| The purpose of this page is to point out a new type of loan that taxes increased human capital. If education increases your earning potential, the share loan is repaid with a portion of that increase. Some people call Share Loans ‘Income-Share Agreements.’ Most writings on this subject only address higher education. This article includes every stage of education funding. Please look at the Haley2024 Education reform. The structure of the reform and Colleges. |

| Share loans: given that Competitive Regulatory Agencies (CRAs) will have judicial authority, CRA’s could come out with Share Loans. A Share Loan is when a bank invests in someone’s human capital (education) and instead of a fixed dollar amount with an interest rate, the contract calls for a share of future earnings of that individual’s income. This might also be just a share of the increased revenue from that education. Share Loans could be used as a tax in Statism Organizations. The contract could be in dollars, charitable hours, hours of work, inheritance, or many other things of value that could be within a contract. |

| This could be a lifetime of earnings or for a specific set of years. The variations are numerous, and many could be tried to success or failure. These Share Loans would be of great interest to, Education CRA's, Charity CRA's, Financial CRA's, Human Resources CRA's, among others. This asset could even be the base for new money. The holders of these loans would be invested in that one person and will help him, or her get a job, advance in a career, and if laid off, find another job. There is an excellent benefit to a person if an institution has a vested interest in that person making the most money possible. Most people would be ok with paying ten percent of a $100,000 a year job versus zero percent of a $50,000 a year job. |

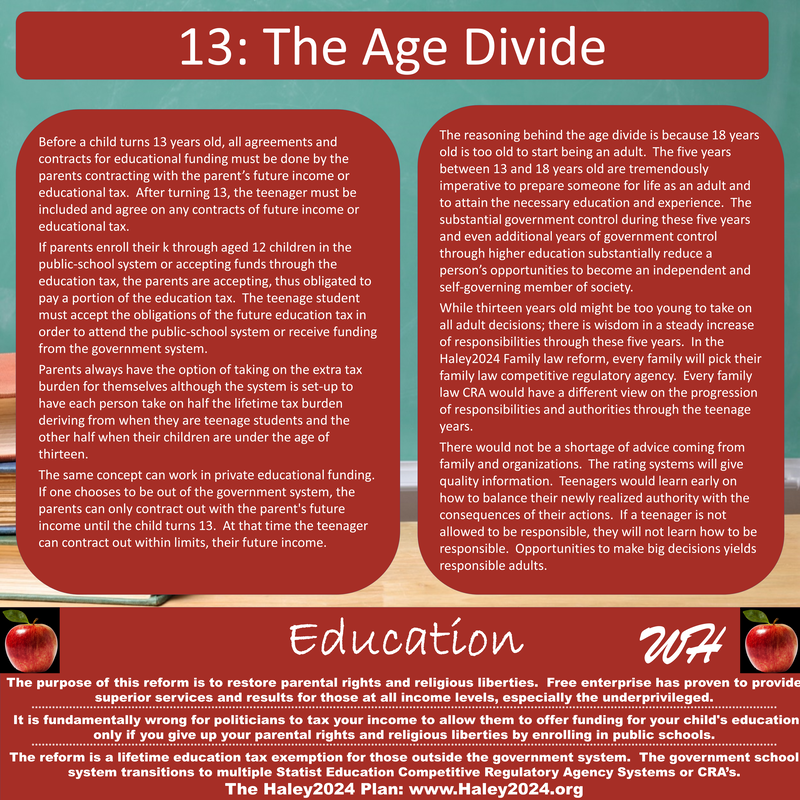

| Usually, a person cannot enter into any contracts before the age of 18. For the occasion of education, all share loans for a child under the age of 13 must be on the parent's future income. A student between 13 and 18 can start contracting within limits, their own future income, labor, or other things of value. After attaining the age of 18, they will have their full right to contract. All government education taxes would not apply to those outside the Public-School System. The current government education taxes act like education loan payments of roughly $800 per month per household for life. |

| A drawback of these Share Loans would be the Laffer Curve effect. When deciding on a job or working that over-time, one examines take-home pay. If the Share Loan is 15%, on top of taxes, that might push someone not to take the extra work hours in-lieu of extra leisure hours. Another primary concern is that of stay at home mothers. If a bank invested $100,000 for the education of a woman and expecting back 10% for 20 years, they have the risk of her choosing not to work. A woman gets married and has a child right after graduation and makes the wonderful decision to raise her child full time. The woman is supported by her husband and has a traditional family, thus not making any money. The investors are out $100,000 because there is not any income to tax. |

| We should never put a woman in a situation where she cannot become a stay at home mother; because motherhood is the most important and valuable job in society. We should not saddle anyone with debt they can not handle. Life coaches and school counselors should lay-out the broadest set of opportunities with the most transparent and realistic possibilities. Parents need to be heavily involved in teaching the realities of life. Colleges and others should force students to look at the job opportunities and the salary range for the college degrees they are striving to attain. There is a high percentage of students that start a degree and do not finish; thus, they have debt and no degree. |

| There are many clauses to put into the contract to deal with many of these issues of people gaming the system or underperforming. The first clause that should be in any type of loan contract is mandatory Charity Hours if payments are not made. Under the Haley2024 Charity System, every Charity CRA would set up a Charity Economy. There would be many work opportunities. The roughly dozen Charity Economies will compete to be the most effective and productive, as well as moving the most people out of the need for assistance. |

| A person with a college degree should be highly valuable in the Charity System. If a graduate is without a job temporarily or long term, the loan repayment during this time would consist of charity hours. A stay at home mother might be required to fulfill her contract by taking in other children while their mothers work, online work opportunities, among others. Imagine if everyone that was delinquent on their student loans were out there helping the poor. |

| This article about education finance should touch on how many ways the government is increasing the cost, decreasing the quality, reducing the supply, and a dozen other issues of government involvement in K-12 and higher education that is doing great harm. We should not just assume that government involvement is a must and try to sand the rough spots. The government induced problems cannot be fixed with the government still involved. Every problem a politician tries to fix is a problem they or other politicians created. Their ‘fixes’ mostly deepen government involvement and worsen the situation. A full-scale removal of government from education and regulations would bring significant improvement to education. This reform would certainly include removing government accreditation and government mandates to work specific jobs. The CRA Structure would replace the government with a far superior private sector accreditation system. |

| This article should also touch on different education work models that could eliminate the need for higher education financing. There is no reason why young adults should not be willing to put sixty-plus hours a week in for work/education. Many businesses could have four to eight-year work/education models. The education and work would be in the same field, and as skills are learned, they are doing real-paying work. As more skills are attained, the more real paying work, the employee/student does. The breakdown might be 30 hours as a student and 30 hours as doing real work, but those lines would likely have significant grey zones where practical work is supervised learning to ensure quality work is provided to consumers and clients. |

| The real work pays for the education and the low living wage. This has aspects of apprenticeship programs; however, would likely end up with highly rated certifications, degrees, and accreditations. Doctors, lawyers, CPAs, MBAs, and other highly skilled professions might take a few more years based on many issues. Law firms, hospitals, big-business, accounting firms, and others would team up with a college. After four or six years, student/employees have a full degree, work experience, and no debt. In fact, they made a livable wage. Every person’s academic ability, drive, work ethic, accomplishments, hours worked, among other factors would determine pay and the length of time in the education part of the job. The options of business/education models are numerous when government regulations do not force people into narrow monopolistic education models. |