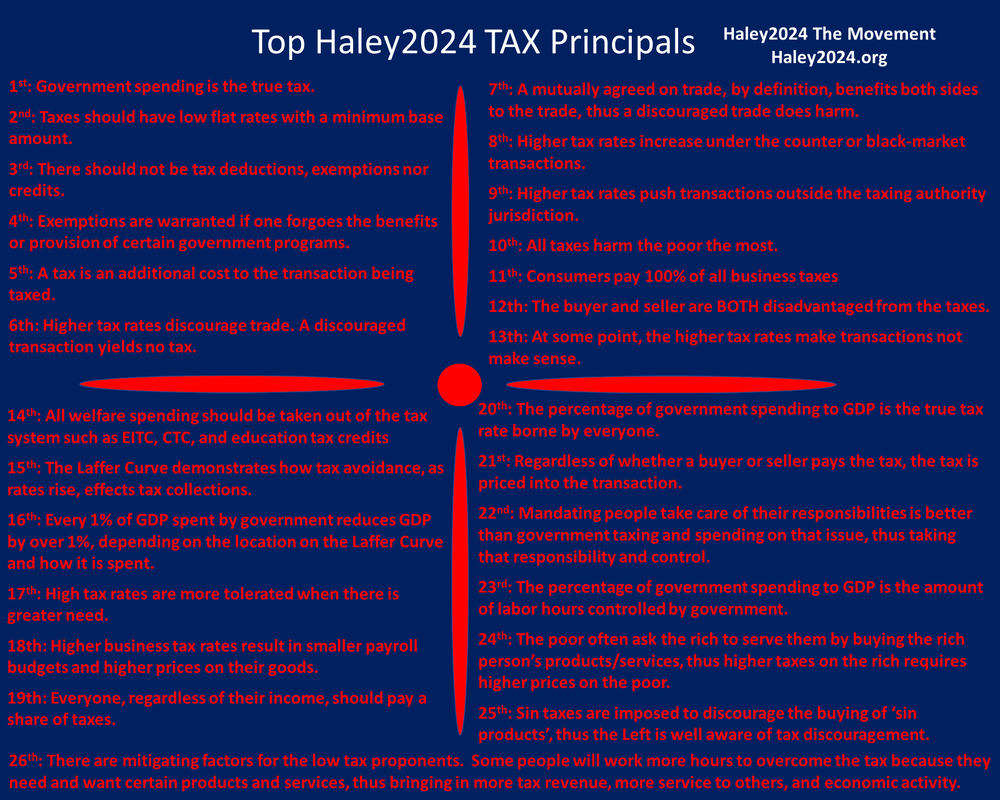

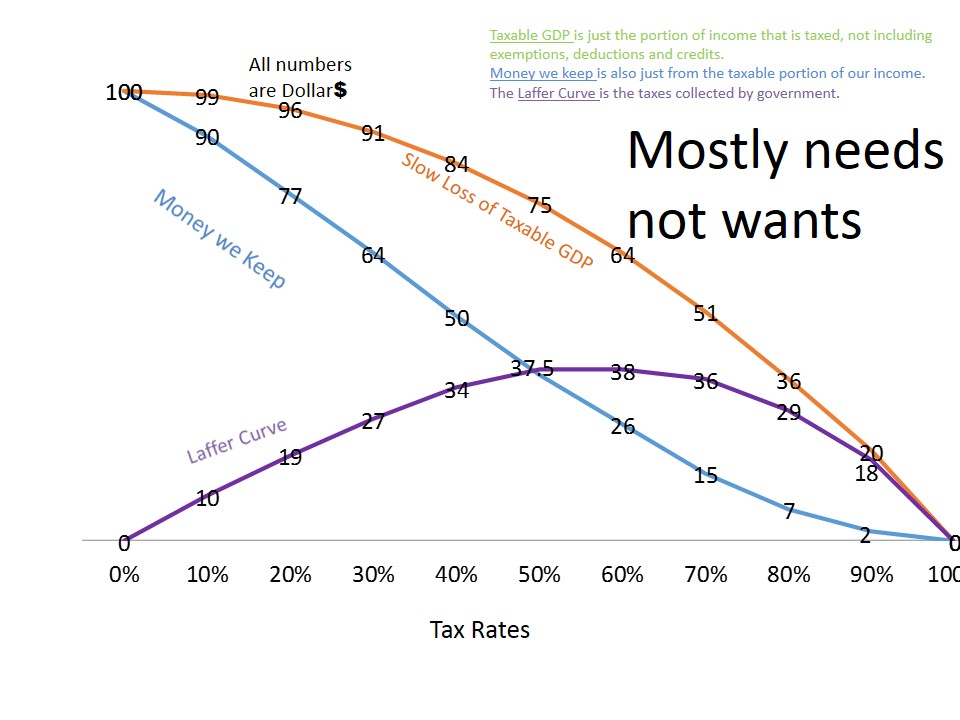

| On the Haley2024 Laffer Curve Page, I describe how people will make decisions on working the next taxable hour based on after-tax pay. This blog proposes the theory that a tax system that funds charities would create fewer disincentives versus the same amount of funding for government-controlled welfare programs. How the taxpayers’ money is spent means a lot. |

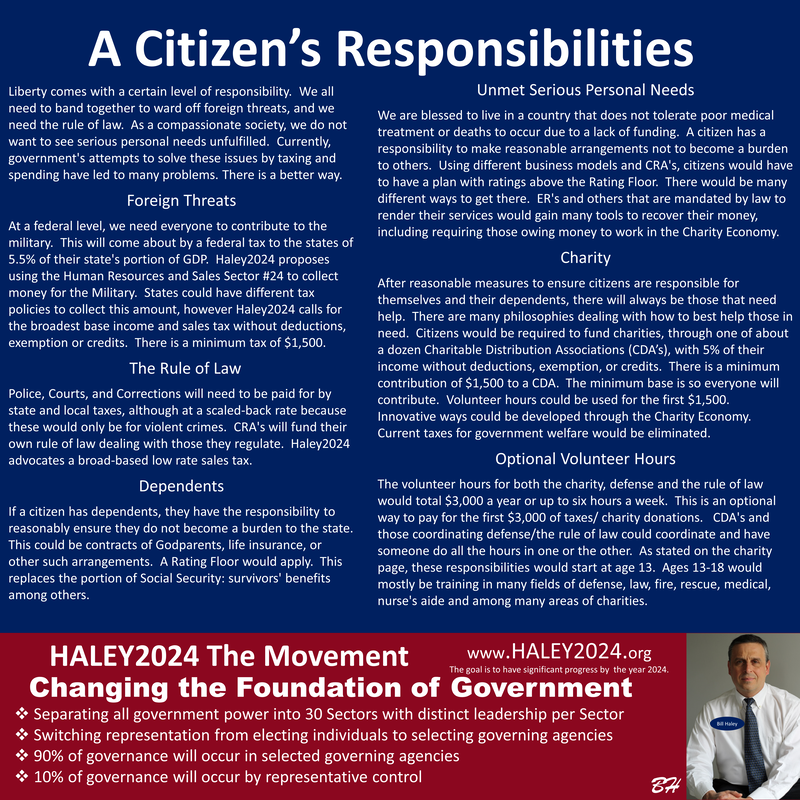

| A significant factor whether one works additional taxable hours is the reduced take-home pay from income taxes or the additional costs of sales or other embedded taxes. The full percentage of a transaction taken by the government of all taxes is the base level of the disincentive. However, the general taxpayer’s support and the sense of productive and efficient use of taxpayer money can really change whether people actively want to pay more or fewer taxes. |

| If a taxpayer is ambivalent about the worth and morality of government spending, the tax rate creates a base level of disincentives of working the next taxable hour. If a taxpayer is hostile to how the government is spending money, the deterrent of taxable work hours grows. If the taxpayer is highly supportive of government spending, the discouragement can decrease and even move to incentivize working the next taxable hour. |

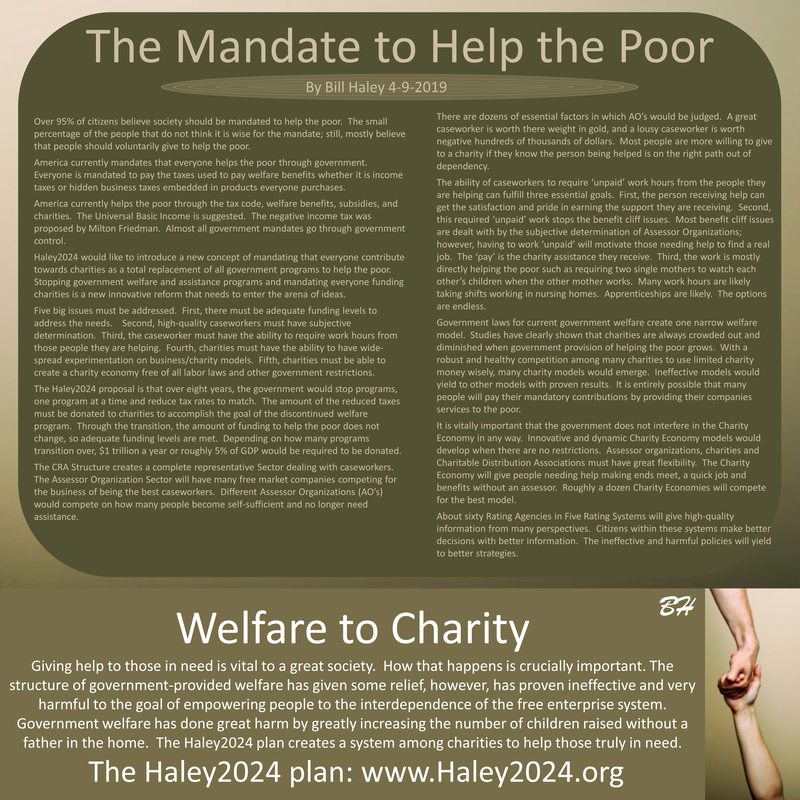

| Many Americans do not like the welfare state. Both the Left and Right think there is a welfare trap where people on welfare have a hard time escaping the government system. Numerous Americans see welfare abuses, such as buying junk and ‘rich’ food. Countless Americans see some people deliberately meeting the requirements to qualify for additional welfare benefits. |

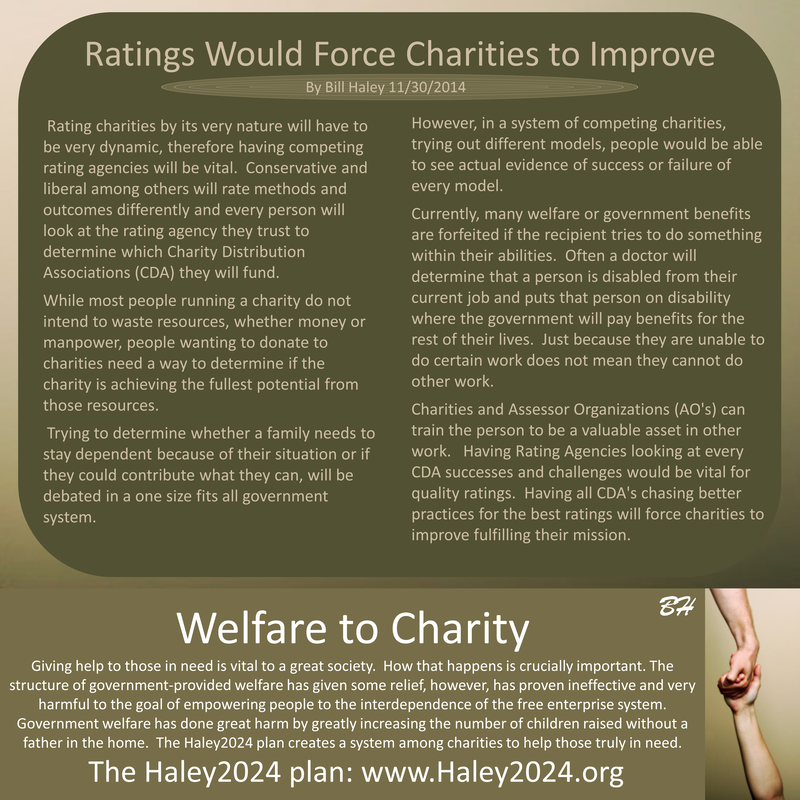

| Many citizens support charities. People really like helping people in need. The significant difference between government welfare and charity is subjective determination. Charities try to limit the destructive lifestyles and shy away from enabling dependency. Charities wisely and productively use scarce resources. Government laws simply cannot use subjective determination at an individual level. |

| Some people support the welfare state with their words; however, rarely with their freely donated dollars. A meager percentage of people pay more taxes than what they legally owe. Charities receive thousands of times more money voluntarily. A decent portion of people put in labor hours working directly for charities. |

| Americans understand that charities curtailed their charitable activities when the government started to take over certain functions. A charity’s essential ability to say ‘no, we will not enable dependency,’ was dramatically harmed by the poor’s ability to demand government help if they put themselves in a qualified position. |

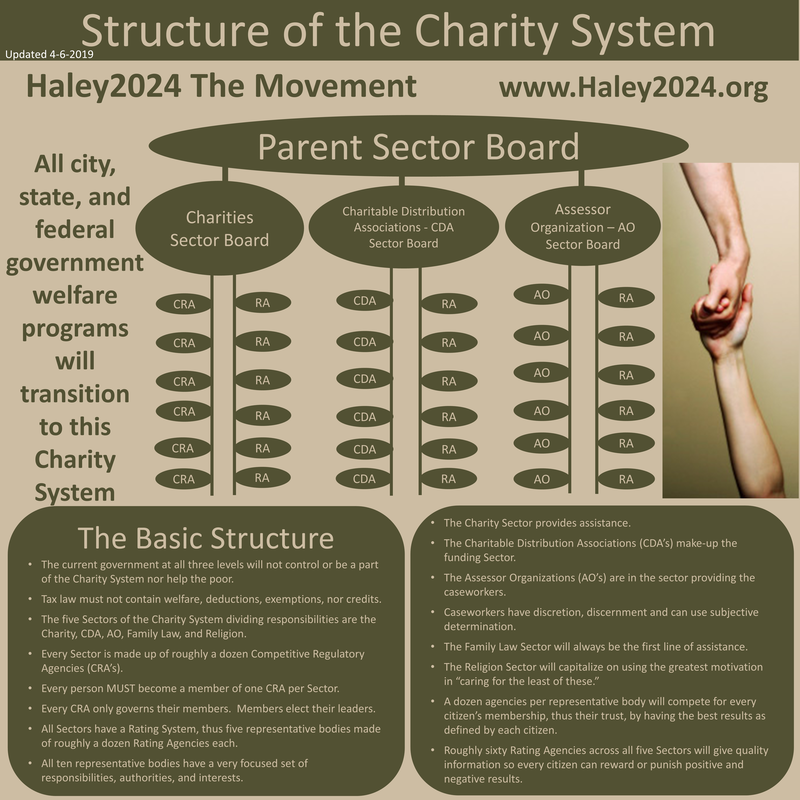

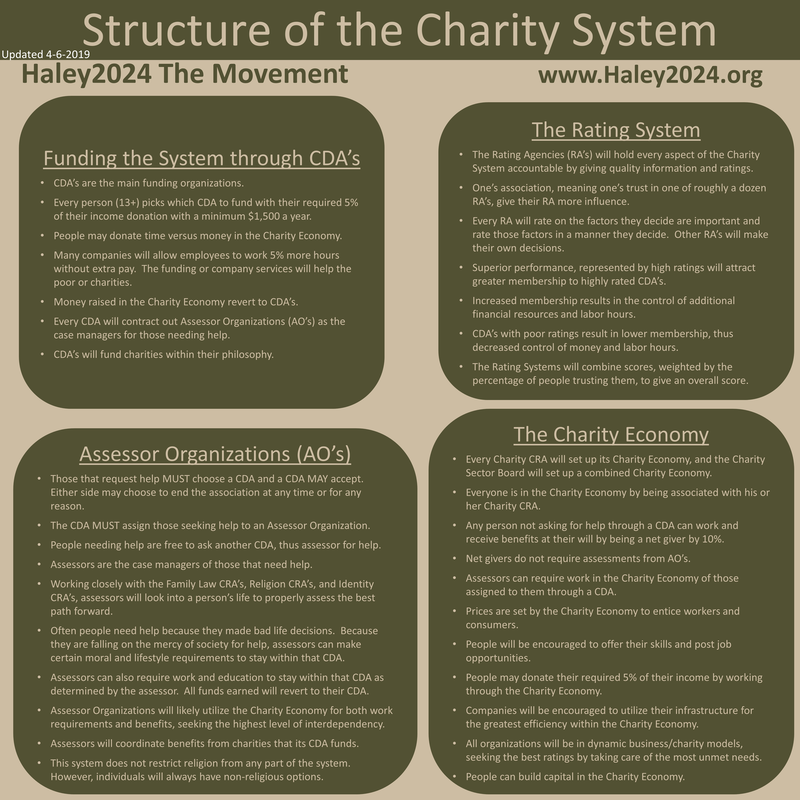

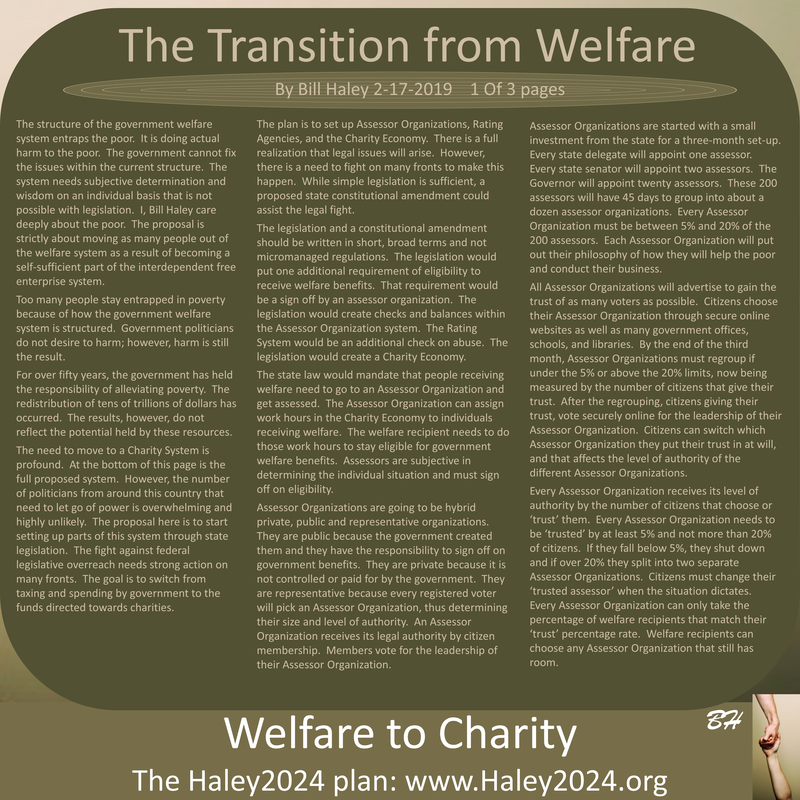

| The Haley2024 Charity System removes 100% of government welfare and lowers tax rates to match the reduction of government spending. This Charity System requires citizens and businesses to ‘donate’ 5% of their earnings to charities. Within this charity structure, citizens have many options to pick their charity philosophy. The Left could use their donations to advance organizations with their viewpoints and the Right, or Liberty-Minded citizens would help solve unmet needs using diverse approaches. |

| If someone were deciding whether to work additional hours for the payment of $100, they know they would only take home $95 (for right now, excluding all other necessary taxes). Typically, this would result in roughly 5% of people deciding to take leisure hours versus working. Having YOUR charities in direct competition with other charities to ‘do the most good’ and you genuinely happy with the poor being helped, in your opinion, ‘the correct way,’ would lessen the disincentive and possibly incentivize you to increase your labor hours. |

| The Haley2024 Charity System, along with the Rating System, encourages businesses to help the poor in productive and efficient ways. Many companies would have incentives to allow their employees doing their regular jobs to, directly and indirectly, meet the poor’s unfulfilled needs. The Rating System would be able to capture a significantly dynamic system to incentivize positive and to deter negative externalities. |

| Taxes and spending going into and out of a general fund hinder a taxpayer’s ability to associate their taxes with government services. Connecting a tax to specific spending can influence taxpayers’ activities. People seeing a clear connection makes it more like buying the services directly and not just an added expense. Keeping taxes and spending local can also help people see direct links. Taxing one million people for the benefit of one thousand people creates many more ‘affirmatives’ on government spending. |

| In WWII, mothers, wives, aunts, sisters, and daughters did not base their willingness to work on the money they would take home. The overriding reason these women worked 60 or 70 hours a week is to make the weapons and other supplies to give their husbands, sons, uncles, nephews and other loved ones a better chance to come home alive and to win the war they agreed with. |

| Citizens want to see that their donations are doing the most good. They want to see appreciation from the recipients. They want the charities to ensure the money does not enable dependency. They want to ensure the recipients have a path to independence. They want to ensure the recipients are living a respectable lifestyle. They do not want their food aid going to sodas and lobsters. Citizens should be able to state with their dollars that they do not wish to support a destructive lifestyle. |

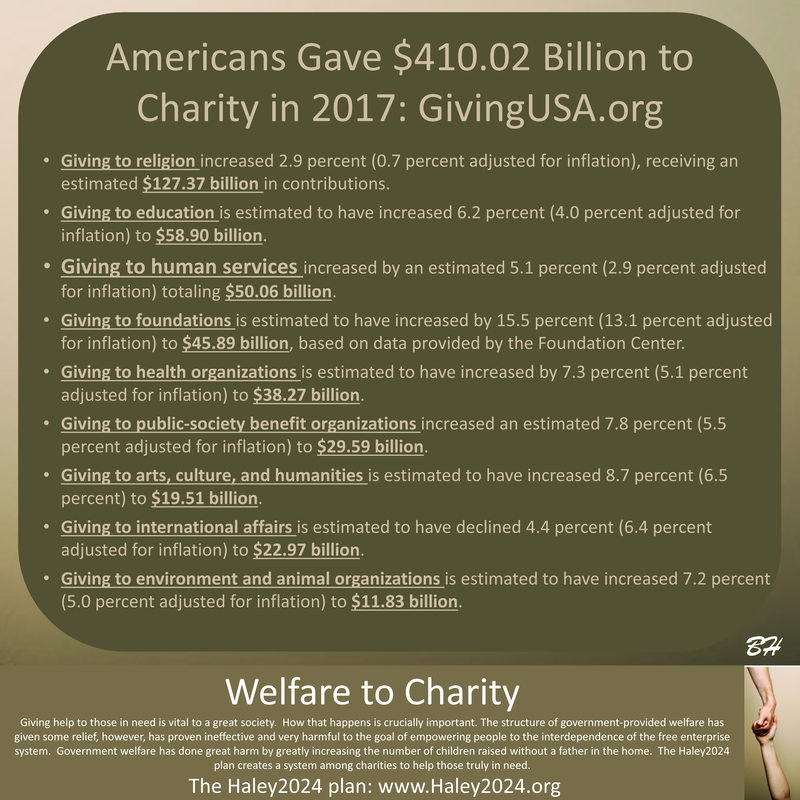

| A couple hundred million dollars are donated to the government, mostly earmarked to charity-like functions such as the National Institutes of Health at $51 million (2010) and National Science Foundation $54 million or to the Veterans. That might sound like a lot; however, with roughly 110 million households in America, it is merely a few dollars per family. To pay down the national debt, the average yearly contribution is a few million dollars. 1 billion dollars is one thousand times as much as 1 million dollars. |

| Giving USA 2018: Americans Gave $410.02 Billion to Charity in 2017 or roughly $4,000 per household. Americans voluntarily donate to private sector charities over a thousand times as much as voluntarily donating to the government. If your company had a meeting asking for employees to support charities with extra hours of work, many employees would consider it much more compared to extra hours working to send the money to the government. |

| In conclusion, when people are supportive of where their mandated donation is going, the deterrent of the tax is reduced. The Haley2024 Charity System proposes that contributions are mandatory for many reasons. The Laffer Curve affects should be at the slow loss of GDP chart, and the 5% mandate having little consequence. |