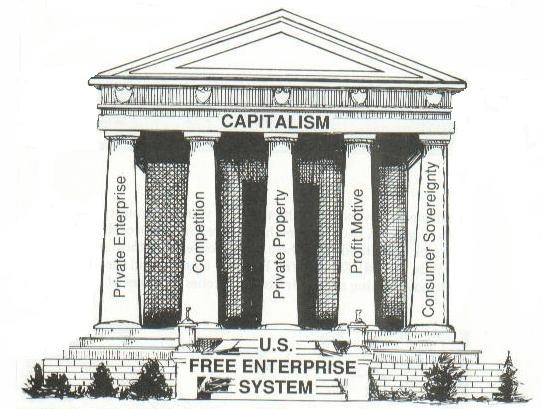

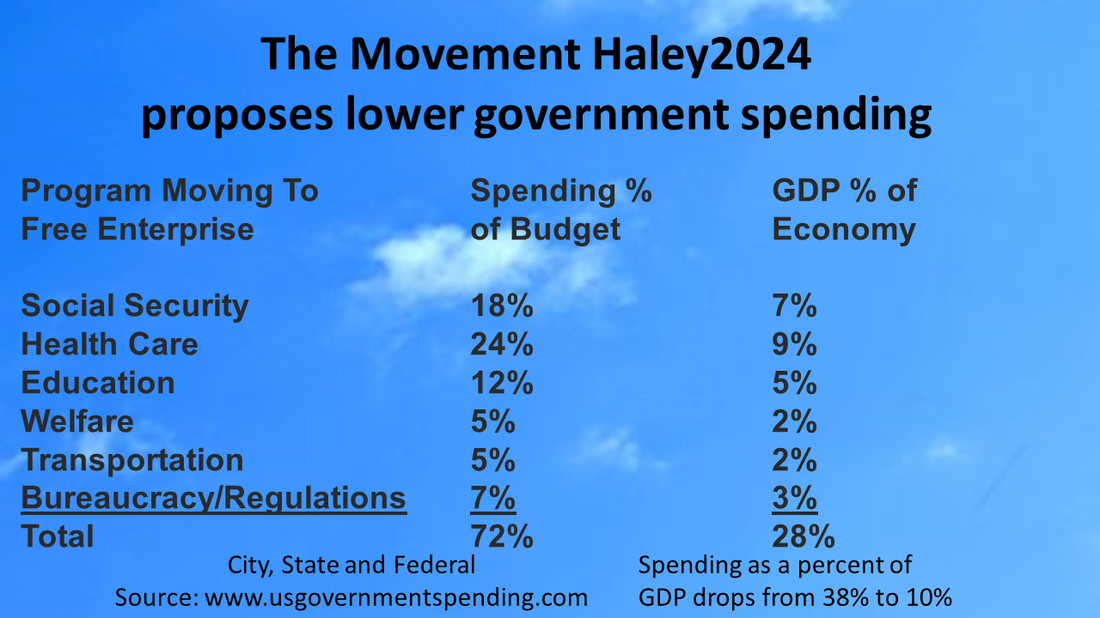

| When the government has a long history of controlling a sector of the economy, they often build up a wealth of assets and capital. When we transition to free enterprise, those assets are likely to be needed and valuable to private companies taking over those roles. The following is a standard transition with the knowledge that there could be modifications depending on many factors. |

The Transition

| Once a bill is passed, the government will create a publicly traded corporation for each item or an appropriate group of items of value (school, Road, Building, ships, personnel, and equipment among others). In the beginning, the government will be the sole owner of all stocks. Each month they will have to price the stocks to sell off an additional one percent of the assets (adjusting in real time on the stock market). |

| As long as the government owns stocks in the corporation, each legislator will have voting rights for a percentage of the stocks that the government owns. These legislators will have to go through Corporate Proxy Groups, thus giving a buffer of conflicts of interest. |

| Funds from selling the stocks of the assets will first account for debt realized from the current system, and then the rest will be government money to pay down government debt. |