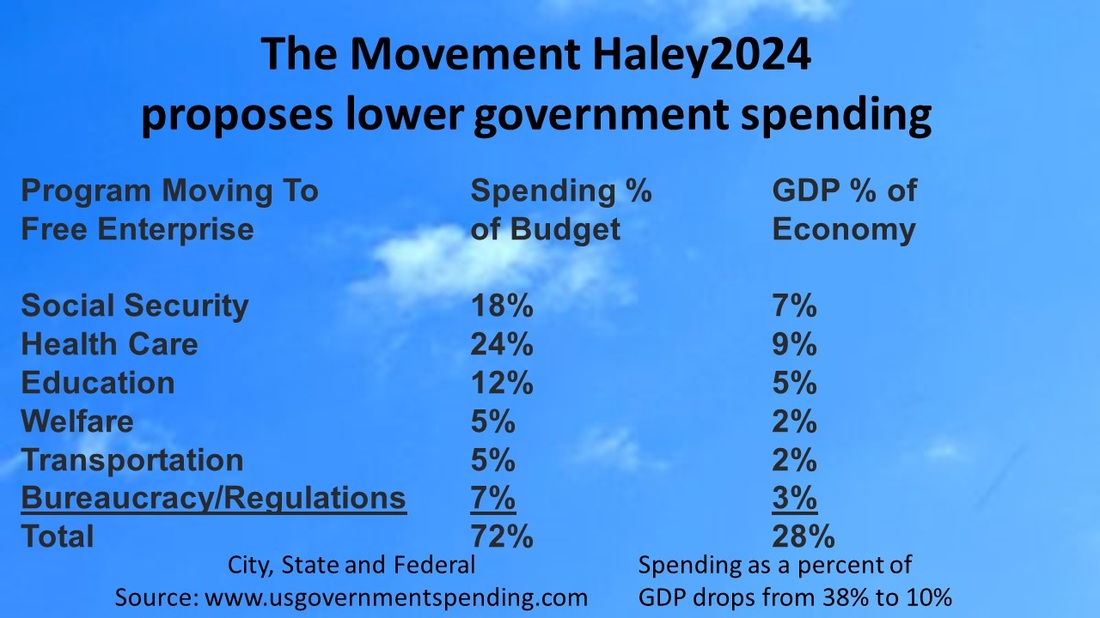

| Total government spending at all three levels is roughly $7.13 trillion (2018). The GDP is roughly $20 trillion, thus there is a 38.4% government spending to GDP. That 38.4% is the best estimation of the overall effective tax rate. I am using USGovernmentspending.com numbers. There is significant spending/welfare included in the tax code that is not counted here, however will be eliminated by going to flat taxes without deductions, exemptions nor credits. |

| Haley2024 calls for tax collections to fall to roughly 7% of GDP with an additional 5% of GDP mandated to go to charities. The plan is not to reduce all the line items by 72%, the plan is to move whole line items to the free enterprise system. The 7% left in government will also be done with more free market principals. The mandate to contribute 5% to charity is a tax, however not taken, touched, nor controlled by government. The Charity System has significant representation and checks and balances. |

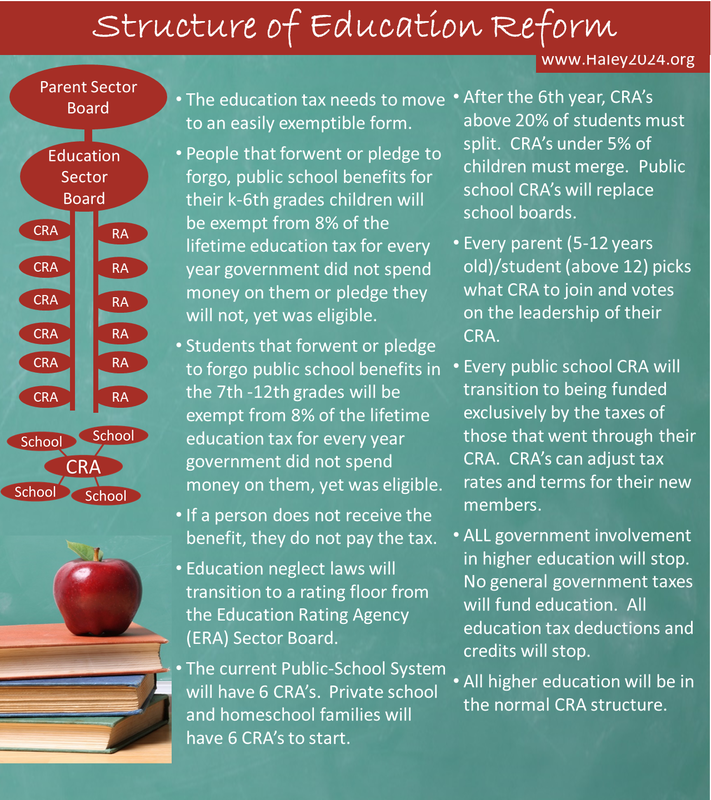

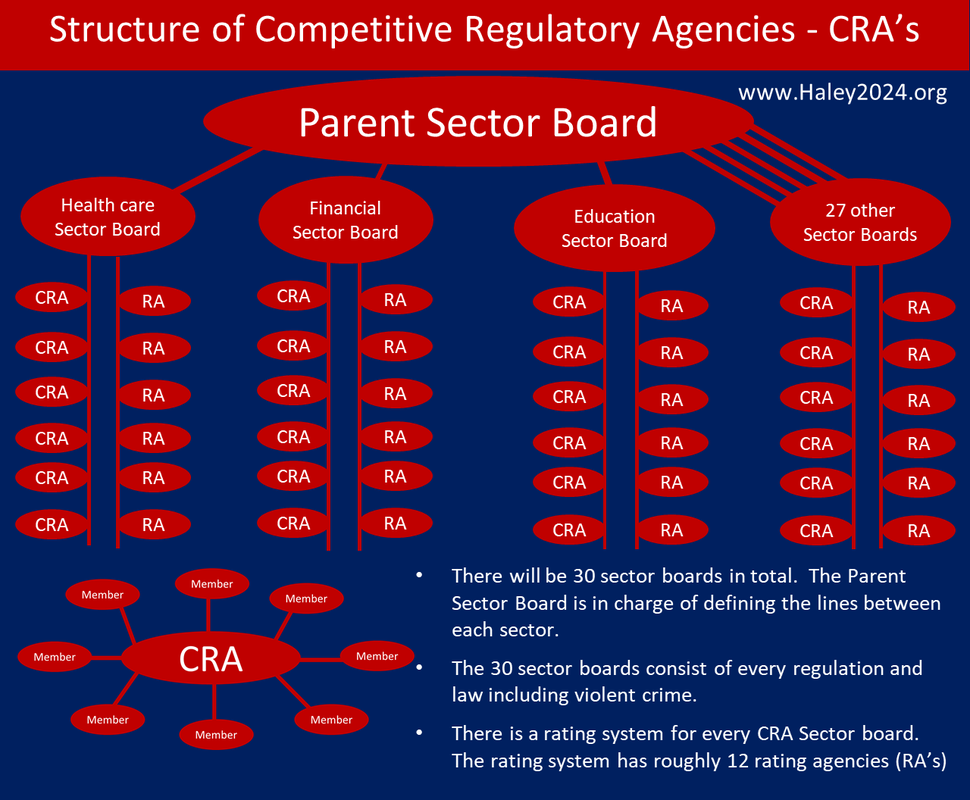

| Education will move to free enterprise; however, parents and students will be given the option to stay with their public school/ in a totally segregated budget, funded by those in that system. Public schools will transition to statist education CRA’s. Given that it will be a user fee and people needing to opt-in; education will not be a general tax. $1.1 trillion or 5% of GDP will be taken from government. Income from the selling of education assets will be used to pay-off part of the debt. |

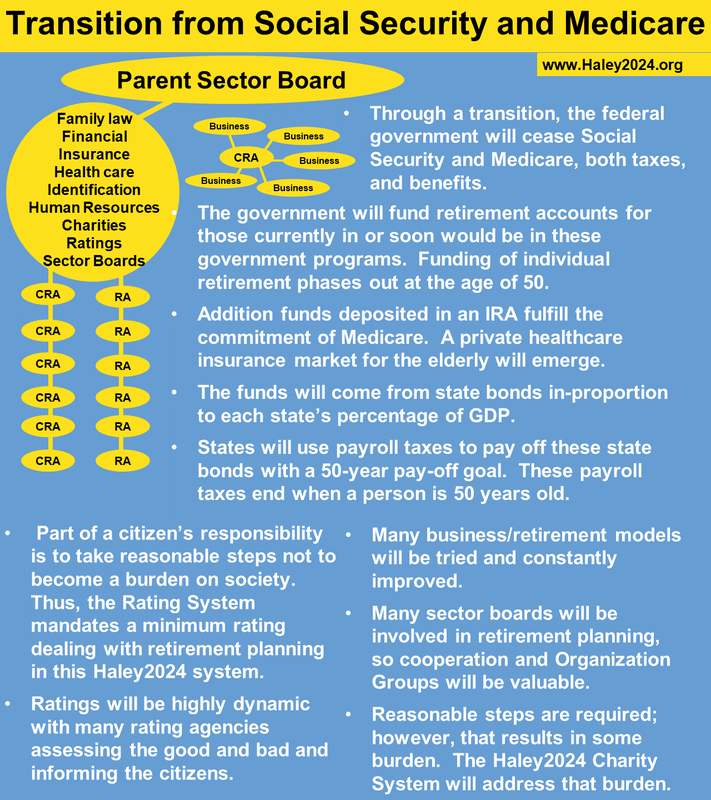

| Health care government spending is roughly $1.57 trillion, which is roughly 8% of GDP. Some of that will be moved to charities. Some of that will be moved to mandated retirement accounts. Military spending or government employee’s spending on health care is not part of this $1.57 trillion. This $1.57 Trillion or 8% of GDP will taken from government. |

| Social Security requires roughly $1.37 Trillion or 7% of GDP. That will transition to individuals mandated to save for their own retirement. This mandate includes both income and medical insurance. After a responsible transition, $1.37 Trillion or 7% of GDP will be taken from government. |

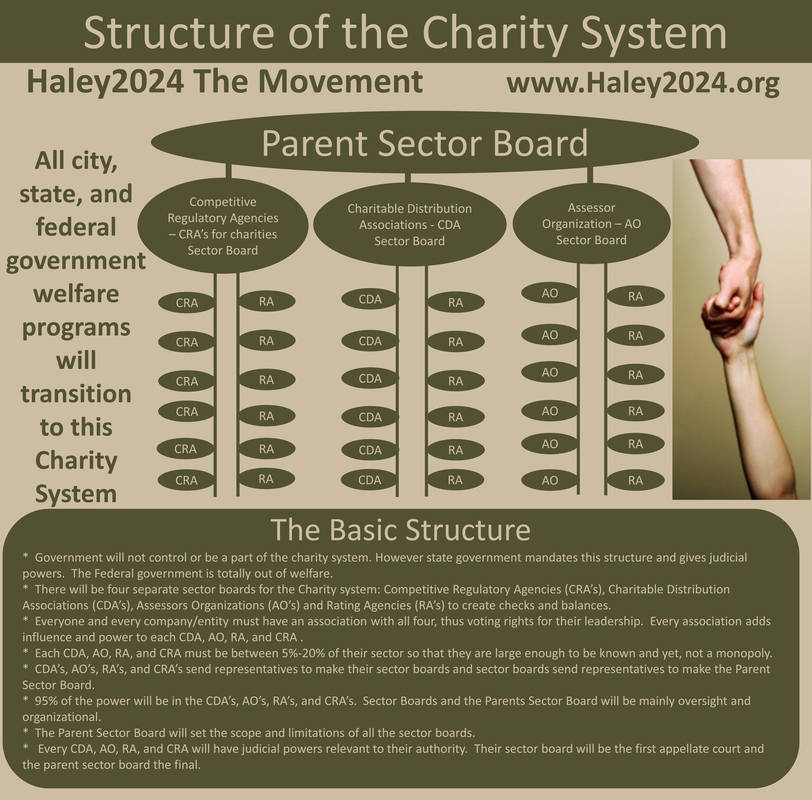

| Welfare requires roughly $0.444 trillion or 2% of GDP. That will be moved entirely to charities with a 5% income mandated contribution to Charitable Distribution Associations. Health care (Medicaid not Medicare) is also moved to charities making up the perceived difference. $0.444 trillion or 2% of GDP will be taken from government. The Charity System will have a charity economy where those being helped, will give labor to help others. This additional labor from roughly 30-50 million people will tremendously increase the standard of living of the poor. |

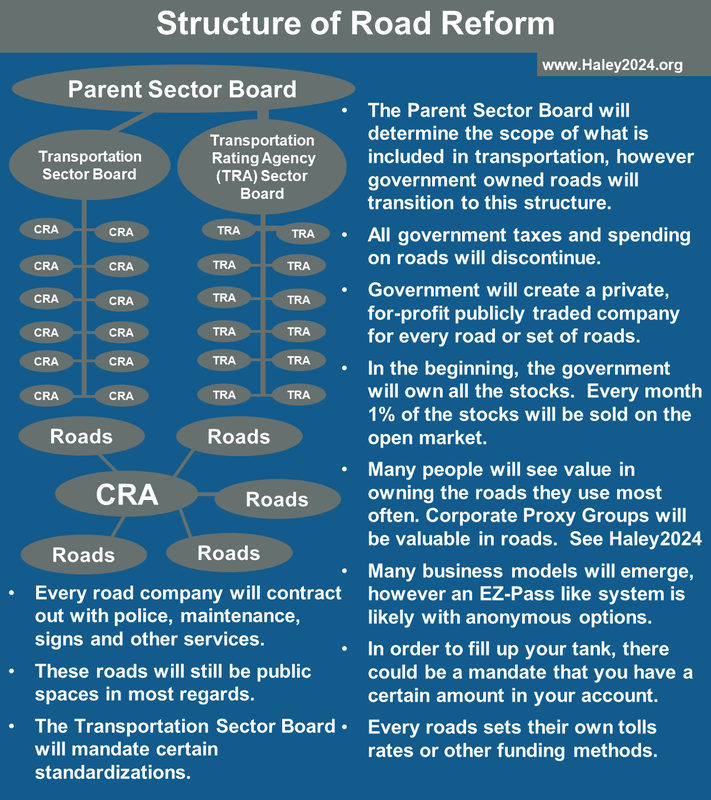

| Transportation spending from government will move entirely to the free enterprise system with some mandates that certain assets are in stockholder owned publicly traded companies. $0.318 Trillion or 1.6% of GDP will be taken from government. Income from the selling of transportation assets will be used to pay-off part of the debt. |

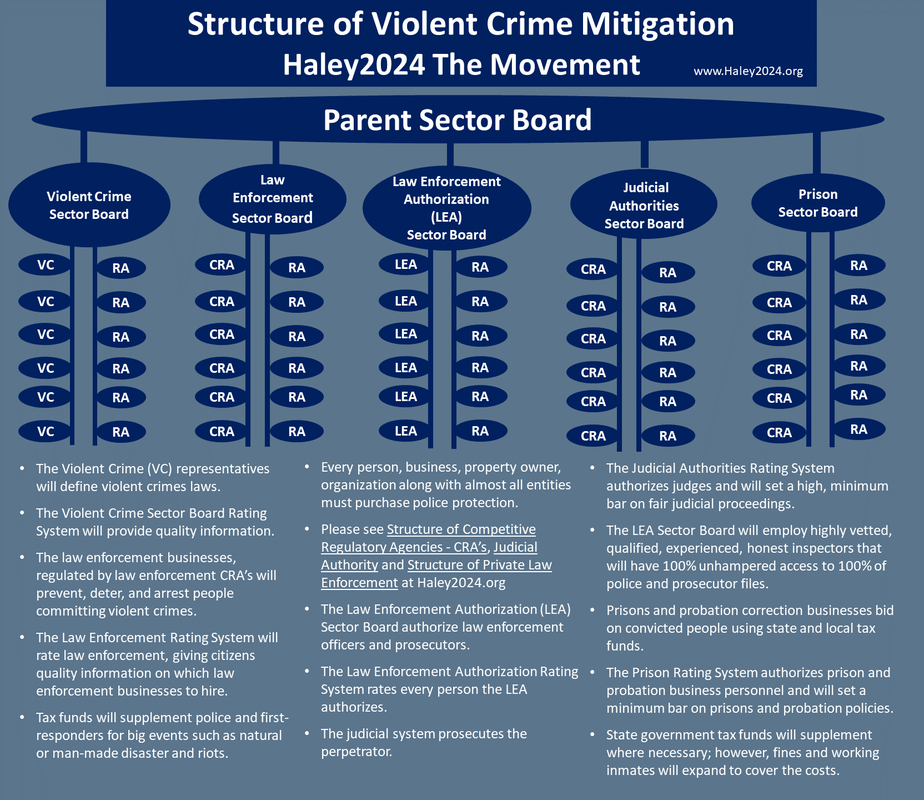

| Police, fire, prisons and protection related services requires roughly $0.29 trillion or 1.5% of GDP. About 75% of this can be transitioned to the free market. Other reforms will bring savings to the 25% staying within government. Roughly $0.22 trillion or 1.1% of GDP will be taken from government. |

| Government bureaucracies will be mostly moved to free enterprise. Roughly $0.14 trillion or 0.7% of GDP will be taken by government. Haley2024 calls for many of the above programs to be moved to free enterprise. These programs have significant assets. The standard transition is to create stockholder owned publicly traded corporations. |

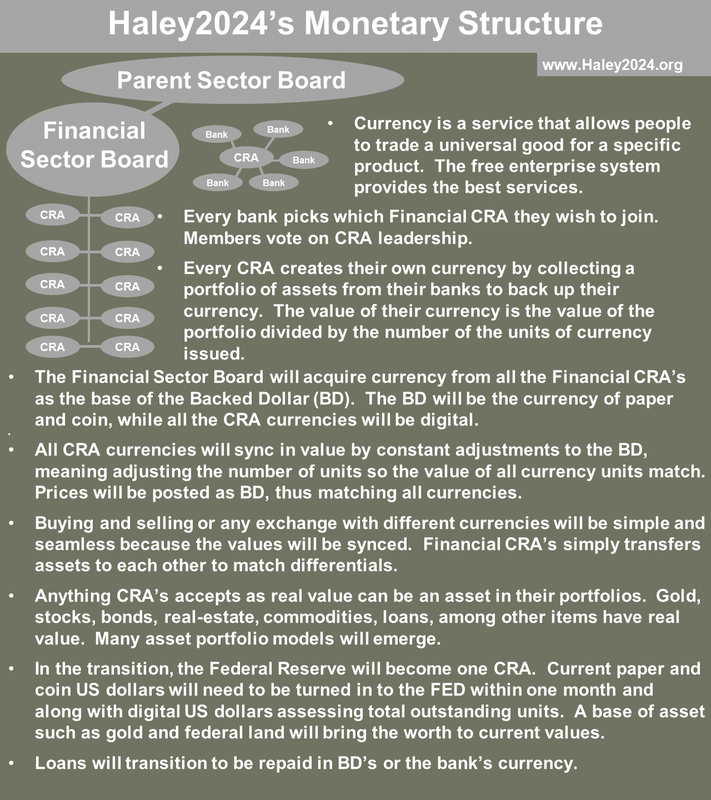

| As the stock is sold off at a one percent a month rate, that money will pay off debt. The current interest payments of $0.416 trillion or 2.2% of GDP will be reduced. With a more stable monetary system and roughly half the debt paid off, roughly $0.2 trillion worth of interest payments or 1% of GDP will be removed from government. These percentages are very rough, because the interest rate is not knowable, and the value of the stocks are just a guesstimation. |

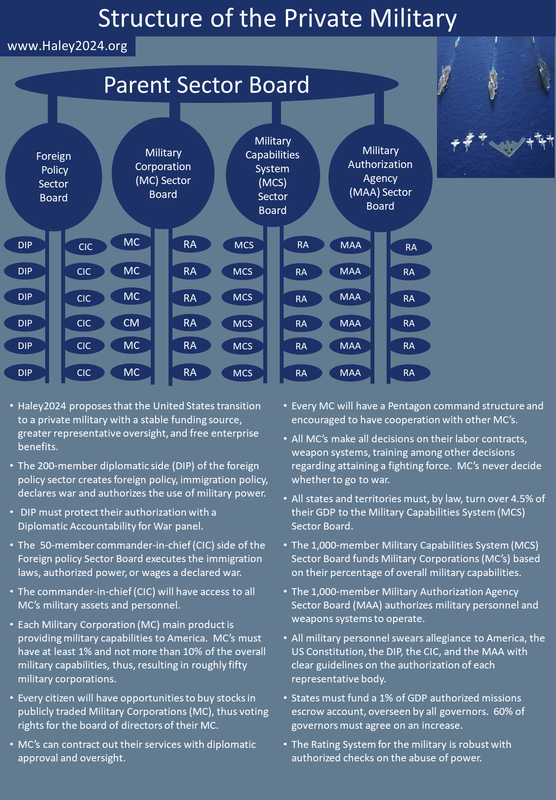

| The programs left for government provision will be the military at $0.893 Trillion or 4.5% of GDP. Interest on the debt will require about $0.2 trillion or 1% of GDP. Protection from first responders and prisons will require about $0.07 trillion or 0.35% of GDP. Other general government functions will require a few more percentage points of GDP. The Haley2024 reforms will result in government controlling roughly 7% of GDP, which is down from roughly 38% of GDP. |

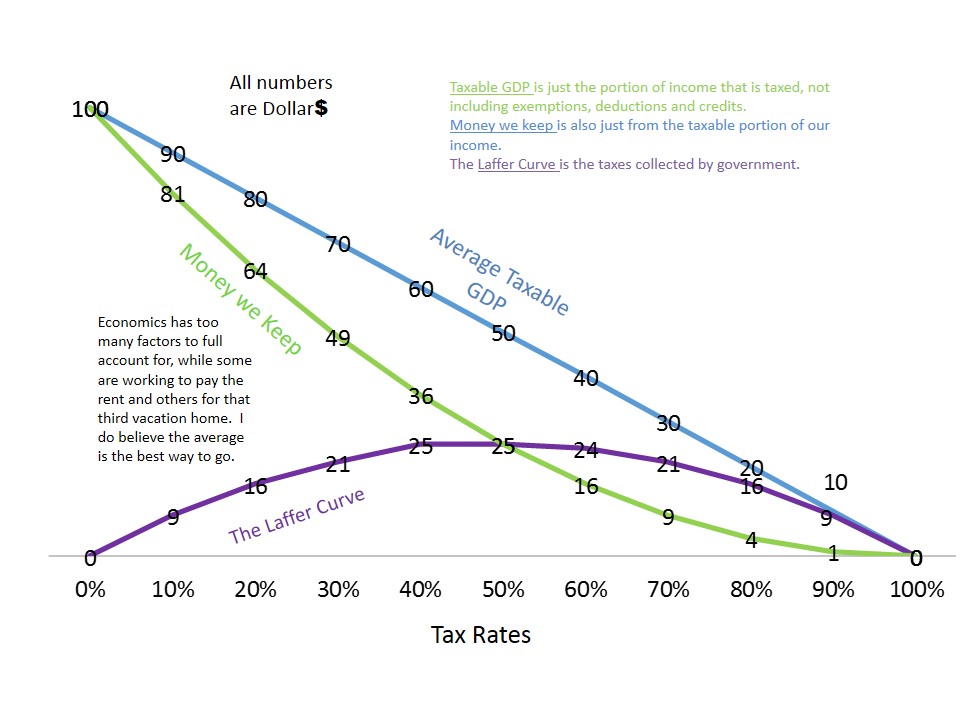

| Roughly 28% to 33% of GDP will be removed from government control. Looking at the Haley2024’s Laffer Curve chart, a 40% GDP tax rate results in a $60x GDP. A 7% GDP tax rate results in a $93x GDP. Over time, these reforms should result in roughly a 50% higher GDP, just from the tax code. Much of these funds will be needed to fulfill the same functions in the free enterprise system, however it will not be in the tax code. |

| Additional benefits will be realized by a superior way of helping the poor. A free market in education will yield a more educated citizenry. A better regulation and bureaucracy system will lower the drag on economic growth. The switch to private retirement accounts will yield a larger pool of capital. A better prison system will lower the amount of unproductive people. These and other reforms will be in the free enterprise system thus have superior results compared to government control. |

| Given that Haley2024 calls on government to collect 7% of GDP, it is important to get the tax system right. The federal government will not have a tax code nor collect taxes; however, a US constitutional amendment will call on every state to contribute 6% of their states GDP to the federal government. |

| 4.5% of GDP of the 6% of GDP will fund the military corporations directly. 1% of GDP of that 6% of GDP will be saved for military action only after a declaration of war has been declared. 0.5% of GDP or about $100 billion is all the federal government will have for their non-military actions such as the State Department. |