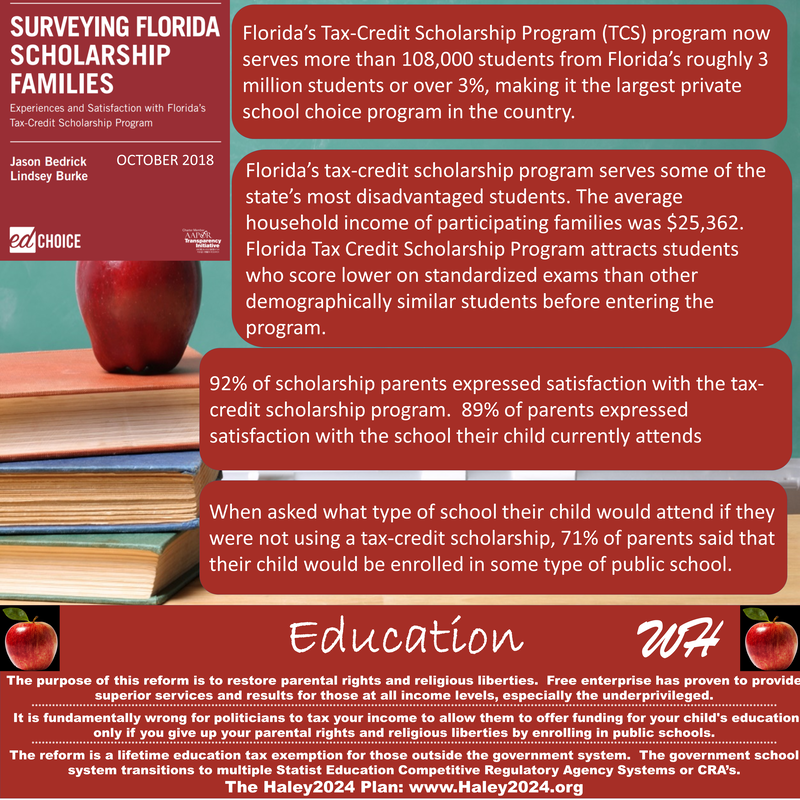

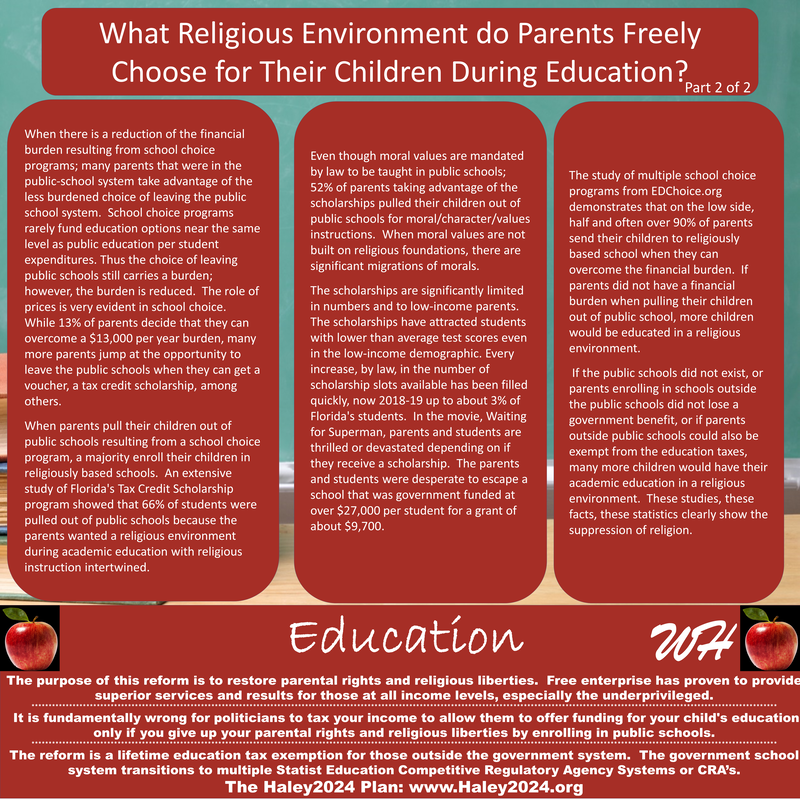

When there is a reduction of the financial burden resulting from school choice programs; many parents that were in the public school system take advantage of the less burdened choice of leaving the public school system. School choice programs rarely fund education options near the same level as public education per student expenditures.

|

|

Thus the choice of leaving public schools still carries a burden; however, the burden is reduced. The role of prices is very evident in school choice. While 13% of parents decide that they can overcome a $13,000 per year burden, many more parents jump at the opportunity to leave the public schools when they can get a voucher, a tax credit scholarship, among others.

|

|

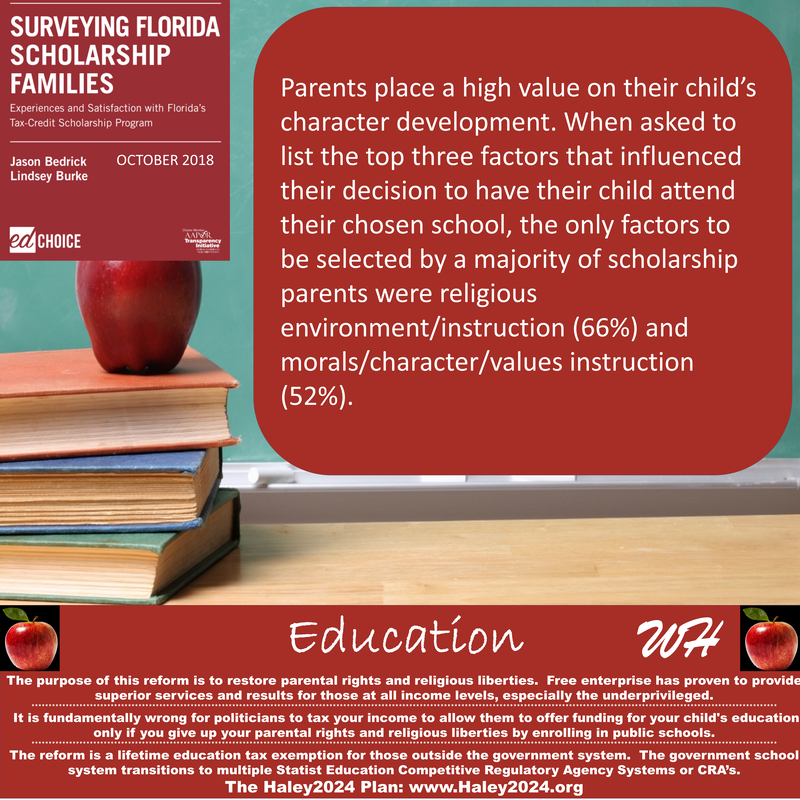

When parents pull their children out of public schools resulting from a school choice program, a majority enroll their children in religiously based schools. An extensive study of Florida's Tax Credit Scholarship program showed that 66% of students were pulled out of public schools because the parents wanted a religious environment during academic education with religious instruction intertwined. Even though moral values are mandated by law to be taught in public schools; 52% of parents taking advantage of the scholarships pulled their children out of public schools for moral/character/values instructions. When moral values are not built on religious foundations, there are significant migrations of morals.

|

|

The scholarships are significantly limited in numbers and to low-income parents. The scholarships have attracted students with lower than average test scores even in the low-income demographic. Every increase, by law, in the number of scholarship slots available has been filled quickly, now 2018-19 up to about 3% of Florida's students. In the movie, Waiting for Superman, parents and students are thrilled or devastated depending on if they receive a scholarship. The parents and students were desperate to escape a school that was government funded at over $27,000 per student for a grant of about $9,700.

|

|

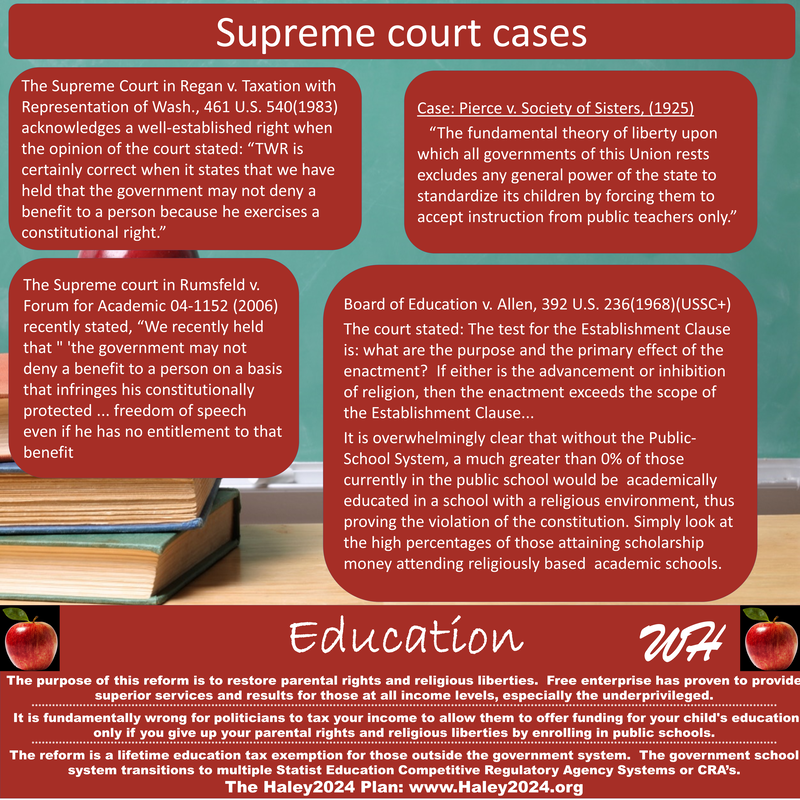

The study of multiple school choice programs from EDChoice.org demonstrates that on the low side, half and often over 90% of parents send their children to religiously based school when they can overcome the financial burden. If parents did not have a financial burden when pulling their children out of public school, more children would be educated in a religious environment.

|

|

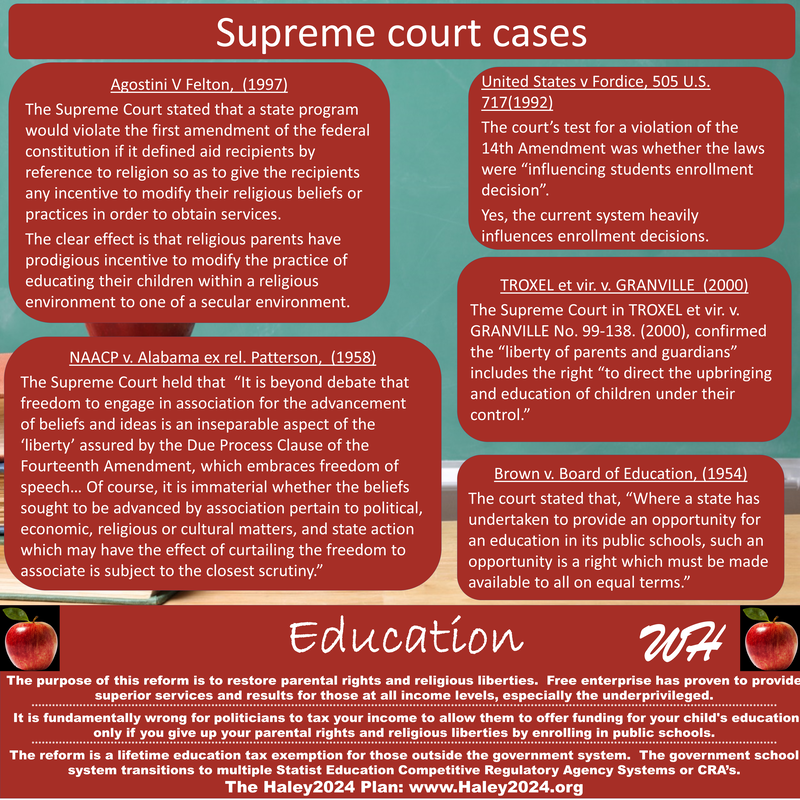

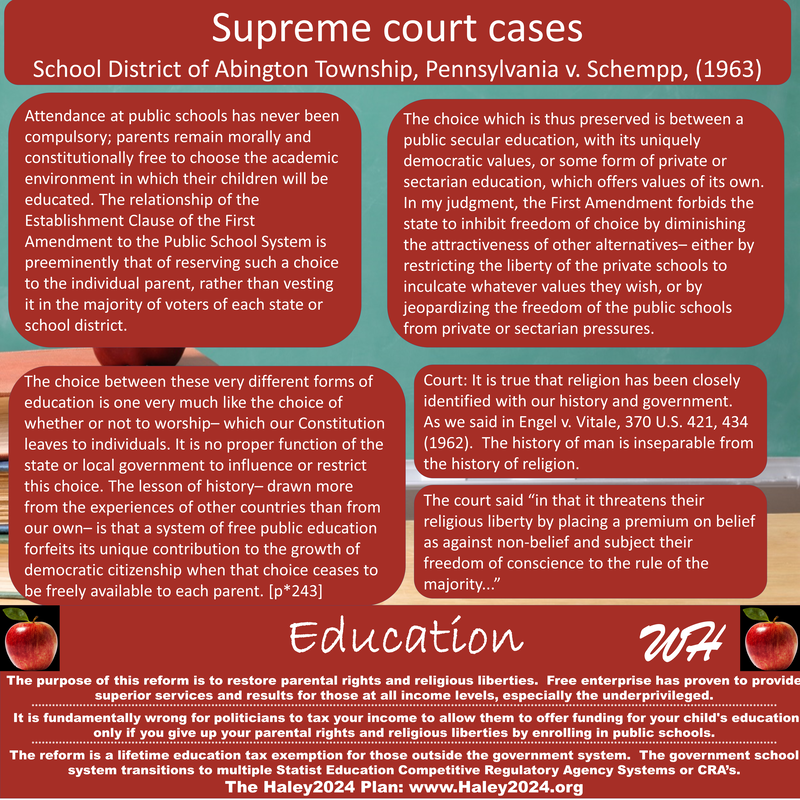

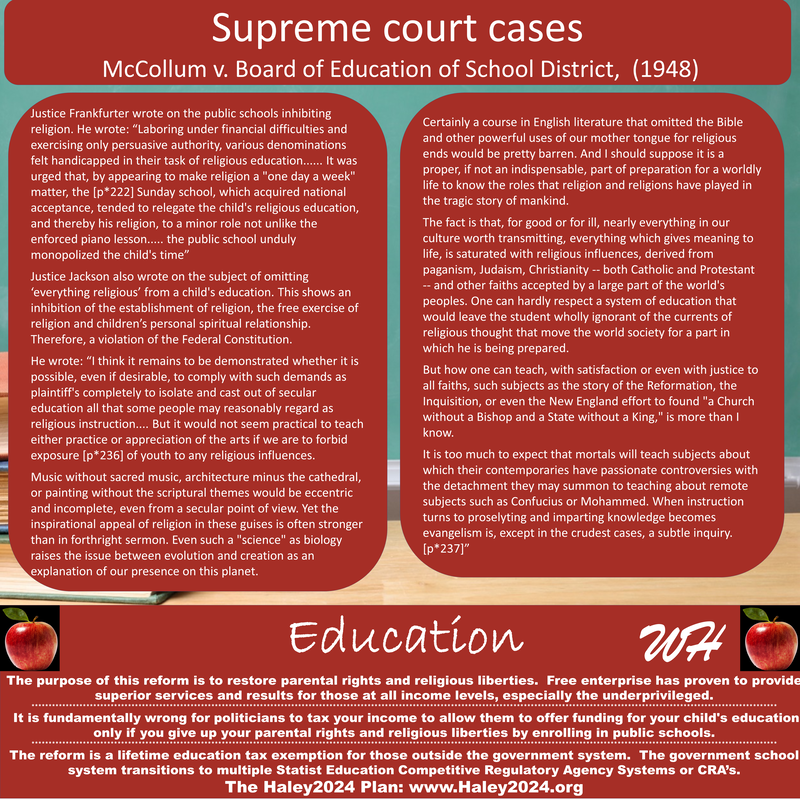

If the public schools did not exist, or parents enrolling in schools outside the public schools did not lose a government benefit, or if parents outside public schools could also be exempt from the education taxes, many more children would have their academic education in a religious environment. These studies, these facts, these statistics clearly show the suppression of religion.

The Public School System is UNCONSTITUTIONAL! |