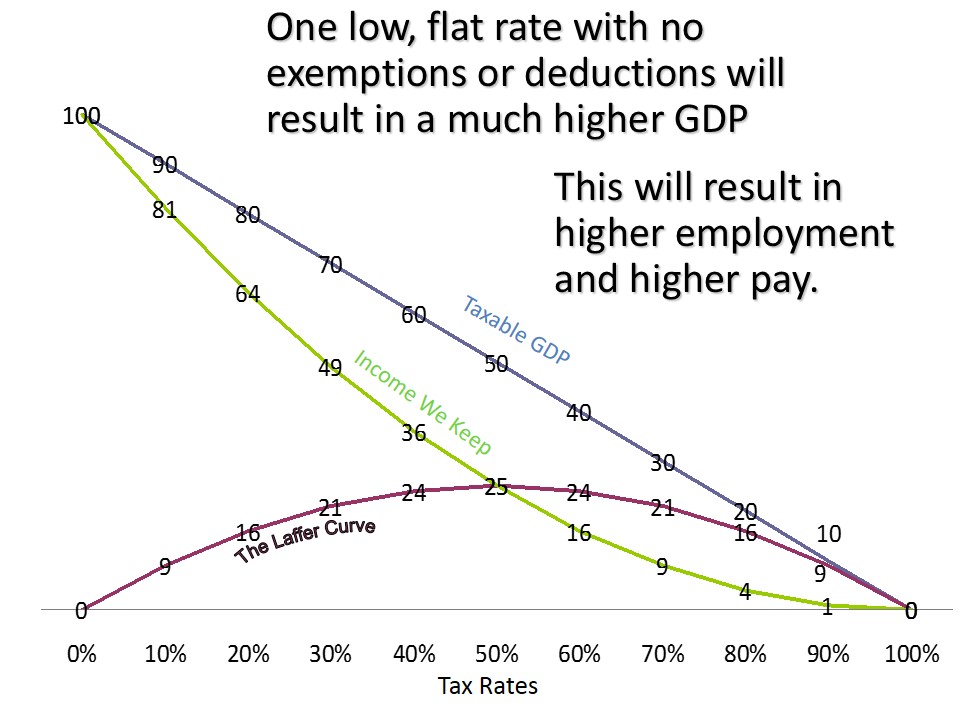

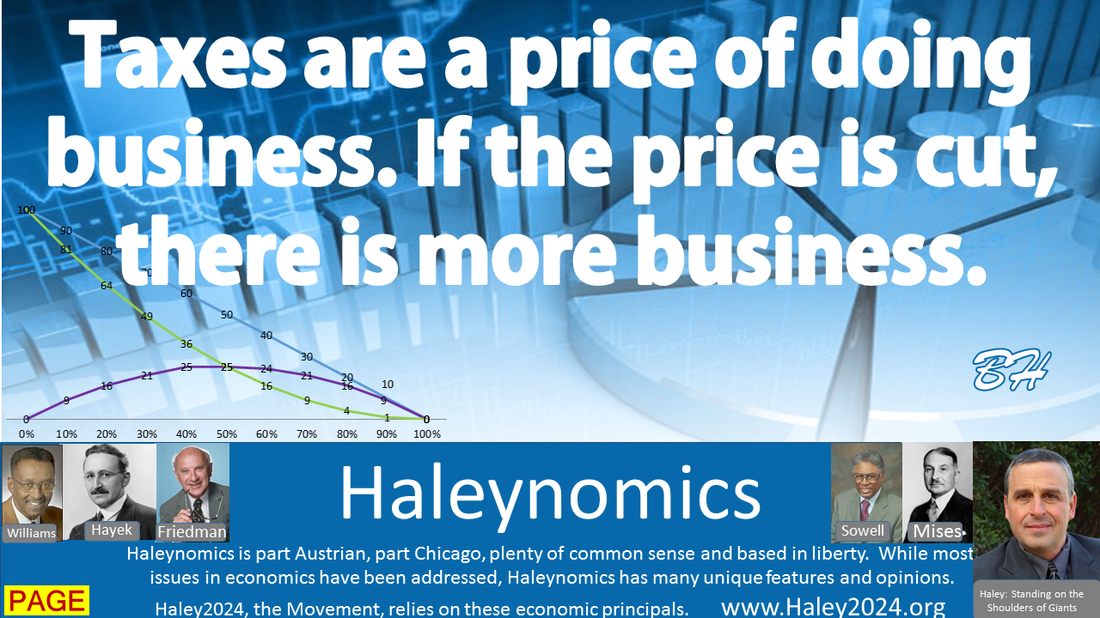

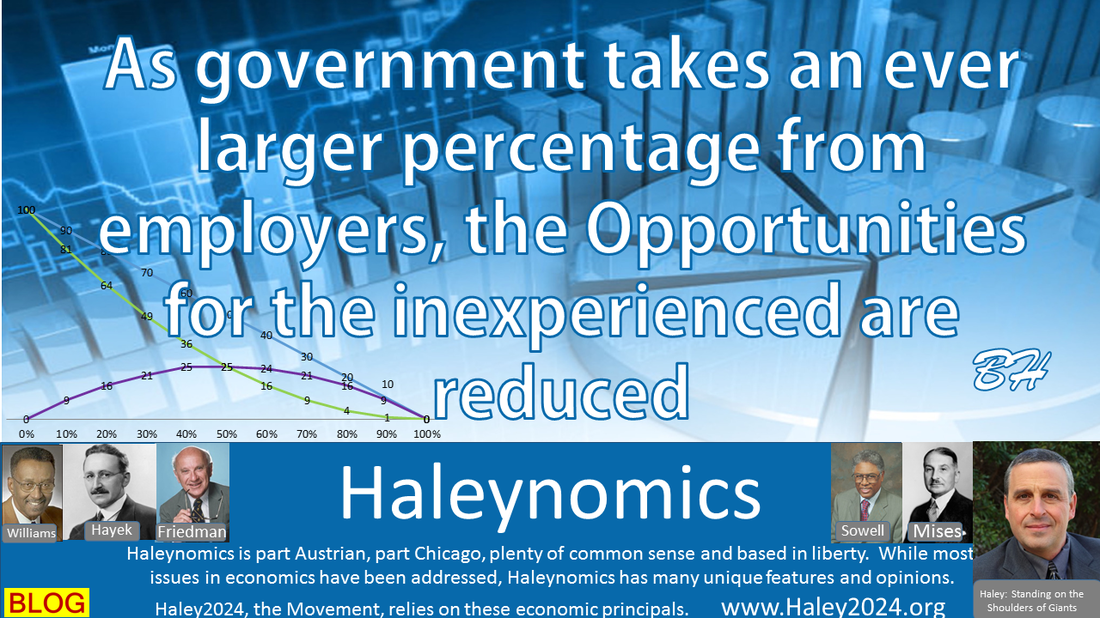

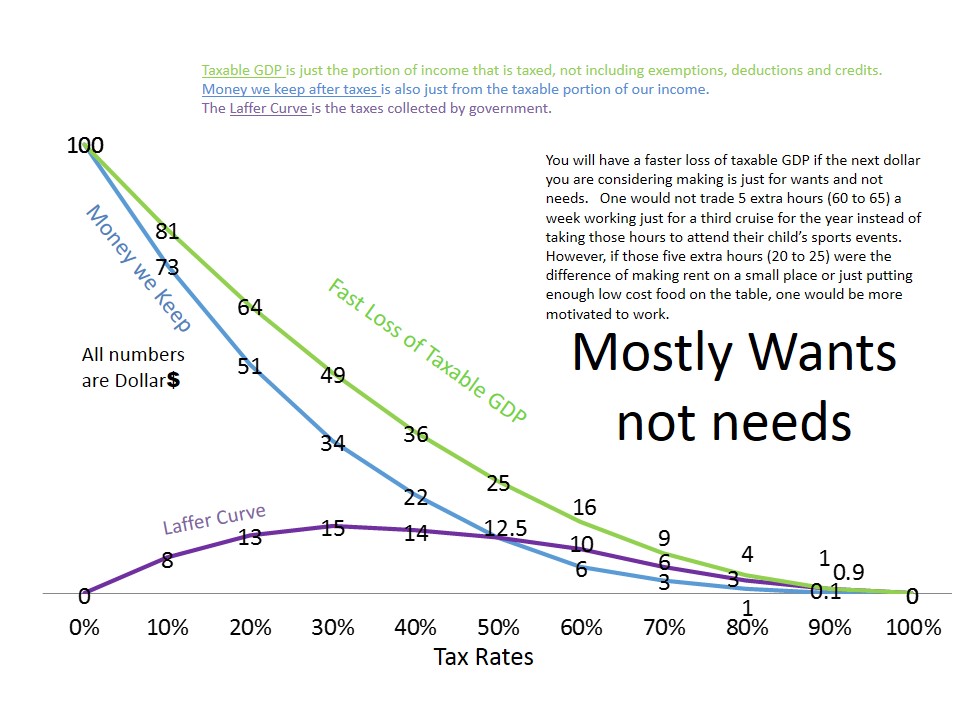

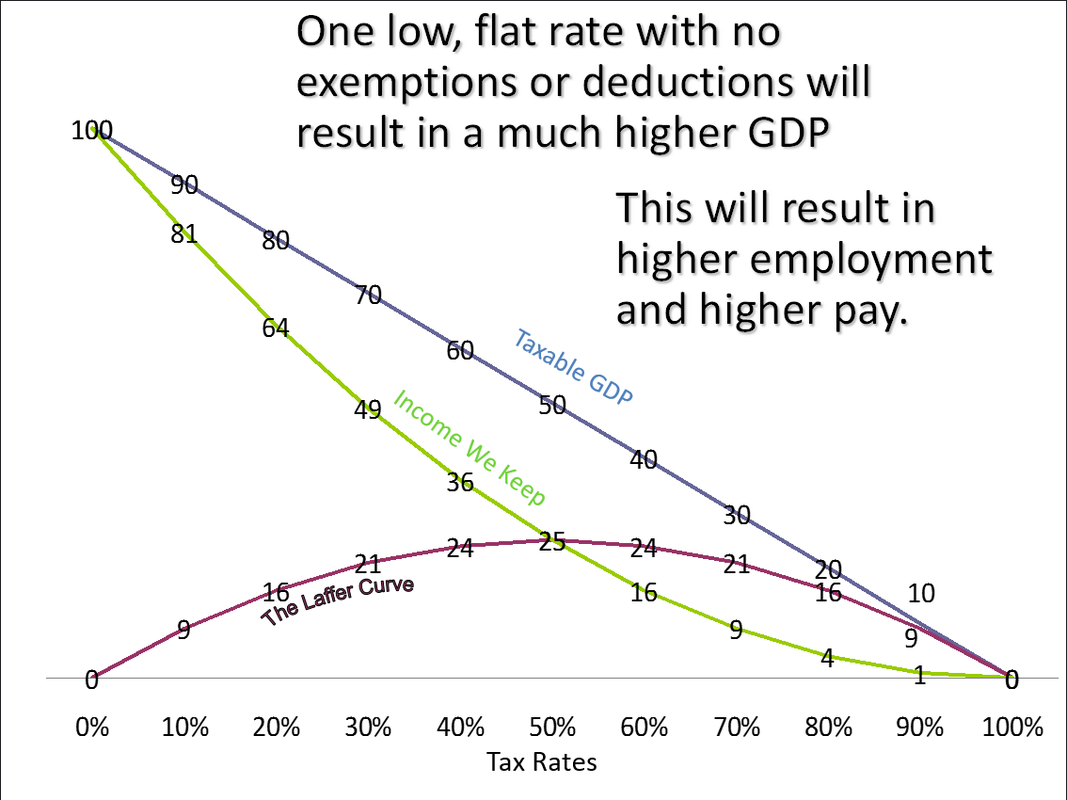

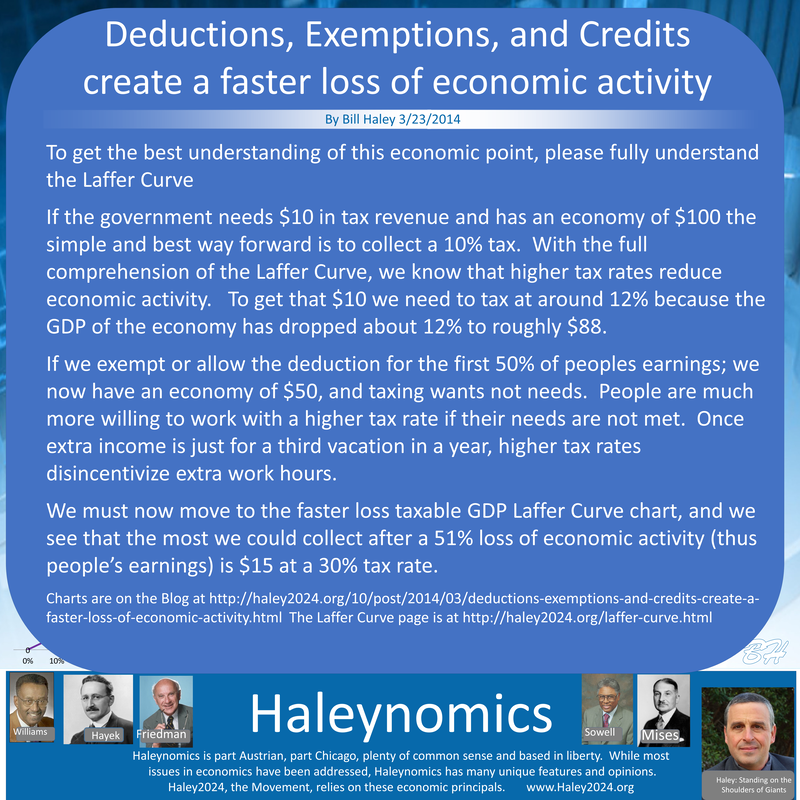

| The Laffer-Curve is all about how people change their behavior dealing with labor that is taxed at increasing rates. You are more willing to work if you are offered more money based on your after-tax income. After a certain high tax rate, the work no longer makes sense, and you decline the job. The tax base drops, thus average incomes and tax revenues drop as well. |

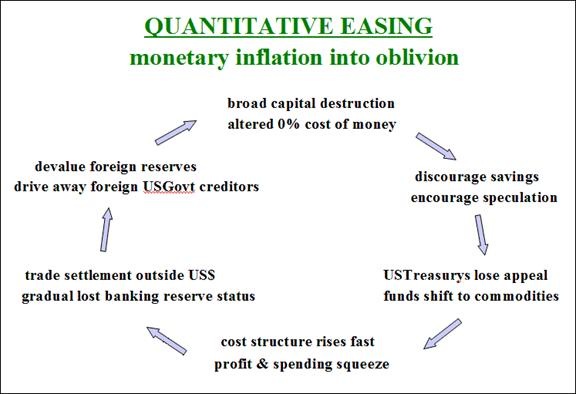

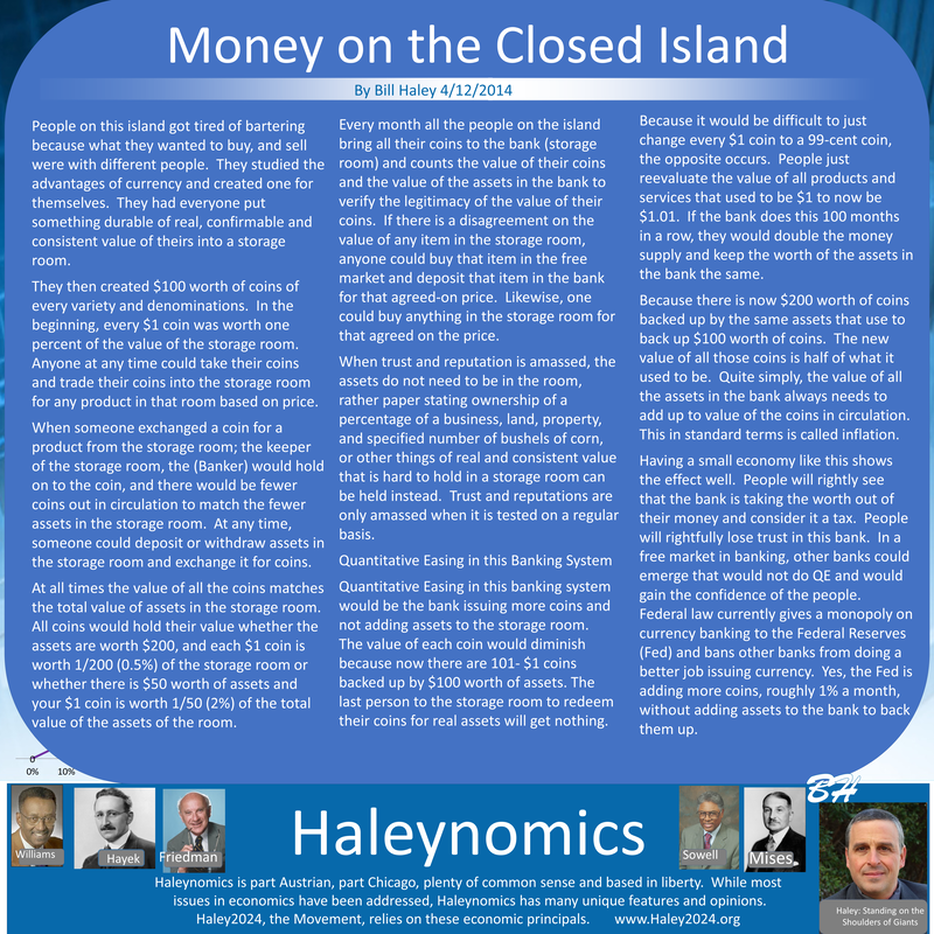

| Inflation is also a tax. Inflation shaves off a little worth from every dollar and combines that worth in new dollars. While the increasing income tax rates discourage work, the inflation tax discourages saving because the inflation taxes savings. Savings is the base of capital and capital is the necessary ingredient for capitalism. |

| Inflation causes uncertainty and businesses dislike uncertainty. Inflation is often hidden for a time and revealed all at once and causes market crashes and business failures. Inflation does the most harm to those on a low fixed income such as those retired or on government assistance. Inflation harms lenders because they are being paid back with devalued dollars. |